Chile_en.pdf

... currency appreciation resumed —a pattern that had been interrupted, in late 2008, by the sharp exchange rate rises that accompanied the onset of the crisis. In response, the monetary authority has limited itself thus far to issuing statements, but has not ruled out the possibility of taking measures ...

... currency appreciation resumed —a pattern that had been interrupted, in late 2008, by the sharp exchange rate rises that accompanied the onset of the crisis. In response, the monetary authority has limited itself thus far to issuing statements, but has not ruled out the possibility of taking measures ...

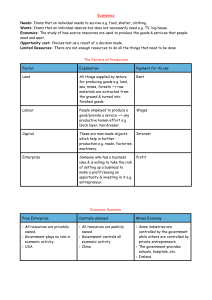

Economics (Notes)

... • Does not have raw materials required for production e.g. oil, coal, steel. • Certain countries have natural skills e.g. French wines. ...

... • Does not have raw materials required for production e.g. oil, coal, steel. • Certain countries have natural skills e.g. French wines. ...

CHAPTER 11 MEASURING THE COST OF LIVING

... 2. Introduction of new goods: When a new good introduced, consumers have more variety from which to choose(it does not reflect the change in purchasing power of the dollar) 3. Unmeasured quality change: If the quality of a good deteriorates from one year to the next, the value of a dollar falls, eve ...

... 2. Introduction of new goods: When a new good introduced, consumers have more variety from which to choose(it does not reflect the change in purchasing power of the dollar) 3. Unmeasured quality change: If the quality of a good deteriorates from one year to the next, the value of a dollar falls, eve ...

class11

... Forwards supply of dollar goes up dollar depreciates by 1% Now – Dollar sells at 2% forward discount = Interest rate in US is 2% point higher than in Ireland ...

... Forwards supply of dollar goes up dollar depreciates by 1% Now – Dollar sells at 2% forward discount = Interest rate in US is 2% point higher than in Ireland ...

Problem Set 10

... 10. Under flexible exchange rates, the price of the British pound will depreciate relative to the dollar if: (a) American desires for British goods increases relative to British desires for American goods. (b) American national income increases while British national income remains constant. (c) wit ...

... 10. Under flexible exchange rates, the price of the British pound will depreciate relative to the dollar if: (a) American desires for British goods increases relative to British desires for American goods. (b) American national income increases while British national income remains constant. (c) wit ...

Bretton Woods System - Wharton Finance Department

... Suddenly, discovery of new gold mines causes huge influx of gold into the market. Gold becomes much cheaper to produce than silver is. ...

... Suddenly, discovery of new gold mines causes huge influx of gold into the market. Gold becomes much cheaper to produce than silver is. ...

Demand in the Open Economy Preliminaries and Assumptions

... Central banks in both Australia and N.Z. expanded real money supply, shifting LM curve right, reducing interest rates. Model: net effect of decrease in export demand and monetary expansion is as follows: Little or no change in output. Decrease in nominal interest rate—investment increases. Inc ...

... Central banks in both Australia and N.Z. expanded real money supply, shifting LM curve right, reducing interest rates. Model: net effect of decrease in export demand and monetary expansion is as follows: Little or no change in output. Decrease in nominal interest rate—investment increases. Inc ...

Spot Market

... New York. • The £0.687 would purchase b57.274 in London. • The b57.274 purchases $1.375 in New York, or 37.5% profit on the transaction. • To understand the arbitrage opportunity, remember “buy low, sell high.” Spot Market ...

... New York. • The £0.687 would purchase b57.274 in London. • The b57.274 purchases $1.375 in New York, or 37.5% profit on the transaction. • To understand the arbitrage opportunity, remember “buy low, sell high.” Spot Market ...

Price Adjustments and Balance-of

... demand tend to be smaller in absolute value than long-run elasticities. Consumers don’t adjust immediately to relative price changes; it’s not unusual for the quantity demanded of imports and the amount of foreign exchange needed to not respond to changes in the exchange rate. The supply of expo ...

... demand tend to be smaller in absolute value than long-run elasticities. Consumers don’t adjust immediately to relative price changes; it’s not unusual for the quantity demanded of imports and the amount of foreign exchange needed to not respond to changes in the exchange rate. The supply of expo ...

