Monitoring financial and social conduct

... Is the Co-op bank ethical or not • Co-op is acting ethically… – Respects fundamental moral obligations and seeks to fulfil desirable moral standards • it is reflecting the interests of customers and depositors • Has clear public position and acts accordingly • Is not a monopoly so has no universal ...

... Is the Co-op bank ethical or not • Co-op is acting ethically… – Respects fundamental moral obligations and seeks to fulfil desirable moral standards • it is reflecting the interests of customers and depositors • Has clear public position and acts accordingly • Is not a monopoly so has no universal ...

PDF

... million in 2007 to HRK 38.7 million in 2011. In that period, the total assets decreased only in 2010, while the average total assets per business entity were down for two consecutive years: 2009 and 2010 (approximate currency rate: € 1.0 = HRK 7.5). If we recall the above described trend in number o ...

... million in 2007 to HRK 38.7 million in 2011. In that period, the total assets decreased only in 2010, while the average total assets per business entity were down for two consecutive years: 2009 and 2010 (approximate currency rate: € 1.0 = HRK 7.5). If we recall the above described trend in number o ...

Don't sweat the downturn

... move that may reduce the cost benefits? And has the organisation really assessed its business needs? Setting expectations in terms of up time, resolution time and business goals is key before, not during or after, discussions with potential providers. It is only by undertaking a thorough price versu ...

... move that may reduce the cost benefits? And has the organisation really assessed its business needs? Setting expectations in terms of up time, resolution time and business goals is key before, not during or after, discussions with potential providers. It is only by undertaking a thorough price versu ...

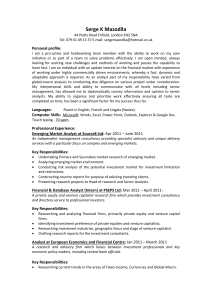

CURRICULUM VITAE

... Identifying investment preference of private equities and venture capitalists. Researching investment industries, geographic focus and stage of venture capitalist. Drafting research reports for the investment consultants. ...

... Identifying investment preference of private equities and venture capitalists. Researching investment industries, geographic focus and stage of venture capitalist. Drafting research reports for the investment consultants. ...

subject : c 306 business financial management

... 6. Suppose you believe that Du Pont’s stock price is going to decline from its current level of $82.50 sometime during the next 5 months. For $510.25 you could buy a 5month put option giving you the right to sell 100 shares at a price of $83.00 per share. If you bought a 100-share contract for $510. ...

... 6. Suppose you believe that Du Pont’s stock price is going to decline from its current level of $82.50 sometime during the next 5 months. For $510.25 you could buy a 5month put option giving you the right to sell 100 shares at a price of $83.00 per share. If you bought a 100-share contract for $510. ...

NSE admits N11b FGN bonds, transactions record N75.1b in one

... N75.1b in one week THE Nigerian Stock Exchange (NSE) has admitted the N111 billion 16.39% FGN Bond January 2022 on the Daily Official List. The number of listed FGN Bonds now stands at 26. At the end of transactions for the week, the Over-The-Counter (OTC) market for FGN bonds recorded a turnover of ...

... N75.1b in one week THE Nigerian Stock Exchange (NSE) has admitted the N111 billion 16.39% FGN Bond January 2022 on the Daily Official List. The number of listed FGN Bonds now stands at 26. At the end of transactions for the week, the Over-The-Counter (OTC) market for FGN bonds recorded a turnover of ...

Presentation - Keith Rankin

... The paper suggests that the financial system acts in the service of creditors to both achieve financial returns for them and to serve as a pump to maintain the circular flow of expenditure in the face of habitual non-spending on the part of many creditors. The financial services industry plays a qui ...

... The paper suggests that the financial system acts in the service of creditors to both achieve financial returns for them and to serve as a pump to maintain the circular flow of expenditure in the face of habitual non-spending on the part of many creditors. The financial services industry plays a qui ...

Slide 1

... • “The extent to which a country, in the conditions of a free and fair market, produces goods and services that meet international markets` standards, while preserving and increasing its citizens` real income in the long-run” (OECD) • “Competitiveness should be equalled to productivity” (World Bank) ...

... • “The extent to which a country, in the conditions of a free and fair market, produces goods and services that meet international markets` standards, while preserving and increasing its citizens` real income in the long-run” (OECD) • “Competitiveness should be equalled to productivity” (World Bank) ...

