Snímek 1

... Dominant role played by established, strong and stable companies. Average profit rate in this industry is declining and some companies leave of industry. Next development of particular industry by two ways: ...

... Dominant role played by established, strong and stable companies. Average profit rate in this industry is declining and some companies leave of industry. Next development of particular industry by two ways: ...

Welcome to the Good Sense Budget Course

... wicked does not repay….” • Avoid debt – Proverbs 22:7 “….The borrower becomes the lender’s slave.” ...

... wicked does not repay….” • Avoid debt – Proverbs 22:7 “….The borrower becomes the lender’s slave.” ...

Market for Loanable Funds

... Higher Interest rates will cause some investment to be ‘crowded out’ by the government’s demand for loadable funds. ...

... Higher Interest rates will cause some investment to be ‘crowded out’ by the government’s demand for loadable funds. ...

The international role of currencies

... on the rest of the world. In 2007, the euro area accounted for about 16% of world GDP, measured at purchasing power parity, and its external trade was equal to more than 18% of world trade, at current exchange rates. ...

... on the rest of the world. In 2007, the euro area accounted for about 16% of world GDP, measured at purchasing power parity, and its external trade was equal to more than 18% of world trade, at current exchange rates. ...

Midyear Outlook - Keystone Financial Group

... separation must be negotiated, which creates uncertainty for businesses operating in the region. There are also fears that similar movements to separate will gain support in other European countries. In the U.S., the upcoming presidential election presents another source of uncertainty, more so in t ...

... separation must be negotiated, which creates uncertainty for businesses operating in the region. There are also fears that similar movements to separate will gain support in other European countries. In the U.S., the upcoming presidential election presents another source of uncertainty, more so in t ...

Macro-economic environment - February 2015

... issuer and market discussed in this publication. No other person should make a decision based on this publication. In particular, in preparing this publication, ING has not taken into account the specific investment objectives, financial situation or individual requirements of any person. The financ ...

... issuer and market discussed in this publication. No other person should make a decision based on this publication. In particular, in preparing this publication, ING has not taken into account the specific investment objectives, financial situation or individual requirements of any person. The financ ...

FM11 Ch 19 Instructors Manual

... Answer: The main agency that regulates the securities market is the Securities And Exchange Commission. Some of the responsibilities of the SEC include: regulation of all national stock exchanges--companies whose securities are listed on an exchange must file annual reports with the SEC; prohibiting ...

... Answer: The main agency that regulates the securities market is the Securities And Exchange Commission. Some of the responsibilities of the SEC include: regulation of all national stock exchanges--companies whose securities are listed on an exchange must file annual reports with the SEC; prohibiting ...

Banking crises in New Zealand: an historical overview.

... with domestic monetary conditions governed by the trading banks holding of sterling reserves in London (Hawke 1985). Any negative economic shock had to be mediated via an internal adjustment in the price level (deflation) given the fixing of the New Zealand pound to the pound sterling at parity by t ...

... with domestic monetary conditions governed by the trading banks holding of sterling reserves in London (Hawke 1985). Any negative economic shock had to be mediated via an internal adjustment in the price level (deflation) given the fixing of the New Zealand pound to the pound sterling at parity by t ...

15 - Finance

... 8. Top management feels that the firm is operating with more inventory that it needs. Manufacturing management has been challenged to increase the Inventory Turnover Ratio based on COGS to 5 from its present level of 3 ...

... 8. Top management feels that the firm is operating with more inventory that it needs. Manufacturing management has been challenged to increase the Inventory Turnover Ratio based on COGS to 5 from its present level of 3 ...

NBER WORKING PAPER SERIES ON THE HIDDEN LINKS BETWEEN Joshua Aizenman

... I show that the relatively costly collection of taxes in developing countries implies that financial repression would be part of the menu of taxes. The impact of financial repression is to allow the government to recycle its domestic debt at a lower real interest rate than one that would have prevai ...

... I show that the relatively costly collection of taxes in developing countries implies that financial repression would be part of the menu of taxes. The impact of financial repression is to allow the government to recycle its domestic debt at a lower real interest rate than one that would have prevai ...

