INTERNATIONAL FINANCE REVISITED

... • Fiscal austerity in the euro zone would sedate EZ economies into near-zero growth. • Imports into US and EZ will decline, partly due to slower economic growth and partly due to the weakening of their currencies. • Prognosis for EUR: will Greece quit EZ? More to follow? If they don’t will Germany e ...

... • Fiscal austerity in the euro zone would sedate EZ economies into near-zero growth. • Imports into US and EZ will decline, partly due to slower economic growth and partly due to the weakening of their currencies. • Prognosis for EUR: will Greece quit EZ? More to follow? If they don’t will Germany e ...

International Financial Market

... Roll-over Credit where the interest is paid in floating rate and TAPS, CD’s for less than a year with min $25,000 denomination which could be in a series of identical CD’s (Tranche) or single issue, and Fivecurrency CD (denominated in a basket of five different currencies). MENU ...

... Roll-over Credit where the interest is paid in floating rate and TAPS, CD’s for less than a year with min $25,000 denomination which could be in a series of identical CD’s (Tranche) or single issue, and Fivecurrency CD (denominated in a basket of five different currencies). MENU ...

SS6CG5B

... when countries work together they are a more powerful force in the world because they involve more people, more money, and more land area • This helps make the smaller countries of Europe more complete in the world market ...

... when countries work together they are a more powerful force in the world because they involve more people, more money, and more land area • This helps make the smaller countries of Europe more complete in the world market ...

Lalin Dias, VP Exchange Systems, MillenniumIT

... commodities) in mature and developing markets. Prior to his current role, Lalin was the product manager for Millennium Exchange and previously the head of MillenniumIT’s business analysis practice. Lalin worked for the Government of Sri Lanka on its public sector reform programme prior to joining Mi ...

... commodities) in mature and developing markets. Prior to his current role, Lalin was the product manager for Millennium Exchange and previously the head of MillenniumIT’s business analysis practice. Lalin worked for the Government of Sri Lanka on its public sector reform programme prior to joining Mi ...

Comments on “Income and Price Elasticities of Croatian Trade

... Traditional imperfect substitutes model: domestic cost and foreign prices are treated as exogenous to exchange rate changes. Such an assumption may be justified for some group of products and possibly in the short run. This seems inappropriate given the pervasive effects of exchange rates on product ...

... Traditional imperfect substitutes model: domestic cost and foreign prices are treated as exogenous to exchange rate changes. Such an assumption may be justified for some group of products and possibly in the short run. This seems inappropriate given the pervasive effects of exchange rates on product ...

第七部分

... • Is the signaling effect “crying ‘wolf!’”? • If governments do not follow up on their exchange market signals with concrete policy moves, the signals soon become ineffective. ...

... • Is the signaling effect “crying ‘wolf!’”? • If governments do not follow up on their exchange market signals with concrete policy moves, the signals soon become ineffective. ...

E. technical analysis

... vi. The spread between the official and market rates are another indicator of currency health. If the spread increases this reflects increasing problems with the fixed rate. C. The second step is for forecasters to evaluate the pressure that market forces exert on the prevailing exchange rate. There ...

... vi. The spread between the official and market rates are another indicator of currency health. If the spread increases this reflects increasing problems with the fixed rate. C. The second step is for forecasters to evaluate the pressure that market forces exert on the prevailing exchange rate. There ...

EC120 week 1 - University of Essex

... EC120: The World Economy in Historical Perspective 3. Policy Constraints (especially in Europe) and the International Monetary Trilemma • The particular problems of differential inflation rates for European economic integration in the context of generalized floating: – either the country with a hig ...

... EC120: The World Economy in Historical Perspective 3. Policy Constraints (especially in Europe) and the International Monetary Trilemma • The particular problems of differential inflation rates for European economic integration in the context of generalized floating: – either the country with a hig ...

