Aim: How does the Federal Reserve regulate the money supply?

... in this photo? What qualifications do you think this employee needs to do her job? ...

... in this photo? What qualifications do you think this employee needs to do her job? ...

money_increases

... increases. The price increase lowers real wages. The lag in expectations of price increases in the labor market expands the system beyond full employment and GDP is above potential GDP. ...

... increases. The price increase lowers real wages. The lag in expectations of price increases in the labor market expands the system beyond full employment and GDP is above potential GDP. ...

Naked Economics Chapter 10: The Federal Reserve

... 1. Why was it important for the FED to be open for business after the attack on September 11, 2001? ...

... 1. Why was it important for the FED to be open for business after the attack on September 11, 2001? ...

Revision – Inflation and deflation

... 1. ‘Good‘ deflation is productivity-driven and comes about as costs and prices are pushed lower by improvements in productivity. 2. ‘Bad‘ deflation reflects a sharp slump in demand, excess capacity and a shrinking money supply (as in the USA in the 1930s). ...

... 1. ‘Good‘ deflation is productivity-driven and comes about as costs and prices are pushed lower by improvements in productivity. 2. ‘Bad‘ deflation reflects a sharp slump in demand, excess capacity and a shrinking money supply (as in the USA in the 1930s). ...

Module 33 - Types of Infl

... The Classical Model of Money and Prices • Assumes adjustment is automatic and instantaneous • Holds true during periods of high inflation but not in times of slower inflation • So in countries with persistently high inflation, increase in M are quickly turned into changes in P (inflation) but in oth ...

... The Classical Model of Money and Prices • Assumes adjustment is automatic and instantaneous • Holds true during periods of high inflation but not in times of slower inflation • So in countries with persistently high inflation, increase in M are quickly turned into changes in P (inflation) but in oth ...

RECESSIONS, DEPRESSIONS, DEFLATION, INFLATION

... The Federal Reserve and the Treasury have their heads full of these concerns, and the more individuals understand them, the more they know about how economic trends develop and how economic policy works. If you’d like to learn more about how inflation trends, interest ...

... The Federal Reserve and the Treasury have their heads full of these concerns, and the more individuals understand them, the more they know about how economic trends develop and how economic policy works. If you’d like to learn more about how inflation trends, interest ...

Worksheet 15 6.1 Price inflation - Liceo Ginnasio Statale «Virgilio

... 2. From the data in the table on the rate of change in consumer prices, in which year did the economy experience i) the highest rate of inflation? 2 ii) disinflation 3 iii) deflation? 4 ...

... 2. From the data in the table on the rate of change in consumer prices, in which year did the economy experience i) the highest rate of inflation? 2 ii) disinflation 3 iii) deflation? 4 ...

A great depression?

... And that’s all not. The purveyors of Great Depression myths—such as this year’s Nobel laureate in Economics Paul Krugman—assert that the fiscal stimulus which accompanied World War II rescued the economy from the Great Depression. In fact, the Great Depression was followed by a spontaneous recovery, ...

... And that’s all not. The purveyors of Great Depression myths—such as this year’s Nobel laureate in Economics Paul Krugman—assert that the fiscal stimulus which accompanied World War II rescued the economy from the Great Depression. In fact, the Great Depression was followed by a spontaneous recovery, ...

Test 2

... this do to the money supply? The New York Federal Reserve Bank advocated open market purchases. Would these purchases have reversed the change in the money supply and helped banks? Explain. Bank failures cause people to lose confidence in the banking system so that deposits fall and banks have less ...

... this do to the money supply? The New York Federal Reserve Bank advocated open market purchases. Would these purchases have reversed the change in the money supply and helped banks? Explain. Bank failures cause people to lose confidence in the banking system so that deposits fall and banks have less ...

Intro to Economics

... raising the price will raise profits because demand doesn’t fall much If a product is unitary elastic (PED=1), then percentage change is price gives same percentage change in quantity. If a product is price elastic (PED>1), then raising price will reduce quantity sold and profits. ...

... raising the price will raise profits because demand doesn’t fall much If a product is unitary elastic (PED=1), then percentage change is price gives same percentage change in quantity. If a product is price elastic (PED>1), then raising price will reduce quantity sold and profits. ...

Economics of the Great Depression

... the government agrees to sell gold at a fixed price in exchange for the circulating currency. In the US, that fixed price was 40%. ...

... the government agrees to sell gold at a fixed price in exchange for the circulating currency. In the US, that fixed price was 40%. ...

Econ 204 Practice Qu..

... a. Money demand is sometimes called the liquidity preference function. b. An increase in interest rates will move left along the money demand curve c. An increase in output will shift the money demand curve to the right d. A decrease in price levels will shift the money demand curve to the left e. N ...

... a. Money demand is sometimes called the liquidity preference function. b. An increase in interest rates will move left along the money demand curve c. An increase in output will shift the money demand curve to the right d. A decrease in price levels will shift the money demand curve to the left e. N ...

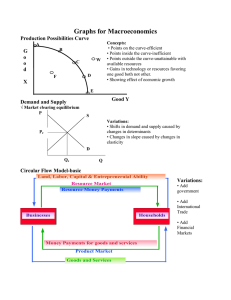

Graphs for Macroeconomics Production Possibilities Curve G o

... • As new demand and supply factors impact this market, changes in interest rate causes changes in investment and interest rate-driven consumption, which affects AD, ASsr, ASlr PL and Real GDP. • When government financing deficit spending, the impact of borrowing increases the demand curve and raises ...

... • As new demand and supply factors impact this market, changes in interest rate causes changes in investment and interest rate-driven consumption, which affects AD, ASsr, ASlr PL and Real GDP. • When government financing deficit spending, the impact of borrowing increases the demand curve and raises ...

Long Wave, Globalization and Technological Salvation - Tsang Shu-ki

... Keynesianism is finally making a comeback, after all these years of domination by orthodox monetarism and anti-government ideology. But I am afraid that the hypothesis of liquidity trap does not explain enough. According to it, people refrain from consuming or investing, not because they do not have ...

... Keynesianism is finally making a comeback, after all these years of domination by orthodox monetarism and anti-government ideology. But I am afraid that the hypothesis of liquidity trap does not explain enough. According to it, people refrain from consuming or investing, not because they do not have ...

The Changing US Economy

... A budget surplus occurs when revenue is more than expenses whereas a budget deficit occurs when expenses are more than revenue. ...

... A budget surplus occurs when revenue is more than expenses whereas a budget deficit occurs when expenses are more than revenue. ...

1 SAMPLE TEST 3 QUESTIONS TRUE

... 1. To decrease the money supply, the Fed buys government securities. TRUE ...

... 1. To decrease the money supply, the Fed buys government securities. TRUE ...