MACRO Study Guide Before AP 2009

... Hint for next problem: All currency transactions go through the “house of money” which is actually the MARKET FOR FOREIGN EXCHANGE. For Example, If real interest rates rise in Japan then foreigners will want to save money in Japan. Therefore Americans will go to the house of money and supply dollars ...

... Hint for next problem: All currency transactions go through the “house of money” which is actually the MARKET FOR FOREIGN EXCHANGE. For Example, If real interest rates rise in Japan then foreigners will want to save money in Japan. Therefore Americans will go to the house of money and supply dollars ...

MACROECONOMICS

... market are the unemployment rate and the change in nonfarm payroll employment. Economic growth is the rate of change of Real GDP for a specific time period, usually a year. Economic growth should be strong enough to generate employment but not so strong as to cause inflation ...

... market are the unemployment rate and the change in nonfarm payroll employment. Economic growth is the rate of change of Real GDP for a specific time period, usually a year. Economic growth should be strong enough to generate employment but not so strong as to cause inflation ...

Aggregate Supply & Demand

... • Aggregate-demand curve (AD)- how demand for the entire economy changes with inflation (price level) – demand from households, firms, exports & government at each price level ...

... • Aggregate-demand curve (AD)- how demand for the entire economy changes with inflation (price level) – demand from households, firms, exports & government at each price level ...

www.XtremePapers.com

... It calculates that the cost of constructing and running the airport will be less than the revenue the airport will generate. It also estimates that benefits to third parties will be greater than the cost to ...

... It calculates that the cost of constructing and running the airport will be less than the revenue the airport will generate. It also estimates that benefits to third parties will be greater than the cost to ...

ch06 - Prof Dimond

... political reform. It also boosts the power of the bureaucrats at the expense of the private sector. Thus, any loans should be tied to the implementation of genuine reforms. Better still, money should be provided directly to private companies on close-to-market terms, thereby building up the private- ...

... political reform. It also boosts the power of the bureaucrats at the expense of the private sector. Thus, any loans should be tied to the implementation of genuine reforms. Better still, money should be provided directly to private companies on close-to-market terms, thereby building up the private- ...

Test 2 - Department of Economics

... of interest rises to i2 (point B) and an excess supply arises in the goods market. As a result, Y decreases and the demand for money falls, thus also decreasing the rate of interest. Note that the adjustment path follows a movement down along the LM’ curve until the excess supply in the goods market ...

... of interest rises to i2 (point B) and an excess supply arises in the goods market. As a result, Y decreases and the demand for money falls, thus also decreasing the rate of interest. Note that the adjustment path follows a movement down along the LM’ curve until the excess supply in the goods market ...

Russian Currency Crisis

... There were numerous factors attributing to the decline in the GDP between the 3rd quarter in 1997 and the 4th quarter of 1998: – The high government debt that Russia had to deal with following the collapse of the Soviet Union, and the doubt that investors had to the ability of the Russian governme ...

... There were numerous factors attributing to the decline in the GDP between the 3rd quarter in 1997 and the 4th quarter of 1998: – The high government debt that Russia had to deal with following the collapse of the Soviet Union, and the doubt that investors had to the ability of the Russian governme ...

Finnish experiences of EU and EMU

... Union • Exchange rate is not any more a domestic issue • Too high inflation detorriorates the price competitiveness and it cannot be restored by depreciation of exchange rate • Labour markets and wage formation in important role in formulating economic development • Asymmetric shocks have to be neut ...

... Union • Exchange rate is not any more a domestic issue • Too high inflation detorriorates the price competitiveness and it cannot be restored by depreciation of exchange rate • Labour markets and wage formation in important role in formulating economic development • Asymmetric shocks have to be neut ...

Latin American Financial Crises and Recovery

... Demand by government on the domestic market, is equal to government expenditure on goods and services, plus government transfers and wages, plus domestic interest payments. Deficit refer to government expenditures above those financed with taxes which in Mexico includes government revenues from oil ...

... Demand by government on the domestic market, is equal to government expenditure on goods and services, plus government transfers and wages, plus domestic interest payments. Deficit refer to government expenditures above those financed with taxes which in Mexico includes government revenues from oil ...

CHAPTER 9

... determined by the reference currency exchange rate. A dirty float occurs when the value of a currency is determined by market forces, but with central bank intervention if it depreciates too rapidly against an important reference currency. Countries that adopt a fixed exchange rate system fix their ...

... determined by the reference currency exchange rate. A dirty float occurs when the value of a currency is determined by market forces, but with central bank intervention if it depreciates too rapidly against an important reference currency. Countries that adopt a fixed exchange rate system fix their ...

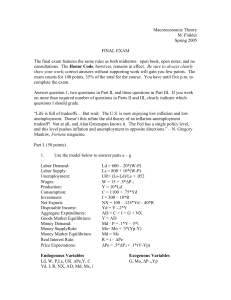

Endogenous Variables Exogenous Variables

... Answer question 1, two questions in Part II, and three questions in Part III. If you work on more than required number of questions in Parts II and III, clearly indicate which ...

... Answer question 1, two questions in Part II, and three questions in Part III. If you work on more than required number of questions in Parts II and III, clearly indicate which ...

pegging to the dollar and the feasibility of the proposed currency area in the gcc

... development of the region's bond and equity markets and by improving the efficiency of financial services. In contrast, the costs of a monetary union to individual countries—such as giving up the ability to set an independent monetary policy and adjust the nominal exchange rate— should not be high b ...

... development of the region's bond and equity markets and by improving the efficiency of financial services. In contrast, the costs of a monetary union to individual countries—such as giving up the ability to set an independent monetary policy and adjust the nominal exchange rate— should not be high b ...