View/Open

... volume of income from FDIA gradually increased (Fig. 2). The total income from FDIA rose from 28 mln euro in 2000 to 1544 mln euro in 2012, amounting to 345,9 mln euro per year on average. A rapid increase in FDIA flows after financial crisis resulted in rise of income by 133.6% in 2012 comparing to ...

... volume of income from FDIA gradually increased (Fig. 2). The total income from FDIA rose from 28 mln euro in 2000 to 1544 mln euro in 2012, amounting to 345,9 mln euro per year on average. A rapid increase in FDIA flows after financial crisis resulted in rise of income by 133.6% in 2012 comparing to ...

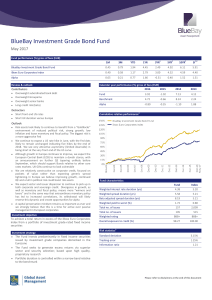

BlueBay Investment Grade Bond Fund

... 4. The Fund AUM is stated on a T+1 basis and includes non-fee earning assets. 5. CDS long exposure means sold protection and CDS short exposure means brought protection. This document is issued in the United Kingdom (UK) by BlueBay Asset Management LLP (BlueBay), which is authorised and regulated by ...

... 4. The Fund AUM is stated on a T+1 basis and includes non-fee earning assets. 5. CDS long exposure means sold protection and CDS short exposure means brought protection. This document is issued in the United Kingdom (UK) by BlueBay Asset Management LLP (BlueBay), which is authorised and regulated by ...

Finance Notes 2008 Size: 351.5kb Last modified

... Operating cash flow + new securities = investments + dividends / repurchases + debt service Operating cash flow = investments + dividends + repurchases - new securities + debt service ...

... Operating cash flow + new securities = investments + dividends / repurchases + debt service Operating cash flow = investments + dividends + repurchases - new securities + debt service ...

collque coface 2004 partie I VA

... ECAs confront substantial changes in business environment Tough competition (private insurers in ST) More experience and technology brought in by the private sector ...

... ECAs confront substantial changes in business environment Tough competition (private insurers in ST) More experience and technology brought in by the private sector ...

Global equities brace for heightened volatility following Fed rate hike

... Fixed-income markets continued to assess the reflationary aspects of the new administration’s proposed policies and the Fed’s acknowledgment that market-based measures of inflation expectations had increased materially since its September meeting. After heading lower through mid-week, the 10-year U. ...

... Fixed-income markets continued to assess the reflationary aspects of the new administration’s proposed policies and the Fed’s acknowledgment that market-based measures of inflation expectations had increased materially since its September meeting. After heading lower through mid-week, the 10-year U. ...

The Impossible Trinity: Where does India stand?

... were also flush with foreign currency reserves and hence looked capable of defending any speculative attack on their respective currencies, and foreign investors in search of yields began investing massively in the equity and debt markets of the emerging world. India with an average growth rate of 9 ...

... were also flush with foreign currency reserves and hence looked capable of defending any speculative attack on their respective currencies, and foreign investors in search of yields began investing massively in the equity and debt markets of the emerging world. India with an average growth rate of 9 ...

U U.S. Monetary Policy in an Integrating World: 1960 to 2000

... times when currency or debt crises in emerging markets threatened the liquidity (or solvency) of U.S. financial institutions (for example, the mid 1980s and 1998). By contrast, it was relatively easy for central bankers with a mandate for maintaining price stability to ignore dollar appreciations th ...

... times when currency or debt crises in emerging markets threatened the liquidity (or solvency) of U.S. financial institutions (for example, the mid 1980s and 1998). By contrast, it was relatively easy for central bankers with a mandate for maintaining price stability to ignore dollar appreciations th ...

PPT

... • If the depreciation is straight-line and the asset is written down to zero over that period, then $5,000/5 = $1,000 would be deducted each year as an expense. • The important thing to recognize is that this $1,000 deduction isn't cash—it's an accounting number. The actual cash outflow occurred whe ...

... • If the depreciation is straight-line and the asset is written down to zero over that period, then $5,000/5 = $1,000 would be deducted each year as an expense. • The important thing to recognize is that this $1,000 deduction isn't cash—it's an accounting number. The actual cash outflow occurred whe ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.