PDF

... NBRM were brought to question, because only in period of three months the NBRM intervened with substantial amount on the currency market with intention to defend the fixed exchange rate regime. When the country makes the decision which sources (taxes or borrowing) to use in financing the expansive f ...

... NBRM were brought to question, because only in period of three months the NBRM intervened with substantial amount on the currency market with intention to defend the fixed exchange rate regime. When the country makes the decision which sources (taxes or borrowing) to use in financing the expansive f ...

Paraguay_en.pdf

... requirements to zero for local currency deposits of more than one year and for foreign currency deposits of more than 541 days. In March, it established a line of credit to provide liquidity to local financial institutions. Monetary aggregates expanded in the first half of 2008. From January to June ...

... requirements to zero for local currency deposits of more than one year and for foreign currency deposits of more than 541 days. In March, it established a line of credit to provide liquidity to local financial institutions. Monetary aggregates expanded in the first half of 2008. From January to June ...

Chapter-08 - Blackwell Publishing

... deteriorated rapidly since 1990. Mexico's international reserves had actually increased every year from 1990 to 1993 because the capital account (Table 8-3 does not show this account) had been consistently positive in all these years. One can say that foreigners increased their direct investments, h ...

... deteriorated rapidly since 1990. Mexico's international reserves had actually increased every year from 1990 to 1993 because the capital account (Table 8-3 does not show this account) had been consistently positive in all these years. One can say that foreigners increased their direct investments, h ...

Industrial countries other than the United States

... • Triffin paradox – world demand for $ requires U.S. to run persistent balance-of-payments deficits that ultimately leads to loss of confidence in the $. • SDR was created to relieve the $ shortage. • Throughout the 1960s countries with large $ reserves began buying gold from the U.S. in increasing ...

... • Triffin paradox – world demand for $ requires U.S. to run persistent balance-of-payments deficits that ultimately leads to loss of confidence in the $. • SDR was created to relieve the $ shortage. • Throughout the 1960s countries with large $ reserves began buying gold from the U.S. in increasing ...

solution

... increase in official foreign reserves. The fall in imports for one country implies a fall in exports for another country, and a corresponding inward shift of that country’s DD curve necessitating a monetary contraction by the central bank to preserve its fixed exchange rate. If all countries impose ...

... increase in official foreign reserves. The fall in imports for one country implies a fall in exports for another country, and a corresponding inward shift of that country’s DD curve necessitating a monetary contraction by the central bank to preserve its fixed exchange rate. If all countries impose ...

fixed exchange rate - McGraw Hill Higher Education

... • The Japanese computer cost is ¥242,000/(¥110/US$1) or $2,200 – The Japanese computer is cheaper • The relative price of the U.S. computer to the Japanese computer is US$2,400 / US$2,200 = 1.09 – U.S. computer costs 9% more than the Japanese ...

... • The Japanese computer cost is ¥242,000/(¥110/US$1) or $2,200 – The Japanese computer is cheaper • The relative price of the U.S. computer to the Japanese computer is US$2,400 / US$2,200 = 1.09 – U.S. computer costs 9% more than the Japanese ...

0133423662_inpp t (11)

... The International Monetary and Financial Systems • International monetary system: the institutional framework, rules, and procedures by which national currencies are exchanged for one another. • Global financial system: the collection of financial institutions that facilitate and regulate the flows ...

... The International Monetary and Financial Systems • International monetary system: the institutional framework, rules, and procedures by which national currencies are exchanged for one another. • Global financial system: the collection of financial institutions that facilitate and regulate the flows ...

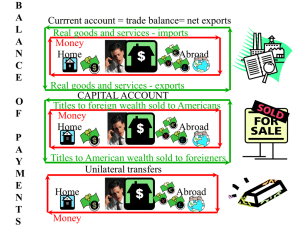

International Lecture

... Home Abroad Real goods and services - exports CAPITAL ACCOUNT Titles to foreign wealth sold to Americans Money Home Abroad Titles to American wealth sold to foreigners Unilateral transfers ...