Subnational Government Financing

... abandoning its prescribed investment regime for institutional investors. Municipal assets are an often underused and overlooked source for enhancement of municipal bonds. Municipalities in China and Poland have used public land as collateral for raising money and then successfully disposing of the a ...

... abandoning its prescribed investment regime for institutional investors. Municipal assets are an often underused and overlooked source for enhancement of municipal bonds. Municipalities in China and Poland have used public land as collateral for raising money and then successfully disposing of the a ...

Evolution of bank and non-bank corporate funding in Peru

... pricing of private sector issuances, and although the private pension funds (AFPs) have sufficient resources to encourage its development. The outstanding stock of private bonds increased from 4.7% of GDP in 2001 to 14% in 2013. Large Peruvian firms have preferred mainly to issue in external markets ...

... pricing of private sector issuances, and although the private pension funds (AFPs) have sufficient resources to encourage its development. The outstanding stock of private bonds increased from 4.7% of GDP in 2001 to 14% in 2013. Large Peruvian firms have preferred mainly to issue in external markets ...

East Asia and Global Imbalances: Saving, Investment, and

... More FD leads to higher saving for countries with underdevelopment institutions and closed financial markets that includes most of East Asian EMGs ...

... More FD leads to higher saving for countries with underdevelopment institutions and closed financial markets that includes most of East Asian EMGs ...

“Defining Financial Stability, and Some Policy Implications of Applying the Definition”

... financial needs) who are unlikely – again, in normal economic times – to all demand their funds at the same time. So financial intermediation is a vital service for a well-functioning economy, allowing the funds from many depositors to be pooled and channeled to riskier and longer-term investment pr ...

... financial needs) who are unlikely – again, in normal economic times – to all demand their funds at the same time. So financial intermediation is a vital service for a well-functioning economy, allowing the funds from many depositors to be pooled and channeled to riskier and longer-term investment pr ...

Shadow Banking and Financial Stability

... including the Financial Stability Board (FSB) and the European Commission (EC) as: The risks of the shadow banking system became apparent during the financial crisis, making it clear that this segment of the financial system requires greater attention. ...

... including the Financial Stability Board (FSB) and the European Commission (EC) as: The risks of the shadow banking system became apparent during the financial crisis, making it clear that this segment of the financial system requires greater attention. ...

Bonds: Fed Watching—and Opportunity Hunting—in 2015

... Jobs growth, and the level of commercial and consumer lending, have been Fed focal points for indications that U.S. economic growth is improving and potentially self-sustaining. The 2014 nonfarm payrolls numbers from the Bureau of Labor Statistics suggest the Fed’s patience ...

... Jobs growth, and the level of commercial and consumer lending, have been Fed focal points for indications that U.S. economic growth is improving and potentially self-sustaining. The 2014 nonfarm payrolls numbers from the Bureau of Labor Statistics suggest the Fed’s patience ...

Houston Investors Association Monthly SIG

... LP Hedge fund and Portfolio Manager of Parallax Asset Management “What’s Working Now” radio show 1110 AM 4pm-5pm, M-F ...

... LP Hedge fund and Portfolio Manager of Parallax Asset Management “What’s Working Now” radio show 1110 AM 4pm-5pm, M-F ...

ETUC Econ 11-10 - European Economic Governance is

... ECB on the one hand and disinflation and economic slowdown in Germany on the other. Note that while the policy of wage stagnation made the German economy continue to struggle to recover from the 2002 economic stagnation, the Spanish economy for example maintained growth rates of 3, even almost 4% ov ...

... ECB on the one hand and disinflation and economic slowdown in Germany on the other. Note that while the policy of wage stagnation made the German economy continue to struggle to recover from the 2002 economic stagnation, the Spanish economy for example maintained growth rates of 3, even almost 4% ov ...

slides

... output, and the financial sector in the economy. This is achieved as the central bank can increase the money supply and reduce interest rates when the economy is depressed, and reduce money growth and raise interest rates when it is overheated. Moreover, it can serve as a lender of last resort in ca ...

... output, and the financial sector in the economy. This is achieved as the central bank can increase the money supply and reduce interest rates when the economy is depressed, and reduce money growth and raise interest rates when it is overheated. Moreover, it can serve as a lender of last resort in ca ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.