Mankiw 6e PowerPoints

... Nonetheless, PPP is a useful theory: It’s simple & intuitive In the real world, nominal exchange rates tend toward their PPP values over the long run. CHAPTER 5 ...

... Nonetheless, PPP is a useful theory: It’s simple & intuitive In the real world, nominal exchange rates tend toward their PPP values over the long run. CHAPTER 5 ...

NBER WORKING PAPER SERIES DYNAMIC STRATEGIC MONETARY POLICIES AND COORDINATION IN INTERDEPENDENT ECONOMIES

... the so-called feedback information pattern (for both countries) as dictated by (1 3b)? Using the recursive technique given in Basar and Olsder (1982, Chapter 6), the solution of the dynamic game can be shown to be unique, and linear in the current value of the state, yielding the expressions given b ...

... the so-called feedback information pattern (for both countries) as dictated by (1 3b)? Using the recursive technique given in Basar and Olsder (1982, Chapter 6), the solution of the dynamic game can be shown to be unique, and linear in the current value of the state, yielding the expressions given b ...

How do exchange rate movements affect Chinese exports? – A firm

... China’s tremendous export growth and increasing influence in global economy is reason enough to direct attention to that country. China’s export shipment to the world market more than quadrupled in 8 years, from 1999-2007, during which China joined the WTO in 2001. In Figure 1 we show China’s recent ...

... China’s tremendous export growth and increasing influence in global economy is reason enough to direct attention to that country. China’s export shipment to the world market more than quadrupled in 8 years, from 1999-2007, during which China joined the WTO in 2001. In Figure 1 we show China’s recent ...

Pass-through and Exposure

... prices relative to the domestic prices of the same producers.1 Most of these studies are based implicitly on a model of a monopoly firm with no strategic behavior relative to its competitors. Dornbusch (1987), Krugman (1987), Froot and Klemperer (1989), Feenstra, Gagnon and Knetter (1996) and Yang ...

... prices relative to the domestic prices of the same producers.1 Most of these studies are based implicitly on a model of a monopoly firm with no strategic behavior relative to its competitors. Dornbusch (1987), Krugman (1987), Froot and Klemperer (1989), Feenstra, Gagnon and Knetter (1996) and Yang ...

Sebastian

... partially integrated to the international financial markets. In that sense, then, the behavior of the interest rate in Colombia cannot be explained by conventional models that assume a fully open or completely closed economy.' The analysis presented in this paper is useful for evaluating two key pol ...

... partially integrated to the international financial markets. In that sense, then, the behavior of the interest rate in Colombia cannot be explained by conventional models that assume a fully open or completely closed economy.' The analysis presented in this paper is useful for evaluating two key pol ...

IOSR Journal of Economics and Finance (IOSR-JEF)

... a proxy to GDP. This IIP is the general IIP computed as the weighted average of all use based IIP, by the Ministry of Statistics and Programme Implementation, Government of India. As IIP numbers present a measure of overall economic activity in the economy and affect stock prices through its influen ...

... a proxy to GDP. This IIP is the general IIP computed as the weighted average of all use based IIP, by the Ministry of Statistics and Programme Implementation, Government of India. As IIP numbers present a measure of overall economic activity in the economy and affect stock prices through its influen ...

NBER WORKING PAPER SERIES INTERNATIONAL MONETARY POLICY IJ PROMOTE ECONOMIC RECOVERY

... throughout follow a constant financial crowding out pressure" policy which consists in keeping constant the real stock of government debt B/P. The foreign authorities similarly keep B*/P* constant. Thus B = B(P/P) and B* = B*(P*/P*) . Whether or not B/P and B*/P* are arguments in the money demand fu ...

... throughout follow a constant financial crowding out pressure" policy which consists in keeping constant the real stock of government debt B/P. The foreign authorities similarly keep B*/P* constant. Thus B = B(P/P) and B* = B*(P*/P*) . Whether or not B/P and B*/P* are arguments in the money demand fu ...

Ch - Pearson Canada

... produce a range of goods and services. An economic unit that hires factors of production and organizes those factors to produce and sell goods and services. A measure of market power that is calculated as the percentage of the value of sales accounted for by the four largest firms in an industry. A ...

... produce a range of goods and services. An economic unit that hires factors of production and organizes those factors to produce and sell goods and services. A measure of market power that is calculated as the percentage of the value of sales accounted for by the four largest firms in an industry. A ...