... Quantitative Easing by the Bank of Japan In the wake of continued weakness in the Japanese economy and recent market turbulence due to the terrorist attacks in the U.S., the Bank of Japan (BOJ) recently increased the intensity of its quantitative easing program, which it had begun in March of this y ...

Goal 9 Study Guide

... Why would the government use fiscal policy to cut taxes? Why would the government use fiscal policy to increase spending? What happens to the value of money during inflation? During expansion, what happens to the unemployment rate? During recession, what happens to the unemployment rate? What is a s ...

... Why would the government use fiscal policy to cut taxes? Why would the government use fiscal policy to increase spending? What happens to the value of money during inflation? During expansion, what happens to the unemployment rate? During recession, what happens to the unemployment rate? What is a s ...

West Orange High School

... Initially the course will explore economics from both “micro” and “macro” perspectives. Students will gain an understanding of how scarcity requires individuals and institutions to make choices about how to use resources, how businesses interact with society, and gain an understanding of the charact ...

... Initially the course will explore economics from both “micro” and “macro” perspectives. Students will gain an understanding of how scarcity requires individuals and institutions to make choices about how to use resources, how businesses interact with society, and gain an understanding of the charact ...

Brazil_en.pdf

... Special System of Clearance and Custody (SELIC) had reached a historical low of 11.25%). The rate was thus held steady at 13.75%. On the financial market, annual lending rates rose by around 2.5 percentage points in October for all types of operation, while the average term for corporate loans was s ...

... Special System of Clearance and Custody (SELIC) had reached a historical low of 11.25%). The rate was thus held steady at 13.75%. On the financial market, annual lending rates rose by around 2.5 percentage points in October for all types of operation, while the average term for corporate loans was s ...

Economic and monetary developments 2007 was the third

... inflation in 2007 Q4 and January 2008 was due mainly to a sharp rise in world prices of food, changes to indirect taxes and a further pick-up in regulated prices. These components of inflation will keep it above the target for the remainder of the year. However, given the oneoff effects of the rise ...

... inflation in 2007 Q4 and January 2008 was due mainly to a sharp rise in world prices of food, changes to indirect taxes and a further pick-up in regulated prices. These components of inflation will keep it above the target for the remainder of the year. However, given the oneoff effects of the rise ...

XIA MENG Brandeis University International Business School Phone

... Exchange Rates and Commodity Prices ---- An Analysis and Trading Strategy on G10 Currencies, Joint paper with Ritirupa Samanta There is a dual relationship between commodity prices and exchange rates. On the one hand, commodity prices can be used to construct a proxy of a country’s terms of trade, w ...

... Exchange Rates and Commodity Prices ---- An Analysis and Trading Strategy on G10 Currencies, Joint paper with Ritirupa Samanta There is a dual relationship between commodity prices and exchange rates. On the one hand, commodity prices can be used to construct a proxy of a country’s terms of trade, w ...

1 point for saying the interest rate increases

... 1. (c) [2 pts] How will the change in the price of the dollar you indicated in part (b) (ii) affect net exports of the U.S. Explain. Answer to 1. (c) The appreciated dollar would cause American goods to be more expensive for Japan and Japan’s goods to be less expensive for Americans; therefore, we ...

... 1. (c) [2 pts] How will the change in the price of the dollar you indicated in part (b) (ii) affect net exports of the U.S. Explain. Answer to 1. (c) The appreciated dollar would cause American goods to be more expensive for Japan and Japan’s goods to be less expensive for Americans; therefore, we ...

WP24

... unprecedentedly fast and stable growth in much of the world, including both developed and developing countries, and an important part of this performance can be attributed to the Bretton Woods architecture. But the system was undermined in the late 1960s and the early 1970s by several forces, most i ...

... unprecedentedly fast and stable growth in much of the world, including both developed and developing countries, and an important part of this performance can be attributed to the Bretton Woods architecture. But the system was undermined in the late 1960s and the early 1970s by several forces, most i ...

Exchange rate

.jpg?width=300)

In finance, an exchange rate (also known as a foreign-exchange rate, forex rate, FX rate or Agio) between two currencies is the rate at which one currency will be exchanged for another. It is also regarded as the value of one country’s currency in terms of another currency. For example, an interbank exchange rate of 119 Japanese yen (JPY, ¥) to the United States dollar (US$) means that ¥119 will be exchanged for each US$1 or that US$1 will be exchanged for each ¥119. In this case it is said that the price of a dollar in terms of yen is ¥119, or equivalently that the price of a yen in terms of dollars is $1/119.Exchange rates are determined in the foreign exchange market, which is open to a wide range of different types of buyers and sellers where currency trading is continuous: 24 hours a day except weekends, i.e. trading from 20:15 GMT on Sunday until 22:00 GMT Friday. The spot exchange rate refers to the current exchange rate. The forward exchange rate refers to an exchange rate that is quoted and traded today but for delivery and payment on a specific future date.In the retail currency exchange market, a different buying rate and selling rate will be quoted by money dealers. Most trades are to or from the local currency. The buying rate is the rate at which money dealers will buy foreign currency, and the selling rate is the rate at which they will sell the currency. The quoted rates will incorporate an allowance for a dealer's margin (or profit) in trading, or else the margin may be recovered in the form of a commission or in some other way. Different rates may also be quoted for cash (usually notes only), a documentary form (such as traveler's cheques) or electronically (such as a credit card purchase). The higher rate on documentary transactions has been justified to compensate for the additional time and cost of clearing the document, while the cash is available for resale immediately. Some dealers on the other hand prefer documentary transactions because of the security concerns with cash.