exchange rate volatility and exports in south africa

... The Rand is one of the most actively traded emerging market currencies. Its daily global turnover volume in 1999 was about 9.5 billion dollars, only below the Brazilian Real (10.8 billion dollars) among emerging market currencies (Galati (2000)). In April 2005 the South African Rand accounted for 0. ...

... The Rand is one of the most actively traded emerging market currencies. Its daily global turnover volume in 1999 was about 9.5 billion dollars, only below the Brazilian Real (10.8 billion dollars) among emerging market currencies (Galati (2000)). In April 2005 the South African Rand accounted for 0. ...

The Inflation-Openness Payoff Revisited: A Note on Romer vs

... Romer (1993) finds closed economies have higher inflation. Central banks in economies more open to trade, Romer argues, find currency fluctuations caused by money surprises more painful and therefore exercise more restraint than their closed economy counterparts. While some question this “inconsiste ...

... Romer (1993) finds closed economies have higher inflation. Central banks in economies more open to trade, Romer argues, find currency fluctuations caused by money surprises more painful and therefore exercise more restraint than their closed economy counterparts. While some question this “inconsiste ...

Japanese Monetary Policy and International Spillovers

... models build in either monetary neutrality (real business cycle models) or monetary e¤ectiveness (New Keynesian models). In these highly structural models, there is little scope to examine whether or not Japanese monetary policy has been to able to a¤ect the real economies in Japan and the U.S. in t ...

... models build in either monetary neutrality (real business cycle models) or monetary e¤ectiveness (New Keynesian models). In these highly structural models, there is little scope to examine whether or not Japanese monetary policy has been to able to a¤ect the real economies in Japan and the U.S. in t ...

Revisiting the Case for a Tobin Tax Post Asian Crisis

... countries are inflicted by this original sin phenomenon. McLean and Shreshta (2001) explore this issue using a case-study approach involving Australia, New Zealand and South Africa, all small and open economies that borrow internationally in domestic currencies. They conclude that countries where do ...

... countries are inflicted by this original sin phenomenon. McLean and Shreshta (2001) explore this issue using a case-study approach involving Australia, New Zealand and South Africa, all small and open economies that borrow internationally in domestic currencies. They conclude that countries where do ...

as a PDF

... should be at a not-distorted price. If there is some implicit subsidy, it will reproduce the same credibility issues that alternative stabilization policies face. In addition, this paper supports the stylized fact presented by Hausmann, Panizza and Stein (1999) where they show that emerging countrie ...

... should be at a not-distorted price. If there is some implicit subsidy, it will reproduce the same credibility issues that alternative stabilization policies face. In addition, this paper supports the stylized fact presented by Hausmann, Panizza and Stein (1999) where they show that emerging countrie ...

PDF

... of a given country possesses with the same purchasing power like the item of the reference currency from the perspective of particular goods and services (in this case: GDP). The reference currency can be the money of a country (the OECD applies dollar as a comparison point) although for this reason ...

... of a given country possesses with the same purchasing power like the item of the reference currency from the perspective of particular goods and services (in this case: GDP). The reference currency can be the money of a country (the OECD applies dollar as a comparison point) although for this reason ...

Evolving Perceptions of Central Bank Credibility

... provided by considering the smoothed time path of the estimated parameters of the coefficient on the news announcement, estimated through another new, and related, econometric technique (Müller and Petalas, forthcoming). Parameter values evolved in a manner consistent with the perception of an incre ...

... provided by considering the smoothed time path of the estimated parameters of the coefficient on the news announcement, estimated through another new, and related, econometric technique (Müller and Petalas, forthcoming). Parameter values evolved in a manner consistent with the perception of an incre ...

NBER WORKING PAPER SERIES DEVALUATION CRISES AND THE MACROECONOMIC CONSEQUENCES

... Regarding real exchange rates, in 15 out of the 19 countries wsth relevant data the bilateral real exchange rate experienced a real apprecia tion in the three years prior to the devaluation; in 13 out of the 19 cases there also was a real appreciation of the multilateral RER during the period immedi ...

... Regarding real exchange rates, in 15 out of the 19 countries wsth relevant data the bilateral real exchange rate experienced a real apprecia tion in the three years prior to the devaluation; in 13 out of the 19 cases there also was a real appreciation of the multilateral RER during the period immedi ...

