Bank regulation - KROS College Kohima

... European financial economics experts – notably the World Pensions Council (WPC) have argued that European powers such as France and Germany pushed dogmatically and naively for the adoption of the "Basel II recommendations", adopted in 2005, transposed in European Union law through the Capital Requir ...

... European financial economics experts – notably the World Pensions Council (WPC) have argued that European powers such as France and Germany pushed dogmatically and naively for the adoption of the "Basel II recommendations", adopted in 2005, transposed in European Union law through the Capital Requir ...

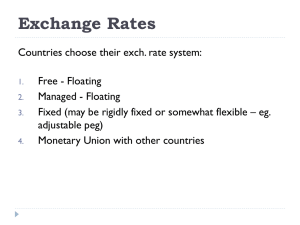

Exchange-Rates

... Fixed (may be rigidly fixed or somewhat flexible – eg. adjustable peg) Monetary Union with other countries ...

... Fixed (may be rigidly fixed or somewhat flexible – eg. adjustable peg) Monetary Union with other countries ...

Economy tanking amidst Fed hot air prior to rate decision

... We need to revisit Deutsche Bank’s DOJ fine. Same could prove to be a dangerous spark in a banking system brimming with “combustible” derivative risks; a world in which debt has increased by roughly $60trn -- only some $10trn shy of one year’s global GDP -- since 2007! In this regard, Deutsche Bank’ ...

... We need to revisit Deutsche Bank’s DOJ fine. Same could prove to be a dangerous spark in a banking system brimming with “combustible” derivative risks; a world in which debt has increased by roughly $60trn -- only some $10trn shy of one year’s global GDP -- since 2007! In this regard, Deutsche Bank’ ...

The 1997 Asian Financial Crisis

... under highly distorted incentives. Under-capitalized banks have incentives to borrow abroad and invest domestically with reckless abandon. If the lending works out, the bankers make money. If the lending fails, the depositors and creditors stand to lose money, but the bank’s owners bear little risk ...

... under highly distorted incentives. Under-capitalized banks have incentives to borrow abroad and invest domestically with reckless abandon. If the lending works out, the bankers make money. If the lending fails, the depositors and creditors stand to lose money, but the bank’s owners bear little risk ...

Voya Financial Advisors, Inc

... an effort to rein in the zero rate policy effect well before it takes action. This has seemed to come out of nowhere but the data on inflation and unemployment have surprised the Fed. GDP has been another surprise: take the second quarter GDP report at 4%, add 2.1% inflation (CPI) and then U.S. nomi ...

... an effort to rein in the zero rate policy effect well before it takes action. This has seemed to come out of nowhere but the data on inflation and unemployment have surprised the Fed. GDP has been another surprise: take the second quarter GDP report at 4%, add 2.1% inflation (CPI) and then U.S. nomi ...

Heads I win, tails I win

... will produce staggering shortfalls when future real pension commitments are discounted at such extremely low rates, driving many of these funds to unnecessary and costly defensive actions. New retirees whose retirement plan includes a lump sum that must be used to buy an annuity will suffer a huge r ...

... will produce staggering shortfalls when future real pension commitments are discounted at such extremely low rates, driving many of these funds to unnecessary and costly defensive actions. New retirees whose retirement plan includes a lump sum that must be used to buy an annuity will suffer a huge r ...

PDF

... turnover, the smaller should be the volatility of operating leverage. But, at the moment the situation in Estonia is the other way round. Many firms operate at breakeven point, and this causes high business risk. So, profitability is strongly influenced by even a little change in net sales. In gener ...

... turnover, the smaller should be the volatility of operating leverage. But, at the moment the situation in Estonia is the other way round. Many firms operate at breakeven point, and this causes high business risk. So, profitability is strongly influenced by even a little change in net sales. In gener ...

Question 1 Over the past quarter XYZ company`s performance has

... is considering lowering the interest rate by two percent to help stimulate the economy sometime next year, but the final decision has not been made (or at least publically announced). Should you invest in the bonds now or wait until the Federal Reserve System makes its announcement? What is your rea ...

... is considering lowering the interest rate by two percent to help stimulate the economy sometime next year, but the final decision has not been made (or at least publically announced). Should you invest in the bonds now or wait until the Federal Reserve System makes its announcement? What is your rea ...

Full Page with Layout Heading

... were near US$850bn in June 2007, and had helped fund the US current account deficit and thus global imbalances. ...

... were near US$850bn in June 2007, and had helped fund the US current account deficit and thus global imbalances. ...

Slide 1

... Reduced flexibility brought by some investors in construction period, in drawings, in repayment phases, in renegotiations,… Reduced access for industry to the networks and other products of banks Financial risks on importers assumed by exporters ...

... Reduced flexibility brought by some investors in construction period, in drawings, in repayment phases, in renegotiations,… Reduced access for industry to the networks and other products of banks Financial risks on importers assumed by exporters ...

Rate Hike Probability

... A key input into deciding how to position a portfolio is, of course, the future direction of interest rates. Given the recent low interest rate environment, market participants have been anticipating an increase in rates. However, the precise timing of such increase is much debated. The following ar ...

... A key input into deciding how to position a portfolio is, of course, the future direction of interest rates. Given the recent low interest rate environment, market participants have been anticipating an increase in rates. However, the precise timing of such increase is much debated. The following ar ...

Knowledge Center

... cannot be set off against normal business profit. Who can be a member of the Exchange? The Bye-laws and Articles of the Association prescribed the criteria for being a member of the Exchange. Any person desirous of being a member of the Exchange may approach the contact persons whose names, telephon ...

... cannot be set off against normal business profit. Who can be a member of the Exchange? The Bye-laws and Articles of the Association prescribed the criteria for being a member of the Exchange. Any person desirous of being a member of the Exchange may approach the contact persons whose names, telephon ...

Videoconference Presentation to the Australian Business Economists

... federal funds rate—close to zero. And we haven’t stopped there. We have put in place an array of unconventional approaches to spur the flow of credit to households and businesses. These include measures to improve liquidity and financial market functioning, and facilities to support the issuance of ...

... federal funds rate—close to zero. And we haven’t stopped there. We have put in place an array of unconventional approaches to spur the flow of credit to households and businesses. These include measures to improve liquidity and financial market functioning, and facilities to support the issuance of ...

NACM TEXAS – Since 1906, the Association of Business Credit

... from the previous year. The “panic” occurred during a period of economic recession and there were many “runs” on both banks and trust companies. Although the “panic” began in New York it eventually spread throughout the country and caused many state and local banks to close their doors. In addition, ...

... from the previous year. The “panic” occurred during a period of economic recession and there were many “runs” on both banks and trust companies. Although the “panic” began in New York it eventually spread throughout the country and caused many state and local banks to close their doors. In addition, ...

Saving and Capital Formation

... remember that interest rates, like prices, are a result of supply and demand, not a cause. Higher investment is a “good thing” from the point of view of economic growth, but it is compatible with either higher or lower interest rates. ...

... remember that interest rates, like prices, are a result of supply and demand, not a cause. Higher investment is a “good thing” from the point of view of economic growth, but it is compatible with either higher or lower interest rates. ...

the Purchasing Power Parity (PPP)Exchange Rate.

... calculate how much these goods and services would sell for in the U.S. $11.391 trillion X 1.8 = $20.503 trillion. This is more than the U.S. GDP of $18 trillion, making China’s economy the largest in the world using a PPP valuation! ...

... calculate how much these goods and services would sell for in the U.S. $11.391 trillion X 1.8 = $20.503 trillion. This is more than the U.S. GDP of $18 trillion, making China’s economy the largest in the world using a PPP valuation! ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.