Philip Lowe: Internal balance, structural change and monetary policy

... This, of course, does not mean that, at each and every point in time, the exchange rate is at its ideal rate from a domestic balance perspective. We should not forget that exchange rates are relative prices between two countries’ moneys. This means that they are determined both by what is happening ...

... This, of course, does not mean that, at each and every point in time, the exchange rate is at its ideal rate from a domestic balance perspective. We should not forget that exchange rates are relative prices between two countries’ moneys. This means that they are determined both by what is happening ...

Econ 1A

... indirect taxes, subtract subsidies, and add capital consumption. subsidies, subtract indirect taxes and capital depreciation.. ...

... indirect taxes, subtract subsidies, and add capital consumption. subsidies, subtract indirect taxes and capital depreciation.. ...

ECONOMICS why study it?

... higher than the natural rate of unemployment which may further reduce inflation. Inflation is dependent on unemployment. If unemployment is high then there is little pressure on prices to go up, but if unemployment is low, then people can bid up prices because they have disposable incomes. There are ...

... higher than the natural rate of unemployment which may further reduce inflation. Inflation is dependent on unemployment. If unemployment is high then there is little pressure on prices to go up, but if unemployment is low, then people can bid up prices because they have disposable incomes. There are ...

document

... • Capital flows were minimal • International prices and interest rates were out of synchronization ...

... • Capital flows were minimal • International prices and interest rates were out of synchronization ...

Final Exam

... 6. Albonia has a fixed exchange rate with the US dollar and Balbonia maintains a real interest rate which rises when domestic inflation rises. We could say that: a. GDP would decline more sharply in Balbonia than in Albonia if oil prices rose and GDP would decline more sharply in Balbonia than in Al ...

... 6. Albonia has a fixed exchange rate with the US dollar and Balbonia maintains a real interest rate which rises when domestic inflation rises. We could say that: a. GDP would decline more sharply in Balbonia than in Albonia if oil prices rose and GDP would decline more sharply in Balbonia than in Al ...

Paraguay_en.pdf

... At 15.3%, economic growth in 2010 was the best seen in Paraguay in four decades. It was driven by a good performance in the agricultural sector, thanks to a bumper crop from the 2009-2010 harvest. Other sectors such as livestock, construction and manufacturing also made substantial contributions. Al ...

... At 15.3%, economic growth in 2010 was the best seen in Paraguay in four decades. It was driven by a good performance in the agricultural sector, thanks to a bumper crop from the 2009-2010 harvest. Other sectors such as livestock, construction and manufacturing also made substantial contributions. Al ...

Explanatory Notes - Central Bank of Nigeria

... transformation over the years. It has moved from officially pegged exchange rate system between 1970 and 1985 to a market-determined system since 1986. The naira exchange rate is now determined through the foreign exchange market on the basis of demand and supply. The dollar is the intervention curr ...

... transformation over the years. It has moved from officially pegged exchange rate system between 1970 and 1985 to a market-determined system since 1986. The naira exchange rate is now determined through the foreign exchange market on the basis of demand and supply. The dollar is the intervention curr ...

Intermediate Macroeconomics,Assignment 5

... b. Since California has a fixed exchange-rate regime, it should use fiscal policy to stimulate employment. As a matter of fact, it cannot use monetary policy along at all as it has to maintain a fixed exchange rate. c. Imposing import restriction essentially shifts the net export schedule to the rig ...

... b. Since California has a fixed exchange-rate regime, it should use fiscal policy to stimulate employment. As a matter of fact, it cannot use monetary policy along at all as it has to maintain a fixed exchange rate. c. Imposing import restriction essentially shifts the net export schedule to the rig ...

25 development of the czechoslovak koruna exchange rate

... of a currency basket of five currencies, but also on the basis of supply and demand for foreign exchange. The difference between the resultant exchange rate and its value calculated on the basis of the currency basket was not allowed to exceed ±5%. Whereas previously the activities of the Czechoslov ...

... of a currency basket of five currencies, but also on the basis of supply and demand for foreign exchange. The difference between the resultant exchange rate and its value calculated on the basis of the currency basket was not allowed to exceed ±5%. Whereas previously the activities of the Czechoslov ...

Combatting currency manipulation

... inflation. On the contrary, when a central bank uses currency manipulation to increase the value of the currency, on a long term it will lead to a decreased inflation rate, through the same steps. Since the abolishment of the Gold Standard and the collapse of the Bretton Woods system, central banks ...

... inflation. On the contrary, when a central bank uses currency manipulation to increase the value of the currency, on a long term it will lead to a decreased inflation rate, through the same steps. Since the abolishment of the Gold Standard and the collapse of the Bretton Woods system, central banks ...

