AP Macroeconomics Crash Course

... 4. GDP Deflator: A price index used to adjust nominal GDP to arrive at real GDP. Called the “deflator” because nominal GDP will usually overstate the value of a nation’s output if there has been inflation. The Consumer Price Index (CPI) is another commonly used price index. 5. Real GDP: ...

... 4. GDP Deflator: A price index used to adjust nominal GDP to arrive at real GDP. Called the “deflator” because nominal GDP will usually overstate the value of a nation’s output if there has been inflation. The Consumer Price Index (CPI) is another commonly used price index. 5. Real GDP: ...

Effects of Tariffs and Real Exchange Rates on Job Reallocation

... able to take advantage. Moreover, exposure to foreign competition generates shifts of market share among producers within tradable industries. In addition to reallocation due to downsizing of less productive firms in favor of more productive ones, new information is revealed after policy changes. Fi ...

... able to take advantage. Moreover, exposure to foreign competition generates shifts of market share among producers within tradable industries. In addition to reallocation due to downsizing of less productive firms in favor of more productive ones, new information is revealed after policy changes. Fi ...

PROGRESS TOWARDS CONVERGENCE 1996

... inflation declined from different levels and at different paces during the course of 1996, and the gap in relation to the reference value narrowed. The difference between inflation in the United Kingdom and the reference value was smaller than in the other countries throughout 1996, and has narrowed ...

... inflation declined from different levels and at different paces during the course of 1996, and the gap in relation to the reference value narrowed. The difference between inflation in the United Kingdom and the reference value was smaller than in the other countries throughout 1996, and has narrowed ...

This PDF is a selection from an out-of-print volume from... of Economic Research Volume Title: Monetary Policy Rules

... rules in two versions of my model: the open economy case considered above and a closed economy case obtained by setting 6 and y to zero. The latter is identical to the model in Ball ( 1997).5 Table 3.1 presents the variances of output and inflation for the six rules. The rules fall into two categori ...

... rules in two versions of my model: the open economy case considered above and a closed economy case obtained by setting 6 and y to zero. The latter is identical to the model in Ball ( 1997).5 Table 3.1 presents the variances of output and inflation for the six rules. The rules fall into two categori ...

Chapter 28(13): Monetary Policy

... To increase the quantity of money, the Fed’s three policy tools are used as follows: ♦ Changes in the required reserve ratio: A decrease in the required reserve ratio increases banks’ lending and so increases the quantity of money. ♦ Changes in the discount rate: A decrease in the discount rate rais ...

... To increase the quantity of money, the Fed’s three policy tools are used as follows: ♦ Changes in the required reserve ratio: A decrease in the required reserve ratio increases banks’ lending and so increases the quantity of money. ♦ Changes in the discount rate: A decrease in the discount rate rais ...

Document

... (b) Because they wish to avoid the rapid and sustained price increases that occurred during the 1970s (c) Because Congress passed a law in 1981 mandating the Fed to reduce the inflation rate to 2% (d) Because high inflation rates increase the value of the dollar and make U.S. goods less competitive ...

... (b) Because they wish to avoid the rapid and sustained price increases that occurred during the 1970s (c) Because Congress passed a law in 1981 mandating the Fed to reduce the inflation rate to 2% (d) Because high inflation rates increase the value of the dollar and make U.S. goods less competitive ...

Unemployment and Inflation

... Lastly, the tax system is distorted due to inflation. In practice, our tax and financial systems do not fully adjust even to anticipated inflation. It is difficult for the government and businesses to change their normal rules of operation every time inflation changes. Our tax system is typically ba ...

... Lastly, the tax system is distorted due to inflation. In practice, our tax and financial systems do not fully adjust even to anticipated inflation. It is difficult for the government and businesses to change their normal rules of operation every time inflation changes. Our tax system is typically ba ...

18.3 aggregate demand

... do you think real GDP is currently above, below, or at potential GDP? Talk to your class mates about where they see the U.S. economy right now. Is there a consensus? What are the main pressures on AS and AD right now? Do you think that real GDP will expand more quickly or more slowly over the coming ...

... do you think real GDP is currently above, below, or at potential GDP? Talk to your class mates about where they see the U.S. economy right now. Is there a consensus? What are the main pressures on AS and AD right now? Do you think that real GDP will expand more quickly or more slowly over the coming ...

Chapter 28

... quantity of real GDP demanded and the price level when all other influences on expenditure plans remain the same. Other things remaining the same, • When the price level rises, the quantity of real GDP demanded decreases. • When the price level falls, the quantity of real GDP demanded increases. ...

