MacroEconomic Goals - JV Penguinomics

... GDP = Market value of all final goods and services produced in an economy in a year ...

... GDP = Market value of all final goods and services produced in an economy in a year ...

Intermediate Macroeconomics

... The real rental price of capital equals f ’(k). Hence these two countries have identical real rental price of capital. ...

... The real rental price of capital equals f ’(k). Hence these two countries have identical real rental price of capital. ...

Document

... defaults since 1983, and their relative outcomes. • U.S. response to the 2008-2009 credit crisis was: write-offs by holders of bad debt, government purchase of debt securities, and government capital injections to support liquidity • Europe has chosen a similar path as the last ...

... defaults since 1983, and their relative outcomes. • U.S. response to the 2008-2009 credit crisis was: write-offs by holders of bad debt, government purchase of debt securities, and government capital injections to support liquidity • Europe has chosen a similar path as the last ...

Week 4

... dollar - for example, 104.75 Japanese yen per dollar or 9.36 Mexican pesos per dollar. However, there are two major exceptions. The exchange rate of the dollar with the British pound and the euro are always quoted as the number of dollars per one unit of the foreign currencies - for example, $1.58 f ...

... dollar - for example, 104.75 Japanese yen per dollar or 9.36 Mexican pesos per dollar. However, there are two major exceptions. The exchange rate of the dollar with the British pound and the euro are always quoted as the number of dollars per one unit of the foreign currencies - for example, $1.58 f ...

THE SPECIALIST IN TRADING AND INVESTMENT Hellerup, 11

... volatility band. But how this will work in practice may be entirely different, as we’ll have to see just how freely the PBOC will allow the exchange rate to fluctuate from hour to hour and day to day. But as the PBOC will want to maintain credibility and stay true to its word for at least a time tha ...

... volatility band. But how this will work in practice may be entirely different, as we’ll have to see just how freely the PBOC will allow the exchange rate to fluctuate from hour to hour and day to day. But as the PBOC will want to maintain credibility and stay true to its word for at least a time tha ...

Choosing an International Fund, Part 2

... Let's go back to our example. You buy Sony, but hedge your currencies by selling Japanese yen and buying U.S. dollars. Sony's stock rises 10% and the yen falls 10% against the dollar. What's your return? 10%. Because you hedged your currency exposure, whether the yen rises or falls doesn't have any ...

... Let's go back to our example. You buy Sony, but hedge your currencies by selling Japanese yen and buying U.S. dollars. Sony's stock rises 10% and the yen falls 10% against the dollar. What's your return? 10%. Because you hedged your currency exposure, whether the yen rises or falls doesn't have any ...

UNIVERSITY OF CAMBRIDGE INTERNATIONAL EXAMINATIONS

... eight months. The German government planned to encourage consumer spending by introducing cuts in both indirect and direct taxation. It also approved measures to increase employment opportunities. (a) Why does the article refer to the Netherlands as the weakest economy? ...

... eight months. The German government planned to encourage consumer spending by introducing cuts in both indirect and direct taxation. It also approved measures to increase employment opportunities. (a) Why does the article refer to the Netherlands as the weakest economy? ...

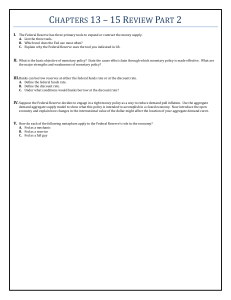

chapters 13 – 15 review part 2

... I. The Federal Reserve has three primary tools to expand or contract the money supply. A. List the three tools. B. Which tool does the Fed use most often? C. Explain why the Federal Reserve uses the tool you indicated in I.B. ...

... I. The Federal Reserve has three primary tools to expand or contract the money supply. A. List the three tools. B. Which tool does the Fed use most often? C. Explain why the Federal Reserve uses the tool you indicated in I.B. ...

