SWITCHING BETWEEN CHARTISTS AND

... agents transact in the market, the more chartist-like their behaviour, just as real-world survey results (Taylor and Allen 1992) would suggest. The difference between an asset’s price and the agent’s notion of its fundamental value also influences how fundamentalist the agent acts. The agents believ ...

... agents transact in the market, the more chartist-like their behaviour, just as real-world survey results (Taylor and Allen 1992) would suggest. The difference between an asset’s price and the agent’s notion of its fundamental value also influences how fundamentalist the agent acts. The agents believ ...

Europe and Global Imbalances Philip R. Lane Department of Economics, TCD

... deficit would have a non-negligible negative wealth effect on European investors, by reducing the value of their dollar-denominated claims. However, this effect would likely be smaller than in China and Japan, that hold larger net dollar positions. Third, there is considerable heterogeneity across E ...

... deficit would have a non-negligible negative wealth effect on European investors, by reducing the value of their dollar-denominated claims. However, this effect would likely be smaller than in China and Japan, that hold larger net dollar positions. Third, there is considerable heterogeneity across E ...

Chapter 16 Money in macroeconomics

... pieces of paper, checks, representing claims on such currency. In spite of no intrinsic value, these media of exchange may be generally accepted means of payment. Regulation by a central authority (the state or the central bank) has been of key importance in bringing about this transition into the p ...

... pieces of paper, checks, representing claims on such currency. In spite of no intrinsic value, these media of exchange may be generally accepted means of payment. Regulation by a central authority (the state or the central bank) has been of key importance in bringing about this transition into the p ...

4. Supply and Demand Developments

... GDP data for the second quarter of 2015 show that economic activity was stronger than anticipated in the July Inflation Report and national income posted a quarterly and annual growth of 1.3 and 3.8 percent, respectively. The annual GDP growth was mainly driven by industrial value added that exhibit ...

... GDP data for the second quarter of 2015 show that economic activity was stronger than anticipated in the July Inflation Report and national income posted a quarterly and annual growth of 1.3 and 3.8 percent, respectively. The annual GDP growth was mainly driven by industrial value added that exhibit ...

Chapter 8. The Natural Rate of Unemployment and the Phillips Curve

... do with the slow adjustment of wage demands to declines in productivity growth. This interpretation is presented in Chapter 13. Note that the interpretations of the changes in the natural rate tend to come after the fact. Such changes are difficult to predict. Third, the relationship between inflati ...

... do with the slow adjustment of wage demands to declines in productivity growth. This interpretation is presented in Chapter 13. Note that the interpretations of the changes in the natural rate tend to come after the fact. Such changes are difficult to predict. Third, the relationship between inflati ...

Time of Troubles: The Yen and Japan`s Economy, 1985

... reasonably closely together most of the time. The real effective CPI rate, in turn, is highly correlated with the real effective rate based on unit labor costs, shown in Figure 1. Having been around 260 yen per dollar in early 1985, the yen price of dollars had fallen to around 125 by early 1988, an ...

... reasonably closely together most of the time. The real effective CPI rate, in turn, is highly correlated with the real effective rate based on unit labor costs, shown in Figure 1. Having been around 260 yen per dollar in early 1985, the yen price of dollars had fallen to around 125 by early 1988, an ...

The Influence of Monetary and Fiscal Policy on Aggregate Demand

... surplus of money puts downward pressure on the interest rate. Conversely, if the interest rate is below the equilibrium level (such as at r2), the quantity of money people want to hold (Md2) is greater than the quantity the Fed has created, and this shortage of money puts upward pressure on the inte ...

... surplus of money puts downward pressure on the interest rate. Conversely, if the interest rate is below the equilibrium level (such as at r2), the quantity of money people want to hold (Md2) is greater than the quantity the Fed has created, and this shortage of money puts upward pressure on the inte ...

Macroeconomic Stabilization and Structural Reform

... Choice among alternative policy packages depends on initial position • If reserves are low and output is low (unemployment is high), devaluation may be advisable • If reserves are low and inflation is high, monetary and fiscal restraint may be in order • As a rule, do both at once ...

... Choice among alternative policy packages depends on initial position • If reserves are low and output is low (unemployment is high), devaluation may be advisable • If reserves are low and inflation is high, monetary and fiscal restraint may be in order • As a rule, do both at once ...

Revisiting Latin America`s debt crisis: some lessons for

... certainly, capacity constraints prevent higher levels of economic activity when supply happens to be inelastic as all productive resources are fully utilised. On the other hand, supply is said to be elastic under less than full employment of productive capacity, in which case aggregate economic acti ...

... certainly, capacity constraints prevent higher levels of economic activity when supply happens to be inelastic as all productive resources are fully utilised. On the other hand, supply is said to be elastic under less than full employment of productive capacity, in which case aggregate economic acti ...

