ch17

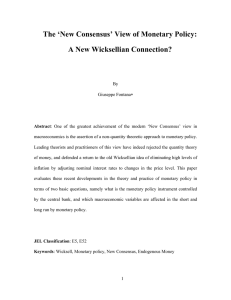

... Inflation targeting rule is a monetary policy strategy in which the central bank makes a public commitment to achieving an explicit inflation target and to explaining how its policy actions will achieve that target. Of the alternatives to the Fed’s current strategy, inflation targeting is the most l ...

... Inflation targeting rule is a monetary policy strategy in which the central bank makes a public commitment to achieving an explicit inflation target and to explaining how its policy actions will achieve that target. Of the alternatives to the Fed’s current strategy, inflation targeting is the most l ...

Example

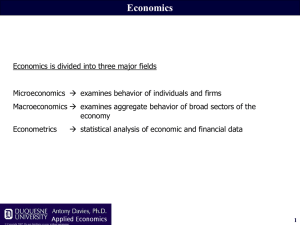

... Some choices involve accounting (“explicit”) costs, but all choices involve opportunity costs. Accounting cost is the giving up of A in order to obtain B. Opportunity cost is the failure to obtain C because you obtained B. Economic cost is accounting cost plus opportunity cost. Example A firm hires ...

... Some choices involve accounting (“explicit”) costs, but all choices involve opportunity costs. Accounting cost is the giving up of A in order to obtain B. Opportunity cost is the failure to obtain C because you obtained B. Economic cost is accounting cost plus opportunity cost. Example A firm hires ...

Sample

... will find their exports becoming more price competitive and their imports relatively more expensive. If a seller of products or services expects payment for exports in any denomination other than their home currency, the total home-country receipts will change depending on the exchange rate at the t ...

... will find their exports becoming more price competitive and their imports relatively more expensive. If a seller of products or services expects payment for exports in any denomination other than their home currency, the total home-country receipts will change depending on the exchange rate at the t ...

portable document (.pdf) format

... As a result of the declining interest rate, Investment projects become very attractive, because the opportunity cost of investing is lower than the subsequent return on investments. ...

... As a result of the declining interest rate, Investment projects become very attractive, because the opportunity cost of investing is lower than the subsequent return on investments. ...

Monetary Policy and Green Finance

... markets that this may bring about provides an illustration. Central banks that do not take these issues into account may be neglecting a key risk with regard to their mandate. Bringing light to this blind spot is critical. As central banks transfer billions of dollars into the global economy on a mo ...

... markets that this may bring about provides an illustration. Central banks that do not take these issues into account may be neglecting a key risk with regard to their mandate. Bringing light to this blind spot is critical. As central banks transfer billions of dollars into the global economy on a mo ...

an External Instruments Approach

... from recursive identification methods that instead detect a rise in inflation in response to an unexpected tightening in monetary policy, an empirical phenomenon labeled “price puzzle,” originally established by Sims (1992) on U.K. data.5 We show that the counterfactual increase in inflation detect ...

... from recursive identification methods that instead detect a rise in inflation in response to an unexpected tightening in monetary policy, an empirical phenomenon labeled “price puzzle,” originally established by Sims (1992) on U.K. data.5 We show that the counterfactual increase in inflation detect ...

Inflation

... Price Indexes for Other Purposes The GDP deflator is a type of price index called an implicit price deflator. An implicit price deflator takes current quantities and calculates what they would have cost at prices prevailing during the base period. GDP deflator = Value of current quantities at cur ...

... Price Indexes for Other Purposes The GDP deflator is a type of price index called an implicit price deflator. An implicit price deflator takes current quantities and calculates what they would have cost at prices prevailing during the base period. GDP deflator = Value of current quantities at cur ...

Euro Area Enlargement and Euro Adoption Strategies

... Exchange Rate Regime 2 • Floating: price level convergence can be partly accommodated by nominal appreciation. • Risks: excessive appreciation, capital flow reversal, excessive exchange rate fluctuations • Exchange rate more a source of shock than shock absorber. Our new calculations for the CEEs re ...

... Exchange Rate Regime 2 • Floating: price level convergence can be partly accommodated by nominal appreciation. • Risks: excessive appreciation, capital flow reversal, excessive exchange rate fluctuations • Exchange rate more a source of shock than shock absorber. Our new calculations for the CEEs re ...

an evaluation of monetary policy instruments in achieving monetary

... For most countries, the maintenance of price stability continues to be the overriding objective of monetary policy. The emphasis given to price stability in the conduct of monetary policy is with a view to promoting sustainable growth and development as well as strengthening the purchasing power of ...

... For most countries, the maintenance of price stability continues to be the overriding objective of monetary policy. The emphasis given to price stability in the conduct of monetary policy is with a view to promoting sustainable growth and development as well as strengthening the purchasing power of ...

Interest_Rates_NY_Fed

... in unsecured loans, so the interest rates are lower, too. Auto loans, for example, carry lower rates than credit-card loans, because the lender can take possession of the car if the borrower fails to pay. When you apply for a loan, you often have to fill out a form on which you provide information t ...

... in unsecured loans, so the interest rates are lower, too. Auto loans, for example, carry lower rates than credit-card loans, because the lender can take possession of the car if the borrower fails to pay. When you apply for a loan, you often have to fill out a form on which you provide information t ...

Chapter 33

... An example is Friedman’s k-percent rule. The k-percent rule is a monetary policy rule that makes the quantity of money grow at k percent per year, where k equals the growth rate of potential GDP. Money targeting works when the demand for money is stable and predictable. But technological change in t ...

