Inflation and the Role of Macroeconomic Policy in Ethiopia

... The ultimate policy objective of any country in general is to have sustainable economic growth and development. Policy measures are geared at achieving moderate inflation rate, keeping unemployment rate low, balancing foreign trade, stabilizing exchange and interest rates, etc and in general attaini ...

... The ultimate policy objective of any country in general is to have sustainable economic growth and development. Policy measures are geared at achieving moderate inflation rate, keeping unemployment rate low, balancing foreign trade, stabilizing exchange and interest rates, etc and in general attaini ...

The St~cture of Financial Markets and the Monetary Mechanism

... represents the effects of a monetary authority which has the power of fixing "exogenously" the nominal money supply through techniques which need not be specified at this point and equation (6) defines equlibrium in the money market. Equations (4)-(6) together define the Hicksian LM schedule, the co ...

... represents the effects of a monetary authority which has the power of fixing "exogenously" the nominal money supply through techniques which need not be specified at this point and equation (6) defines equlibrium in the money market. Equations (4)-(6) together define the Hicksian LM schedule, the co ...

CHAPTER 8 Introduction to Economic Growth and

... 10. If the economy's real GDP doubles in 18 years, we can: A) not say anything about the average annual rate of growth. B) conclude that its average annual rate of growth is about 5.5 percent. C) conclude that its average annual rate of growth is about 2 percent. D) conclude that its average annual ...

... 10. If the economy's real GDP doubles in 18 years, we can: A) not say anything about the average annual rate of growth. B) conclude that its average annual rate of growth is about 5.5 percent. C) conclude that its average annual rate of growth is about 2 percent. D) conclude that its average annual ...

Study Guide for Williamson Intermediate Macroeconomics, First

... 1. If the deficit is caused by a decrease in taxes, the government debt will ultimately be paid off with higher taxes that benefits current citizens and harms future ones. If the deficit is caused by higher government spending, however, the economy will be affected in a different way. 2. Without mon ...

... 1. If the deficit is caused by a decrease in taxes, the government debt will ultimately be paid off with higher taxes that benefits current citizens and harms future ones. If the deficit is caused by higher government spending, however, the economy will be affected in a different way. 2. Without mon ...

increase

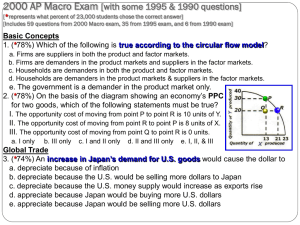

... a. increase in welfare payments d. a decrease in the required reserve ratio b. increase in exports e. an open market sale of bonds by the Fed c. a decrease in savings by consumers 20. (58%) Which of the following would cause a rightward shift of the AS curve? a. an increase in interest rates b. a ta ...

... a. increase in welfare payments d. a decrease in the required reserve ratio b. increase in exports e. an open market sale of bonds by the Fed c. a decrease in savings by consumers 20. (58%) Which of the following would cause a rightward shift of the AS curve? a. an increase in interest rates b. a ta ...

Liquidity Traps and Expectation Dynamics: Fiscal Stimulus or Fiscal

... consider IH learning. In Evans and Honkapohja (2010) we still see deflation traps under IH learning. The transversality condition (TVC) fails to rule out deflationary spirals (lower and lower deflation rates) because the perceived TVC is always met along these disequilibrium paths. What about the d ...

... consider IH learning. In Evans and Honkapohja (2010) we still see deflation traps under IH learning. The transversality condition (TVC) fails to rule out deflationary spirals (lower and lower deflation rates) because the perceived TVC is always met along these disequilibrium paths. What about the d ...

Increasing Entrepreneurship is a Key to Lowering Poverty Rates

... During the economic boom of the 2000s, poverty rates declined in many states. Yet some states were more effective at getting the poverty rate down than others. While there has been much analysis of why some states are more successful than others, what’s been missing is a discussion of the role of en ...

... During the economic boom of the 2000s, poverty rates declined in many states. Yet some states were more effective at getting the poverty rate down than others. While there has been much analysis of why some states are more successful than others, what’s been missing is a discussion of the role of en ...

What Does Monetary Policy Do?

... monetarypolicy, we need to specify an element of the E vector, or a list of its elements, that representsdisturbancesto monetarypolicy. The equationsystem 1 contains one equationfor each element of the E vector, defining it as a function of currentand past values of y(t). So specifying the element o ...

... monetarypolicy, we need to specify an element of the E vector, or a list of its elements, that representsdisturbancesto monetarypolicy. The equationsystem 1 contains one equationfor each element of the E vector, defining it as a function of currentand past values of y(t). So specifying the element o ...

Monetary Policy Statement June 2006 Contents

... The Official Cash Rate (OCR) will remain at 7.25 per cent. Recent economic activity has been weaker than projected in the March Monetary Policy Statement. However, the shortterm inflation outlook has worsened. Growth is expected to remain low through 2006, before recovering in 2007. The much awaited e ...

... The Official Cash Rate (OCR) will remain at 7.25 per cent. Recent economic activity has been weaker than projected in the March Monetary Policy Statement. However, the shortterm inflation outlook has worsened. Growth is expected to remain low through 2006, before recovering in 2007. The much awaited e ...