... quantity of real GDP demanded and the price level when all other influences on expenditure plans remain the same. Other things remaining the same, • When the price level rises, the quantity of real GDP demanded decreases. • When the price level falls, the quantity of real GDP demanded increases. ...

International Comparisons of GDP: Issues of - ANU Press

... to carry out systematic and detailed analyses of inflation and economic growth and fluctuations. For all the above purposes, a necessary first step is to separate out price and quantity elements. Both nominal and real GDP can be expressed either as an output total, where the component parts comprise ...

... to carry out systematic and detailed analyses of inflation and economic growth and fluctuations. For all the above purposes, a necessary first step is to separate out price and quantity elements. Both nominal and real GDP can be expressed either as an output total, where the component parts comprise ...

NBER WORKING PAPER SERIES CURRENT ACCOUNT DEFICITS IN INDUSTRIAL COUNTRIES:

... Persistent deficits need not result in large negative NFA positions if valuation effects offset the current account deficits. In practice, this can be true for a given year, as exchange rate movements can lead to large valuation adjustments. However, if there is mean reversion in exchange rates, the ...

... Persistent deficits need not result in large negative NFA positions if valuation effects offset the current account deficits. In practice, this can be true for a given year, as exchange rate movements can lead to large valuation adjustments. However, if there is mean reversion in exchange rates, the ...

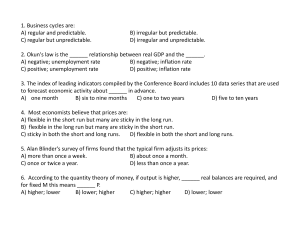

1. Business cycles are: A) regular and predictable. B) irregular but

... 8. Aggregate supply is the relationship between the quantity of goods and services supplied and the: A) money supply. B) unemployment rate. C) interest rate. D) price level. 9. If the short‐run aggregate supply curve is horizontal, then changes in aggregate demand affect: A) level of output but not ...

... 8. Aggregate supply is the relationship between the quantity of goods and services supplied and the: A) money supply. B) unemployment rate. C) interest rate. D) price level. 9. If the short‐run aggregate supply curve is horizontal, then changes in aggregate demand affect: A) level of output but not ...

A Dynamic Enquiry into the Causes of Hyperinflation in Zimbabwe

... they continue to be concerned about policies required to attain price stability (Siklos, 1995). This renewed interest can be attributed to Cagan’s (1956) seminal paper on the demand for money under hyperinflation. Although Zimbabwe’s hyperinflation in terms of monthly averages and maximums rates to ...

... they continue to be concerned about policies required to attain price stability (Siklos, 1995). This renewed interest can be attributed to Cagan’s (1956) seminal paper on the demand for money under hyperinflation. Although Zimbabwe’s hyperinflation in terms of monthly averages and maximums rates to ...

This PDF is a selection from an out-of-print volume from... Bureau of Economic Research Volume Title: Inflation: Causes and Effects

... be strong pressure for continual increases in the dollar price of the resource unit in order to keep up with the inflationary momentum built into the economy today. It is no more realistic to expect that the dollar price of the resource unit could be held constant under a commodity standard than it ...

... be strong pressure for continual increases in the dollar price of the resource unit in order to keep up with the inflationary momentum built into the economy today. It is no more realistic to expect that the dollar price of the resource unit could be held constant under a commodity standard than it ...

put title here - Terry FitzPatrick: Reporting, Training, Media

... that ability to enter and exit and get paid back for your investment in those shares creates a great market for the initial investment. People are more willing to put that money up if they know that some time in the future they'll be able to sell out their interest and go onto the next best-thing." ...

... that ability to enter and exit and get paid back for your investment in those shares creates a great market for the initial investment. People are more willing to put that money up if they know that some time in the future they'll be able to sell out their interest and go onto the next best-thing." ...

Fiscal Devaluations No. 12-10 Emmanuel Farhi, Gita Gopinath, and Oleg Itskhoki

... When is a reduction in consumption taxes and increase in income taxes required? Without a reduction in consumption taxes, fiscal devaluations result in an appreciated real exchange rate relative to a nominal devaluation. This is because fiscal devaluations, despite having the same effect on internat ...

