words

... 2010, compared to 18.0 percent for the same period in 2009. Selling, general and administrative expense totaled 10.4 percent of homebuilding revenues for the second quarter of 2010, compared to 14.4 percent of homebuilding revenues for the same period in 2009. This decrease in the selling, general a ...

... 2010, compared to 18.0 percent for the same period in 2009. Selling, general and administrative expense totaled 10.4 percent of homebuilding revenues for the second quarter of 2010, compared to 14.4 percent of homebuilding revenues for the same period in 2009. This decrease in the selling, general a ...

report - Commerzbank

... September rather than June. In case of doubt, the Fed will start rather later instead of pausing after the first rate hike, which would confuse investors. But in contrast to many market participants, we adhere to our forecast that the Fed will raise its key rate by 25 basis points at each meeting (c ...

... September rather than June. In case of doubt, the Fed will start rather later instead of pausing after the first rate hike, which would confuse investors. But in contrast to many market participants, we adhere to our forecast that the Fed will raise its key rate by 25 basis points at each meeting (c ...

UK Contracts for Difference: Risks and

... suggested that the big suppliers may become even less willing to enter into long-term PPAs under the CfD mechanism, since they will no longer be looking to purchase ROCs to manage exposures imposed by the RO. The reasons for the decline in PPA availability may include a preference for the large play ...

... suggested that the big suppliers may become even less willing to enter into long-term PPAs under the CfD mechanism, since they will no longer be looking to purchase ROCs to manage exposures imposed by the RO. The reasons for the decline in PPA availability may include a preference for the large play ...

Momentum Strategies in Futures Markets and Trend

... knowledge, the hypothesis of capacity constraints in strategies followed by CTAs has not been examined rigorously in the academic literature. Our objective is, therefore, to carefully examine the question of capacity constraints in trend-following investing. Our paper makes three main contributions. ...

... knowledge, the hypothesis of capacity constraints in strategies followed by CTAs has not been examined rigorously in the academic literature. Our objective is, therefore, to carefully examine the question of capacity constraints in trend-following investing. Our paper makes three main contributions. ...

interest rate risk in turkish financial markets across

... Responses on policies by Bank Indonesia and coordination with the Government performed positive impact on the reduction of inflation pressure in quarter IV 2013. After the period of high inflation pressure led by food volatility and the increase of fuel price in quarter II and III 2013, CPI inflatio ...

... Responses on policies by Bank Indonesia and coordination with the Government performed positive impact on the reduction of inflation pressure in quarter IV 2013. After the period of high inflation pressure led by food volatility and the increase of fuel price in quarter II and III 2013, CPI inflatio ...

Estimating the intensity of price and non

... More recently, these price-based indicators of competition have been augmented with non-price measures of competitive behaviour under the assumption that banks may substitute one for the other in certain instances. For example, Pinho (2000) looks at advertising expenditures and branches as non-price ...

... More recently, these price-based indicators of competition have been augmented with non-price measures of competitive behaviour under the assumption that banks may substitute one for the other in certain instances. For example, Pinho (2000) looks at advertising expenditures and branches as non-price ...

This PDF is a selection from an out-of-print volume from... of Economic Research Volume Title: International Capital Flows

... to say that during the first half of this decade most countries in Latin America followed the steps of the two early reformers: Chile and Mexico.’ And when the world was about to believe that Latin America had finally changed, the Mexican currency crisis erupted in December 1994. This turn of events ...

... to say that during the first half of this decade most countries in Latin America followed the steps of the two early reformers: Chile and Mexico.’ And when the world was about to believe that Latin America had finally changed, the Mexican currency crisis erupted in December 1994. This turn of events ...

II. How to Read a Mutual Fund Prospectus

... Low turnover rates (< .30) indicates a more passive investing strategy, while high rates (>1.00) indicates active investing Passive Investing Index funds promote this strategy. In the long-term, few funds beat the index Most of the difference in fund performance is related to asset allocation: how m ...

... Low turnover rates (< .30) indicates a more passive investing strategy, while high rates (>1.00) indicates active investing Passive Investing Index funds promote this strategy. In the long-term, few funds beat the index Most of the difference in fund performance is related to asset allocation: how m ...

Back to the Future – A Round-Trip with Discounted Cash Flows

... When the valuation date of a business is in the past, historical cash flows may become certain, or risk free, with the passage of time. This certainty can arise when historical prices and quantities can be established reliably. Historical cash flows can then be seen as risk free cash flows. To match ...

... When the valuation date of a business is in the past, historical cash flows may become certain, or risk free, with the passage of time. This certainty can arise when historical prices and quantities can be established reliably. Historical cash flows can then be seen as risk free cash flows. To match ...

The role of information asymmetry and financial reporting quality in

... traders into public information in the secondary loan market. The effect of timely loss recognition on the effectiveness of debt agreements and its influence on the borrower’s information environment make the secondary loan market an excellent empirical setting in which to explore the importance of ...

