Lahore School of Economics

... E. the dollars that the United States uses to buy goods from other countries 8. One explanation of why the aggregate demand curve is downward sloping is that A. as prices fall, nominal income rises and so does the demand for real goods and services B. rising prices reduce people’s wealth and thereby ...

... E. the dollars that the United States uses to buy goods from other countries 8. One explanation of why the aggregate demand curve is downward sloping is that A. as prices fall, nominal income rises and so does the demand for real goods and services B. rising prices reduce people’s wealth and thereby ...

Exam 4 outline notes

... argued that money supply does not matter much. 2. Monetarists challenged Keynesian view during 1960s and 1970s. According to monetarist, changes in the money supply are the cause of both inflation and economic instability. 3. Modern view emerged from this debate: While minor disagreements remain, bo ...

... argued that money supply does not matter much. 2. Monetarists challenged Keynesian view during 1960s and 1970s. According to monetarist, changes in the money supply are the cause of both inflation and economic instability. 3. Modern view emerged from this debate: While minor disagreements remain, bo ...

CHAPTER 15

... 10. Critics maintain that active changes in the money supply by the Fed may destabilize the economy. They note that the Fed does not have up-to-the-minute, reliable information about the state of the economy and prices. Also, the Fed has a less-than-perfect understanding of the way the economy works ...

... 10. Critics maintain that active changes in the money supply by the Fed may destabilize the economy. They note that the Fed does not have up-to-the-minute, reliable information about the state of the economy and prices. Also, the Fed has a less-than-perfect understanding of the way the economy works ...

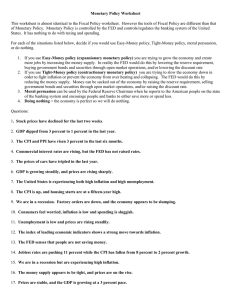

Monetary Policy Worksheet

... 1. If you use Easy-Money policy you are trying to grow the economy and create more jobs by increasing the money supply. In reality the FED would do this by lowering the reserve requirement, buying government bonds and securities through open market operations, and/or lowering the discount rate 2. If ...

... 1. If you use Easy-Money policy you are trying to grow the economy and create more jobs by increasing the money supply. In reality the FED would do this by lowering the reserve requirement, buying government bonds and securities through open market operations, and/or lowering the discount rate 2. If ...

Why the US Economy Is Not Depression-Proof

... I am well aware of the fact that numerous free-market economists and hardmoney investment advisors have predicted economic calamity over the past two decades.11 So far their dire forecasts have not materialized because they underestimated the government's ability to defuse the crises and postpone de ...

... I am well aware of the fact that numerous free-market economists and hardmoney investment advisors have predicted economic calamity over the past two decades.11 So far their dire forecasts have not materialized because they underestimated the government's ability to defuse the crises and postpone de ...

Suppose that the economy is in a long

... Suppose that the economy is in a long-run equilibrium. a. Draw a diagram to illustrate the state of the economy. Be sure to show aggregate demand, short-run aggregate supply, and long-run aggregate supply. b. Now suppose that a stock-market crash causes aggregate demand to fall. Use your diagram to ...

... Suppose that the economy is in a long-run equilibrium. a. Draw a diagram to illustrate the state of the economy. Be sure to show aggregate demand, short-run aggregate supply, and long-run aggregate supply. b. Now suppose that a stock-market crash causes aggregate demand to fall. Use your diagram to ...

Case Study: Keynesians in the White House

... If government spends so much money that the resulting increase in the interest rate drives out more investment than government initially spent, the effect on the aggregate demand for goods and services could be smaller than the original government ...

... If government spends so much money that the resulting increase in the interest rate drives out more investment than government initially spent, the effect on the aggregate demand for goods and services could be smaller than the original government ...

Blank5.1 - Bellarmine University

... this is possible depends on the elasticities of demand and supply. Generally, the more elastic (inelastic) demand is, the more difficult (easier) it is for the firm to pass the tax burden to the consumer. In contrast, the more inelastic (elastic) supply is, the more difficult (easier) it is to pass ...

... this is possible depends on the elasticities of demand and supply. Generally, the more elastic (inelastic) demand is, the more difficult (easier) it is for the firm to pass the tax burden to the consumer. In contrast, the more inelastic (elastic) supply is, the more difficult (easier) it is to pass ...

Unanticipated Changes in Aggregate Supply Page 1 of 3

... there quickly rather than waiting for prices to fall; especially if prices are not inclined to fall because of sticky wages and things like that. What the government might do in that case is spend more money. The government might cut taxes or the Fed might stimulate the economy by increasing the mon ...

... there quickly rather than waiting for prices to fall; especially if prices are not inclined to fall because of sticky wages and things like that. What the government might do in that case is spend more money. The government might cut taxes or the Fed might stimulate the economy by increasing the mon ...

interest rates

... quantity of money demanded at all interest rates and vice versa Change in Aggregate Price Level: if goods/services in an economy cost more, people need to hold more money ( MD ) ...

... quantity of money demanded at all interest rates and vice versa Change in Aggregate Price Level: if goods/services in an economy cost more, people need to hold more money ( MD ) ...

