Institute of Business Management Semester: Summer Course

... model. What are the classical and Keynesian views about whether money is neutral in the short run? In the long run? Q#11 Drive aggregate demand (AD) curve? Why does the AD curve slope downward? Give two examples of changes in the economy that shift the AD curve up and to the right and explain why th ...

... model. What are the classical and Keynesian views about whether money is neutral in the short run? In the long run? Q#11 Drive aggregate demand (AD) curve? Why does the AD curve slope downward? Give two examples of changes in the economy that shift the AD curve up and to the right and explain why th ...

Unit 4 Filled In

... reduce interest rates by expanding the supply of money in the economy. • In turn, the lower interest rates will encourage additional aggregate demand for consumption and investment, and thus help shorten or end the recession. • When an economy is experiencing inflation central bank officials will us ...

... reduce interest rates by expanding the supply of money in the economy. • In turn, the lower interest rates will encourage additional aggregate demand for consumption and investment, and thus help shorten or end the recession. • When an economy is experiencing inflation central bank officials will us ...

GLOBAL ECONOMIC ALERT on European Negative Interest Rates

... promoting negative interest rates and paying banks to lend money to borrowers. This is their latest monetary policy response to try to combat poor economic growth. We believe this is a step too far. We think a year or two from now negative interest rates are likely to prove to have been a poorly con ...

... promoting negative interest rates and paying banks to lend money to borrowers. This is their latest monetary policy response to try to combat poor economic growth. We believe this is a step too far. We think a year or two from now negative interest rates are likely to prove to have been a poorly con ...

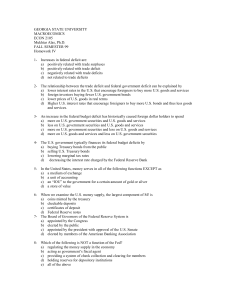

Homework IV - Georgia State University

... 1- Increases in federal deficit are: a) positively related with trade surpluses b) positively related with trade deficit c) negatively related with trade deficits d) not related to trade deficits 2- The relationship between the trade deficit and federal government deficit can be explained by a) lowe ...

... 1- Increases in federal deficit are: a) positively related with trade surpluses b) positively related with trade deficit c) negatively related with trade deficits d) not related to trade deficits 2- The relationship between the trade deficit and federal government deficit can be explained by a) lowe ...

This PDF is a selection from an out-of-print volume from... of Economic Research Volume Title: Inflation, Tax Rules, and Capital Formation

... See also Interest rates; Real interest Wealth, total private, 36 rates Weiss, G., 129 Relative price of land, 236-38 Welfare loss, inflationary, 21-22, 40Replacement cost depreciation, 51 ...

... See also Interest rates; Real interest Wealth, total private, 36 rates Weiss, G., 129 Relative price of land, 236-38 Welfare loss, inflationary, 21-22, 40Replacement cost depreciation, 51 ...

Economics for business

... would have been made will not now be risked. This process will occur even if a business’s investment project was to be self-financed, since the rate of interest still represents the opportunity cost of the internally generated funds. What is not clear is how much a given change in interest rate will ...

... would have been made will not now be risked. This process will occur even if a business’s investment project was to be self-financed, since the rate of interest still represents the opportunity cost of the internally generated funds. What is not clear is how much a given change in interest rate will ...

Monetary Policy - Effingham County Schools

... Kinds of Unemployment • Frictional: between jobs (it’s personal) • Structural: changes in consumer tastes or industry operations; skills don’t match jobs (jobs not coming back) • Cyclical: changes in business cycle (jobs will come back) • Seasonal: changes in weather/seasons ...

... Kinds of Unemployment • Frictional: between jobs (it’s personal) • Structural: changes in consumer tastes or industry operations; skills don’t match jobs (jobs not coming back) • Cyclical: changes in business cycle (jobs will come back) • Seasonal: changes in weather/seasons ...

Republica_Dominicana_en.pdf

... (37%), furfural (17%) and coffee (56%). Total exports expanded by 6.4%, a slightly lower rate than that observed in 2012 (6.8%). Sales from free trade zones continued to grow, but at a more moderate pace (1.8%, versus 2.6% in 2012). The most important exports from these zones were textiles and servi ...

