The Federal Reserve

... Say the Fed announces that the Reserve Ratio for all banks is 0.2 Banks are mandated to hold 20% of all new deposits in reserve to manipulate the money supply The other 80% will be taken and loaned out or withdrawn and will become deposits in other banks or used for consumption ...

... Say the Fed announces that the Reserve Ratio for all banks is 0.2 Banks are mandated to hold 20% of all new deposits in reserve to manipulate the money supply The other 80% will be taken and loaned out or withdrawn and will become deposits in other banks or used for consumption ...

Will we be hit by hyperinflation?

... In the wake of the financial market crisis, central banks and finance ministers in many countries resorted to measures which can be compared only with those taken before the Second World War. Especially the strong expansion of claims by central banks, which exceeded 50% in the case of the ECB and 15 ...

... In the wake of the financial market crisis, central banks and finance ministers in many countries resorted to measures which can be compared only with those taken before the Second World War. Especially the strong expansion of claims by central banks, which exceeded 50% in the case of the ECB and 15 ...

1 Objectives for Chapter 12: The Great Depression (1929 to 1941

... Some Suggested Causes of the Great Depression When we look back at the Great Depression, there are two different, but related, questions we must ask. First, why did the Great Depression occur at all? And second, why did the Great Depression persist for so long? The most famous cause of the Great Dep ...

... Some Suggested Causes of the Great Depression When we look back at the Great Depression, there are two different, but related, questions we must ask. First, why did the Great Depression occur at all? And second, why did the Great Depression persist for so long? The most famous cause of the Great Dep ...

UNIT – VII: MONEY AND BANKING MEANING OF MONEY: Money is

... 3. Discuss the functions of money. 4. Describe how money over comes the problems of barter system? 5. What are the measures of money supply? 6. What do you mean by High powered money? 7. Describe the process of money creation or credit creation by commercial banks. 8. Why only a fraction of deposits ...

... 3. Discuss the functions of money. 4. Describe how money over comes the problems of barter system? 5. What are the measures of money supply? 6. What do you mean by High powered money? 7. Describe the process of money creation or credit creation by commercial banks. 8. Why only a fraction of deposits ...

Sample Exam Questions

... Explain why or why not? Each of these newspapers are being produced in markets with differentiated goods and free entry. If SCMP were indeed earning higher profits, new English language newspapers would enter the market pushing down the demand for SCMP until the price was equal to average cost. This ...

... Explain why or why not? Each of these newspapers are being produced in markets with differentiated goods and free entry. If SCMP were indeed earning higher profits, new English language newspapers would enter the market pushing down the demand for SCMP until the price was equal to average cost. This ...

Answers to Test Your Understanding Questions

... switch, the bank will find itself over-reserved by 90 (increased actual reserves of 100 minus increased target reserves of 10% x 100 = 10). Loaning out these excess reserves will result in an increase in demand deposits, which is part of the money supply. 6. Economic growth and full-employment are c ...

... switch, the bank will find itself over-reserved by 90 (increased actual reserves of 100 minus increased target reserves of 10% x 100 = 10). Loaning out these excess reserves will result in an increase in demand deposits, which is part of the money supply. 6. Economic growth and full-employment are c ...

SOLUTION EXAM 06/07/04

... 4. given that output is determined by factor supplies and technology, when the Central Bank alters the money supply and induces parallel changes in nominal output (P x Y), these changes are reflected in the price level (P). 5. therefore, when the Central Bank increases the money supply, the result i ...

... 4. given that output is determined by factor supplies and technology, when the Central Bank alters the money supply and induces parallel changes in nominal output (P x Y), these changes are reflected in the price level (P). 5. therefore, when the Central Bank increases the money supply, the result i ...

Exam - Pearson Canada

... A. increases, appreciation B. increases, depreciation C. decreases, appreciation D. decreases, depreciation 13. One of the main factors causing the "stagflation" of the 1970s was A. increasing government deficits. B. substantial increases in the money supply. C. aggressive labour union activity duri ...

... A. increases, appreciation B. increases, depreciation C. decreases, appreciation D. decreases, depreciation 13. One of the main factors causing the "stagflation" of the 1970s was A. increasing government deficits. B. substantial increases in the money supply. C. aggressive labour union activity duri ...

Chapter 53: Causes and consequences of inflation and

... In fact, Milton Friedman’s tongue-in-cheek suggestion for solving deflation was for the government to print money and fly around in helicopters and unload the bills on a happy citizenry – the bills would be timelimited in order to induce consumption rather than saving. This was actually attempted – ...

... In fact, Milton Friedman’s tongue-in-cheek suggestion for solving deflation was for the government to print money and fly around in helicopters and unload the bills on a happy citizenry – the bills would be timelimited in order to induce consumption rather than saving. This was actually attempted – ...

Econ110: Principles of Economics TEST YOUR UNDERSTANDING

... If the reserve ratio is 100 percent, then a new deposit of $500 into a bank account a. eventually increases the money supply by $500. b. leaves the size of the money supply unchanged. c. eventually decreases the size of the money supply by $500. d. None of the above is correct. ...

