PPT

... • If the depreciation is straight-line and the asset is written down to zero over that period, then $5,000/5 = $1,000 would be deducted each year as an expense. • The important thing to recognize is that this $1,000 deduction isn't cash—it's an accounting number. The actual cash outflow occurred whe ...

... • If the depreciation is straight-line and the asset is written down to zero over that period, then $5,000/5 = $1,000 would be deducted each year as an expense. • The important thing to recognize is that this $1,000 deduction isn't cash—it's an accounting number. The actual cash outflow occurred whe ...

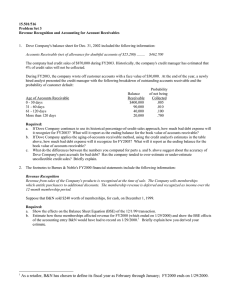

1305501187_526858

... – An interest rate swap, often combined with a currency swap, if the interest being swapped is in different currencies ...

... – An interest rate swap, often combined with a currency swap, if the interest being swapped is in different currencies ...

growth opportunities in europe

... rules effectively allow employers to recruit new people for up to three years on temporary contracts in nearly all positions, all while broadening the social benefit system. By focusing reforms on conditions pertaining to the newly employed as opposed to the existing staff, they can help maintain co ...

... rules effectively allow employers to recruit new people for up to three years on temporary contracts in nearly all positions, all while broadening the social benefit system. By focusing reforms on conditions pertaining to the newly employed as opposed to the existing staff, they can help maintain co ...

PDF

... the incremental employment growth between 2000 and 2005 was 46.72 million, which encompassed 8.84 million jobs in agriculture, 8.64 million in manufacturing, 6.44 million in construction, 10.70 million in trade, hotels and restaurants, 4.04 million in transport, storage and communications, 3.12 mill ...

... the incremental employment growth between 2000 and 2005 was 46.72 million, which encompassed 8.84 million jobs in agriculture, 8.64 million in manufacturing, 6.44 million in construction, 10.70 million in trade, hotels and restaurants, 4.04 million in transport, storage and communications, 3.12 mill ...

Managing Risks in a Rising Interest Rate

... Mid-Term (Five-, Seven-, and 10-Year) “Fixed” Rate Debt Mid-term debt is a common funding structure wherein bonds are directly purchased by a commercial bank. However, it should be noted the debt is not as much fixed as it is subject to reset in the future. As such, borrowers are exposed to renewal ...

... Mid-Term (Five-, Seven-, and 10-Year) “Fixed” Rate Debt Mid-term debt is a common funding structure wherein bonds are directly purchased by a commercial bank. However, it should be noted the debt is not as much fixed as it is subject to reset in the future. As such, borrowers are exposed to renewal ...

finance - I blog di Unica

... 2 Read part of a presentation. Write the words in brackets as an adjective or adverb. This pie chart shows the differences between the three sectors are (9)_________________(strike). Our Europe markets fell (10)_________________(dramatic) compared with last year. Though this market is still (11) __ ...

... 2 Read part of a presentation. Write the words in brackets as an adjective or adverb. This pie chart shows the differences between the three sectors are (9)_________________(strike). Our Europe markets fell (10)_________________(dramatic) compared with last year. Though this market is still (11) __ ...

Low interest rates pressuring US bank margins

... The US banking industry in 2011 was a strongly profitable one: return on assets rose across banks of all sizes and net income was close to pre-crisis levels. A closer look, however, reveals this profitability was mainly a result of lower loan loss provisions. Provisions declined year-over-year for t ...

... The US banking industry in 2011 was a strongly profitable one: return on assets rose across banks of all sizes and net income was close to pre-crisis levels. A closer look, however, reveals this profitability was mainly a result of lower loan loss provisions. Provisions declined year-over-year for t ...

Sofia, Bulgaria, October 13, 2006 Milen Markov Chairman of

... 4. Status of the already existing funds – determining their risk profile. Determining the type of fund for people who have not made a choice and for unpersonified contributions 5. The right to change funds managed by a single pensions company – taxes and how often it can be done 6. Binding the right ...

... 4. Status of the already existing funds – determining their risk profile. Determining the type of fund for people who have not made a choice and for unpersonified contributions 5. The right to change funds managed by a single pensions company – taxes and how often it can be done 6. Binding the right ...

Earnings and Cash Flow Analysis

... Dividends per Share Dividend Yield Dividend Payout Ratio Book Value per Share Price-to-Book-Value, Price-to-Cash Flow, Price-toSales ...

... Dividends per Share Dividend Yield Dividend Payout Ratio Book Value per Share Price-to-Book-Value, Price-to-Cash Flow, Price-toSales ...

