forward rate

... • Two general conclusions can be drawn from the tests: – PPP holds up well over the very long term but is poor for short term estimates – The theory holds better for countries with relatively high rates of inflation and underdeveloped capital markets ...

... • Two general conclusions can be drawn from the tests: – PPP holds up well over the very long term but is poor for short term estimates – The theory holds better for countries with relatively high rates of inflation and underdeveloped capital markets ...

Untitled

... • Growth of the money supply – quantity theory – inflation states that too much money in the economy causes inflation • changes in aggregate demand – (amount of goods and services in the economy that will be purchases at all possible price levels) can be affected by inflation • changes in aggregate ...

... • Growth of the money supply – quantity theory – inflation states that too much money in the economy causes inflation • changes in aggregate demand – (amount of goods and services in the economy that will be purchases at all possible price levels) can be affected by inflation • changes in aggregate ...

Panel Discussion Bennett T. McCallum*

... Regarding the (nominal) GNP or GDP target, some critics would favor traditional monetary aggregates and others would prefer direct targeting of the price level---or some other weighted average of price level and output movements. I favor GDP because one can be confident that keeping its growth close ...

... Regarding the (nominal) GNP or GDP target, some critics would favor traditional monetary aggregates and others would prefer direct targeting of the price level---or some other weighted average of price level and output movements. I favor GDP because one can be confident that keeping its growth close ...

What Do Rising Interest Rates Mean for You?

... If you've been keeping up with news stories about the economy lately, you may have heard that the "Fed" has been raising rates, and is likely to do so more often in the future. What does this mean, and how will it impact the average consumer? Who is "the Fed"? The Federal Reserve is the central bank ...

... If you've been keeping up with news stories about the economy lately, you may have heard that the "Fed" has been raising rates, and is likely to do so more often in the future. What does this mean, and how will it impact the average consumer? Who is "the Fed"? The Federal Reserve is the central bank ...

Graphs - Mr. Thomas

... to help you answer questions even when a graph is not required. For example, drawing a supply and demand graph can often help you answer multiple-choice questions that involve the supply and demand model. And a graph can often be used to help explain an answer to a free-response question, even if a ...

... to help you answer questions even when a graph is not required. For example, drawing a supply and demand graph can often help you answer multiple-choice questions that involve the supply and demand model. And a graph can often be used to help explain an answer to a free-response question, even if a ...

THE POLITICAL ECONOMY OF GLOBAL ECONOMIC DISGOVERNANCE Luiz Carlos Bresser-Pereira

... It is difficult to deny the success of the Plaza Agreements. Not only because they were effective in achieving the stated objectives, but also for a question of correspondence: if countries are supposed to make macroeconomic policy, there is no reason why the world should not. Yet, immediately afte ...

... It is difficult to deny the success of the Plaza Agreements. Not only because they were effective in achieving the stated objectives, but also for a question of correspondence: if countries are supposed to make macroeconomic policy, there is no reason why the world should not. Yet, immediately afte ...

OCR A2 Economics Unit F585

... 9 Fiscal policy could be used to affect the international competitiveness of an economy. A tariff could be imposed on certain imports to protect a domestic industry, giving it time to become more competitive in international markets. Also, a subsidy could be provided to the domestic industry to enab ...

... 9 Fiscal policy could be used to affect the international competitiveness of an economy. A tariff could be imposed on certain imports to protect a domestic industry, giving it time to become more competitive in international markets. Also, a subsidy could be provided to the domestic industry to enab ...

The Last Shall Be the First: The East European Financial

... Crisis bred budget deficits 2009-11 ...

... Crisis bred budget deficits 2009-11 ...

slides - Harvard University

... *) Deflated by US consumer price2010=100 index. Source: HWWA, Datastream. ...

... *) Deflated by US consumer price2010=100 index. Source: HWWA, Datastream. ...

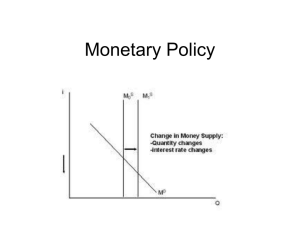

Intro to Monetary Policy

... Bernanke Interview • http://www.cbsnews.com/stories/2009/03/12/60minutes/main4862191.shtml?ta g=mncol;lst;1 AS1 ...

... Bernanke Interview • http://www.cbsnews.com/stories/2009/03/12/60minutes/main4862191.shtml?ta g=mncol;lst;1 AS1 ...

MUSE: The Bank of Canada`s New Projection Model of the U.S.

... account for expected inflation and some persistence in the adjustment process of inflation.2 The model is closed by a third endogenous equation, an estimated forward-looking interest rate rule for monetary policy. It relates the nominal short-term interest rate to the deviation of forecast inflation ...

... account for expected inflation and some persistence in the adjustment process of inflation.2 The model is closed by a third endogenous equation, an estimated forward-looking interest rate rule for monetary policy. It relates the nominal short-term interest rate to the deviation of forecast inflation ...

Monetary Economics Lecture 1. October 30, 2007

... • Puts emphasis on quantity not price. • Matters for small firms as big firms can raise funds directly via equity issuance. • It has been argued that given innovations in financial markets, this channel is likely not to be too important. But it may remain so in countries with underdeveloped financia ...

