* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Review for Final I

Monetary policy wikipedia , lookup

Business cycle wikipedia , lookup

Ragnar Nurkse's balanced growth theory wikipedia , lookup

Balance of payments wikipedia , lookup

Nominal rigidity wikipedia , lookup

Pensions crisis wikipedia , lookup

Fear of floating wikipedia , lookup

Full employment wikipedia , lookup

Early 1980s recession wikipedia , lookup

Exchange rate wikipedia , lookup

Interest rate wikipedia , lookup

Macro - Review

GDP = C + I + G + NX

MV = P Q (= $GDP)

GDP: Real and Nominal

• Gross Domestic Product (GDP): the market

value of all final goods and services

produced within a country during a year.

GDP = C + I + G + Ex – Im

= C + I + G + NX

• Real GDP adjusts for inflation

Nominal GDP = $GDP = P x Q

$ GDP = GDP Deflator x Real GDP

Real GDP = Q = $GDP/P

= Nominal GDP divided by

(deflated by) the GDP Price Deflator

Price Indexes (Base Year = 100)

• Consumer Price Index (CPI)

– cost over time of a typical bundle of goods

and services purchased by households.

CPI = Cost of Typical Market Basket Now

divided by

Cost of the Same Basket in Base Year

Inflation Rate = {Change in CPI} ÷ {Initial CPI}

• GDP Price Deflator (GDP Price Index)

– measures average prices over time of all

goods and services included in GDP.

Foreign Exchange Rate: Appreciation

and Depreciation

• A currency appreciates when it buys more of

a foreign currency.

– Appreciation makes foreign goods cheaper.

– Appreciation Imports Up and Exports Down.

• A currency depreciates when it buys less of a

foreign currency.

– Depreciation makes foreign goods more

expensive.

– Depreciation Imports Down and Exports Up.

Current Account vs. Financial Account

• The balance of payments must balance

Current Account + Financial Account = 0

– If we buy more goods and services from

foreigners than they buy from us, we have

to borrow the difference

sell them our IOUs.

Capital inflows help finance domestic

investment and the government’s deficit

Unemployment

Unemployment rate: % of labor force not working.

number unemployed

Rate of

= number in the Labor Force

Unemployment

• Unemployed persons: not working and looking

• Labor force: Employed + unemployed

noninstitutionalized persons 16+ years of age

• Underemployed workers are treated as employed

• Discouraged workers are not in the labor force

• “Natural” or normal rate of unemployment (NAIRU)

Seasonal Unemployment

Frictional Unemployment: searching for jobs

Structural Unemployment: Imperfect match between

employee skills and requirements of available jobs.

• Cyclical Unemployment : Results from business cycle

Interest Rates: Nominal and Real

• Nominal Interest Rate (i): the interest

rate observed in the market.

• Real Interest Rate (r): the nominal rate

adjusted for inflation ().

Real Interest Rate = Nominal Interest Rate

– Inflation Rate

r=i-

• Low real interest rates spur business

investment spending (the I in C + I + G + NX)

Aggregate Demand (AD): the economywide demand for goods and services.

• Aggregate demand curve relates aggregate

expenditure for goods and services to the

price level

• The aggregate demand curve slopes

downward owing to price-level effects:

– Wealth Effect (Real Wealth/Real Balances)

– Interest Rate Effect

– International Trade Effect (Substitution)

Shifting Aggregate Demand Curve

Factors that Affect AD Shifts in AD

AD = C + I + G + NX

• Consumption

– Income

– Wealth

– Interest Rates

– Expectations/Confidence

– Demographics

– Taxes

• Investment

– Interest Rates

– Technology

– Cost of Capital Goods

– Capacity Utilization

– Expectations/Confidence

Government Spending

Net Exports

– Domestic & Foreign

Income

– Domestic & Foreign

Prices

– Exchange Rates

– Government Policy

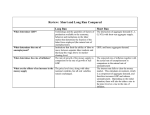

Aggregate Supply

• Aggregate Supply (AS): the quantity of real GDP

produced at different price levels.

Short-run Aggregate Supply SRAS slopes upward

– a higher price level (holding production costs and

capital constant in the short-run)

higher profit margins

firms want to produce more.

Long Run Aggregate Supply LRAS is vertical: higher

prices cannot elicit more output in the long-run.

• Resource costs are NOT fixed in the long-run.

– As prices rises, workers demand and get higher

wages

Profits don’t rise with price in long-run

AS is set by production possibilities in the long-run

Aggregate Supply:

Short – Run & Long – Run

Aggregate

Demand and

Supply

Equilibrium:

Short-run

and long-run

responses

to increase

in aggregate

demand

Aggregate Expenditures = AE = GDP

Y = AE = C + I + G + NX

• Disposable income = Yd = Y-T = after tax

income.

Yd = Y - T = C + S

Consumption is related to disposable income

(Y-T).

C = Ca +cYd

where c = Marginal Propensity to Consume = mpc

Ca = Autonomous consumption

Additional income not consumed is saved

mpc + mps =1

Aggregate Expenditures = AE = GDP

In a closed economy, saving either finances

private investment (I) or the government’s

deficit (G – T)

S = I + (G – T) at equilibrium

Investment can be crowded out by the deficit

I = S – (G-T)

• Leakages from the spending stream (S + T)

= Injections to the spending stream (I + G)

• S+T=I+G

Shifts in the Consumption Function

Expected Future Income

–

Wealth

–

–

An increase in wealth raises current consumption and

lowers current saving.

Expected Real Interest Rate

An increase in expected future income will cause

current consumption to rise and your saving to fall.

Higher real return incentive to save more … but

Higher return to saving less needs to be put aside to

achieve the same desired future savings.

– Net effect: increased real interest rates reduce

consumption and increase saving.

Demographics

Taxes – Ricardian Equivalence: Anticipation of Future

Taxes

Imports and Exports

The demand for imports depends on current

economic activity, Y

IM = IMa + mpi Y

“mpi” is the marginal propensity to import

Exports are exogenously determined

they depend on conditions in foreign economies,

not our economy

Net exports is NX = EX – (IMa + mpi Y) or

NX = NXa – mpi Y

Net expects decrease as the economy expands

Demand-Side Equilibrium and the Multiplier

At equilibrium: Y = C + I + G + NX = AE

Increase in Y = Spending Multiplier x {Increase in

Autonomous Spending}

Multiplier = 1/(mps + mpi)

From Aggregate

Expenditure to

Aggregate

Demand:

As price level rises,

real money balances

decrease and

consumption function

shifts owing to

i) wealth effect

ii) interest rate effect

iii) international

competition

Circular

Flow