... Home Abroad Real goods and services - exports CAPITAL ACCOUNT Titles to foreign wealth sold to Americans Money Home Abroad Titles to American wealth sold to foreigners Unilateral transfers ...

... remainder. Public sector financing using central bank resources held steady, contributing to a 31% expansion of the monetary base up to September. The combination of all these factors resulted in 32% year-on-year growth in M3, well above nominal GDP growth. Although the foreign-exchange market began ...

South East Asia before the Crisis

... Capital mobility the national authorities will lose control over monetary policy to some extent , and the economy will become more vulnerable to external shocks ...

... Capital mobility the national authorities will lose control over monetary policy to some extent , and the economy will become more vulnerable to external shocks ...

The International Gold Standard, 1879-1913

... Each country was responsible for maintaining its exchange rate within ±1% of the adopted par value by buying or selling foreign reserves as necessary. The U.S. was only responsible for maintaining the gold parity. This created strong demand for $ reserves and allowed the U.S. to run trade deficits. ...

... Each country was responsible for maintaining its exchange rate within ±1% of the adopted par value by buying or selling foreign reserves as necessary. The U.S. was only responsible for maintaining the gold parity. This created strong demand for $ reserves and allowed the U.S. to run trade deficits. ...

Monetary Policy - Diablo Valley College

... Shift of AD Less money Less Income leftward Shift of AD ...

... Shift of AD Less money Less Income leftward Shift of AD ...

How Exchange Rate Influence a Country`s Import and

... Abstract- Businesspersons and governments all over the globe are very serious about the severe results of currency appreciation and depreciation on different things such as imports, exports, domestic products, etc. Academic researchers conducted many researches in order to explore the impact of curr ...

... Abstract- Businesspersons and governments all over the globe are very serious about the severe results of currency appreciation and depreciation on different things such as imports, exports, domestic products, etc. Academic researchers conducted many researches in order to explore the impact of curr ...

relevant macroeconomic parameters

... means that more jobs are created and more incomes are received. The per capita GNP (GNP divided by population) is also an important gauge of economic development and is often used as the basis for classifying countries as underdeveloped or developing. ...

... means that more jobs are created and more incomes are received. The per capita GNP (GNP divided by population) is also an important gauge of economic development and is often used as the basis for classifying countries as underdeveloped or developing. ...

Exchange rate

.jpg?width=300)

In finance, an exchange rate (also known as a foreign-exchange rate, forex rate, FX rate or Agio) between two currencies is the rate at which one currency will be exchanged for another. It is also regarded as the value of one country’s currency in terms of another currency. For example, an interbank exchange rate of 119 Japanese yen (JPY, ¥) to the United States dollar (US$) means that ¥119 will be exchanged for each US$1 or that US$1 will be exchanged for each ¥119. In this case it is said that the price of a dollar in terms of yen is ¥119, or equivalently that the price of a yen in terms of dollars is $1/119.Exchange rates are determined in the foreign exchange market, which is open to a wide range of different types of buyers and sellers where currency trading is continuous: 24 hours a day except weekends, i.e. trading from 20:15 GMT on Sunday until 22:00 GMT Friday. The spot exchange rate refers to the current exchange rate. The forward exchange rate refers to an exchange rate that is quoted and traded today but for delivery and payment on a specific future date.In the retail currency exchange market, a different buying rate and selling rate will be quoted by money dealers. Most trades are to or from the local currency. The buying rate is the rate at which money dealers will buy foreign currency, and the selling rate is the rate at which they will sell the currency. The quoted rates will incorporate an allowance for a dealer's margin (or profit) in trading, or else the margin may be recovered in the form of a commission or in some other way. Different rates may also be quoted for cash (usually notes only), a documentary form (such as traveler's cheques) or electronically (such as a credit card purchase). The higher rate on documentary transactions has been justified to compensate for the additional time and cost of clearing the document, while the cash is available for resale immediately. Some dealers on the other hand prefer documentary transactions because of the security concerns with cash.