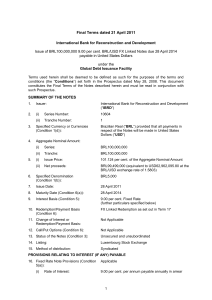

Final Terms dated 21 April 2011

... “BRL Rate” means, in respect of a BRL Valuation Date, the BRL/USD exchange rate, expressed as the amount of BRL per one USD: (a) determined by the Calculation Agent on the relevant BRL Valuation Date by reference to the applicable BRLPTAX Rate; or (b) in the event that the BRL-PTAX Rate is not avail ...

... “BRL Rate” means, in respect of a BRL Valuation Date, the BRL/USD exchange rate, expressed as the amount of BRL per one USD: (a) determined by the Calculation Agent on the relevant BRL Valuation Date by reference to the applicable BRLPTAX Rate; or (b) in the event that the BRL-PTAX Rate is not avail ...

The Efficacy of Foreign Exchange Market Intervention in Malawi

... package, the RBM has also intervened to buy foreign exchange in order to build up reserves for the government and to moderate exchange rate fluctuations. There has been much debate in the literature on the question of whether these interventions affect the value of the kwacha. Friedman (1953) provid ...

... package, the RBM has also intervened to buy foreign exchange in order to build up reserves for the government and to moderate exchange rate fluctuations. There has been much debate in the literature on the question of whether these interventions affect the value of the kwacha. Friedman (1953) provid ...

Slides for Chapter 9 - the School of Economics and Finance

... …rst, it is $0.25 per hour. After in‡ation-adjusted, it becomes $4.15 per hour). In November 2010, legislators of the Hong Kong Government agreed to set a minimum wage level of HK$28 ($4.70). ...

... …rst, it is $0.25 per hour. After in‡ation-adjusted, it becomes $4.15 per hour). In November 2010, legislators of the Hong Kong Government agreed to set a minimum wage level of HK$28 ($4.70). ...

Exchange rate volatility–economic growth nexus in Uganda

... act of 1964, the public was forbidden to hold foreign currency. There was an acute shortage of foreign exchange during this period and exporters/importers of commodities were required to deal directly with the central bank which operated under various fixed exchange regimes that were at odds with ma ...

... act of 1964, the public was forbidden to hold foreign currency. There was an acute shortage of foreign exchange during this period and exporters/importers of commodities were required to deal directly with the central bank which operated under various fixed exchange regimes that were at odds with ma ...

October Michael THE IFLATIO NARY PROCESS IN ISRAEL:

... Taking as given successive governments' reluctance to force the inflation rate down through restrictive policy that might produce a major recession, there remain serious economic questions about the forces driving the inflationary process and the institutional adaptations that permit the economy to ...

... Taking as given successive governments' reluctance to force the inflation rate down through restrictive policy that might produce a major recession, there remain serious economic questions about the forces driving the inflationary process and the institutional adaptations that permit the economy to ...

L - cerge-ei

... to think about that. First, observe in Figure 1 that government debt is negligible before July 1994, when the government started to change seigniorage for debt as source of government finance. Also, average inflation decreased from a roughly average of 500% before that date to an average of 50% afte ...

... to think about that. First, observe in Figure 1 that government debt is negligible before July 1994, when the government started to change seigniorage for debt as source of government finance. Also, average inflation decreased from a roughly average of 500% before that date to an average of 50% afte ...

mmi14-Mueller 19106649 en

... and Barro 2002). Delegating monetary policy to a hawkish central bank reduces inflation bias and thus differences in nominal interest rates across member states. The euro area is a case in point. Figure 1 displays monthly yield spreads on government bonds for Italy, Spain, Ireland, and Greece relative ...

... and Barro 2002). Delegating monetary policy to a hawkish central bank reduces inflation bias and thus differences in nominal interest rates across member states. The euro area is a case in point. Figure 1 displays monthly yield spreads on government bonds for Italy, Spain, Ireland, and Greece relative ...

Chapter 10: The Housing Market and Housing Finance in Russia

... The financial crisis contributed to a further slowdown in construction. Construction companies were unable to refinance short-term loans and went bankrupt in several cases, abandoning many construction projects. Construction activity continued to decrease throughout the crisis. We now turn to the ho ...

