... September. Meanwhile, the default rate on loans from private banks stood at 4.2% at the end of October. In October, the National Assembly adopted the Organic Law on Incentives for Public-Private Partnerships, whose principal aim is to attract more foreign direct investment to priority projects such ...

Real Estate Finance - Instructor`s Manual - Ch 02

... the four basic tools the Federal Reserve Bank Board uses to influence the economy by: Money Supply The most important tool available to the Fed is control of the supply of money. The difficult task is to increase the money supply at close to the same rate as the growth of the economy. Too much money ...

... the four basic tools the Federal Reserve Bank Board uses to influence the economy by: Money Supply The most important tool available to the Fed is control of the supply of money. The difficult task is to increase the money supply at close to the same rate as the growth of the economy. Too much money ...

An Analysis of Russia`s 19998 Meltdown Fundamentals and Market

... and low liquidity simultaneously. Inflation reduction at the expense of fiscal and growth fundamentals will simply not work. Real appreciation with deteriorating enterprise performance and PDD is unlikely to be sustainable EVEN if CA in balance. ...

... and low liquidity simultaneously. Inflation reduction at the expense of fiscal and growth fundamentals will simply not work. Real appreciation with deteriorating enterprise performance and PDD is unlikely to be sustainable EVEN if CA in balance. ...

FinalExamReviewGuide

... Understand what a Fractional Reserve Banking System is and how this leads to money creation o T-account calculations Understand the 3-functions of Money Understand the components of M1, M2, & M3 Understand the money multiplier theory Understand the 2-conflicting goals of monetary policy Understand t ...

... Understand what a Fractional Reserve Banking System is and how this leads to money creation o T-account calculations Understand the 3-functions of Money Understand the components of M1, M2, & M3 Understand the money multiplier theory Understand the 2-conflicting goals of monetary policy Understand t ...

govt. in the economy practice quiz

... 6. The unemployment rate does not take into account the number of part-time workers who want to have full-time jobs. 7. Full employment is reached when the unemployment rate drops below 7 percent. 8. The Fed requires all member banks to deposit a percentage of every deposit either in their bank vaul ...

... 6. The unemployment rate does not take into account the number of part-time workers who want to have full-time jobs. 7. Full employment is reached when the unemployment rate drops below 7 percent. 8. The Fed requires all member banks to deposit a percentage of every deposit either in their bank vaul ...

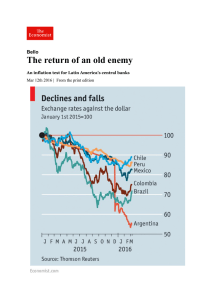

The return of an old enemy | The Economist

... Latin American countries floated their previously fixed currencies and adopted inflation targeting, large depreciations were associated with very high rates of inflation. Now the average pass-through in these countries is below 10% (ie, if the currency depreciates by 10%, domestic prices will rise ...

... Latin American countries floated their previously fixed currencies and adopted inflation targeting, large depreciations were associated with very high rates of inflation. Now the average pass-through in these countries is below 10% (ie, if the currency depreciates by 10%, domestic prices will rise ...

Honduras_en.pdf

... attracting deposits and cut the deposit rate by 3.71%, the result being an 8.65 percentage point increase in the interest-rate spread. There was a change in the distribution of lending, with 49.5% going to enterprises and 50.5% to households. The monetary authorities are expecting an increase of abo ...

... attracting deposits and cut the deposit rate by 3.71%, the result being an 8.65 percentage point increase in the interest-rate spread. There was a change in the distribution of lending, with 49.5% going to enterprises and 50.5% to households. The monetary authorities are expecting an increase of abo ...

ASSIGNMENT FOR MONDAY, MARCH 21 ... CHAPTER 15

... to predict the effects of money on output.” “Government policymakers should use fiscal policy to adjust aggregate demand in response to aggregate supply shocks.” “The economy is subject to recurring disequilibrium in labor and goods markets, so the government can serve a useful function of helping t ...

... to predict the effects of money on output.” “Government policymakers should use fiscal policy to adjust aggregate demand in response to aggregate supply shocks.” “The economy is subject to recurring disequilibrium in labor and goods markets, so the government can serve a useful function of helping t ...

Japan

... BOJ realizes the bubble and responds by tightening monetary policy, and from 1989 to 1990 discount rates are increased five times to cap at 6% ...

... BOJ realizes the bubble and responds by tightening monetary policy, and from 1989 to 1990 discount rates are increased five times to cap at 6% ...

chapter 8 - Spring Branch ISD

... 17. Define the “full-employment” or “natural” rate of unemployment and give its approximate percentage rate as economists currently define it. 18. “The economic cost of unemployment is measured by the GDP gap.” Explain this statement. 19. What is Okun’s law? Give an example of how it works. ...

... 17. Define the “full-employment” or “natural” rate of unemployment and give its approximate percentage rate as economists currently define it. 18. “The economic cost of unemployment is measured by the GDP gap.” Explain this statement. 19. What is Okun’s law? Give an example of how it works. ...