... When is a reduction in consumption taxes and increase in income taxes required? Without a reduction in consumption taxes, fiscal devaluations result in an appreciated real exchange rate relative to a nominal devaluation. This is because fiscal devaluations, despite having the same effect on internat ...

united states securities and exchange commission - corporate

... Liquidity– As of December 31, 2016, the Company had approximately $3.6 billion of total liquidity, consisting of approximately $0.8 billion in cash and cash equivalents plus the ability to borrow an aggregate of approximately $2.8 billion under its revolving credit facilities, net of any outstanding ...

... Liquidity– As of December 31, 2016, the Company had approximately $3.6 billion of total liquidity, consisting of approximately $0.8 billion in cash and cash equivalents plus the ability to borrow an aggregate of approximately $2.8 billion under its revolving credit facilities, net of any outstanding ...

frenchdavis2001financialcrisis_en.pdf

... stock of external liabilities.4 All these macroeconomic variables experienced some overshooting.5 Adjustment was frequently anchored to one dominant balance, which generated imbalances in other macroeconomic variables, as in a falling inflation rate associated with real exchange rate appreciation a ...

... stock of external liabilities.4 All these macroeconomic variables experienced some overshooting.5 Adjustment was frequently anchored to one dominant balance, which generated imbalances in other macroeconomic variables, as in a falling inflation rate associated with real exchange rate appreciation a ...

Arab Republic of Egypt Request For Extended Arrangement Under

... monetary policy to anchor inflation expectations, contain domestic and external demand pressures, and allow accumulation of foreign exchange reserves. “Reducing fiscal deficits considerably and thereby placing public debt on a clearly declining path is an important objective of the authorities’ prog ...

... monetary policy to anchor inflation expectations, contain domestic and external demand pressures, and allow accumulation of foreign exchange reserves. “Reducing fiscal deficits considerably and thereby placing public debt on a clearly declining path is an important objective of the authorities’ prog ...

Link to Text - Johns Hopkins University

... floating, fixed, and pegged. With a floating rate, currencies are allowed to float more or less freely against one another. Many major currencies float--the U.S. dollar, German mark and Japanese yen are examples--but few developing countries have truly floating rates. Floating rates have not been ve ...

... floating, fixed, and pegged. With a floating rate, currencies are allowed to float more or less freely against one another. Many major currencies float--the U.S. dollar, German mark and Japanese yen are examples--but few developing countries have truly floating rates. Floating rates have not been ve ...

The Effect of Changes in the Federal Funds Rate on Stock Markets

... policy may be expansionary, where a decrease in the federal funds rate increases the money supply through an increase in the non-borrowed reserves. These changes may be unanticipated or anticipated. Theories such as the present value of future cash flows (Presented by Crowder, 2006) about stock pric ...

... policy may be expansionary, where a decrease in the federal funds rate increases the money supply through an increase in the non-borrowed reserves. These changes may be unanticipated or anticipated. Theories such as the present value of future cash flows (Presented by Crowder, 2006) about stock pric ...

Exchange rate

.jpg?width=300)

In finance, an exchange rate (also known as a foreign-exchange rate, forex rate, FX rate or Agio) between two currencies is the rate at which one currency will be exchanged for another. It is also regarded as the value of one country’s currency in terms of another currency. For example, an interbank exchange rate of 119 Japanese yen (JPY, ¥) to the United States dollar (US$) means that ¥119 will be exchanged for each US$1 or that US$1 will be exchanged for each ¥119. In this case it is said that the price of a dollar in terms of yen is ¥119, or equivalently that the price of a yen in terms of dollars is $1/119.Exchange rates are determined in the foreign exchange market, which is open to a wide range of different types of buyers and sellers where currency trading is continuous: 24 hours a day except weekends, i.e. trading from 20:15 GMT on Sunday until 22:00 GMT Friday. The spot exchange rate refers to the current exchange rate. The forward exchange rate refers to an exchange rate that is quoted and traded today but for delivery and payment on a specific future date.In the retail currency exchange market, a different buying rate and selling rate will be quoted by money dealers. Most trades are to or from the local currency. The buying rate is the rate at which money dealers will buy foreign currency, and the selling rate is the rate at which they will sell the currency. The quoted rates will incorporate an allowance for a dealer's margin (or profit) in trading, or else the margin may be recovered in the form of a commission or in some other way. Different rates may also be quoted for cash (usually notes only), a documentary form (such as traveler's cheques) or electronically (such as a credit card purchase). The higher rate on documentary transactions has been justified to compensate for the additional time and cost of clearing the document, while the cash is available for resale immediately. Some dealers on the other hand prefer documentary transactions because of the security concerns with cash.