... traders into public information in the secondary loan market. The effect of timely loss recognition on the effectiveness of debt agreements and its influence on the borrower’s information environment make the secondary loan market an excellent empirical setting in which to explore the importance of ...

catalytic first-loss capital - Global Impact Investing Network

... guarantees spurring business growth. There are many examples. In the US, the Small Business Administration (SBA) runs a program that guarantees up to 85% of commercial loans made to small businesses.2 Elsewhere, government sponsored enterprises, such as Fannie Mae and Freddie Mac aim to enhance the ...

... guarantees spurring business growth. There are many examples. In the US, the Small Business Administration (SBA) runs a program that guarantees up to 85% of commercial loans made to small businesses.2 Elsewhere, government sponsored enterprises, such as Fannie Mae and Freddie Mac aim to enhance the ...

An Investigation into the Impact of Debt Financing

... determine if the use of debt (leverage) by small firms in Zimbabwe leads to an increase in the returns generated by a firm with the intention of improving the value of small manufacturing firms through capital structure. Apart from determination of the impact of debt on the profitability of small m ...

... determine if the use of debt (leverage) by small firms in Zimbabwe leads to an increase in the returns generated by a firm with the intention of improving the value of small manufacturing firms through capital structure. Apart from determination of the impact of debt on the profitability of small m ...

financial leverage

... Capital Structure Theory • According to finance theory, firms possess a target capital structure that will minimize its cost of capital. • Unfortunately, theory can not yet provide financial mangers with a specific methodology to help them determine what their firm’s optimal capital structure might ...

... Capital Structure Theory • According to finance theory, firms possess a target capital structure that will minimize its cost of capital. • Unfortunately, theory can not yet provide financial mangers with a specific methodology to help them determine what their firm’s optimal capital structure might ...

stocks - McGraw Hill Higher Education

... Expected return is a forecast of what the return would be if your predictions about the price and the dividend are correct. However, the actual return on a stock could be more or less than what you expect! Calculate how well you did as versus the 12% expected return if the following occurs to ...

... Expected return is a forecast of what the return would be if your predictions about the price and the dividend are correct. However, the actual return on a stock could be more or less than what you expect! Calculate how well you did as versus the 12% expected return if the following occurs to ...

Financial Leverage Does Not Cause the Leverage Effect

... of stock volatility. We explore the dynamics of stock volatility in a dynamic general equilibrium economy at both a market and a firm level. We characterize the economic channels through which financial leverage drives the dynamics of stock volatility, and quantify the leverage effect. The assumpti ...

... of stock volatility. We explore the dynamics of stock volatility in a dynamic general equilibrium economy at both a market and a firm level. We characterize the economic channels through which financial leverage drives the dynamics of stock volatility, and quantify the leverage effect. The assumpti ...

201703090000000010_PR Full Year Results 2016 Final

... up from €6.3 million in 2015). This shows the immediate effect of the Valeant transaction on the top line – Revenues from product sales from the US for the first nine months of 2016 were €5.8 million, whereas in the fourth quarter alone they were €6.0 million. Sales for RUCONEST® in Europe and the R ...

... up from €6.3 million in 2015). This shows the immediate effect of the Valeant transaction on the top line – Revenues from product sales from the US for the first nine months of 2016 were €5.8 million, whereas in the fourth quarter alone they were €6.0 million. Sales for RUCONEST® in Europe and the R ...

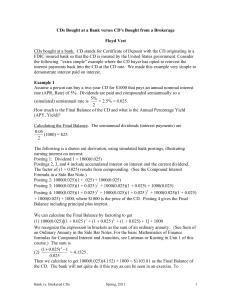

Form 19b-4 - NASDAQTrader.com

... The counting of U.S. dollar-settled option contracts as less than one full contract reflects the fact that the size of the U.S. dollar-settled option contract is smaller than the Exchange’s physical delivery contract on the same currencies. The position limit rules were originally adopted for the la ...

... The counting of U.S. dollar-settled option contracts as less than one full contract reflects the fact that the size of the U.S. dollar-settled option contract is smaller than the Exchange’s physical delivery contract on the same currencies. The position limit rules were originally adopted for the la ...

a japanese giant launches on the australian market

... Providing a hybrid Cloud solution allowed DMM access to their physical servers while offering the benefits of the Cloud - with great financial benefits: “The project included building servers on NTT ICT’s enterprise cloud platform to host DMM’s bespoke FX trading and hosting applications. This was c ...

... Providing a hybrid Cloud solution allowed DMM access to their physical servers while offering the benefits of the Cloud - with great financial benefits: “The project included building servers on NTT ICT’s enterprise cloud platform to host DMM’s bespoke FX trading and hosting applications. This was c ...

The new revenue recognition standard - asset management

... The new standard affects all fund managers that enter into contracts to provide services to their customers. Among the more significant potential changes are the accounting for performance-based fees, upfront fees and contract costs. IFRS 15 constrains the amount of revenue to be recognised to amoun ...

... The new standard affects all fund managers that enter into contracts to provide services to their customers. Among the more significant potential changes are the accounting for performance-based fees, upfront fees and contract costs. IFRS 15 constrains the amount of revenue to be recognised to amoun ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.