Solutions to Problems

... 7a. An increase in government expenditures and a decrease in taxes are expansionary fiscal policies. Aggregate demand increases in the first round. Real GDP and the price level begin to increase. In the second round, the increasing real GDP increases the demand for money and the interest rate rises. ...

... 7a. An increase in government expenditures and a decrease in taxes are expansionary fiscal policies. Aggregate demand increases in the first round. Real GDP and the price level begin to increase. In the second round, the increasing real GDP increases the demand for money and the interest rate rises. ...

Real currency appreciation in accession countries

... Slovak Republic, by contrast, gradually transformed their conventional fixed pegs into regimes of managed or independently floating exchange rates.2 ...

... Slovak Republic, by contrast, gradually transformed their conventional fixed pegs into regimes of managed or independently floating exchange rates.2 ...

Management & Engineering Empirical Analysis of

... Great numbers of literature have interpreted which factors have decision effect in the process of currency internationalization. There four factors approved by the majority of researchers including economic scale, stability of monetary value, network externality and the developed and open financial ...

... Great numbers of literature have interpreted which factors have decision effect in the process of currency internationalization. There four factors approved by the majority of researchers including economic scale, stability of monetary value, network externality and the developed and open financial ...

Política monetaria en un entorno de dos monedas

... partially dollarized economy ”... a signi…cant constraint on monetary policy discretion is imposed. Not only is the monetary authority given control of a smaller share of the money supply but also this share can rapidly shrink (via currency switching) if credibility of domestic policies falters.” Bu ...

... partially dollarized economy ”... a signi…cant constraint on monetary policy discretion is imposed. Not only is the monetary authority given control of a smaller share of the money supply but also this share can rapidly shrink (via currency switching) if credibility of domestic policies falters.” Bu ...

Chapter 18

... monetary growth, one effect is an automatic increase in monetary growth rates and inflation abroad. U.S. macroeconomic policies in the late 1960s helped cause the breakdown of the Bretton Woods system by ...

... monetary growth, one effect is an automatic increase in monetary growth rates and inflation abroad. U.S. macroeconomic policies in the late 1960s helped cause the breakdown of the Bretton Woods system by ...

Exchange Rate Volatility and Productivity Growth

... exchange rate regime; (iii) rms' debt can be partially or completely denominated in dollars. First, we describe how, in the presence of credit constraints, growth depends on rms' pro ts and thus on the interplay between liability dollarization and the real exchange rate, but only in a partial equi ...

... exchange rate regime; (iii) rms' debt can be partially or completely denominated in dollars. First, we describe how, in the presence of credit constraints, growth depends on rms' pro ts and thus on the interplay between liability dollarization and the real exchange rate, but only in a partial equi ...

Welfare Costs of Inflation and the Circulation of US Currency Abroad

... previous empirical money demand studies (e.g. Dutkowsky and Cynamon, 2003; Ireland, 2009; Calza and Zaghini, 2010). In addition, for the purpose of computing the money income ratio, the volume of transactions is measured by seasonally adjusted data on GDP sourced from the Bureau of Economic Analysis ...

... previous empirical money demand studies (e.g. Dutkowsky and Cynamon, 2003; Ireland, 2009; Calza and Zaghini, 2010). In addition, for the purpose of computing the money income ratio, the volume of transactions is measured by seasonally adjusted data on GDP sourced from the Bureau of Economic Analysis ...

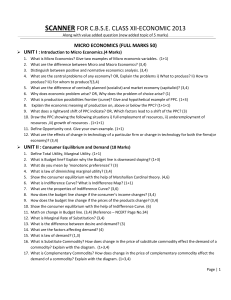

SCANNER FOR C.B.S.E. CLASS XII

... 10. Define GDP at market price ,GNP at market price, NDP at market price, National Income, NDP at factor cost, GNP at factor cost, NNP at market price. (1 each) 11. What is the difference between GDP and GNP? When is GDP of an economy equal to GNP? (3,4+1) 12. Which of the followings are not include ...

... 10. Define GDP at market price ,GNP at market price, NDP at market price, National Income, NDP at factor cost, GNP at factor cost, NNP at market price. (1 each) 11. What is the difference between GDP and GNP? When is GDP of an economy equal to GNP? (3,4+1) 12. Which of the followings are not include ...

Comparative Study: Factors that Affect Foreign Currency Reserves

... needed to buy a unit of the oped. Again, the literature positively correlated with the does not agree as to what the foreign currency. In order to counteract this devaluaappropriate benchmark is, so level of reserves.” tion of the currency, the they are mostly arbitrary. central currency will have S ...