... • Puts emphasis on quantity not price. • Matters for small firms as big firms can raise funds directly via equity issuance. • It has been argued that given innovations in financial markets, this channel is likely not to be too important. But it may remain so in countries with underdeveloped financia ...

86007026I_en.pdf

... Exchange rate regimes and macroeconomic performance For a while, there was a doctrine —or rather a consensus— holding that either a full float or a hard peg (“dollarization” or monetary unions) was the best exchange rate policy to adopt, and this influenced much of the new literature about currency ...

... Exchange rate regimes and macroeconomic performance For a while, there was a doctrine —or rather a consensus— holding that either a full float or a hard peg (“dollarization” or monetary unions) was the best exchange rate policy to adopt, and this influenced much of the new literature about currency ...

Triangular Relation Foreign Direct Investments - Exchange Rate – Capital Market for the CEE Countries:

... The statistic output revealed the fact that the variables are integrated of order one, highlighting the transitory dimension of shocks. This finding permitted the cointegration tests which revealed important findings. The analysis focused on foreign direct investments both in the position of determi ...

... The statistic output revealed the fact that the variables are integrated of order one, highlighting the transitory dimension of shocks. This finding permitted the cointegration tests which revealed important findings. The analysis focused on foreign direct investments both in the position of determi ...

Monetary Policy

... • Decreases AD (investment and consumption) • Higher interest rates lead to capital inflow, so dollar appreciates, and exports decrease (lower AD) • Asset prices decrease ...

... • Decreases AD (investment and consumption) • Higher interest rates lead to capital inflow, so dollar appreciates, and exports decrease (lower AD) • Asset prices decrease ...

NBER WORKING PAPER SERIES INTERNATIONAL BALANCE OF PAYMENTS FINANCING AND Willem H. Buiter

... there are two types of countries, one characterized by a low inflation rate under financial autarky and another by a high inflation rate under financiai. autarky. We distinguish two cases, one in which gross international lending is always denominated in the currency of the lender, in which case res ...

... there are two types of countries, one characterized by a low inflation rate under financial autarky and another by a high inflation rate under financiai. autarky. We distinguish two cases, one in which gross international lending is always denominated in the currency of the lender, in which case res ...

Test 4

... 17. The vertical Phillips curve occurs in the long run because A) the aggregate supply curve is vertical which means that changes in aggregate demand will not change unemployment. B) wage and price rigidities prevent changes in aggregate demand to change unemployment. C) economic agents are quick to ...

... 17. The vertical Phillips curve occurs in the long run because A) the aggregate supply curve is vertical which means that changes in aggregate demand will not change unemployment. B) wage and price rigidities prevent changes in aggregate demand to change unemployment. C) economic agents are quick to ...

This PDF is a selection from an out-of-print volume from... of Economic Research

... he deals only with the effects of deficits within closed economies. If deficits are anticipated to be much larger in the U.S. than in other countries, then in open economies with international capital mobility there would be large movements in exchange rates. Indeed, the large appreciation of the do ...

... he deals only with the effects of deficits within closed economies. If deficits are anticipated to be much larger in the U.S. than in other countries, then in open economies with international capital mobility there would be large movements in exchange rates. Indeed, the large appreciation of the do ...

economic polices to control inflation

... growth of wages and have the potential to reduce cost inflation. Western Governments have not used such policies in recent years as they distort the labour market and lead to allocative inefficiency, but they does still try to influence wage growth by restricting pay rises in the public sector and b ...

... growth of wages and have the potential to reduce cost inflation. Western Governments have not used such policies in recent years as they distort the labour market and lead to allocative inefficiency, but they does still try to influence wage growth by restricting pay rises in the public sector and b ...

Paul Krugman wrote The Return of Depression Economics (1999

... not being able to repay external crisis; or 2) too much printing of money hyperinflation internal crisis. By the late 1980s, starting in Chile, Latin American countries began to switch away from planning toward competition, with governments adopting western economic policies to control spendin ...

... not being able to repay external crisis; or 2) too much printing of money hyperinflation internal crisis. By the late 1980s, starting in Chile, Latin American countries began to switch away from planning toward competition, with governments adopting western economic policies to control spendin ...

Beginning Activity

... • Creeping inflation – 1 to 3% per year • Galloping inflation – 100 to 300% per year • Hyperinflation – 500% and up – Ex. Hungary’s currency inflation went up to 828 octillion to 1 because it printed money to pay its bills. – What currency rule does that violate? ...

... • Creeping inflation – 1 to 3% per year • Galloping inflation – 100 to 300% per year • Hyperinflation – 500% and up – Ex. Hungary’s currency inflation went up to 828 octillion to 1 because it printed money to pay its bills. – What currency rule does that violate? ...

East Asia: Success and Crisis

... 3. A recent variant to this approach is presented in Arias, Haussmann, and Rigobon (1998) and Forbes and Rigobon (1998), who define contagion more narrowly by requiring an increase in excess comovement in crisis periods. 4. Eichengreen, Rose, and Wyplosz (1996) defined contagion as a case where know ...

... 3. A recent variant to this approach is presented in Arias, Haussmann, and Rigobon (1998) and Forbes and Rigobon (1998), who define contagion more narrowly by requiring an increase in excess comovement in crisis periods. 4. Eichengreen, Rose, and Wyplosz (1996) defined contagion as a case where know ...