... The financial crisis contributed to a further slowdown in construction. Construction companies were unable to refinance short-term loans and went bankrupt in several cases, abandoning many construction projects. Construction activity continued to decrease throughout the crisis. We now turn to the ho ...

The Phillips curve -- is there a trade

... • Pt. C illustrates an economy experiencing 4% inflation that was anticipated by decision makers, and because the inflation was anticipated, the natural rate of unemployment is present. • With adaptive expectations, demand stimulus policies that result in a still higher rate of inflation (like 8%) w ...

... • Pt. C illustrates an economy experiencing 4% inflation that was anticipated by decision makers, and because the inflation was anticipated, the natural rate of unemployment is present. • With adaptive expectations, demand stimulus policies that result in a still higher rate of inflation (like 8%) w ...

First North Price List

... by multiplying the number of shares by the closing prices for all trading days of the previous calendar year. Upon admission for trade, the market value of shares is calculated as the product of the number of shares and the weighted average price of transactions recorded with the Estonian CSD during ...

... by multiplying the number of shares by the closing prices for all trading days of the previous calendar year. Upon admission for trade, the market value of shares is calculated as the product of the number of shares and the weighted average price of transactions recorded with the Estonian CSD during ...

Practice Exam PPT

... (c) Equal increases in both imports and exports (d) Equal increases in both taxes and government expenditures (e) Equal decreases in both investment and government expenditures 25. If the federal government reduces its budget deficit when the economy is close to full employment, which of the followi ...

... (c) Equal increases in both imports and exports (d) Equal increases in both taxes and government expenditures (e) Equal decreases in both investment and government expenditures 25. If the federal government reduces its budget deficit when the economy is close to full employment, which of the followi ...

DRAFT September 8, 2010

... The current account balance is the sum of the trade balance, remittance inflows, and the interest payments/receipts associated with the country’s international investment position. The latter is the product of the nominal interest rate on external debt/assets (given by the rate of time preference pl ...

... The current account balance is the sum of the trade balance, remittance inflows, and the interest payments/receipts associated with the country’s international investment position. The latter is the product of the nominal interest rate on external debt/assets (given by the rate of time preference pl ...

Martin Feldstein DEFLATION

... I’m very happy to do so. Deflation is certainly an important issue. It is a real problem in Japan. I’m frequently asked by people in business and in the general public whether the US is now experiencing deflation or is heading into deflation and, if so, what should be done about it. Similar concerns ...

... I’m very happy to do so. Deflation is certainly an important issue. It is a real problem in Japan. I’m frequently asked by people in business and in the general public whether the US is now experiencing deflation or is heading into deflation and, if so, what should be done about it. Similar concerns ...

Exchange rate

.jpg?width=300)

In finance, an exchange rate (also known as a foreign-exchange rate, forex rate, FX rate or Agio) between two currencies is the rate at which one currency will be exchanged for another. It is also regarded as the value of one country’s currency in terms of another currency. For example, an interbank exchange rate of 119 Japanese yen (JPY, ¥) to the United States dollar (US$) means that ¥119 will be exchanged for each US$1 or that US$1 will be exchanged for each ¥119. In this case it is said that the price of a dollar in terms of yen is ¥119, or equivalently that the price of a yen in terms of dollars is $1/119.Exchange rates are determined in the foreign exchange market, which is open to a wide range of different types of buyers and sellers where currency trading is continuous: 24 hours a day except weekends, i.e. trading from 20:15 GMT on Sunday until 22:00 GMT Friday. The spot exchange rate refers to the current exchange rate. The forward exchange rate refers to an exchange rate that is quoted and traded today but for delivery and payment on a specific future date.In the retail currency exchange market, a different buying rate and selling rate will be quoted by money dealers. Most trades are to or from the local currency. The buying rate is the rate at which money dealers will buy foreign currency, and the selling rate is the rate at which they will sell the currency. The quoted rates will incorporate an allowance for a dealer's margin (or profit) in trading, or else the margin may be recovered in the form of a commission or in some other way. Different rates may also be quoted for cash (usually notes only), a documentary form (such as traveler's cheques) or electronically (such as a credit card purchase). The higher rate on documentary transactions has been justified to compensate for the additional time and cost of clearing the document, while the cash is available for resale immediately. Some dealers on the other hand prefer documentary transactions because of the security concerns with cash.