Hw5s-11

... the principle, let’s find a more general solution. The consumption function is of the form C = a + b(Y-T), where b is the marginal propensity to consume. Plug this into the equilibrium condition: Y = C(Y- T ) + I + G : Y = a + b(Y- T ) + I + G Solve for Y: Y = (1/(1-b)) G - (b/(1-b)) T + (1/(1-b)) I ...

... the principle, let’s find a more general solution. The consumption function is of the form C = a + b(Y-T), where b is the marginal propensity to consume. Plug this into the equilibrium condition: Y = C(Y- T ) + I + G : Y = a + b(Y- T ) + I + G Solve for Y: Y = (1/(1-b)) G - (b/(1-b)) T + (1/(1-b)) I ...

CPI & TRADE SITUATION OF VIETNAM 2012

... • Banking interest fell but remained high; • Enterprises struggled to absorb capital while the bank cannot lend; • The rate of industrial growth is lower than the same period last year; • Purchase Power decreases sharply; • Investment decreases especially from the foreign investment sources; • Livin ...

... • Banking interest fell but remained high; • Enterprises struggled to absorb capital while the bank cannot lend; • The rate of industrial growth is lower than the same period last year; • Purchase Power decreases sharply; • Investment decreases especially from the foreign investment sources; • Livin ...

Key

... If the economy is in a recession, does this seem like a wise policy? No (Yes, No). Please explain. By increasing the required reserve ratio, we are decreasing the money supply when we should be increasing it in order to stimulate aggregate demand. A higher level of aggregate demand will reduce unemp ...

... If the economy is in a recession, does this seem like a wise policy? No (Yes, No). Please explain. By increasing the required reserve ratio, we are decreasing the money supply when we should be increasing it in order to stimulate aggregate demand. A higher level of aggregate demand will reduce unemp ...

QUIZ BOWL - Minnesota Council on Economic Education

... 107. Name two basic functions of money. (medium of exchange, measure of value, and store of value) 108. The rate of interest at which banks borrow overnight from other banks is called what? (the federal funds rate) 109. To the nearest trillion, what is the current size of the public debt of the fede ...

... 107. Name two basic functions of money. (medium of exchange, measure of value, and store of value) 108. The rate of interest at which banks borrow overnight from other banks is called what? (the federal funds rate) 109. To the nearest trillion, what is the current size of the public debt of the fede ...

14.02 Macroeconomics May 18, 2006 Practice Question: Mundell-Fleming Model Managing Vermont’s Economy

... Y : Vermont’s Real GDP Y U S : Real GDP of the US T : Vermont’s Taxes i : Vermont’s nominal interest rate iU S : Nominal interest rate of the US E : VT$ in terms of US$ E e : Expected future VT$ in terms of US$ M : Vermont’s stock of money in circulation The only trading partner of Vermont is the US ...

... Y : Vermont’s Real GDP Y U S : Real GDP of the US T : Vermont’s Taxes i : Vermont’s nominal interest rate iU S : Nominal interest rate of the US E : VT$ in terms of US$ E e : Expected future VT$ in terms of US$ M : Vermont’s stock of money in circulation The only trading partner of Vermont is the US ...

Macroeconomic Policy in an Open Economy

... In an open economy, the interest rate changes will affect the demand for currency ...

... In an open economy, the interest rate changes will affect the demand for currency ...

Perspectives on key economic issues

... The South African rand has a floating exchange rate, so that deficits or surpluses deemed unsustainable by market participants result in exchange rate adjustment; there is an inbuilt shock absorber at play However, large exchange rate movements may have implications for inflation and necessitate pol ...

... The South African rand has a floating exchange rate, so that deficits or surpluses deemed unsustainable by market participants result in exchange rate adjustment; there is an inbuilt shock absorber at play However, large exchange rate movements may have implications for inflation and necessitate pol ...

Interest rate

An interest rate is the rate at which interest is paid by borrowers (debtors) for the use of money that they borrow from lenders (creditors). Specifically, the interest rate is a percentage of principal paid a certain number of times per period for all periods during the total term of the loan or credit. Interest rates are normally expressed as a percentage of the principal for a period of one year, sometimes they are expressed for different periods such as a month or a day. Different interest rates exist parallelly for the same or comparable time periods, depending on the default probability of the borrower, the residual term, the payback currency, and many more determinants of a loan or credit. For example, a company borrows capital from a bank to buy new assets for its business, and in return the lender receives rights on the new assets as collateral and interest at a predetermined interest rate for deferring the use of funds and instead lending it to the borrower.Interest-rate targets are a vital tool of monetary policy and are taken into account when dealing with variables like investment, inflation, and unemployment. The central banks of countries generally tend to reduce interest rates when they wish to increase investment and consumption in the country's economy. However, a low interest rate as a macro-economic policy can be risky and may lead to the creation of an economic bubble, in which large amounts of investments are poured into the real-estate market and stock market. In developed economies, interest-rate adjustments are thus made to keep inflation within a target range for the health of economic activities or cap the interest rate concurrently with economic growth to safeguard economic momentum.