Wealth Effect and Nominal Interest Rates

... The goal of this short paper is to use an explicit optimization in order to derive the consumption function and the IS relationship with a wealth effect. This derivation is then used as a possible explanation of the puzzle of interest rate smoothing. Another natural application is a simplification o ...

... The goal of this short paper is to use an explicit optimization in order to derive the consumption function and the IS relationship with a wealth effect. This derivation is then used as a possible explanation of the puzzle of interest rate smoothing. Another natural application is a simplification o ...

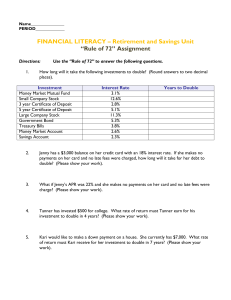

Rule of 72 Assignment

... What would Mark’s investment be if he had invested at age 28? (Please show your work). ...

... What would Mark’s investment be if he had invested at age 28? (Please show your work). ...

The Economic Outlook and Monetary Policy

... – FOMC provides statement of longer‐run goals and monetary policy strategy that includes a 2% numerical inflation target. – Fed policymakers regularly report their short‐term interest rate projections over the next few years. th tf ...

... – FOMC provides statement of longer‐run goals and monetary policy strategy that includes a 2% numerical inflation target. – Fed policymakers regularly report their short‐term interest rate projections over the next few years. th tf ...

Credibility of Government, Corporate, and Banking Sectors in Japan

... downgrading them one to two notches from the current rating of Aa3 (three notches lower than the top rating, and equivalent to a AA-). If tax revenues continue to deteriorate due to deflation and the fiscal deficit does not improve, then we may even see the ratings of Japanese government bonds downg ...

... downgrading them one to two notches from the current rating of Aa3 (three notches lower than the top rating, and equivalent to a AA-). If tax revenues continue to deteriorate due to deflation and the fiscal deficit does not improve, then we may even see the ratings of Japanese government bonds downg ...

Inflation Report February 2005

... (a) Measured as the effective rate less the repo rate. The effective rate measures the average rate paid to households on their outstanding bank deposits. (b) Also includes cash ISAs. (c) Weighted average of time and sight deposit rates. ...

... (a) Measured as the effective rate less the repo rate. The effective rate measures the average rate paid to households on their outstanding bank deposits. (b) Also includes cash ISAs. (c) Weighted average of time and sight deposit rates. ...

Notes for Chapter 14 - FIU Faculty Websites

... Discount rate is the rate of interest charged by the Federal Reserve Banks for lending reserves to private banks. Banks can ensure continual compliance with reserve requirements by maintaining large amounts of excess reserves. But this is unprofitable. By keeping the minimum reserves the bank will p ...

... Discount rate is the rate of interest charged by the Federal Reserve Banks for lending reserves to private banks. Banks can ensure continual compliance with reserve requirements by maintaining large amounts of excess reserves. But this is unprofitable. By keeping the minimum reserves the bank will p ...

Presentation to Gettysburg College Gettysburg, Pennsylvania

... because faster productivity growth creates business opportunities that stimulate spending. ...

... because faster productivity growth creates business opportunities that stimulate spending. ...

Keynes Theory and Sample Questions

... Conclusion: When interest rates are high, the demand for money is low. b. Opportunity Cost of Money – by some of Keynes’ followers If interest rates are high, investors will not want to hold their money in the form of cash because cash does not pay interest. If interest rates are really high, would ...

... Conclusion: When interest rates are high, the demand for money is low. b. Opportunity Cost of Money – by some of Keynes’ followers If interest rates are high, investors will not want to hold their money in the form of cash because cash does not pay interest. If interest rates are really high, would ...

Answers to Questions in Economics for Business

... GDP will rise if aggregate expenditure exceeds GDP (see Figure 29.2). This will occur if injections exceed withdrawals. A budget deficit means that government expenditure (an injection) exceeds taxation (a withdrawal). Whether total injections exceed total withdrawals, however, depends on the size o ...

... GDP will rise if aggregate expenditure exceeds GDP (see Figure 29.2). This will occur if injections exceed withdrawals. A budget deficit means that government expenditure (an injection) exceeds taxation (a withdrawal). Whether total injections exceed total withdrawals, however, depends on the size o ...

Top of Form Name Question 1 Assuming that both the price level

... equilibrium point A, the government cuts net taxes moving the aggregate demand curve from its initial position AD to AD´ so that the economy is in short-run equilibrium in period 1 at point B. Assume the backward looking component of core-inflation dominates the forward looking component. Which of t ...

... equilibrium point A, the government cuts net taxes moving the aggregate demand curve from its initial position AD to AD´ so that the economy is in short-run equilibrium in period 1 at point B. Assume the backward looking component of core-inflation dominates the forward looking component. Which of t ...

FedViews

... volatile food and energy prices, was unchanged in September and is up only 1.2% over the past 12 months. With considerable slack remaining in the economy, we expect core PCE inflation to be about 1% over the next 12 months. In the current environment, the uncertainty in our economic forecast is high ...

... volatile food and energy prices, was unchanged in September and is up only 1.2% over the past 12 months. With considerable slack remaining in the economy, we expect core PCE inflation to be about 1% over the next 12 months. In the current environment, the uncertainty in our economic forecast is high ...