Ecns 202 and Ecns 206 Course Packet

... Finance: how credit markets create economic efficiency and improved wellbeing. Government policy: how government policies effect the economy. ...

... Finance: how credit markets create economic efficiency and improved wellbeing. Government policy: how government policies effect the economy. ...

Currency Mismatch: New Database and Indicators for Latin America

... employed as proxies for currency mismatch. These indicators do not represent good proxies because they only consider the liability side of the balance sheet: The greater the proportion of foreign currencydenominated securities, the greater original sin is.10 The original sin measures indicate a larg ...

... employed as proxies for currency mismatch. These indicators do not represent good proxies because they only consider the liability side of the balance sheet: The greater the proportion of foreign currencydenominated securities, the greater original sin is.10 The original sin measures indicate a larg ...

Is the J-Curve Effect Observable for Small North European

... frictions to international trade are sufficient to allow deviations from purchasing power parity, at least in the short run. In reaction to exchange rate changes, producers may not immediately change the foreign currency price on products they sell in a foreign country. This the producers may do bec ...

... frictions to international trade are sufficient to allow deviations from purchasing power parity, at least in the short run. In reaction to exchange rate changes, producers may not immediately change the foreign currency price on products they sell in a foreign country. This the producers may do bec ...

Financial Globalization and the Russian Crisis of 1998

... In the Emerging Market Crises Hall of Fame--if there ever were such a thing--Russia 1998 would surely be assigned a place of distinction. It was preceded by the East Asian crisis of 1997-98, which began with the collapse of the Thai baht in July 1997, and then spread to envelope many of the prominen ...

... In the Emerging Market Crises Hall of Fame--if there ever were such a thing--Russia 1998 would surely be assigned a place of distinction. It was preceded by the East Asian crisis of 1997-98, which began with the collapse of the Thai baht in July 1997, and then spread to envelope many of the prominen ...

The Giant Sucking Sound: Did NAFTA Devour the Mexican Peso?

... Mexico also committed itself to address other long-standing U.S. concerns, like the protection of intellectual property rights and reform of Mexico’s regulation of foreign investment. NAFTA was the culmination of a significant break with Mexico’s protectionist past.3 Until the 1970s, Mexico followed ...

... Mexico also committed itself to address other long-standing U.S. concerns, like the protection of intellectual property rights and reform of Mexico’s regulation of foreign investment. NAFTA was the culmination of a significant break with Mexico’s protectionist past.3 Until the 1970s, Mexico followed ...

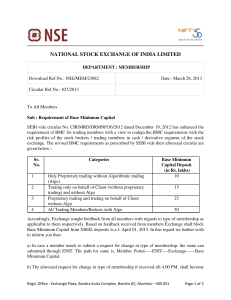

Ref No

... effective on next working day. Accordingly, all requests received after 4.00 PM, shall be processed in next cycle. Example: - In case a request is received for change in type of membership on April 01, 2013 at 3.00 PM, the revised BMC requirement shall become effective on next working day i.e. Apri ...

... effective on next working day. Accordingly, all requests received after 4.00 PM, shall be processed in next cycle. Example: - In case a request is received for change in type of membership on April 01, 2013 at 3.00 PM, the revised BMC requirement shall become effective on next working day i.e. Apri ...

IOSR Journal of Economics and Finance (IOSR-JEF)

... Therefore, if the authorities desire to maintain the level of expenditure in order to sustain the prevailing levels of employment, it means financing the deficit domestically from the banking system. This would mean monetary expansion, which therefore exerts further pressures on the balance of payme ...

... Therefore, if the authorities desire to maintain the level of expenditure in order to sustain the prevailing levels of employment, it means financing the deficit domestically from the banking system. This would mean monetary expansion, which therefore exerts further pressures on the balance of payme ...

Macroeconomic Stabilization and Structural Reform

... Then, to reduce deficit, consider reducing M or G or raising t to reduce demand (shift AD left) End result is still point A, but now with balance of payments equilibrium (B = 0). Level of GNP is unchanged, but its composition has changed. ...

... Then, to reduce deficit, consider reducing M or G or raising t to reduce demand (shift AD left) End result is still point A, but now with balance of payments equilibrium (B = 0). Level of GNP is unchanged, but its composition has changed. ...

Ch 17

... • Are New Keynesians correct? – Not all economists agree – The new classical theory already indicates that when prices are flexible, higher inflation expectations should reduce short-run aggregate supply and contribute to increased inflation – All macroeconomic theories suggest that various factors ...