... If the reserve ratio is 100 percent, then a new deposit of $500 into a bank account a. eventually increases the money supply by $500. b. leaves the size of the money supply unchanged. c. eventually decreases the size of the money supply by $500. d. None of the above is correct. ...

Answers - Palomar College

... 1. Which of the following will result if there is a decrease in aggregate demand? a. expansion; inflation c. expansion; deflation b. recession; deflation d. recession; inflation 2. Which of the following scenarios can cause cost-push inflation (and therefore stagflation)? a. an increase in taxes on ...

... 1. Which of the following will result if there is a decrease in aggregate demand? a. expansion; inflation c. expansion; deflation b. recession; deflation d. recession; inflation 2. Which of the following scenarios can cause cost-push inflation (and therefore stagflation)? a. an increase in taxes on ...

Practice Quizzes (Word)

... 1. Which of the following will result if there is a decrease in aggregate demand? a. expansion; inflation c. expansion; deflation b. recession; deflation d. recession; inflation 2. Which of the following scenarios can cause cost-push inflation (and therefore stagflation)? a. an increase in taxes on ...

... 1. Which of the following will result if there is a decrease in aggregate demand? a. expansion; inflation c. expansion; deflation b. recession; deflation d. recession; inflation 2. Which of the following scenarios can cause cost-push inflation (and therefore stagflation)? a. an increase in taxes on ...

http://socrates

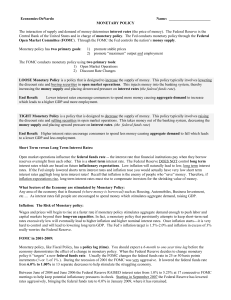

... End Result: Higher interest rates encourage consumers to spend less money causing aggregate demand to fall which leads to a lower GDP and less employment. Short Term versus Long Term Interest Rates: Open market operations influence the federal funds rate -- the interest rate that financial instituti ...

... End Result: Higher interest rates encourage consumers to spend less money causing aggregate demand to fall which leads to a lower GDP and less employment. Short Term versus Long Term Interest Rates: Open market operations influence the federal funds rate -- the interest rate that financial instituti ...

Inflation - Murphonomics

... Inflation is measured by using a ‘basket’ of goods and services that the average consumer would buy and looking at the changes in price. This method is known as the Consumer Price Index. However, in practice, there are many practical difficulties for measuring inflation. 1. There is no such thing as ...

... Inflation is measured by using a ‘basket’ of goods and services that the average consumer would buy and looking at the changes in price. This method is known as the Consumer Price Index. However, in practice, there are many practical difficulties for measuring inflation. 1. There is no such thing as ...

The Great Depression and the Beginning of Keynesian Economics

... Some Suggested Causes of the Great Depression When we look back at the Great Depression, there are two different, but related, questions we must ask. First, why did the Great Depression occur at all? And second, why did the Great Depression persist for so long? The most famous cause of the Great Dep ...

... Some Suggested Causes of the Great Depression When we look back at the Great Depression, there are two different, but related, questions we must ask. First, why did the Great Depression occur at all? And second, why did the Great Depression persist for so long? The most famous cause of the Great Dep ...

LECTURE 4. Monetary Policy

... A restriction of the economic activity is achieved through a sale of government bonds by the Central Bank. The Central Bank offers less liquid assets (bonds) and collects money against it. The money supply is reduced and the equilibrium interest rate rises.1 4. Effectiveness of monetary policy As w ...

... A restriction of the economic activity is achieved through a sale of government bonds by the Central Bank. The Central Bank offers less liquid assets (bonds) and collects money against it. The money supply is reduced and the equilibrium interest rate rises.1 4. Effectiveness of monetary policy As w ...

Test 2 - Dasha Safonova

... 1. Money market mutual funds invest in A. residential mortgages. B. long term government securities. C. commercial real estate. D. highly liquid assets. 2. The slope of the consumption function is A. negative. B. 1. C. less than 1. D. greater than 1. 3. To prevent cost-push inflation A. there must n ...

... 1. Money market mutual funds invest in A. residential mortgages. B. long term government securities. C. commercial real estate. D. highly liquid assets. 2. The slope of the consumption function is A. negative. B. 1. C. less than 1. D. greater than 1. 3. To prevent cost-push inflation A. there must n ...

Midterm Exam No. 2 - Answers April 1, 2004

... Sticky price: Suppose some firms set prices in advance, while others have market power and set prices in response to market conditions. A rise in aggregate output increases demand for all firms, and the firms that are able to set prices respond by increasing their prices relative to the expected pri ...

... Sticky price: Suppose some firms set prices in advance, while others have market power and set prices in response to market conditions. A rise in aggregate output increases demand for all firms, and the firms that are able to set prices respond by increasing their prices relative to the expected pri ...

Inflation - Murphonomics

... more from falling prices of mobile phones and electronic goods. Therefore, the basket of goods may not be representative. Also, as it is updated once a year, it may soon become outdated for changes in spending habits. 2. Changes in the quality of goods. Changes in the quality of goods mean that pric ...

... more from falling prices of mobile phones and electronic goods. Therefore, the basket of goods may not be representative. Also, as it is updated once a year, it may soon become outdated for changes in spending habits. 2. Changes in the quality of goods. Changes in the quality of goods mean that pric ...