India`s Economic Reforms

... the need to integrate with the global economy through trade, investment and technology flows and for this purpose to create conditions which would give Indian entrepreneurs an environment broadly comparable to that in other developing countries, and to do this within the space of four to five years. ...

... the need to integrate with the global economy through trade, investment and technology flows and for this purpose to create conditions which would give Indian entrepreneurs an environment broadly comparable to that in other developing countries, and to do this within the space of four to five years. ...

India`s financial openness and integration with Southeast Asian

... fivefold since 1950, the volume of world trade has grown 16 times, that is, at an annual compound growth rate of about 7 per cent. It has been documented that exports have tended to grow steadily in countries with more liberal trade regimes and these countries have experienced faster growth of outp ...

... fivefold since 1950, the volume of world trade has grown 16 times, that is, at an annual compound growth rate of about 7 per cent. It has been documented that exports have tended to grow steadily in countries with more liberal trade regimes and these countries have experienced faster growth of outp ...

evaluating comparative and absolute advantage

... political instability to economic uncertainty. Sometimes a country's currency is not exchanged for the simple reason that the country produces very few products of interest to other countries. Unlike the commodities or stock markets, the forex market has no central trading floor where buyers and sel ...

... political instability to economic uncertainty. Sometimes a country's currency is not exchanged for the simple reason that the country produces very few products of interest to other countries. Unlike the commodities or stock markets, the forex market has no central trading floor where buyers and sel ...

The Details of our Investment Process

... responsibilities consistently well, our clients will be happy and, hopefully, wealthier than when we first met--and so will we. Asset Allocation In the last few years, asset allocation has received an increasing amount of attention from all major media outlets. Deciding what portion of your portfoli ...

... responsibilities consistently well, our clients will be happy and, hopefully, wealthier than when we first met--and so will we. Asset Allocation In the last few years, asset allocation has received an increasing amount of attention from all major media outlets. Deciding what portion of your portfoli ...

Explanation for Financial Crisis from Monetary Perspective

... 1. MV=PT. M stands for money in circulation, V stands for velocity of money, P is price level, T is total level of transaction 2. The supply of commodity G is constant 3. The demand for commodity G declines 4. In short term, the money stock is unchanged (Other economic situations could be achieved b ...

... 1. MV=PT. M stands for money in circulation, V stands for velocity of money, P is price level, T is total level of transaction 2. The supply of commodity G is constant 3. The demand for commodity G declines 4. In short term, the money stock is unchanged (Other economic situations could be achieved b ...

Developing the Rural Economy through Financial Inclusion

... Within the above framework, value chain finance plays an important role in the rural economy, as distorting the flow of financial products and services at any point in the value chain can make the whole chain collapse. Directly related to value chain finance is contract farming, as a form of vertica ...

... Within the above framework, value chain finance plays an important role in the rural economy, as distorting the flow of financial products and services at any point in the value chain can make the whole chain collapse. Directly related to value chain finance is contract farming, as a form of vertica ...

International Capital Flows and US Interest Rates

... International Capital Flows and U.S. Interest Rates Francis Warnock and Veronica Warnock Discussion by Aart Kraay The World Bank International Monetary Fund 7th Jacques Polak Annual Research Conference November 9, 2006 ...

... International Capital Flows and U.S. Interest Rates Francis Warnock and Veronica Warnock Discussion by Aart Kraay The World Bank International Monetary Fund 7th Jacques Polak Annual Research Conference November 9, 2006 ...

Exam #2 Review Material -

... 26. How much did Company D pay for the inventory in stock (i.e. how much money did they pay to acquire their current inventory?) a. $1,550 b. $1,340 c. $1,054 d. $1,220 27. Using lower cost or market (item by item), how much does the inventory need to be written down? a. $104 b. $154 c. $87 d. $95 ...

... 26. How much did Company D pay for the inventory in stock (i.e. how much money did they pay to acquire their current inventory?) a. $1,550 b. $1,340 c. $1,054 d. $1,220 27. Using lower cost or market (item by item), how much does the inventory need to be written down? a. $104 b. $154 c. $87 d. $95 ...

Concept Note: GHG Protocol Financial Sector Guidance for

... beneficiaries, regulators, and the general public) have an interest in understanding both the carbon risk exposure of financial institutions as well as their alignment with the low-carbon economy. At present, however, many financial actors only calculate and report GHG emissions from their direct op ...

... beneficiaries, regulators, and the general public) have an interest in understanding both the carbon risk exposure of financial institutions as well as their alignment with the low-carbon economy. At present, however, many financial actors only calculate and report GHG emissions from their direct op ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.