... (37%), furfural (17%) and coffee (56%). Total exports expanded by 6.4%, a slightly lower rate than that observed in 2012 (6.8%). Sales from free trade zones continued to grow, but at a more moderate pace (1.8%, versus 2.6% in 2012). The most important exports from these zones were textiles and servi ...

UE and Inflation Outline

... ii. Debtors c. Anticipating Inflation in Rates 1. Nominal Interest Rate i. NIR = real interest rate + inflation premium (expected rate of inflation ii. Illustration: 3. Hyperinflation a. Speculative measure are taken to counter inflation that leas to further inflation 1. I perceive inflation is comi ...

... ii. Debtors c. Anticipating Inflation in Rates 1. Nominal Interest Rate i. NIR = real interest rate + inflation premium (expected rate of inflation ii. Illustration: 3. Hyperinflation a. Speculative measure are taken to counter inflation that leas to further inflation 1. I perceive inflation is comi ...

Second–Quarter 2013 Securities Market Commentary The second

... As of the writing of this letter, the U.S. stock market indexes are either at or slightly above their all-time highs. It is critical that corporate earnings meet or exceed Wall Street's expectations for the current rally to continue. These historically high equity prices, combined with the markets c ...

... As of the writing of this letter, the U.S. stock market indexes are either at or slightly above their all-time highs. It is critical that corporate earnings meet or exceed Wall Street's expectations for the current rally to continue. These historically high equity prices, combined with the markets c ...

Review Questions Chapter 16

... 2. What is the Fed? What are reserves? Define fractional-reserve banking and reserve ratio. Define money multiplier, open market operations, and reserve requirements. What is the discount rate? What is the central bank? Define money supply and monetary policy. 3. Suppose the reserve requirement for ...

... 2. What is the Fed? What are reserves? Define fractional-reserve banking and reserve ratio. Define money multiplier, open market operations, and reserve requirements. What is the discount rate? What is the central bank? Define money supply and monetary policy. 3. Suppose the reserve requirement for ...

*Turn in your *measuring the economy* processing assignment

... decisions take into account the needs and interests of all parts of the country. *One Federal Reserve Bank operates in each district. *Members of the Board of Governors are appointed by the president and confirmed by the Senate to 14-year terms of office. Once confirmed, a member is limited to one t ...

... decisions take into account the needs and interests of all parts of the country. *One Federal Reserve Bank operates in each district. *Members of the Board of Governors are appointed by the president and confirmed by the Senate to 14-year terms of office. Once confirmed, a member is limited to one t ...

1. The tax multiplier associated with a $10B reduction in taxes is

... smaller than / a tax change also involves a change in savings in the first round of spending c. larger than / taxes cause more discretionary income to be spent whether it is a tax increase or a tax decrease d. smaller than / the tax multiplier is usually very unstable ...

... smaller than / a tax change also involves a change in savings in the first round of spending c. larger than / taxes cause more discretionary income to be spent whether it is a tax increase or a tax decrease d. smaller than / the tax multiplier is usually very unstable ...

Trinidad_and_Tobago_en.pdf

... Until mid-2009 monetary policy was focused mainly on curbing inflation. Since then, however, the aim of both fiscal and monetary policy has been to boost economic activity. The new policy mix, as well as the quasi-fixed exchange rate regime, is expected to remain in place in 2010 with a view to main ...

... Until mid-2009 monetary policy was focused mainly on curbing inflation. Since then, however, the aim of both fiscal and monetary policy has been to boost economic activity. The new policy mix, as well as the quasi-fixed exchange rate regime, is expected to remain in place in 2010 with a view to main ...

Document

... • Present values convert future receipts or payments into current values. Because lenders can earn – and borrowers must pay – interest over time, a pound tomorrow is worth less than a pound today. • Nominal interest rates measure the monetary interest payments on a loan. • The inflation-adjusted rea ...

... • Present values convert future receipts or payments into current values. Because lenders can earn – and borrowers must pay – interest over time, a pound tomorrow is worth less than a pound today. • Nominal interest rates measure the monetary interest payments on a loan. • The inflation-adjusted rea ...