... • Are New Keynesians correct? – Not all economists agree – The new classical theory already indicates that when prices are flexible, higher inflation expectations should reduce short-run aggregate supply and contribute to increased inflation – All macroeconomic theories suggest that various factors ...

secondary school improvement programme (ssip) 2015 - Sci

... Discuss in detail, with the aid of a clearly labelled diagram, the interaction between the four participants in the open economy circular-flow model. ...

... Discuss in detail, with the aid of a clearly labelled diagram, the interaction between the four participants in the open economy circular-flow model. ...

Board of Governors of the Federal Reserve System Number 825 January 2005

... has been linked to domestic U.S. capital formation increasing more than U.S. saving. Perceived high rates of return on U.S. assets, based on strong productivity growth relative to the rest of the world, combined with an efficient and secure U.S. capital market attracts foreign investment. By contras ...

... has been linked to domestic U.S. capital formation increasing more than U.S. saving. Perceived high rates of return on U.S. assets, based on strong productivity growth relative to the rest of the world, combined with an efficient and secure U.S. capital market attracts foreign investment. By contras ...

1 - Griffith Research Online

... The Sultanate of Oman is located in the Middle East and occupies the South Eastern corner of the Arabian Peninsula. Oman is a small open economy that depends largely on oil revenues for financing investment projects. Over the past three decades, oil revenues allowed Oman to achieve an impressive gro ...

... The Sultanate of Oman is located in the Middle East and occupies the South Eastern corner of the Arabian Peninsula. Oman is a small open economy that depends largely on oil revenues for financing investment projects. Over the past three decades, oil revenues allowed Oman to achieve an impressive gro ...

Quiz 2 - solutions

... 1. When the overall level of prices in the economy is increasing, we say that the economy is experiencing a. economic growth. b. inflation. c. unemployment. d. deflation. ...

... 1. When the overall level of prices in the economy is increasing, we say that the economy is experiencing a. economic growth. b. inflation. c. unemployment. d. deflation. ...

PRIVATE CAPITAL FLOWS AND THE REAL EXCHANGE RATE IN

... with the appreciation of the real exchange rate. However, other case studies do not conclude to a real appreciation of the exchange rate associated with public flows [Bandara (1995) in Sri Lanka; Nyoni (1998) and Li and Rowe (2007) in Tanzania; Aiyar et al., (2007) in Ethiopia, Ghana, Mozambique, Ta ...

... with the appreciation of the real exchange rate. However, other case studies do not conclude to a real appreciation of the exchange rate associated with public flows [Bandara (1995) in Sri Lanka; Nyoni (1998) and Li and Rowe (2007) in Tanzania; Aiyar et al., (2007) in Ethiopia, Ghana, Mozambique, Ta ...

Name: Date: ______ 1. The natural rate of unemployment is: A) the

... production function, same saving rate, same depreciation rate, and same rate of population growth) except that Country Large has a population of one billion workers and Country Small has a population of ten million workers, then the steady-state level of output per worker will be ______ and the stea ...

... production function, same saving rate, same depreciation rate, and same rate of population growth) except that Country Large has a population of one billion workers and Country Small has a population of ten million workers, then the steady-state level of output per worker will be ______ and the stea ...

Exchange rate

.jpg?width=300)

In finance, an exchange rate (also known as a foreign-exchange rate, forex rate, FX rate or Agio) between two currencies is the rate at which one currency will be exchanged for another. It is also regarded as the value of one country’s currency in terms of another currency. For example, an interbank exchange rate of 119 Japanese yen (JPY, ¥) to the United States dollar (US$) means that ¥119 will be exchanged for each US$1 or that US$1 will be exchanged for each ¥119. In this case it is said that the price of a dollar in terms of yen is ¥119, or equivalently that the price of a yen in terms of dollars is $1/119.Exchange rates are determined in the foreign exchange market, which is open to a wide range of different types of buyers and sellers where currency trading is continuous: 24 hours a day except weekends, i.e. trading from 20:15 GMT on Sunday until 22:00 GMT Friday. The spot exchange rate refers to the current exchange rate. The forward exchange rate refers to an exchange rate that is quoted and traded today but for delivery and payment on a specific future date.In the retail currency exchange market, a different buying rate and selling rate will be quoted by money dealers. Most trades are to or from the local currency. The buying rate is the rate at which money dealers will buy foreign currency, and the selling rate is the rate at which they will sell the currency. The quoted rates will incorporate an allowance for a dealer's margin (or profit) in trading, or else the margin may be recovered in the form of a commission or in some other way. Different rates may also be quoted for cash (usually notes only), a documentary form (such as traveler's cheques) or electronically (such as a credit card purchase). The higher rate on documentary transactions has been justified to compensate for the additional time and cost of clearing the document, while the cash is available for resale immediately. Some dealers on the other hand prefer documentary transactions because of the security concerns with cash.