Evolution by Region - Pennsylvania State University

... called the Balassa-Samuelson effect – economic growth is associated with increased productivity in traded goods, so that they fall relative to the price of nontraded goods. – Why does economic growth cause the relative price of tradables to fall? ...

... called the Balassa-Samuelson effect – economic growth is associated with increased productivity in traded goods, so that they fall relative to the price of nontraded goods. – Why does economic growth cause the relative price of tradables to fall? ...

Exchange Rates and the Foreign Exchange Market - uc

... 2) risk: uncertainty about rate of return. Even if a stock has a higher expected payoff than a saving account, the fact that the payoff is uncertain means it may be less desirable, because people not like risk. 3) liquidity: how easy it is to convert the asset to cash if you want to buy a different ...

... 2) risk: uncertainty about rate of return. Even if a stock has a higher expected payoff than a saving account, the fact that the payoff is uncertain means it may be less desirable, because people not like risk. 3) liquidity: how easy it is to convert the asset to cash if you want to buy a different ...

Document

... labor market, but should not be taken literally as a measure of the fraction of people who want to work but can’t find jobs. may overstate the true level of unemployment because a person typically spends time unemployed while in search of a job before finding one. It ...

... labor market, but should not be taken literally as a measure of the fraction of people who want to work but can’t find jobs. may overstate the true level of unemployment because a person typically spends time unemployed while in search of a job before finding one. It ...

Course Outline School of Business and Economics BUSN 6030/1

... 4. Explain the important implications that international trade theory holds for business practice. 5. Explain why some governments intervene in international trade to restrict imports and promote exports. 6. Assess the costs and benefits of foreign direct investment to receiving and source countries ...

... 4. Explain the important implications that international trade theory holds for business practice. 5. Explain why some governments intervene in international trade to restrict imports and promote exports. 6. Assess the costs and benefits of foreign direct investment to receiving and source countries ...

Lecture 2 - Comparative Economic Development

... Looking at Purchasing Power Parity(PPP) • In the 1970s economists considered if official income numbers were a good reflection of differences between countries • For example, an income of $200 per year would not be enough to live in the US (not even necessities could be purchased on this income) • ...

... Looking at Purchasing Power Parity(PPP) • In the 1970s economists considered if official income numbers were a good reflection of differences between countries • For example, an income of $200 per year would not be enough to live in the US (not even necessities could be purchased on this income) • ...

Econ 336 - Rutgers Economics

... B) Has a zero slope because a fall in the interest rate keeps constant the desired real money holdings of each household and firm in the economy C) Slopes upward because a fall in the interest rate raises the desired real money holdings of each household and firm in the economy D) Slopes downward be ...

... B) Has a zero slope because a fall in the interest rate keeps constant the desired real money holdings of each household and firm in the economy C) Slopes upward because a fall in the interest rate raises the desired real money holdings of each household and firm in the economy D) Slopes downward be ...

Get Paid to Borrow – Monetary Madness?

... expecting their bond holders to mail in monthly checks; rather, the buyers pay a premium for a bond that pays no interest, recognizing that the bond will mature at a price below what the buyer paid. That way, the loss (or negative interest rate) is built in. If you borrow from the Japanese governmen ...

... expecting their bond holders to mail in monthly checks; rather, the buyers pay a premium for a bond that pays no interest, recognizing that the bond will mature at a price below what the buyer paid. That way, the loss (or negative interest rate) is built in. If you borrow from the Japanese governmen ...

- Allama Iqbal Open University

... Consumption function and the determination of equilibrium level of income and output. Inflationary and deflationary gap Determinants of investment and the marginal efficiency of capital ...

... Consumption function and the determination of equilibrium level of income and output. Inflationary and deflationary gap Determinants of investment and the marginal efficiency of capital ...

Course: Marketing Theory and Practice (561/5534) Semester:

... Consumption function and the determination of equilibrium level of income and output. Inflationary and deflationary gap Determinants of investment and the marginal efficiency of capital ...

