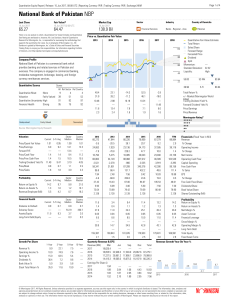

National Bank of Pakistan NBP

... responsible for overseeing the methodology that supports the quantitative equity ratings used in this report. As an employee of Morningstar, Inc., Mr. Davidson is guided by Morningstar, Inc.’s Code of Ethics and Personal Securities Trading Policy in carrying out his responsibilities. Quantitative Eq ...

... responsible for overseeing the methodology that supports the quantitative equity ratings used in this report. As an employee of Morningstar, Inc., Mr. Davidson is guided by Morningstar, Inc.’s Code of Ethics and Personal Securities Trading Policy in carrying out his responsibilities. Quantitative Eq ...

Risks in Hedge Fund Strategies: Case of Convertible Arbitrage

... All three primitive trading strategies are variations from a basic theme where CAs are essentially short-term providers of liquidity to the CB market. In doing so, CAs seek to capture a liquidity premium for managing the risk inherent in these PCASs. The concept is predicated on an illiquid, incompl ...

... All three primitive trading strategies are variations from a basic theme where CAs are essentially short-term providers of liquidity to the CB market. In doing so, CAs seek to capture a liquidity premium for managing the risk inherent in these PCASs. The concept is predicated on an illiquid, incompl ...

Definitions to Basic Technical Analysis Terms

... The confirmation type indicates how the event was confirmed to have occurred. Classic Patterns are found or recognized based on the price movements creating a specific formation. The pattern is finally confirmed when the price of the stock breaks through the "breakout price" of the instrument. The b ...

... The confirmation type indicates how the event was confirmed to have occurred. Classic Patterns are found or recognized based on the price movements creating a specific formation. The pattern is finally confirmed when the price of the stock breaks through the "breakout price" of the instrument. The b ...

The Impacts of Risk Reduction Strategy on Customer

... Sabol’s (2002) argument, which divides two sources contributing to customer perceived value, one is providing customer perceived benefits, and the other is reducing customer perceived risk. The literature generally agrees that customers evaluating supplier offerings by two dimensions, benefit side ( ...

... Sabol’s (2002) argument, which divides two sources contributing to customer perceived value, one is providing customer perceived benefits, and the other is reducing customer perceived risk. The literature generally agrees that customers evaluating supplier offerings by two dimensions, benefit side ( ...

ESSENTIALS OF INTERNATIONAL ECONOMICS:

... foreign trade, interstate flows of production factors, financial and monetary system that causes those flows. Establishment, development and functioning of the world economic relations as a special, integral and organic system influenced the separation of “International economics” into the independe ...

... foreign trade, interstate flows of production factors, financial and monetary system that causes those flows. Establishment, development and functioning of the world economic relations as a special, integral and organic system influenced the separation of “International economics” into the independe ...

U.S. Small Caps: Outperformers during Rising Rate Environments

... • One possible reason for small-cap The truth about small caps and rising rates The conventional wisdom suggests that rising interest rates are detrimental to the performance of stocks in general and to small-cap stocks in particular, both in absolute terms and relative to large caps. There are many ...

... • One possible reason for small-cap The truth about small caps and rising rates The conventional wisdom suggests that rising interest rates are detrimental to the performance of stocks in general and to small-cap stocks in particular, both in absolute terms and relative to large caps. There are many ...

Did the Basel Process of Capital Regulation Enhance the Resiliency

... their goals? How did they affect the conduct of banks in European banking markets where they were actually implemented? After almost thirty years of capital reform, it is high time for an evidencebased evaluation of the economic consequences of the massive regulatory interventions since the initial ...

... their goals? How did they affect the conduct of banks in European banking markets where they were actually implemented? After almost thirty years of capital reform, it is high time for an evidencebased evaluation of the economic consequences of the massive regulatory interventions since the initial ...

Questions from Ofgem`s Liquidity in the GB wholesale energy markets

... place in physical terms. However, the GB electricity market is strongly linked to several markets, in particular the GB gas market. The two markets are strongly linked in price terms with the gas market having a much greater effect on the GB electricity market than do continental gas markets have on ...