FRONT BARNETT ASSOCIATES LLC Market events of the past few

... management to increase their exposure to economically sensitive issues. In midMarch we began rebuilding positions in depressed technology holdings given their attractive valuations when viewed beyond the current slowdown. U.S. Stock Market Beyond the favorable quantitative message our model was deli ...

... management to increase their exposure to economically sensitive issues. In midMarch we began rebuilding positions in depressed technology holdings given their attractive valuations when viewed beyond the current slowdown. U.S. Stock Market Beyond the favorable quantitative message our model was deli ...

1999

... An amount of $1 is invested at an annual rate of r compounded annually. (Case 1) After 1 year the original amount plus accumulated interest is withdrawn and the accumulated interest is taxed at a rate t. The effective rate of interest e is then defined to be the rate of interest on the original amou ...

... An amount of $1 is invested at an annual rate of r compounded annually. (Case 1) After 1 year the original amount plus accumulated interest is withdrawn and the accumulated interest is taxed at a rate t. The effective rate of interest e is then defined to be the rate of interest on the original amou ...

Izmir University of Economics Econ 100 Spring 2013

... b) planned reserve ratio; a currency drain c) desired reserve ratio; excess reserves d) planned deposit ratio; a shortage of currency 11) When the Bank of England buys securities from a bank, a sequence of events begins. The events are listed below. Number each event in the order in which it occurs. ...

... b) planned reserve ratio; a currency drain c) desired reserve ratio; excess reserves d) planned deposit ratio; a shortage of currency 11) When the Bank of England buys securities from a bank, a sequence of events begins. The events are listed below. Number each event in the order in which it occurs. ...

chapter 29 - exchange rates

... c. Jordan would eventually run out of foreign reserves, and so could not buy dinars forever. d. ...

... c. Jordan would eventually run out of foreign reserves, and so could not buy dinars forever. d. ...

Review Sheet - Syracuse University

... (a) what sellers generally accept and buyers generally use to pay for goods and services. (b) an asset that can be used to transport purchasing power from one period of time to another. (c) a standard unit that provides a consistent way of quoting prices. (d) the ability to buy something today but t ...

... (a) what sellers generally accept and buyers generally use to pay for goods and services. (b) an asset that can be used to transport purchasing power from one period of time to another. (c) a standard unit that provides a consistent way of quoting prices. (d) the ability to buy something today but t ...

Notes 1. that`s a Fedspeak for - что на языке ФРС означает 2

... to restrict economic activity productivity growth to boost productivity global economies, global competition trade-weighted dollar business facilities unit labor costs monthly job growth Exercise 1. Answer the following questions: ...

... to restrict economic activity productivity growth to boost productivity global economies, global competition trade-weighted dollar business facilities unit labor costs monthly job growth Exercise 1. Answer the following questions: ...

Interest rate

An interest rate is the rate at which interest is paid by borrowers (debtors) for the use of money that they borrow from lenders (creditors). Specifically, the interest rate is a percentage of principal paid a certain number of times per period for all periods during the total term of the loan or credit. Interest rates are normally expressed as a percentage of the principal for a period of one year, sometimes they are expressed for different periods such as a month or a day. Different interest rates exist parallelly for the same or comparable time periods, depending on the default probability of the borrower, the residual term, the payback currency, and many more determinants of a loan or credit. For example, a company borrows capital from a bank to buy new assets for its business, and in return the lender receives rights on the new assets as collateral and interest at a predetermined interest rate for deferring the use of funds and instead lending it to the borrower.Interest-rate targets are a vital tool of monetary policy and are taken into account when dealing with variables like investment, inflation, and unemployment. The central banks of countries generally tend to reduce interest rates when they wish to increase investment and consumption in the country's economy. However, a low interest rate as a macro-economic policy can be risky and may lead to the creation of an economic bubble, in which large amounts of investments are poured into the real-estate market and stock market. In developed economies, interest-rate adjustments are thus made to keep inflation within a target range for the health of economic activities or cap the interest rate concurrently with economic growth to safeguard economic momentum.