Uruguay_en.pdf

... In the quarter from January to March 2014, total public-sector revenue fell by 0.3% of GDP in relation to December 2013, while expenditure (not including additional outlays on pensions) was up by 0.2% of GDP. Tax revenue having increased, the drop in income during this quarter was accounted for by t ...

... In the quarter from January to March 2014, total public-sector revenue fell by 0.3% of GDP in relation to December 2013, while expenditure (not including additional outlays on pensions) was up by 0.2% of GDP. Tax revenue having increased, the drop in income during this quarter was accounted for by t ...

Document

... 4. (2 points) In the Japanese economy, business confidence increases. Using the ASAD model, we know this would lead to a certain short-run equilibrium impact on P and Y. Suppose the Bank of Japan acts to keep the money supply fixed. Draw a picture of the money market which shows the impact of these ...

... 4. (2 points) In the Japanese economy, business confidence increases. Using the ASAD model, we know this would lead to a certain short-run equilibrium impact on P and Y. Suppose the Bank of Japan acts to keep the money supply fixed. Draw a picture of the money market which shows the impact of these ...

Government Expenditures to Lead Long

... • South African Rand has free-floating exchange rate • Appreciated steadily from 2002-2006 after large depreciation due to Argentina crisis • Fall dramatically in mid-2006 due to global currency sell-off due to US monetary contraction • Has continued to depreciate and is projected to continue deprec ...

... • South African Rand has free-floating exchange rate • Appreciated steadily from 2002-2006 after large depreciation due to Argentina crisis • Fall dramatically in mid-2006 due to global currency sell-off due to US monetary contraction • Has continued to depreciate and is projected to continue deprec ...

Review, Chapters 15-17

... surplus in the federal government’s budget if the economy were at potential GDP. Tax wedge The difference between the pre-tax and post-tax return to an economic activity. Disincentive to work??? Supply-side tax cuts ...

... surplus in the federal government’s budget if the economy were at potential GDP. Tax wedge The difference between the pre-tax and post-tax return to an economic activity. Disincentive to work??? Supply-side tax cuts ...

Trinidad_and_Tobago_en.pdf

... total energy production. The new budget projects a fiscal deficit of 5.4% of GDP, and is oriented towards supporting economic recovery. The new property tax regime, which enters into force in January 2010, will introduce the rental value method for property valuations and lower, uniform tax rates th ...

... total energy production. The new budget projects a fiscal deficit of 5.4% of GDP, and is oriented towards supporting economic recovery. The new property tax regime, which enters into force in January 2010, will introduce the rental value method for property valuations and lower, uniform tax rates th ...

Foreign exchange market intervention in emerging markets: motives

... a systematic basis, and only in exceptional circumstances to counter disruptive short-term movements in the riyal money market. SAMA’s intervention may be characterised as both passive and active. In terms of passive intervention/foreign exchange operation’s, SAMA keeps on providing spot dollars to ...

... a systematic basis, and only in exceptional circumstances to counter disruptive short-term movements in the riyal money market. SAMA’s intervention may be characterised as both passive and active. In terms of passive intervention/foreign exchange operation’s, SAMA keeps on providing spot dollars to ...

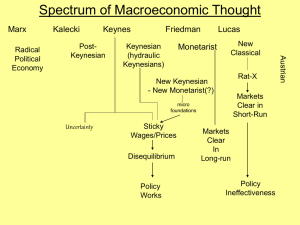

Macro Spectrum

... agents make errors…[A]gents temporarily mistake a general increase in all absolute prices as an increase in the relative price of the good they are selling, leading them to increase their supply of that good…Since everyone is, on average, making the same mistake, aggregate output will rise… • While ...

... agents make errors…[A]gents temporarily mistake a general increase in all absolute prices as an increase in the relative price of the good they are selling, leading them to increase their supply of that good…Since everyone is, on average, making the same mistake, aggregate output will rise… • While ...

This at the conference “Finance and Macroeconomics” held

... and have a sustained impact on long-run inflation expectations. Such movements in long-run inflation expectations would then be reflected in long-term interest rates. Open market purchases in a liquidity trap Auerbach and Obstfeld examine whether monetary policy is effective when short-term nominal ...

... and have a sustained impact on long-run inflation expectations. Such movements in long-run inflation expectations would then be reflected in long-term interest rates. Open market purchases in a liquidity trap Auerbach and Obstfeld examine whether monetary policy is effective when short-term nominal ...

This PDF is a selection from a published volume from... of Economic Research Volume Title: NBER International Seminar on Macroeconomics 2012

... external effects play an explicit role in the monetary policy framework. Central banks in these countries should pay more attention to their collective policy stance and its global implications.”1 I do not agree with this conclusion. The Federal Reserve’s mandate concerns US inflation and employment ...

