speech by Ben Broadbent at Imperial College, London, on Thursday

... rate in isolation. Asset prices are volatile in the short run, sometimes inexplicably so. But over time they tend to move for a reason. They’re driven by deeper things that can have important effects of their own. To get the full picture you need to take both into account, not just the partial impac ...

... rate in isolation. Asset prices are volatile in the short run, sometimes inexplicably so. But over time they tend to move for a reason. They’re driven by deeper things that can have important effects of their own. To get the full picture you need to take both into account, not just the partial impac ...

Lecture12_Duncan

... Inflow of foreign investment - higher the CAD, higher the surplus in capital account - higher investment in Australia by the foreigners - higher the demand for A$. Outflow of foreign currency - income (interest & profit) on foreign investment goes out of the country- higher the CAD, higher the deman ...

... Inflow of foreign investment - higher the CAD, higher the surplus in capital account - higher investment in Australia by the foreigners - higher the demand for A$. Outflow of foreign currency - income (interest & profit) on foreign investment goes out of the country- higher the CAD, higher the deman ...

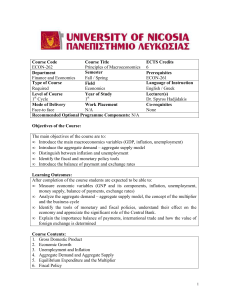

ECON-262 Principles of Macroeconomics

... • Introduce the balance of payment and exchange rates Learning Outcomes: After completion of the course students are expected to be able to: • Measure economic variables (GNP and its components, inflation, unemployment, money supply, balance of payments, exchange rates) • Analyze the aggregate deman ...

... • Introduce the balance of payment and exchange rates Learning Outcomes: After completion of the course students are expected to be able to: • Measure economic variables (GNP and its components, inflation, unemployment, money supply, balance of payments, exchange rates) • Analyze the aggregate deman ...

PDF Download

... 8.5%). The same was true of the average unemployment rate of the EU-15 countries which remained unchanged at 8% (August 2002: 7.7%). The lowest rates were registered by Luxembourg (3.8%), the Netherlands (4.1%), Austria (4.5%), and Ireland (4.7%). At 11.4%, Spain continued to record the EU’s highest ...

... 8.5%). The same was true of the average unemployment rate of the EU-15 countries which remained unchanged at 8% (August 2002: 7.7%). The lowest rates were registered by Luxembourg (3.8%), the Netherlands (4.1%), Austria (4.5%), and Ireland (4.7%). At 11.4%, Spain continued to record the EU’s highest ...

Economic Activity

... The money used for capital projects comes from three main sources: • The stock market ...

... The money used for capital projects comes from three main sources: • The stock market ...

International Economics - LaGuardia Community College

... This course will provide the students with the foundations of the theory and practice of international trade and finance necessary for understanding how international economic interactions influence the allocation of scarce resources both within and between nations. The subject matter of internation ...

... This course will provide the students with the foundations of the theory and practice of international trade and finance necessary for understanding how international economic interactions influence the allocation of scarce resources both within and between nations. The subject matter of internation ...

open economy

... the US. (measured in dollars), P* is the price of a basket of goods in Japan (measured in yen), and e is the nominal exchange rate (the number of yen a dollar can buy). Now consider the quantity of goods a dollar can buy at home and abroad. At home, the price level is P, so the purchasing power of $ ...

... the US. (measured in dollars), P* is the price of a basket of goods in Japan (measured in yen), and e is the nominal exchange rate (the number of yen a dollar can buy). Now consider the quantity of goods a dollar can buy at home and abroad. At home, the price level is P, so the purchasing power of $ ...

PDF Download

... As far as the EU candidate countries are concerned, such a combination of faster productivity growth than in the reference country and a fixed exchange rate could be at variance with the requirement of the Maastricht inflation criterion. In addition, there is a danger of spillovers to the sheltered ...

... As far as the EU candidate countries are concerned, such a combination of faster productivity growth than in the reference country and a fixed exchange rate could be at variance with the requirement of the Maastricht inflation criterion. In addition, there is a danger of spillovers to the sheltered ...