... An example is Friedman’s k-percent rule. The k-percent rule is a monetary policy rule that makes the quantity of money grow at k percent per year, where k equals the growth rate of potential GDP. Money targeting works when the demand for money is stable and predictable. But technological change in t ...

Monetary Regime Change and Business Cycles

... After the Bretton Woods collapse in 1973, Sweden participated in the so-called “snake” exchange rate mechanism. In 1977, the Riksbank announced a unilateral target zone to a currency basket constructed using trading weights. In May 1991, the ECU became the official target. Lindbeck et al. (1994), Li ...

... After the Bretton Woods collapse in 1973, Sweden participated in the so-called “snake” exchange rate mechanism. In 1977, the Riksbank announced a unilateral target zone to a currency basket constructed using trading weights. In May 1991, the ECU became the official target. Lindbeck et al. (1994), Li ...

Chapter 32

... An example is Friedman’s k-percent rule. The k-percent rule is a monetary policy rule that makes the quantity of money grow at k percent per year, where k equals the growth rate of potential GDP. Money targeting works when the demand for money is stable and predictable. But technological change in t ...

... An example is Friedman’s k-percent rule. The k-percent rule is a monetary policy rule that makes the quantity of money grow at k percent per year, where k equals the growth rate of potential GDP. Money targeting works when the demand for money is stable and predictable. But technological change in t ...

International Financial Management Web Links

... Short-Term Foreign Interest Rates Short-term interest rates for major currencies such as the Canadian dollar, Japanese yen, and British pound for various maturities are provided at http://www.bloomberg.com . The short-term interest rates provided at this site reflect the government cost of borrowing ...

... Short-Term Foreign Interest Rates Short-term interest rates for major currencies such as the Canadian dollar, Japanese yen, and British pound for various maturities are provided at http://www.bloomberg.com . The short-term interest rates provided at this site reflect the government cost of borrowing ...

This PDF is a selection from a published volume

... open economy to analyze the welfare implications of fixed and floating exchange rates. The model departs from much of the recent literature by allowing the degree of price flexibility to be determined endogenously. The home country is subject to stochastic shocks from internal and external sources a ...

... open economy to analyze the welfare implications of fixed and floating exchange rates. The model departs from much of the recent literature by allowing the degree of price flexibility to be determined endogenously. The home country is subject to stochastic shocks from internal and external sources a ...

Optimal Simple Targeting Rules for Small Open Economies Richard Dennis

... Questions have been raised about whether policy makers could actually implement a Taylor rule to set policy. McCallum (1999) stresses that the Taylor rule is infeasible because it is based on information unavailable to policy makers when policy is set. Similarly, Orphanides (1997) shows that the pre ...

... Questions have been raised about whether policy makers could actually implement a Taylor rule to set policy. McCallum (1999) stresses that the Taylor rule is infeasible because it is based on information unavailable to policy makers when policy is set. Similarly, Orphanides (1997) shows that the pre ...

PDF

... (1998). On the basis of this inclusion Nickell states that aggregate demand and unemployment are not independent, but should be cointegrated with each other. However, there is some sort of a puzzle here as both variables have trended upward in Europe and therefore the long-run relationship should ev ...

... (1998). On the basis of this inclusion Nickell states that aggregate demand and unemployment are not independent, but should be cointegrated with each other. However, there is some sort of a puzzle here as both variables have trended upward in Europe and therefore the long-run relationship should ev ...

The effect of Australian cash rate target announcements

... on markets and financial institutions. These included controls on bank interest rates, reserve requirements and various other balance-sheet restrictions. A change in monetary policy under this system could be achieved through a range of different mechanisms or through some combination of them. This ...

... on markets and financial institutions. These included controls on bank interest rates, reserve requirements and various other balance-sheet restrictions. A change in monetary policy under this system could be achieved through a range of different mechanisms or through some combination of them. This ...

Exchange rate

.jpg?width=300)

In finance, an exchange rate (also known as a foreign-exchange rate, forex rate, FX rate or Agio) between two currencies is the rate at which one currency will be exchanged for another. It is also regarded as the value of one country’s currency in terms of another currency. For example, an interbank exchange rate of 119 Japanese yen (JPY, ¥) to the United States dollar (US$) means that ¥119 will be exchanged for each US$1 or that US$1 will be exchanged for each ¥119. In this case it is said that the price of a dollar in terms of yen is ¥119, or equivalently that the price of a yen in terms of dollars is $1/119.Exchange rates are determined in the foreign exchange market, which is open to a wide range of different types of buyers and sellers where currency trading is continuous: 24 hours a day except weekends, i.e. trading from 20:15 GMT on Sunday until 22:00 GMT Friday. The spot exchange rate refers to the current exchange rate. The forward exchange rate refers to an exchange rate that is quoted and traded today but for delivery and payment on a specific future date.In the retail currency exchange market, a different buying rate and selling rate will be quoted by money dealers. Most trades are to or from the local currency. The buying rate is the rate at which money dealers will buy foreign currency, and the selling rate is the rate at which they will sell the currency. The quoted rates will incorporate an allowance for a dealer's margin (or profit) in trading, or else the margin may be recovered in the form of a commission or in some other way. Different rates may also be quoted for cash (usually notes only), a documentary form (such as traveler's cheques) or electronically (such as a credit card purchase). The higher rate on documentary transactions has been justified to compensate for the additional time and cost of clearing the document, while the cash is available for resale immediately. Some dealers on the other hand prefer documentary transactions because of the security concerns with cash.