The Foreign Exchange Crisis in Belarus

... unchanged. The official rate was used by banks trading foreign currency to individuals, and by businesses, which had to sell 30 percent of their foreign exchange revenues to the Central Bank. It was also used for “crucially important” imports — such as energy and pharmaceuticals — as well as for the ...

... unchanged. The official rate was used by banks trading foreign currency to individuals, and by businesses, which had to sell 30 percent of their foreign exchange revenues to the Central Bank. It was also used for “crucially important” imports — such as energy and pharmaceuticals — as well as for the ...

introduction to exchange rates and the foreign exchange

... we can use the exchange rate to compare prices in same currency terms. Changes in the exchange rate affect the relative prices of goods across countries: Appreciation in the home currency leads to an increase in the relative price of its exports to foreigners and a decrease in the relative price ...

... we can use the exchange rate to compare prices in same currency terms. Changes in the exchange rate affect the relative prices of goods across countries: Appreciation in the home currency leads to an increase in the relative price of its exports to foreigners and a decrease in the relative price ...

Intro - Prof Dimond

... • Increased demand for currency as more foreign goods are demanded, more of the foreign currency is demand at each possible exchange rate • The price of the foreign currency in local currency increases. • Home Currency Depreciation happens when the foreign currency’s “price” rises. In other words, t ...

... • Increased demand for currency as more foreign goods are demanded, more of the foreign currency is demand at each possible exchange rate • The price of the foreign currency in local currency increases. • Home Currency Depreciation happens when the foreign currency’s “price” rises. In other words, t ...

Ignore the Trade Balance: Concentrate on Full Employment

... value of a currency does necessitate a decrease in domestic real incomes, depending among other factors on the openness of the domestic economy, on price and cross elasticities and on exchange-rate pass-through effects. However, the potential for this to feed a continuous inflation depends on domest ...

... value of a currency does necessitate a decrease in domestic real incomes, depending among other factors on the openness of the domestic economy, on price and cross elasticities and on exchange-rate pass-through effects. However, the potential for this to feed a continuous inflation depends on domest ...

How to conduct monetary policy

... When a bank makes a loan it increases the money supply. Also, changing reserve ratios changes money supply: ...

... When a bank makes a loan it increases the money supply. Also, changing reserve ratios changes money supply: ...

Peru_en.pdf

... sales tax receipts continued to rise.1 Central government non-financial expenditure increased nearly 20% in real terms, mainly as a result of increased capital spending. (b) Monetary and exchange-rate policy As regards monetary policy, it became necessary to tackle inflation, which had been above t ...

... sales tax receipts continued to rise.1 Central government non-financial expenditure increased nearly 20% in real terms, mainly as a result of increased capital spending. (b) Monetary and exchange-rate policy As regards monetary policy, it became necessary to tackle inflation, which had been above t ...

Appendices to Chapter 8 Capital Mobility, Monetary Policy, and Exchange Rate

... The chapter discusses two real exchange rate measures, both of which appear in panel 1 of Figure 7 of the chapter. The CBK’s real effective exchange rate (REER) is defined as a trade-weighted average of bilateral CPI-based real exchange rates with Kenya’s 8 biggest trading partners. The second measu ...

... The chapter discusses two real exchange rate measures, both of which appear in panel 1 of Figure 7 of the chapter. The CBK’s real effective exchange rate (REER) is defined as a trade-weighted average of bilateral CPI-based real exchange rates with Kenya’s 8 biggest trading partners. The second measu ...

AD/AS Model - Gore High School

... -- Mainly driven from rising imports -- Service balance went from deficit to small surplus -- Investment income deficit increased to over 11billion in 2006 -- result of increasing income earned by foreign investors (high foreign investment) ...

... -- Mainly driven from rising imports -- Service balance went from deficit to small surplus -- Investment income deficit increased to over 11billion in 2006 -- result of increasing income earned by foreign investors (high foreign investment) ...

Venezuela_en.pdf

... maintained in the Transaction System for Foreign Currency Denominated Securities (SITME) for transactions that were not eligible for the 4.3 bolívares fuertes per dollar rate authorized by the Foreign Exchange Administration Commission (CADIVI). Nevertheless, high inflation during the period caused ...

