EconomicHistory(ASRIMarch2016)

... • The US need to devalue it currency and could not under the BW system • The US needed to devalue as it was importing more than it was exporting and it had rising national debt (not least due to the cost of the ...

... • The US need to devalue it currency and could not under the BW system • The US needed to devalue as it was importing more than it was exporting and it had rising national debt (not least due to the cost of the ...

final exam review packet with answers for jan 2014 exam

... *Federal Reserve System (“The Fed”)- main function of? -to maintain a stable $ supply; raise and lower interest rates as it sees fit (if want to motivate people to spend= lower interest rates) *Reserve Requirement- banks must keep 10% of all deposits in the bank ; cannot lend out/invest *3 ways bank ...

... *Federal Reserve System (“The Fed”)- main function of? -to maintain a stable $ supply; raise and lower interest rates as it sees fit (if want to motivate people to spend= lower interest rates) *Reserve Requirement- banks must keep 10% of all deposits in the bank ; cannot lend out/invest *3 ways bank ...

Inflation practice

... A left shift of the aggregate supply line causes an increase in A. Deflation B. Employment C. GDP and employment D. Inflation and unemployment In a time of high inflation prices are rising quickly. In August, 1971, President Nixon attempted to reduce inflation by declaring a freeze on prices. This m ...

... A left shift of the aggregate supply line causes an increase in A. Deflation B. Employment C. GDP and employment D. Inflation and unemployment In a time of high inflation prices are rising quickly. In August, 1971, President Nixon attempted to reduce inflation by declaring a freeze on prices. This m ...

Document

... demanded is proportional to the aggregate price level. So money demand can also be represented using the real money demand curve. Changes in real aggregate spending, technology, and institutions shift the real and nominal money demand curves. According to the quantity equation, the real quantity of ...

... demanded is proportional to the aggregate price level. So money demand can also be represented using the real money demand curve. Changes in real aggregate spending, technology, and institutions shift the real and nominal money demand curves. According to the quantity equation, the real quantity of ...

Homework 4

... The relatively low demand for labor in the recession will put downward pressure on the nominal wage rate. The falling cost of production reduces the prices that firms demand for their production (i.e the SRAS curve shifts down). Wages will fall until the labor market equilibrium return relative wage ...

... The relatively low demand for labor in the recession will put downward pressure on the nominal wage rate. The falling cost of production reduces the prices that firms demand for their production (i.e the SRAS curve shifts down). Wages will fall until the labor market equilibrium return relative wage ...

Abstract

... The Central Bank is the highest authority employed by the government for formulation of monetary policy to guide the economy in a certain country. Monetary policy is defined as the regulation of the money supply and interest rates by a central bank. Monetary policy also refers to how the central ban ...

... The Central Bank is the highest authority employed by the government for formulation of monetary policy to guide the economy in a certain country. Monetary policy is defined as the regulation of the money supply and interest rates by a central bank. Monetary policy also refers to how the central ban ...

Chapter 15

... o Medium of exchange is an item that buyers give to sellers when they purchase goods & services o A unit of account is the yardstick people use to post prices and record debts o A store of value is an item that people can use to transfer purchasing power from the present to the future ...

... o Medium of exchange is an item that buyers give to sellers when they purchase goods & services o A unit of account is the yardstick people use to post prices and record debts o A store of value is an item that people can use to transfer purchasing power from the present to the future ...

Martin Feldstein DEFLATION

... The problems caused by anticipated deflation – whether in the US or in Europe – are substantially worse if the sustained rate of deflation is greater than the rate of productivity growth and than the real rate of interest on risk free securities. Nominal wages would have to fall2 and the real rate o ...

... The problems caused by anticipated deflation – whether in the US or in Europe – are substantially worse if the sustained rate of deflation is greater than the rate of productivity growth and than the real rate of interest on risk free securities. Nominal wages would have to fall2 and the real rate o ...

Focus Points July 2009

... That relative stability of the aggregate volume allows monetarists to focus on rates of change – how fast the supply of new money is growing and how rapidly it is being used to accomplish transactions. To stabilize credit markets, many governments have created unprecedented amounts of new reserves, ...

... That relative stability of the aggregate volume allows monetarists to focus on rates of change – how fast the supply of new money is growing and how rapidly it is being used to accomplish transactions. To stabilize credit markets, many governments have created unprecedented amounts of new reserves, ...