... needed to buy a unit of the oped. Again, the literature positively correlated with the does not agree as to what the foreign currency. In order to counteract this devaluaappropriate benchmark is, so level of reserves.” tion of the currency, the they are mostly arbitrary. central currency will have S ...

Long-Horizon Forecasts of Asset Prices when the Discount Factor is

... approximately follows a random walk when the fundamentals are I(1) and the discount factor is large (close to one). Engel and West (2005) also show that a wide range of exchange rate models can be written in the form of a present-value asset pricing model, and discount factors estimated from monthly ...

... approximately follows a random walk when the fundamentals are I(1) and the discount factor is large (close to one). Engel and West (2005) also show that a wide range of exchange rate models can be written in the form of a present-value asset pricing model, and discount factors estimated from monthly ...

the inflation rate determined as a change in the gdp deflator and in cpi

... same typical market basket, CPI doesn’t reflect the change in the purchasing power of the money. Inflation rate has different values depending on the calculation method, and is different felt among diverse social categories. The perception of price increase is subjectively and varies from a consumer ...

... same typical market basket, CPI doesn’t reflect the change in the purchasing power of the money. Inflation rate has different values depending on the calculation method, and is different felt among diverse social categories. The perception of price increase is subjectively and varies from a consumer ...

Chapter 9 Keynesian Models of Aggregate Demand

... consumption would respond strongly to changes in current income. Second, if households cannot borrow against future income due to imperfections in capital markets, then they may not be able to smooth consumption. Such “liquidityconstrained” households will typically spend nearly all of their income ...

... consumption would respond strongly to changes in current income. Second, if households cannot borrow against future income due to imperfections in capital markets, then they may not be able to smooth consumption. Such “liquidityconstrained” households will typically spend nearly all of their income ...

Price dispersion: the role of borders, distance, and location∗

... technology and expenditure weights, the aggregate value of this expression should be close to zero since it is averaging trade costs of opposite sign. The implication of this logic is that aggregate real exchange rates for traded intermediate inputs should be zero (See Table X first row first column ...

... technology and expenditure weights, the aggregate value of this expression should be close to zero since it is averaging trade costs of opposite sign. The implication of this logic is that aggregate real exchange rates for traded intermediate inputs should be zero (See Table X first row first column ...

Question 1: Deriving and Solving the IS

... grapes. In the IS-LM framework, this situation represents a beneficial supply shock. Specifically, suppose the full-employment level of output Ȳ increases temporarily to Ȳ 0 = 1050. Show what happens to the economy in a graph. What will be the new long-run equilibrium value of r and how will the ...

... grapes. In the IS-LM framework, this situation represents a beneficial supply shock. Specifically, suppose the full-employment level of output Ȳ increases temporarily to Ȳ 0 = 1050. Show what happens to the economy in a graph. What will be the new long-run equilibrium value of r and how will the ...

Exchange rate

.jpg?width=300)

In finance, an exchange rate (also known as a foreign-exchange rate, forex rate, FX rate or Agio) between two currencies is the rate at which one currency will be exchanged for another. It is also regarded as the value of one country’s currency in terms of another currency. For example, an interbank exchange rate of 119 Japanese yen (JPY, ¥) to the United States dollar (US$) means that ¥119 will be exchanged for each US$1 or that US$1 will be exchanged for each ¥119. In this case it is said that the price of a dollar in terms of yen is ¥119, or equivalently that the price of a yen in terms of dollars is $1/119.Exchange rates are determined in the foreign exchange market, which is open to a wide range of different types of buyers and sellers where currency trading is continuous: 24 hours a day except weekends, i.e. trading from 20:15 GMT on Sunday until 22:00 GMT Friday. The spot exchange rate refers to the current exchange rate. The forward exchange rate refers to an exchange rate that is quoted and traded today but for delivery and payment on a specific future date.In the retail currency exchange market, a different buying rate and selling rate will be quoted by money dealers. Most trades are to or from the local currency. The buying rate is the rate at which money dealers will buy foreign currency, and the selling rate is the rate at which they will sell the currency. The quoted rates will incorporate an allowance for a dealer's margin (or profit) in trading, or else the margin may be recovered in the form of a commission or in some other way. Different rates may also be quoted for cash (usually notes only), a documentary form (such as traveler's cheques) or electronically (such as a credit card purchase). The higher rate on documentary transactions has been justified to compensate for the additional time and cost of clearing the document, while the cash is available for resale immediately. Some dealers on the other hand prefer documentary transactions because of the security concerns with cash.