... place in physical terms. However, the GB electricity market is strongly linked to several markets, in particular the GB gas market. The two markets are strongly linked in price terms with the gas market having a much greater effect on the GB electricity market than do continental gas markets have on ...

A Model of Monetary Policy and Risk Premia

... In textbook models (e.g. Woodford, 2003), monetary policy works by changing the real interest rate. Yet a growing body of empirical evidence shows that monetary policy also has a large impact on the risk premium component of the cost of capital.1 Moreover, many central bank interventions can be usef ...

... In textbook models (e.g. Woodford, 2003), monetary policy works by changing the real interest rate. Yet a growing body of empirical evidence shows that monetary policy also has a large impact on the risk premium component of the cost of capital.1 Moreover, many central bank interventions can be usef ...

Competition Report

... What do we mean by ‘competition’? Competition in the commercial world means firms striving to win customers, with innovative firms bringing ideas to market, successful firms thriving, and unsuccessful ones making an exit. When markets are competitive, consumers will be offered variety and choice, wi ...

... What do we mean by ‘competition’? Competition in the commercial world means firms striving to win customers, with innovative firms bringing ideas to market, successful firms thriving, and unsuccessful ones making an exit. When markets are competitive, consumers will be offered variety and choice, wi ...

... has become increasingly clear that recovery in the developed economies has come to a grinding halt. This has led to a second stage of the crisis in which the United States of America and the advanced economies of Europe need to tackle their public debt issues amid ailing growth, in contrast to the i ...

The Balearic tourism empire, where “the sun never sets”

... Joan Buades: They are very important. If the tourism industry can claim to be the number one sector of the international economy, by generating more than 10% of the Gross World Product, we have eight Spanish multinational corporations among the top 70 in the world, and five of those companies were b ...

... Joan Buades: They are very important. If the tourism industry can claim to be the number one sector of the international economy, by generating more than 10% of the Gross World Product, we have eight Spanish multinational corporations among the top 70 in the world, and five of those companies were b ...

chapter 26: managing client portfolios

... This result can also be obtained by computing these returns for each of the individual holdings, weighting each result by the portfolio percentage and then adding to derive a total portfolio result. From the data available, it is not possible to determine specifically the inherent degree of portfoli ...

... This result can also be obtained by computing these returns for each of the individual holdings, weighting each result by the portfolio percentage and then adding to derive a total portfolio result. From the data available, it is not possible to determine specifically the inherent degree of portfoli ...

Leading indicators of distress in Danish banks in the period 2008-12

... interpreted as risk indicators of a bank becoming distressed in the nearby future rather than an exact timing of the distress event. 3.1. Identification of distressed banks From 2008 until March 2013 60 banks in Denmark have ceased business. This number comprises 19 smaller ceased banks not included ...

... interpreted as risk indicators of a bank becoming distressed in the nearby future rather than an exact timing of the distress event. 3.1. Identification of distressed banks From 2008 until March 2013 60 banks in Denmark have ceased business. This number comprises 19 smaller ceased banks not included ...

Domestic Government Debt Structure, Risk Characteristics

... instruments so as to deepen the financial markets) .It should be noted that despite a variety of theories of domestic debt markets developments, there have been relatively few empirical analysis of actual developments in many countries especially in subSaharan Africa. Our intention here is not to te ...

... instruments so as to deepen the financial markets) .It should be noted that despite a variety of theories of domestic debt markets developments, there have been relatively few empirical analysis of actual developments in many countries especially in subSaharan Africa. Our intention here is not to te ...

Chapter 6 - Fund Accounting

... INTRODUCTION The definition of a fund is an entity with a separate set of accounting records segregated for carrying on a specific activity. For example, a Local Unit of Administration (LUA) might account for a federal grant in its own fund. They would record the proceeds from a bond sale (e.g., a s ...

... INTRODUCTION The definition of a fund is an entity with a separate set of accounting records segregated for carrying on a specific activity. For example, a Local Unit of Administration (LUA) might account for a federal grant in its own fund. They would record the proceeds from a bond sale (e.g., a s ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.