... external effects play an explicit role in the monetary policy framework. Central banks in these countries should pay more attention to their collective policy stance and its global implications.”1 I do not agree with this conclusion. The Federal Reserve’s mandate concerns US inflation and employment ...

Economic Indicators Essay Research Paper

... the AUD. For this to occur the RBA must get into the market and start to buy the $AUD which hopefully will bring the value of the dollar up, since it will create a domino effect of other investors purchasing the AUD, thus resulting in an increase in demand. Another method that could be used to incre ...

... the AUD. For this to occur the RBA must get into the market and start to buy the $AUD which hopefully will bring the value of the dollar up, since it will create a domino effect of other investors purchasing the AUD, thus resulting in an increase in demand. Another method that could be used to incre ...

International accounting ch6 Foreign Currency

... of currency amounts. For example, inventories or certain liabilities may be restated according to accounting practices different from those originally used. The temporal principle can accommodate any asset valuation framework, be it historical cost, current replacement price, or net realizable value ...

... of currency amounts. For example, inventories or certain liabilities may be restated according to accounting practices different from those originally used. The temporal principle can accommodate any asset valuation framework, be it historical cost, current replacement price, or net realizable value ...

PowerPoint 演示文稿 - Xiamen University

... may differ in a number of important respects which undermine tests of the Law of One Price. • One test of the Law of One Price is the Big Mac index, which has been published annually in The Economist since 1986. – It was devised as a light-hearted guide to whether currencies are at their “correct” l ...

... may differ in a number of important respects which undermine tests of the Law of One Price. • One test of the Law of One Price is the Big Mac index, which has been published annually in The Economist since 1986. – It was devised as a light-hearted guide to whether currencies are at their “correct” l ...

14.02 Principles of Macroeconomics Problem Set 3 Solutions Fall 2004

... 6. In an open economy, fiscal policy is more effective than (or at least as effective as) monetary policy (in terms of changing output). False. In an open economy with fixed exchange rates, fiscal policy is, indeed, more effective than monetary policy. In fact, monetary policy has absolutely no effe ...

... 6. In an open economy, fiscal policy is more effective than (or at least as effective as) monetary policy (in terms of changing output). False. In an open economy with fixed exchange rates, fiscal policy is, indeed, more effective than monetary policy. In fact, monetary policy has absolutely no effe ...

No Slide Title

... If reference credit(s) default (or other credit event occurs), buyer receives payout equal to one of the following: – Physical settlement: Par value in return for delivery of reference obligation; or – Cash settlement: Post-event fall in price of reference obligation below par; or – Binary settlem ...

... If reference credit(s) default (or other credit event occurs), buyer receives payout equal to one of the following: – Physical settlement: Par value in return for delivery of reference obligation; or – Cash settlement: Post-event fall in price of reference obligation below par; or – Binary settlem ...

Exchange rate

.jpg?width=300)

In finance, an exchange rate (also known as a foreign-exchange rate, forex rate, FX rate or Agio) between two currencies is the rate at which one currency will be exchanged for another. It is also regarded as the value of one country’s currency in terms of another currency. For example, an interbank exchange rate of 119 Japanese yen (JPY, ¥) to the United States dollar (US$) means that ¥119 will be exchanged for each US$1 or that US$1 will be exchanged for each ¥119. In this case it is said that the price of a dollar in terms of yen is ¥119, or equivalently that the price of a yen in terms of dollars is $1/119.Exchange rates are determined in the foreign exchange market, which is open to a wide range of different types of buyers and sellers where currency trading is continuous: 24 hours a day except weekends, i.e. trading from 20:15 GMT on Sunday until 22:00 GMT Friday. The spot exchange rate refers to the current exchange rate. The forward exchange rate refers to an exchange rate that is quoted and traded today but for delivery and payment on a specific future date.In the retail currency exchange market, a different buying rate and selling rate will be quoted by money dealers. Most trades are to or from the local currency. The buying rate is the rate at which money dealers will buy foreign currency, and the selling rate is the rate at which they will sell the currency. The quoted rates will incorporate an allowance for a dealer's margin (or profit) in trading, or else the margin may be recovered in the form of a commission or in some other way. Different rates may also be quoted for cash (usually notes only), a documentary form (such as traveler's cheques) or electronically (such as a credit card purchase). The higher rate on documentary transactions has been justified to compensate for the additional time and cost of clearing the document, while the cash is available for resale immediately. Some dealers on the other hand prefer documentary transactions because of the security concerns with cash.