B-Inflation

... 4. The rise in demand for real estate, which increases real estate prices in addition to sharp increase in the cost of housing due to shortage in property supplies such as steel and cement. 5. The dollar peg forces GCC central banks to follow the US Federal Reserve in setting interest rates. But whi ...

... 4. The rise in demand for real estate, which increases real estate prices in addition to sharp increase in the cost of housing due to shortage in property supplies such as steel and cement. 5. The dollar peg forces GCC central banks to follow the US Federal Reserve in setting interest rates. But whi ...

PowerPoint Presentation - University High School

... a. Has not been adjusted for changes in prices over time. b. Has been adjusted for changes in prices over time. c. Is a small or nominal amount of output. d. Excludes the international sector. e. Excludes government spending. ...

... a. Has not been adjusted for changes in prices over time. b. Has been adjusted for changes in prices over time. c. Is a small or nominal amount of output. d. Excludes the international sector. e. Excludes government spending. ...

Answers to Paper Practice Test

... A. it is not backed by a valuable commodity. - C.-it-acts-as-a-source-of-intrinsic-value. D.alacks portability. E-it does not-function-as-a-mediurn_af_exchange. 17. A criticism of expansionary fiscal polig to stimulate the economy and contractionary monetary policy to restrict the economy is that th ...

... A. it is not backed by a valuable commodity. - C.-it-acts-as-a-source-of-intrinsic-value. D.alacks portability. E-it does not-function-as-a-mediurn_af_exchange. 17. A criticism of expansionary fiscal polig to stimulate the economy and contractionary monetary policy to restrict the economy is that th ...

This PDF is a selection from a published volume from... Bureau of Economic Research

... income tax cut leads to a drop in marginal cost and, hence, in the price level. When there are price-setting frictions, a drop in the price level is accomplished by a period of falling prices. With the nominal interest rate unable to fall, the price deflation necessarily corresponds to a rise in the ...

... income tax cut leads to a drop in marginal cost and, hence, in the price level. When there are price-setting frictions, a drop in the price level is accomplished by a period of falling prices. With the nominal interest rate unable to fall, the price deflation necessarily corresponds to a rise in the ...

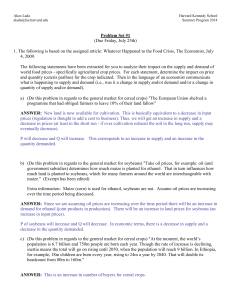

ps1_answers

... 2. In this problem we will be examining the United States' and China's hypothetical production possibility curves (ie. production possibility frontiers). Instead of placing narrow types of goods on the two axes, we will be placing very broadly defined goods on the axes. These good categories will be ...

... 2. In this problem we will be examining the United States' and China's hypothetical production possibility curves (ie. production possibility frontiers). Instead of placing narrow types of goods on the two axes, we will be placing very broadly defined goods on the axes. These good categories will be ...

M&B-Ch.3

... to someone else’s account when he deposits the check. Checks allow transactions to take place without the need to carry around large amount of currency. The introduction of checks was a major innovation that improved the efficiency of the payments system. ...

... to someone else’s account when he deposits the check. Checks allow transactions to take place without the need to carry around large amount of currency. The introduction of checks was a major innovation that improved the efficiency of the payments system. ...

HO 8

... § Shoeleather costs: the resources wasted when inflation encourages people to reduce their money holdings ...

... § Shoeleather costs: the resources wasted when inflation encourages people to reduce their money holdings ...

Inflation and growth: Explaining a negative effect

... negative inflation-growth effect above a certain ‘‘threshold’’ value of the inflation rate, and no significant effect below the threshold value, without using instrumental variables and with differences found between less and more developed country samples. Further the above-threshold negative effect that ...

... negative inflation-growth effect above a certain ‘‘threshold’’ value of the inflation rate, and no significant effect below the threshold value, without using instrumental variables and with differences found between less and more developed country samples. Further the above-threshold negative effect that ...

B - Effingham County Schools

... Of the following groups, the one hurt the LEAST by unanticipated inflation is • A workers who have cost-of-living adjustments in their labor contracts • B people who have saved money in accounts with a fixed interest rate • C banks that have made long term, fixed rate mortgage loans • D consumers w ...