... maintained in the Transaction System for Foreign Currency Denominated Securities (SITME) for transactions that were not eligible for the 4.3 bolívares fuertes per dollar rate authorized by the Foreign Exchange Administration Commission (CADIVI). Nevertheless, high inflation during the period caused ...

IMS Issues: Eurozone Crisis

... Why is reliance on cash crops so risky? What are the pros and cons of FTAs for farmers? Why did Vietnam enter pepper production? What global effect did this have? ...

... Why is reliance on cash crops so risky? What are the pros and cons of FTAs for farmers? Why did Vietnam enter pepper production? What global effect did this have? ...

Zimbabwe: A Country In Crisis

... Quantity theory of money says we need some growth in money supply to support growth in production. Just not this much. Government’s policy worsens things: – Regulation of exchange rates and interest rates within certain ranges (so never reach real market values) – Price controls and ‘official’ excha ...

... Quantity theory of money says we need some growth in money supply to support growth in production. Just not this much. Government’s policy worsens things: – Regulation of exchange rates and interest rates within certain ranges (so never reach real market values) – Price controls and ‘official’ excha ...

Making Inflation Targeting Appropriately Flexible

... of its mineral products are strong on world markets? • Does the rand otherwise act like major currencies? – in light of its developed financial markets? – This does not necessarily mean fitting standard theories closely, as those theories don’t work well in practice for major industrialized currenci ...

... of its mineral products are strong on world markets? • Does the rand otherwise act like major currencies? – in light of its developed financial markets? – This does not necessarily mean fitting standard theories closely, as those theories don’t work well in practice for major industrialized currenci ...

One market, One Money

... standard signed the birth of the age of international liberalism. This extraordinary epoch of prosperity and stability for the world economy was dramatically interrupted by the outbreak of the First World War, an event that Robbins does not hesitate as defining as “the nationalistic reaction” toward ...

... standard signed the birth of the age of international liberalism. This extraordinary epoch of prosperity and stability for the world economy was dramatically interrupted by the outbreak of the First World War, an event that Robbins does not hesitate as defining as “the nationalistic reaction” toward ...

Review for Final I

... Interest Rates: Nominal and Real • Nominal Interest Rate (i): the interest rate observed in the market. • Real Interest Rate (r): the nominal rate adjusted for inflation (). Real Interest Rate = Nominal Interest Rate – Inflation Rate ...

... Interest Rates: Nominal and Real • Nominal Interest Rate (i): the interest rate observed in the market. • Real Interest Rate (r): the nominal rate adjusted for inflation (). Real Interest Rate = Nominal Interest Rate – Inflation Rate ...

Exchange rate

.jpg?width=300)

In finance, an exchange rate (also known as a foreign-exchange rate, forex rate, FX rate or Agio) between two currencies is the rate at which one currency will be exchanged for another. It is also regarded as the value of one country’s currency in terms of another currency. For example, an interbank exchange rate of 119 Japanese yen (JPY, ¥) to the United States dollar (US$) means that ¥119 will be exchanged for each US$1 or that US$1 will be exchanged for each ¥119. In this case it is said that the price of a dollar in terms of yen is ¥119, or equivalently that the price of a yen in terms of dollars is $1/119.Exchange rates are determined in the foreign exchange market, which is open to a wide range of different types of buyers and sellers where currency trading is continuous: 24 hours a day except weekends, i.e. trading from 20:15 GMT on Sunday until 22:00 GMT Friday. The spot exchange rate refers to the current exchange rate. The forward exchange rate refers to an exchange rate that is quoted and traded today but for delivery and payment on a specific future date.In the retail currency exchange market, a different buying rate and selling rate will be quoted by money dealers. Most trades are to or from the local currency. The buying rate is the rate at which money dealers will buy foreign currency, and the selling rate is the rate at which they will sell the currency. The quoted rates will incorporate an allowance for a dealer's margin (or profit) in trading, or else the margin may be recovered in the form of a commission or in some other way. Different rates may also be quoted for cash (usually notes only), a documentary form (such as traveler's cheques) or electronically (such as a credit card purchase). The higher rate on documentary transactions has been justified to compensate for the additional time and cost of clearing the document, while the cash is available for resale immediately. Some dealers on the other hand prefer documentary transactions because of the security concerns with cash.