1 There is no general co-movement between the SA economy and

... economy, raising systemic risk and contributing to reduced investment. Consequently, if it is the government’s aim to raise FDI or to boost export performance, it is the regulatory environment, and not necessarily the rand, that requires policy attention. Furthermore, insofar as the rand does have a ...

... economy, raising systemic risk and contributing to reduced investment. Consequently, if it is the government’s aim to raise FDI or to boost export performance, it is the regulatory environment, and not necessarily the rand, that requires policy attention. Furthermore, insofar as the rand does have a ...

exchange rate

... • high-speed computer linkages between trading centers around the globe have effectively created a single market ...

... • high-speed computer linkages between trading centers around the globe have effectively created a single market ...

Week 9 - cda college

... country’s foreign exchange. A pegged, rate is a rate the government (or central bank) sets and maintains as the official exchange rate. A set price will be determined against a major world currency (usually the U.S. dollar, but also other major currencies such as the euro, the yen or a basket of cur ...

... country’s foreign exchange. A pegged, rate is a rate the government (or central bank) sets and maintains as the official exchange rate. A set price will be determined against a major world currency (usually the U.S. dollar, but also other major currencies such as the euro, the yen or a basket of cur ...

Strong Euro Weakening Dollar

... 1.9% while inflation-adjusted wages are lower today than they were at the beginning of the recovery. Also, the household income of the middle class has been falling for the past five years. The result of these problems has been a rise in inflation, a housing and financial crisis and negative consume ...

... 1.9% while inflation-adjusted wages are lower today than they were at the beginning of the recovery. Also, the household income of the middle class has been falling for the past five years. The result of these problems has been a rise in inflation, a housing and financial crisis and negative consume ...

The Exchange Rate

... If one U.S. dollar buys more goods and services in the United States than 100 yen buys in Japan, people will expect that the dollar will eventually appreciate. Similarly, if one U.S. dollar buys less goods and services in the United States than 100 yen buys in Japan, people will expect that the doll ...

... If one U.S. dollar buys more goods and services in the United States than 100 yen buys in Japan, people will expect that the dollar will eventually appreciate. Similarly, if one U.S. dollar buys less goods and services in the United States than 100 yen buys in Japan, people will expect that the doll ...

US adjusts the currency by about 10 yen (March 30, 2016)

... when the yen weakened to levels above 120 yen to the dollar, indicates the start of the “Red Light” and depreciation of the dollar by about 10 yen to below 115 yen. The G20 meeting in February is seen to have given tacit approval to the weak dollar stance of the US. At the same time, the use of incr ...

... when the yen weakened to levels above 120 yen to the dollar, indicates the start of the “Red Light” and depreciation of the dollar by about 10 yen to below 115 yen. The G20 meeting in February is seen to have given tacit approval to the weak dollar stance of the US. At the same time, the use of incr ...

Khon Kaen University International College

... Large working age populations in developing countries Japan has been the largest direct investor since the late 1980s ...

... Large working age populations in developing countries Japan has been the largest direct investor since the late 1980s ...

Graphs - Mr. Thomas

... graphs you have studied throughout the course. The following pages are designed to help you learn the various graphs that you will be required to use to answer questions on the exam. You should be comfortable and confident drawing each of them and using them to answer questions. Correct labeling of ...

... graphs you have studied throughout the course. The following pages are designed to help you learn the various graphs that you will be required to use to answer questions on the exam. You should be comfortable and confident drawing each of them and using them to answer questions. Correct labeling of ...

Comment - Lars E.O. Svensson

... external effects play an explicit role in the monetary policy framework. Central banks in these countries should pay more attention to their collective policy stance and its global implications.”1 I do not agree with this conclusion. The Federal Reserve’s mandate concerns US inflation and employment ...

... external effects play an explicit role in the monetary policy framework. Central banks in these countries should pay more attention to their collective policy stance and its global implications.”1 I do not agree with this conclusion. The Federal Reserve’s mandate concerns US inflation and employment ...

tax rate

... loans from a Federal Reserve Bank. The discount rate is usually lower than the federal funds rate, although they are closely related. The discount rate is important because it is a visible announcement of change in the Fed's monetary policy and it gives the rest of the market insight into the Fed's ...

... loans from a Federal Reserve Bank. The discount rate is usually lower than the federal funds rate, although they are closely related. The discount rate is important because it is a visible announcement of change in the Fed's monetary policy and it gives the rest of the market insight into the Fed's ...