... Of the following groups, the one hurt the LEAST by unanticipated inflation is • A workers who have cost-of-living adjustments in their labor contracts • B people who have saved money in accounts with a fixed interest rate • C banks that have made long term, fixed rate mortgage loans • D consumers w ...

Unit 5 Test …may the force be with you…….

... used as a medium of exchange. Bonds are illiquid and so are costly to convert to a medium of exchange. PTS: 1 DIF: 2 REF: 34-1 TOP: Money demand MSC: Interpretive 4. Describe the process in the money market by which the interest rate reaches its equilibrium value if it starts above equilibrium. ANS: ...

... used as a medium of exchange. Bonds are illiquid and so are costly to convert to a medium of exchange. PTS: 1 DIF: 2 REF: 34-1 TOP: Money demand MSC: Interpretive 4. Describe the process in the money market by which the interest rate reaches its equilibrium value if it starts above equilibrium. ANS: ...

This PDF is a selection from an out-of-print volume from... of Economic Research

... part of the total, they cannot provide a margin of safety. Secondly, for any given debt/GNP ratio, a higher share of exports in national income means a larger base of foreign exchange earnings with which to cushion external shocks and service debt. A country twice as open as another can generate twi ...

... part of the total, they cannot provide a margin of safety. Secondly, for any given debt/GNP ratio, a higher share of exports in national income means a larger base of foreign exchange earnings with which to cushion external shocks and service debt. A country twice as open as another can generate twi ...

EXCESSIVE LIQUIDITY PREFERENCE Prabhat Patnaik

... particular, together with the losses on loans, exceeds the total capital backing of the assets. For instance, in the case of banks the following estimates have been made. The total losses on loans by U.S. financial firms and fall in the value of their assets is estimated to peak at $3.6 trillion, of ...

... particular, together with the losses on loans, exceeds the total capital backing of the assets. For instance, in the case of banks the following estimates have been made. The total losses on loans by U.S. financial firms and fall in the value of their assets is estimated to peak at $3.6 trillion, of ...

document

... • The biggest fear as an economy reaches full employment is inflation. • Inflation is an increase in the average level of prices and services, not a change in any specific price. ...

... • The biggest fear as an economy reaches full employment is inflation. • Inflation is an increase in the average level of prices and services, not a change in any specific price. ...

Monetary Policy

... 1. The Fed will initially announce a lower target for the Federal funds rate, then use open-market operations (buying bonds in this case). The Fed may also lower the reserve ratio or the discount rate. 2. Increasing reserves will generate two results: a. The supply of Federal funds will increase, l ...

... 1. The Fed will initially announce a lower target for the Federal funds rate, then use open-market operations (buying bonds in this case). The Fed may also lower the reserve ratio or the discount rate. 2. Increasing reserves will generate two results: a. The supply of Federal funds will increase, l ...

Revaluation of the Chinese currency and its impact on China

... Figure 2 shows that the overall trade balance was consistently positive from 1/1994 to 9/2005. This implies an undervaluation of the RMB in the 19942005 period, with the extent of undervaluation especially severe in 200405. But, the trade balance test is const ...

... Figure 2 shows that the overall trade balance was consistently positive from 1/1994 to 9/2005. This implies an undervaluation of the RMB in the 19942005 period, with the extent of undervaluation especially severe in 200405. But, the trade balance test is const ...

Macroeconomic Adjustment and Structural Reform

... stimulate supply (shift AS right) in addition to reducing demand End result is point E with balance of payments equilibrium (B = 0). Level of GNP is unchanged, but its composition has changed. Price level is lower. ...

... stimulate supply (shift AS right) in addition to reducing demand End result is point E with balance of payments equilibrium (B = 0). Level of GNP is unchanged, but its composition has changed. Price level is lower. ...

EditedxThesis

... is complete government intervention in the foreign exchange market. The exchange rate is fixed at a given equilibrium level; and if the market forces of demand and supply tend to upset this equilibrium, the central bank would intervene and see that the fixed exchange rate is maintained (IBID). This ...

... is complete government intervention in the foreign exchange market. The exchange rate is fixed at a given equilibrium level; and if the market forces of demand and supply tend to upset this equilibrium, the central bank would intervene and see that the fixed exchange rate is maintained (IBID). This ...