14.02 Principles of Macroeconomics Fall 2004 Quiz 2

... 3. If the Fed carries out a monetary contraction, what happens in the short-run and the medium-run/long-run? Start from point A where P = Pe. (10 points) Label the following: all curves including (IS0, ISSR, ISMR, LM0, LMSR, LMMR, ADSR, ADMR, ASSR, ASMR), the short-run equilibrium as point B, the m ...

... 3. If the Fed carries out a monetary contraction, what happens in the short-run and the medium-run/long-run? Start from point A where P = Pe. (10 points) Label the following: all curves including (IS0, ISSR, ISMR, LM0, LMSR, LMMR, ADSR, ADMR, ASSR, ASMR), the short-run equilibrium as point B, the m ...

The General Theory as the gateway to the re

... Mr Keynes, in certain parts of The General Theory appears to use the term ‘liquidity’ in a sense which comes very close to our concept of ‘perfect marketability’; ie goods which can be sold at any time for the same price, or nearly the same price, at which they can be bought. Yet it is obvious that ...

... Mr Keynes, in certain parts of The General Theory appears to use the term ‘liquidity’ in a sense which comes very close to our concept of ‘perfect marketability’; ie goods which can be sold at any time for the same price, or nearly the same price, at which they can be bought. Yet it is obvious that ...

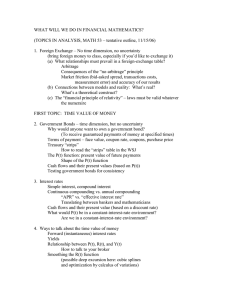

TopicsInAnalysis

... FIRST TOPIC: TIME VALUE OF MONEY 2. Government Bonds – time dimension, but no uncertainty Why would anyone want to own a government bond? (To receive guaranteed payments of money at specified times) Terms of payment – face value, coupon rate, coupons, purchase price Treasury “strips” How to read the ...

... FIRST TOPIC: TIME VALUE OF MONEY 2. Government Bonds – time dimension, but no uncertainty Why would anyone want to own a government bond? (To receive guaranteed payments of money at specified times) Terms of payment – face value, coupon rate, coupons, purchase price Treasury “strips” How to read the ...

FedViews

... 2007-09 recession began. This drop contrasts with previous recoveries, when the government sector contributed to job growth. Sequestration cuts are expected to further reduce government jobs and slow private-sector hiring, reducing the projected decline in the unemployment rate this year. ...

... 2007-09 recession began. This drop contrasts with previous recoveries, when the government sector contributed to job growth. Sequestration cuts are expected to further reduce government jobs and slow private-sector hiring, reducing the projected decline in the unemployment rate this year. ...

inflation targeting and new eu entrants: is there

... • The case of Slovenia is mixed as both coefficients are significant. Some researchers compare the magnitude of the coefficients to determine the orientation of policy. Based on this interpretation Slovenia becomes an output targeting nation. ...

... • The case of Slovenia is mixed as both coefficients are significant. Some researchers compare the magnitude of the coefficients to determine the orientation of policy. Based on this interpretation Slovenia becomes an output targeting nation. ...

economics (hons) – sem-ii

... Explain how the interest rate works in the classical system stabilize aggregate demand in the face of autonomous changes components of aggregate demand such as investment government spending. ...

... Explain how the interest rate works in the classical system stabilize aggregate demand in the face of autonomous changes components of aggregate demand such as investment government spending. ...

Word Document

... Say’s Law – total supply of goods and services will equal total demand derived from consumption; a general glut (economy-wide over-supply) is impossible money illusion – nominal vs. real confusion (wages or prices) crowding out – fiscal policy is ineffective because a rise in government spendi ...

... Say’s Law – total supply of goods and services will equal total demand derived from consumption; a general glut (economy-wide over-supply) is impossible money illusion – nominal vs. real confusion (wages or prices) crowding out – fiscal policy is ineffective because a rise in government spendi ...

Interest rate

An interest rate is the rate at which interest is paid by borrowers (debtors) for the use of money that they borrow from lenders (creditors). Specifically, the interest rate is a percentage of principal paid a certain number of times per period for all periods during the total term of the loan or credit. Interest rates are normally expressed as a percentage of the principal for a period of one year, sometimes they are expressed for different periods such as a month or a day. Different interest rates exist parallelly for the same or comparable time periods, depending on the default probability of the borrower, the residual term, the payback currency, and many more determinants of a loan or credit. For example, a company borrows capital from a bank to buy new assets for its business, and in return the lender receives rights on the new assets as collateral and interest at a predetermined interest rate for deferring the use of funds and instead lending it to the borrower.Interest-rate targets are a vital tool of monetary policy and are taken into account when dealing with variables like investment, inflation, and unemployment. The central banks of countries generally tend to reduce interest rates when they wish to increase investment and consumption in the country's economy. However, a low interest rate as a macro-economic policy can be risky and may lead to the creation of an economic bubble, in which large amounts of investments are poured into the real-estate market and stock market. In developed economies, interest-rate adjustments are thus made to keep inflation within a target range for the health of economic activities or cap the interest rate concurrently with economic growth to safeguard economic momentum.