... Consumption function and the determination of equilibrium level of income and output. Inflationary and deflationary gap Determinants of investment and the marginal efficiency of capital ...

Chapter18

... increases the supply of loanable funds made available by the savings of Canadians and reduces the quantity of loanable funds demanded for domestic investment. For both of these ...

... increases the supply of loanable funds made available by the savings of Canadians and reduces the quantity of loanable funds demanded for domestic investment. For both of these ...

Influence of Macroeconomic Variables on Exchange Rates

... adjust the interest rate, this increase in one country creates inequilibrium in demand and supply for money and in turn it causes the exchange rate to move to equilibrium. If not arbitrage profits are possible in borrowing and investing between countries. If both home and host countries simultaneous ...

... adjust the interest rate, this increase in one country creates inequilibrium in demand and supply for money and in turn it causes the exchange rate to move to equilibrium. If not arbitrage profits are possible in borrowing and investing between countries. If both home and host countries simultaneous ...

Dollar Drops Versus Euro, Yen as Bush Nominates Bernanke for

... Fed policy makers today cut the benchmark U.S. interest rate today by three-quarters of a percentage point to 2.25 percent to support financial markets. Brazil's currency gained even as the country's central bank bought U.S. dollars in the spot market, part of a strategy to increase international re ...

... Fed policy makers today cut the benchmark U.S. interest rate today by three-quarters of a percentage point to 2.25 percent to support financial markets. Brazil's currency gained even as the country's central bank bought U.S. dollars in the spot market, part of a strategy to increase international re ...

Chap02

... • The average of the short term one year rates is 7%, but the three year rate is only 5%. • One could borrow any given amount such as $1000 for the full three years and invest that money one year at a time and rolling over the investment for three years. • The borrowing cost per year is 5% and the a ...

... • The average of the short term one year rates is 7%, but the three year rate is only 5%. • One could borrow any given amount such as $1000 for the full three years and invest that money one year at a time and rolling over the investment for three years. • The borrowing cost per year is 5% and the a ...

Key Issues in Monetary and External Sector Policies

... Liberalize outflows after macroeconomic imbalances have been addressed ...

... Liberalize outflows after macroeconomic imbalances have been addressed ...

Exchange rate

.jpg?width=300)

In finance, an exchange rate (also known as a foreign-exchange rate, forex rate, FX rate or Agio) between two currencies is the rate at which one currency will be exchanged for another. It is also regarded as the value of one country’s currency in terms of another currency. For example, an interbank exchange rate of 119 Japanese yen (JPY, ¥) to the United States dollar (US$) means that ¥119 will be exchanged for each US$1 or that US$1 will be exchanged for each ¥119. In this case it is said that the price of a dollar in terms of yen is ¥119, or equivalently that the price of a yen in terms of dollars is $1/119.Exchange rates are determined in the foreign exchange market, which is open to a wide range of different types of buyers and sellers where currency trading is continuous: 24 hours a day except weekends, i.e. trading from 20:15 GMT on Sunday until 22:00 GMT Friday. The spot exchange rate refers to the current exchange rate. The forward exchange rate refers to an exchange rate that is quoted and traded today but for delivery and payment on a specific future date.In the retail currency exchange market, a different buying rate and selling rate will be quoted by money dealers. Most trades are to or from the local currency. The buying rate is the rate at which money dealers will buy foreign currency, and the selling rate is the rate at which they will sell the currency. The quoted rates will incorporate an allowance for a dealer's margin (or profit) in trading, or else the margin may be recovered in the form of a commission or in some other way. Different rates may also be quoted for cash (usually notes only), a documentary form (such as traveler's cheques) or electronically (such as a credit card purchase). The higher rate on documentary transactions has been justified to compensate for the additional time and cost of clearing the document, while the cash is available for resale immediately. Some dealers on the other hand prefer documentary transactions because of the security concerns with cash.