Economic Survey 2014-15

... which sets the context for brief discussions of the policy issues focused on “creating opportunity and reducing vulnerability.” These issues are then elaborated in the following nine chapters. Growth requires macroeconomic and hence fiscal stability (Chapter 2). A re-visiting of the fiscal framework ...

... which sets the context for brief discussions of the policy issues focused on “creating opportunity and reducing vulnerability.” These issues are then elaborated in the following nine chapters. Growth requires macroeconomic and hence fiscal stability (Chapter 2). A re-visiting of the fiscal framework ...

Click Here

... which sets the context for brief discussions of the policy issues focused on “creating opportunity and reducing vulnerability.” These issues are then elaborated in the following nine chapters. Growth requires macroeconomic and hence fiscal stability (Chapter 2). A re-visiting of the fiscal framework ...

... which sets the context for brief discussions of the policy issues focused on “creating opportunity and reducing vulnerability.” These issues are then elaborated in the following nine chapters. Growth requires macroeconomic and hence fiscal stability (Chapter 2). A re-visiting of the fiscal framework ...

Form 10-K - Kimco Investor Relations

... Corporation (the “Company”) contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The Company intends such forward-looking statements to be covered by the safe harbo ...

... Corporation (the “Company”) contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The Company intends such forward-looking statements to be covered by the safe harbo ...

Notes - Barchart.com

... Industries, Ltd. (Kawasaki) and Kohler Co. (Kohler). Several Japanese and Chinese small engine manufacturers, of which Honda and Kawasaki are the largest, compete directly with Briggs & Stratton in world markets in the sale of engines to other OEMs and indirectly through their sale of end products. ...

... Industries, Ltd. (Kawasaki) and Kohler Co. (Kohler). Several Japanese and Chinese small engine manufacturers, of which Honda and Kawasaki are the largest, compete directly with Briggs & Stratton in world markets in the sale of engines to other OEMs and indirectly through their sale of end products. ...

Author`s Note, Crash Proof 2.0

... of the previous two years and offering various theories about the future. With all due respect to my fellow authors, however, most of them were writing after the fact and starting from the premise that the present crisis could not have been predicted. More important, while most believe that the econ ...

... of the previous two years and offering various theories about the future. With all due respect to my fellow authors, however, most of them were writing after the fact and starting from the premise that the present crisis could not have been predicted. More important, while most believe that the econ ...

Interpreting Farm Financial Ratios

... Working capital is simply a way to see how much of the current assets would be left over if all of them were sold and used to pay off all current liabilities. This is like the current ratio in that the farmer wants a positive number, but not too high a number as this indicates the assets not being u ...

... Working capital is simply a way to see how much of the current assets would be left over if all of them were sold and used to pay off all current liabilities. This is like the current ratio in that the farmer wants a positive number, but not too high a number as this indicates the assets not being u ...

The Development of the Brazilian Bond Market

... The bond market represents a large proportion of the GDP in developed countries but seems to be underdeveloped in emerging markets In the particular case of Brazil, it is widely known that firms do not have access to enough credit at a reasonable cost The Brazilian bond market as a % of GDP is small ...

... The bond market represents a large proportion of the GDP in developed countries but seems to be underdeveloped in emerging markets In the particular case of Brazil, it is widely known that firms do not have access to enough credit at a reasonable cost The Brazilian bond market as a % of GDP is small ...

matrix service company - Investor Relations Solutions

... Consequently, all of the forward-looking statements made in this Annual Report are qualified by these cautionary statements and there can be no assurance that the actual results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected co ...

... Consequently, all of the forward-looking statements made in this Annual Report are qualified by these cautionary statements and there can be no assurance that the actual results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected co ...

RISK MANAGEMENT

... ¥20,952 in June 2015. Thereafter, however, the rally lost momentum and in February 2016 the Nikkei Stock Average temporarily fell below ¥15,000 for the first time in a year and four months as market concerns that the U.S. ...

... ¥20,952 in June 2015. Thereafter, however, the rally lost momentum and in February 2016 the Nikkei Stock Average temporarily fell below ¥15,000 for the first time in a year and four months as market concerns that the U.S. ...

EXIDE TECHNOLOGIES - Nasdaq`s INTEL Solutions

... commitment letter executed by certain members of the UNC to provide additional term loan financing with net cash proceeds of $60.0 million, subject to satisfaction of certain conditions including approval by the Bankruptcy Court. On July 28, 2014, the Bankruptcy Court entered an order approving the ...

... commitment letter executed by certain members of the UNC to provide additional term loan financing with net cash proceeds of $60.0 million, subject to satisfaction of certain conditions including approval by the Bankruptcy Court. On July 28, 2014, the Bankruptcy Court entered an order approving the ...

Investing in Common Stocks

... number of shares outstanding by exchanging a specified number of new shares of stock for each outstanding share – Usually done to lower the stock price to make it more attractive to investors – Stockholders end up with more shares of stock that sells for a lower price – Investor with 200 shares in a ...