Ch.5 Aggregate Supply and Demand I. Introduction II. Equilibrium in

... wage does not fall even though there is excess demand, since the Keynesian model assumes that wages are sticky downward. Price is also assumed to be ...

... wage does not fall even though there is excess demand, since the Keynesian model assumes that wages are sticky downward. Price is also assumed to be ...

tma07 - john p birchall

... At equilibrium:mD = (M/P)D The demand for money increasing as national income increases and more money is required to support increased activity; but decreasing when interest rates rise as high interest rates encourage people to hold bonds. Fig 1 shows the relationship. The links between the goods a ...

... At equilibrium:mD = (M/P)D The demand for money increasing as national income increases and more money is required to support increased activity; but decreasing when interest rates rise as high interest rates encourage people to hold bonds. Fig 1 shows the relationship. The links between the goods a ...

PQ 3 - N. Meltem Daysal

... prices 5 percent: A) in both the short and long runs. B) in neither the short nor long run. C) in the short run but lead to unemployment in the long run. D) in the long run but lead to unemployment in the short run. 3. The aggregate demand curve is the ______ relationship between the quantity of out ...

... prices 5 percent: A) in both the short and long runs. B) in neither the short nor long run. C) in the short run but lead to unemployment in the long run. D) in the long run but lead to unemployment in the short run. 3. The aggregate demand curve is the ______ relationship between the quantity of out ...

Title: Inflation Activity - Maryland Council on Economic Education

... 1. Why doesn’t the government just print more money and give everyone some? 2. What would be likely to happen if the government (or Bill Gates) gave every family in the United States a million dollars? 3. What factors (other than monetary or fiscal policy action) could affect the level of inflation ...

... 1. Why doesn’t the government just print more money and give everyone some? 2. What would be likely to happen if the government (or Bill Gates) gave every family in the United States a million dollars? 3. What factors (other than monetary or fiscal policy action) could affect the level of inflation ...

Spring 2002

... of money is declining. Then households and firms will attempt to reduce individual quantities of money held, resulting in spending in excess of income. This will lead to increases in wages and prices without much of an increase in real economic activity. As wages and prices rise, the demand for mone ...

... of money is declining. Then households and firms will attempt to reduce individual quantities of money held, resulting in spending in excess of income. This will lead to increases in wages and prices without much of an increase in real economic activity. As wages and prices rise, the demand for mone ...

Real Estate Finance - Instructor`s Manual - Ch 02

... "Money" should be distinguished from "investment capital." The latter includes such assets as buildings, land, commodities, and securities. Money is invested in these assets. It is the growth of mortgage pools using investable money that has helped reduce mortgage interest rates and sustains adequat ...

... "Money" should be distinguished from "investment capital." The latter includes such assets as buildings, land, commodities, and securities. Money is invested in these assets. It is the growth of mortgage pools using investable money that has helped reduce mortgage interest rates and sustains adequat ...

Session 6 Inflation - University of Reading

... Alternatively, in a competitive market, producers may cut back supply because of increased costs (aggregate supply falls), so again demand exceeds supply and prices rise. Box 1 The central bank and the money supply ...

... Alternatively, in a competitive market, producers may cut back supply because of increased costs (aggregate supply falls), so again demand exceeds supply and prices rise. Box 1 The central bank and the money supply ...

Chapter 26 Money and Economic Stability in the ISLM World

... that policy makers do not have the information or the skill to make it more stable. In contrast, Keynesians believe that the economy is sufficiently unstable that, although policy cannot make it work perfectly, it can surely improve how it works. This chapter provides some historical perspective on ...

... that policy makers do not have the information or the skill to make it more stable. In contrast, Keynesians believe that the economy is sufficiently unstable that, although policy cannot make it work perfectly, it can surely improve how it works. This chapter provides some historical perspective on ...

Current Issues

... is the physical volume of all goods and services produced (real output)]. c. Monetarists say that velocity, V, is stable, meaning that the factors altering velocity change gradually and predictably. People and firms have a stable pattern to holding money. d. If velocity is stable, the equation of ex ...

... is the physical volume of all goods and services produced (real output)]. c. Monetarists say that velocity, V, is stable, meaning that the factors altering velocity change gradually and predictably. People and firms have a stable pattern to holding money. d. If velocity is stable, the equation of ex ...

Chapters 26-28

... Possibly, the announcement itself would be enough to change the behavior of workers and firms. Understanding that the new Chair would fight unemployment even at the cost of inflation, they would expect higher inflation in the future. People would build higher inflation into their contracts and the P ...

... Possibly, the announcement itself would be enough to change the behavior of workers and firms. Understanding that the new Chair would fight unemployment even at the cost of inflation, they would expect higher inflation in the future. People would build higher inflation into their contracts and the P ...

Economics 101

... 9. C. Selling securities will decrease the money supply. The amount is equal to -5/.16=-31.25. 10. A. A classic example of the time value of money. The promise will worth less than $2000. So B and E are incorrect. If the interest rate is higher, or the time to maturity is longer, the promise will wo ...

... 9. C. Selling securities will decrease the money supply. The amount is equal to -5/.16=-31.25. 10. A. A classic example of the time value of money. The promise will worth less than $2000. So B and E are incorrect. If the interest rate is higher, or the time to maturity is longer, the promise will wo ...