Determinants of Agricultural and Mineral Commodity Prices

... The third explanation, somewhat less prominent than the first two, is that easy monetary policy was at least one of the factors contributing to either the high demand for, or low supply of, commodities. Easy monetary policy is often mediated through low real interest rates.3 Some have argued that h ...

... The third explanation, somewhat less prominent than the first two, is that easy monetary policy was at least one of the factors contributing to either the high demand for, or low supply of, commodities. Easy monetary policy is often mediated through low real interest rates.3 Some have argued that h ...

inflation - Economics

... For example we all know that diamonds are more expensive than water. But this is a paradox of value because most of us regard water ultimately as the more valuable commodity. The price of diamonds is not so much a reflection of their necessity but their relative scarcity. Water, although essential f ...

... For example we all know that diamonds are more expensive than water. But this is a paradox of value because most of us regard water ultimately as the more valuable commodity. The price of diamonds is not so much a reflection of their necessity but their relative scarcity. Water, although essential f ...

An Empirical Analysis on Excessive Reserves in U.S Banking

... reserve could be turned into lending either to firms or to other banks (through the Federal Funds market), excessive reserves bear only opportunity cost and no profit (before the 2008 financial crisis), and thus should be viewed as negative assets (costs) to commercial banks (Mishkin, 2009). As comm ...

... reserve could be turned into lending either to firms or to other banks (through the Federal Funds market), excessive reserves bear only opportunity cost and no profit (before the 2008 financial crisis), and thus should be viewed as negative assets (costs) to commercial banks (Mishkin, 2009). As comm ...

Estimating the Expected Marginal Rate of Substitution

... appropriate short-term riskless interest rate. 2 That is, the EMRS is simply equated with e.g., the Treasury-bill rate; it is not estimated at all. While this simplifies empirical work considerably, this assumes integration between stock and money markets, one of the very assumptions we wish to test ...

... appropriate short-term riskless interest rate. 2 That is, the EMRS is simply equated with e.g., the Treasury-bill rate; it is not estimated at all. While this simplifies empirical work considerably, this assumes integration between stock and money markets, one of the very assumptions we wish to test ...

The yield curve as a predictor of recessions in the United States and

... recessions, both indices of leading economic indicators, and particularly the Stock-Watson index, are quite accurate, outperforming the yield curve spread and the NYSE stock price index with a high predicted probability during the recession periods. However, despite excellent performance in these ea ...

... recessions, both indices of leading economic indicators, and particularly the Stock-Watson index, are quite accurate, outperforming the yield curve spread and the NYSE stock price index with a high predicted probability during the recession periods. However, despite excellent performance in these ea ...

Chapter 9

... loans have been paid off, but can use income of the real estate investment they own. Typical term is no more than 20 years and could be for borrower’s lifetime as an annuity. Homeowners’ equity declines by amount borrowed. Copyright© 2006 John Wiley & Sons, Inc. ...

... loans have been paid off, but can use income of the real estate investment they own. Typical term is no more than 20 years and could be for borrower’s lifetime as an annuity. Homeowners’ equity declines by amount borrowed. Copyright© 2006 John Wiley & Sons, Inc. ...

SIGNIFICANCE OF CREDIT RATIONING IN UKRAINE by Ivan

... credit rationing cannot exist. In the neoclassical framework, the loan has two characteristics: interest rate and maturity. The customer's risk is known, and, provided there are no information costs, the lenders may perfectly price discriminate amongst borrowers through setting interest rates on the ...

... credit rationing cannot exist. In the neoclassical framework, the loan has two characteristics: interest rate and maturity. The customer's risk is known, and, provided there are no information costs, the lenders may perfectly price discriminate amongst borrowers through setting interest rates on the ...

FROM STANDARD TO David I. Fand A RANDOM-WALK MONETARY

... to thin out, and markets for some kinds of instruments may even disappear. The raggedness of price adjustment in an inflation puts noise into the relative price mechanism and makes it more difficult to allocate or coordinate resources efficiently. Frequent changes in monetary policy will probably ca ...

... to thin out, and markets for some kinds of instruments may even disappear. The raggedness of price adjustment in an inflation puts noise into the relative price mechanism and makes it more difficult to allocate or coordinate resources efficiently. Frequent changes in monetary policy will probably ca ...

Interest rate

An interest rate is the rate at which interest is paid by borrowers (debtors) for the use of money that they borrow from lenders (creditors). Specifically, the interest rate is a percentage of principal paid a certain number of times per period for all periods during the total term of the loan or credit. Interest rates are normally expressed as a percentage of the principal for a period of one year, sometimes they are expressed for different periods such as a month or a day. Different interest rates exist parallelly for the same or comparable time periods, depending on the default probability of the borrower, the residual term, the payback currency, and many more determinants of a loan or credit. For example, a company borrows capital from a bank to buy new assets for its business, and in return the lender receives rights on the new assets as collateral and interest at a predetermined interest rate for deferring the use of funds and instead lending it to the borrower.Interest-rate targets are a vital tool of monetary policy and are taken into account when dealing with variables like investment, inflation, and unemployment. The central banks of countries generally tend to reduce interest rates when they wish to increase investment and consumption in the country's economy. However, a low interest rate as a macro-economic policy can be risky and may lead to the creation of an economic bubble, in which large amounts of investments are poured into the real-estate market and stock market. In developed economies, interest-rate adjustments are thus made to keep inflation within a target range for the health of economic activities or cap the interest rate concurrently with economic growth to safeguard economic momentum.