... number of shares outstanding by exchanging a specified number of new shares of stock for each outstanding share – Usually done to lower the stock price to make it more attractive to investors – Stockholders end up with more shares of stock that sells for a lower price – Investor with 200 shares in a ...

Tilburg University The impact of Taxation on Bank

... The leverage-inducing effect of CIT has long been known and investigated for nonfinancial firms, but only recently has attention turned to the role of CIT in determining banks’ capital structure (Keen and de Mooij, 2012; De Mooij et al., 2013; Gu et al., 2012; Hemmelgarn and Teichmann, 2013). The ta ...

... The leverage-inducing effect of CIT has long been known and investigated for nonfinancial firms, but only recently has attention turned to the role of CIT in determining banks’ capital structure (Keen and de Mooij, 2012; De Mooij et al., 2013; Gu et al., 2012; Hemmelgarn and Teichmann, 2013). The ta ...

Understanding Personal Finances and Investments

... Once you have formulated specific goals and have some money to invest, investment planning is similar to planning for a business. It begins with the evaluation of different investment opportunities—including the potential return and risk involved in each. At the very least, this process requires som ...

... Once you have formulated specific goals and have some money to invest, investment planning is similar to planning for a business. It begins with the evaluation of different investment opportunities—including the potential return and risk involved in each. At the very least, this process requires som ...

Understanding Systemic Risk: The Trade

... participants through fair-value accounting, as well as spillover effects through a network of interbank exposures.2 One of their main findings is that ignoring the interactions between solvency and market liquidity seriously underestimates the importance of risks in the whole financial system. GLS f ...

... participants through fair-value accounting, as well as spillover effects through a network of interbank exposures.2 One of their main findings is that ignoring the interactions between solvency and market liquidity seriously underestimates the importance of risks in the whole financial system. GLS f ...

INTERPRETING AGGREGATE STOCK MARKET BEHAVIOR: HOW

... Alternatively, habit formation models postulate that agents care not only about the level of their consumption, but also the distance between the level and some reference point. In some cases, as in Campbell and Cochrane (1999), the reliance on habit is more extreme: utility does not depend on the l ...

... Alternatively, habit formation models postulate that agents care not only about the level of their consumption, but also the distance between the level and some reference point. In some cases, as in Campbell and Cochrane (1999), the reliance on habit is more extreme: utility does not depend on the l ...

Macroprudential Policies in a Global Perspective Olivier Jeanne

... has been argued that the rest of the world’s appetite for U.S. “safe assets” was an important factor behind the U.S. credit and asset price boom and the subsequent crisis (Bernanke et al. 2011). The relationship between macroprudential policies and international capital flows goes both ways. Not onl ...

... has been argued that the rest of the world’s appetite for U.S. “safe assets” was an important factor behind the U.S. credit and asset price boom and the subsequent crisis (Bernanke et al. 2011). The relationship between macroprudential policies and international capital flows goes both ways. Not onl ...

Past 65 and Still Working: Big Data Insights on

... people to generate income from accumulated assets. Accordingly, further growth in participation by seniors appears quite possible. Among all adults, participation in the Online Platform Economy has been growing very quickly. To measure this growth, we assembled a dataset of over 260,000 anonymized ...

... people to generate income from accumulated assets. Accordingly, further growth in participation by seniors appears quite possible. Among all adults, participation in the Online Platform Economy has been growing very quickly. To measure this growth, we assembled a dataset of over 260,000 anonymized ...

Characterizing world market integration through time

... our knowledge, this is one of the Þrst papers to test time-varying market integration based on a theoretical IAPM. SpeciÞcally, we construct an “Integration Index” based on the two factor E-L asset pricing model, which is a special case of the more general IAPM of Stulz (1981) derived under barrier ...

... our knowledge, this is one of the Þrst papers to test time-varying market integration based on a theoretical IAPM. SpeciÞcally, we construct an “Integration Index” based on the two factor E-L asset pricing model, which is a special case of the more general IAPM of Stulz (1981) derived under barrier ...

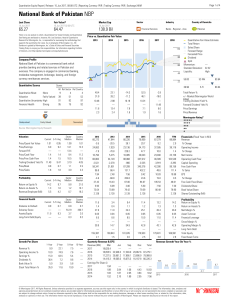

National Bank of Pakistan NBP

... responsible for overseeing the methodology that supports the quantitative equity ratings used in this report. As an employee of Morningstar, Inc., Mr. Davidson is guided by Morningstar, Inc.’s Code of Ethics and Personal Securities Trading Policy in carrying out his responsibilities. Quantitative Eq ...

... responsible for overseeing the methodology that supports the quantitative equity ratings used in this report. As an employee of Morningstar, Inc., Mr. Davidson is guided by Morningstar, Inc.’s Code of Ethics and Personal Securities Trading Policy in carrying out his responsibilities. Quantitative Eq ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.