Q1. The British pound has lost value (weakened/depreciated)

... continental vacations aside, how does the weak dollar affect the average Joe? With higher prices on almost everything imported from abroad. As our currency loses value, a dollar buys less and less from manufacturers in other countries. Because the euro has been so strong, this effect is especially p ...

... continental vacations aside, how does the weak dollar affect the average Joe? With higher prices on almost everything imported from abroad. As our currency loses value, a dollar buys less and less from manufacturers in other countries. Because the euro has been so strong, this effect is especially p ...

總體1/2003 第二次考試班級: 學號: 姓名:

... a. both the unemployment rate and labor-force participation rate would be higher. b. both the unemployment rate and labor-force participation rate would be lower. c. the unemployment rate would be higher and the labor-force participation rate would be higher. d. the unemployment rate would be lower ...

... a. both the unemployment rate and labor-force participation rate would be higher. b. both the unemployment rate and labor-force participation rate would be lower. c. the unemployment rate would be higher and the labor-force participation rate would be higher. d. the unemployment rate would be lower ...

Currency Depreciation and J Curve Analysis

... The variability of foreign exchange rates affects many economic activities in all over the world. Currency depreciation or currency devaluation directly affects to decrease imports and increase exports. Therefore trade balance will be favorable. The currency devaluation immediately raises the domest ...

... The variability of foreign exchange rates affects many economic activities in all over the world. Currency depreciation or currency devaluation directly affects to decrease imports and increase exports. Therefore trade balance will be favorable. The currency devaluation immediately raises the domest ...

Currency crises: A forth generation model approach

... Multi-country studies avoid the limitations of the above single country studies. Among the most significant determinants of currency crises are the low levels of foreign direct investment, low international reserves, high domestic credit growth, high foreign interest rates, overvaluation of the real ...

... Multi-country studies avoid the limitations of the above single country studies. Among the most significant determinants of currency crises are the low levels of foreign direct investment, low international reserves, high domestic credit growth, high foreign interest rates, overvaluation of the real ...

PDF Download

... interest rates are lower than local interest rates, they presume that foreign-currency loans are cheaper. But they do not take into account potential negative effects due to depreciation of the local currency. A more flexible exchange rate regime could reduce incentives to borrow in foreign currency ...

... interest rates are lower than local interest rates, they presume that foreign-currency loans are cheaper. But they do not take into account potential negative effects due to depreciation of the local currency. A more flexible exchange rate regime could reduce incentives to borrow in foreign currency ...

Exchange rate

.jpg?width=300)

In finance, an exchange rate (also known as a foreign-exchange rate, forex rate, FX rate or Agio) between two currencies is the rate at which one currency will be exchanged for another. It is also regarded as the value of one country’s currency in terms of another currency. For example, an interbank exchange rate of 119 Japanese yen (JPY, ¥) to the United States dollar (US$) means that ¥119 will be exchanged for each US$1 or that US$1 will be exchanged for each ¥119. In this case it is said that the price of a dollar in terms of yen is ¥119, or equivalently that the price of a yen in terms of dollars is $1/119.Exchange rates are determined in the foreign exchange market, which is open to a wide range of different types of buyers and sellers where currency trading is continuous: 24 hours a day except weekends, i.e. trading from 20:15 GMT on Sunday until 22:00 GMT Friday. The spot exchange rate refers to the current exchange rate. The forward exchange rate refers to an exchange rate that is quoted and traded today but for delivery and payment on a specific future date.In the retail currency exchange market, a different buying rate and selling rate will be quoted by money dealers. Most trades are to or from the local currency. The buying rate is the rate at which money dealers will buy foreign currency, and the selling rate is the rate at which they will sell the currency. The quoted rates will incorporate an allowance for a dealer's margin (or profit) in trading, or else the margin may be recovered in the form of a commission or in some other way. Different rates may also be quoted for cash (usually notes only), a documentary form (such as traveler's cheques) or electronically (such as a credit card purchase). The higher rate on documentary transactions has been justified to compensate for the additional time and cost of clearing the document, while the cash is available for resale immediately. Some dealers on the other hand prefer documentary transactions because of the security concerns with cash.