Economic Changes and Cycles

... • Demand-side inflation occurs when an _____________________ in the price level originates on the demand side of the economy. Demand-side inflation can be caused by an increase in the ____________________________. • Supply-side inflation occurs when an increase in the price level originates on the s ...

... • Demand-side inflation occurs when an _____________________ in the price level originates on the demand side of the economy. Demand-side inflation can be caused by an increase in the ____________________________. • Supply-side inflation occurs when an increase in the price level originates on the s ...

Real Money Rob Rikoon Good news for retirees: low

... when interest rates go up 1%. Investors who own short-term bonds face a paper decline of only 2% for every 1% rise in interest rates. Interest rates will rise because that is the only direction they can go. It has become clear to most economists that one of the unexpected costs for continuing to art ...

... when interest rates go up 1%. Investors who own short-term bonds face a paper decline of only 2% for every 1% rise in interest rates. Interest rates will rise because that is the only direction they can go. It has become clear to most economists that one of the unexpected costs for continuing to art ...

illinois economics challenge - UIC Center for Economic Education

... Later Adam is granted a loan for $1200 by the same bank. What has happened to the money supply due to these two transactions? A. Increased by $600. B. Increased by $1200. C. It has remained unchanged. D. Decreased by $600. E. Decreased by $1200 2. Which of the following would most likely result if t ...

... Later Adam is granted a loan for $1200 by the same bank. What has happened to the money supply due to these two transactions? A. Increased by $600. B. Increased by $1200. C. It has remained unchanged. D. Decreased by $600. E. Decreased by $1200 2. Which of the following would most likely result if t ...

The Details In The Dollar

... The Details In The Dollar In the same week the Federal Reserve shut off the printing presses, the Bank of Japan ordered more ink and paper! On Halloween, Haruhiko Kuroda, the Governor of the Bank of Japan shocked the investing community by announcing the central bank would increase its quantitative ...

... The Details In The Dollar In the same week the Federal Reserve shut off the printing presses, the Bank of Japan ordered more ink and paper! On Halloween, Haruhiko Kuroda, the Governor of the Bank of Japan shocked the investing community by announcing the central bank would increase its quantitative ...

questions to the Lecture 5

... 20. What is producer price index? What interesting feature, related to the prediction of overall inflation rate, does it have? 21. Is it true that in time of inflation real wages are decreasing? 22. How might rapid inflation affect college enrollments? 23. Who gains and who loses from rising housing ...

... 20. What is producer price index? What interesting feature, related to the prediction of overall inflation rate, does it have? 21. Is it true that in time of inflation real wages are decreasing? 22. How might rapid inflation affect college enrollments? 23. Who gains and who loses from rising housing ...

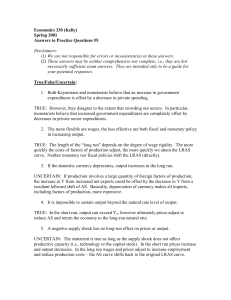

Economics 330 (Kelly)

... UNCERTAIN: First, this depends on your view of money demand. Generally, though, changes in money supply do affect Y. However, the direction of causation in practice is not at all obvious. One can justify that output growth leads money supply growth. See Ch. 25 for a complete explanation. 8. If an ec ...

... UNCERTAIN: First, this depends on your view of money demand. Generally, though, changes in money supply do affect Y. However, the direction of causation in practice is not at all obvious. One can justify that output growth leads money supply growth. See Ch. 25 for a complete explanation. 8. If an ec ...

Inflation

... c. It's unfair on creditors and savers, since the value of money changes over time ...

... c. It's unfair on creditors and savers, since the value of money changes over time ...

14.02 Principles of Macroeconomics Problem Set 2 Fall 2005

... 3. The bond that offers the highest interest rate has to be the most expensive one. 4. An increase in consumer confidence shifts the LM curve down and the IS curve to the right. 5. A monetary expansion is more effective in changing the interest rate when money demand is very sensitive to the interes ...

... 3. The bond that offers the highest interest rate has to be the most expensive one. 4. An increase in consumer confidence shifts the LM curve down and the IS curve to the right. 5. A monetary expansion is more effective in changing the interest rate when money demand is very sensitive to the interes ...