Mankiw SM Chap10 correct size:chap10.qxd.qxd

... The reason is that according to the consumption function, higher income causes higher consumption. For example, an increase in government purchases of ΔG raises expenditure and, therefore, income by ΔG. This increase in income causes consumption to rise by MPC × ΔG, where MPC is the marginal propens ...

... The reason is that according to the consumption function, higher income causes higher consumption. For example, an increase in government purchases of ΔG raises expenditure and, therefore, income by ΔG. This increase in income causes consumption to rise by MPC × ΔG, where MPC is the marginal propens ...

country spreads in emerging countries: who drives whom?

... Until this point, I have used intuitive arguments to claim that the impulse response functions implied by the estimated VAR system make sense. I now would like to show that those impulse response functions are sensible in terms of a fully fledged dynamic general equilibrium model of an emerging coun ...

... Until this point, I have used intuitive arguments to claim that the impulse response functions implied by the estimated VAR system make sense. I now would like to show that those impulse response functions are sensible in terms of a fully fledged dynamic general equilibrium model of an emerging coun ...

NBER WORKING PAPER SERIES THE EXCHANGE RATE AS A TOOL OF COMMERCIAL POLICY

... fiscal expansion, financed by an increase in government debt, is also shown to appreciate the real exchange rate in the short run, even though private agents correctly forecast the future taxes that will be necessary to pay the interest ...

... fiscal expansion, financed by an increase in government debt, is also shown to appreciate the real exchange rate in the short run, even though private agents correctly forecast the future taxes that will be necessary to pay the interest ...

Eco120Int_Lecture8

... • The total demand for money is the sum of transactions and asset demand. • Transactions demand rises in P and Y. As i rises, people will try to minimize the use of cash in purchases, so transactions demand does not rise in i, and perhaps even falls in i. (We will assume it does not depend on i for ...

... • The total demand for money is the sum of transactions and asset demand. • Transactions demand rises in P and Y. As i rises, people will try to minimize the use of cash in purchases, so transactions demand does not rise in i, and perhaps even falls in i. (We will assume it does not depend on i for ...

Financial Education for College Access and Success

... This information is provided for the reader's convenience. Tennessee and the U.S. Department of Education are not responsible for controlling or guaranteeing the accuracy, relevance, timeliness, or completeness of this information. Further, the inclusion of information or Web site address does not r ...

... This information is provided for the reader's convenience. Tennessee and the U.S. Department of Education are not responsible for controlling or guaranteeing the accuracy, relevance, timeliness, or completeness of this information. Further, the inclusion of information or Web site address does not r ...

Exchange rate

.jpg?width=300)

In finance, an exchange rate (also known as a foreign-exchange rate, forex rate, FX rate or Agio) between two currencies is the rate at which one currency will be exchanged for another. It is also regarded as the value of one country’s currency in terms of another currency. For example, an interbank exchange rate of 119 Japanese yen (JPY, ¥) to the United States dollar (US$) means that ¥119 will be exchanged for each US$1 or that US$1 will be exchanged for each ¥119. In this case it is said that the price of a dollar in terms of yen is ¥119, or equivalently that the price of a yen in terms of dollars is $1/119.Exchange rates are determined in the foreign exchange market, which is open to a wide range of different types of buyers and sellers where currency trading is continuous: 24 hours a day except weekends, i.e. trading from 20:15 GMT on Sunday until 22:00 GMT Friday. The spot exchange rate refers to the current exchange rate. The forward exchange rate refers to an exchange rate that is quoted and traded today but for delivery and payment on a specific future date.In the retail currency exchange market, a different buying rate and selling rate will be quoted by money dealers. Most trades are to or from the local currency. The buying rate is the rate at which money dealers will buy foreign currency, and the selling rate is the rate at which they will sell the currency. The quoted rates will incorporate an allowance for a dealer's margin (or profit) in trading, or else the margin may be recovered in the form of a commission or in some other way. Different rates may also be quoted for cash (usually notes only), a documentary form (such as traveler's cheques) or electronically (such as a credit card purchase). The higher rate on documentary transactions has been justified to compensate for the additional time and cost of clearing the document, while the cash is available for resale immediately. Some dealers on the other hand prefer documentary transactions because of the security concerns with cash.