dynamic AD

... Inflation + 2.0 + 0.5 (Inflation – 2.0) – 0.5 (GDP gap) The GDP gap is the percentage shortfall of real GDP from an estimate of its natural level. The Taylor Rule has the real federal funds rate— the nominal rate minus inflation responding to inflation and the GDP gap. According to this rule, the re ...

... Inflation + 2.0 + 0.5 (Inflation – 2.0) – 0.5 (GDP gap) The GDP gap is the percentage shortfall of real GDP from an estimate of its natural level. The Taylor Rule has the real federal funds rate— the nominal rate minus inflation responding to inflation and the GDP gap. According to this rule, the re ...

chpt 16

... Open market operations consists of the buying and selling of U.S. government securities by the Fed for the purpose of carrying out monetary policy. Open market operations are the most important instrument for influencing the money supply. Copyright © 2007 by the McGraw-Hill Companies, Inc. All right ...

... Open market operations consists of the buying and selling of U.S. government securities by the Fed for the purpose of carrying out monetary policy. Open market operations are the most important instrument for influencing the money supply. Copyright © 2007 by the McGraw-Hill Companies, Inc. All right ...

Lecture 27: CAPM and Risk Premium

... i. Where LV is the loan value, FP is the fixed payment and i is the interest rate. ii. Note the difference fixed payment loans make. With an interest rate of 7% and a LV of $100,000, the fixed payment over a 25 year period is $9,439.29 (or $235,982.25 total). The pendulum of compound interest rates ...

... i. Where LV is the loan value, FP is the fixed payment and i is the interest rate. ii. Note the difference fixed payment loans make. With an interest rate of 7% and a LV of $100,000, the fixed payment over a 25 year period is $9,439.29 (or $235,982.25 total). The pendulum of compound interest rates ...

INTERNATIONAL FINANCE

... B. price of securities will be high C. domestic currency possibly appreciates in the foreign exchange market D. all of the above are true 9. Which of the following does NOT belong to the expansionary monetary policy? A. The central bank purchases government bonds. B. The central bank lowers reserve ...

... B. price of securities will be high C. domestic currency possibly appreciates in the foreign exchange market D. all of the above are true 9. Which of the following does NOT belong to the expansionary monetary policy? A. The central bank purchases government bonds. B. The central bank lowers reserve ...

Debates in Macroeconomics: Monetarism, New

... • Among the criticisms of supply-side economics is that it is unlikely a tax cut would substantially increase the supply of labor. • In theory, a tax cut could even lead to a reduction in labor supply – hang out at the pool. • Research done during the 1980s suggests that tax cuts seem to increase th ...

... • Among the criticisms of supply-side economics is that it is unlikely a tax cut would substantially increase the supply of labor. • In theory, a tax cut could even lead to a reduction in labor supply – hang out at the pool. • Research done during the 1980s suggests that tax cuts seem to increase th ...

Debates in Macroeconomics: Monetarism, New

... • Among the criticisms of supply-side economics is that it is unlikely a tax cut would substantially increase the supply of labor. • In theory, a tax cut could even lead to a reduction in labor supply – hang out at the pool. • Research done during the 1980s suggests that tax cuts seem to increase th ...

... • Among the criticisms of supply-side economics is that it is unlikely a tax cut would substantially increase the supply of labor. • In theory, a tax cut could even lead to a reduction in labor supply – hang out at the pool. • Research done during the 1980s suggests that tax cuts seem to increase th ...

Federal Reserve

... Open-market operations by the Fed are the principal tool of monetary policy: the Fed can increase or reduce the monetary base by buying government debt from banks or selling government debt to banks. The Federal Reserve’s Assets and Liabilities: ...

... Open-market operations by the Fed are the principal tool of monetary policy: the Fed can increase or reduce the monetary base by buying government debt from banks or selling government debt to banks. The Federal Reserve’s Assets and Liabilities: ...

This PDF is a selection from a published volume from... Bureau of Economic Research

... standard new Keynesian model leads to several novel and perhaps surprising conclusions. Several policies commonly thought to be expansionary, such as reductions in taxes on wages or reduced capital taxes, are recessionary during a crisis. These policies encourage greater savings precisely when great ...

... standard new Keynesian model leads to several novel and perhaps surprising conclusions. Several policies commonly thought to be expansionary, such as reductions in taxes on wages or reduced capital taxes, are recessionary during a crisis. These policies encourage greater savings precisely when great ...

Economics 101

... increases Y* by +400. The change in taxes is +1000 and this changes Y* by -1000. So the net is -600. 9. C. Selling securities will decrease the money supply. The amount is equal to -5/.16=-31.25. 10. A. A classic example of the time value of money. The promise will worth less than $2000. So B and E ...

... increases Y* by +400. The change in taxes is +1000 and this changes Y* by -1000. So the net is -600. 9. C. Selling securities will decrease the money supply. The amount is equal to -5/.16=-31.25. 10. A. A classic example of the time value of money. The promise will worth less than $2000. So B and E ...

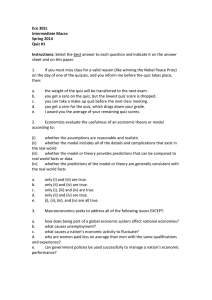

Quiz 1

... how does being part of a global economic system affect national economies? b. what causes unemployment? c. what causes a nation’s economic activity to fluctuate? d. why are women paid less on average than men with the same qualifications and experience? e. can government policies be used successfull ...

... how does being part of a global economic system affect national economies? b. what causes unemployment? c. what causes a nation’s economic activity to fluctuate? d. why are women paid less on average than men with the same qualifications and experience? e. can government policies be used successfull ...

a. Depositors become concerned about the safety of depository

... Assume the economy is initially in equilibrium at point E. If the Fed wrongly believes that the natural rate of unemployment is higher and acts to bring the economy back to its supposed potential, it will decrease the money supply. This will cause the interest rate to rise from r1 to r2, causing the ...

... Assume the economy is initially in equilibrium at point E. If the Fed wrongly believes that the natural rate of unemployment is higher and acts to bring the economy back to its supposed potential, it will decrease the money supply. This will cause the interest rate to rise from r1 to r2, causing the ...

MONETARY AND FISCAL POLICIES

... How is the Monetary Policy different from the Fiscal Policy? • The Monetary Policy regulates the supply of money and the cost and availability of credit in the economy. It deals with both the lending and borrowing rates of interest for commercial banks. • The Monetary Policy aims to maintain price ...

... How is the Monetary Policy different from the Fiscal Policy? • The Monetary Policy regulates the supply of money and the cost and availability of credit in the economy. It deals with both the lending and borrowing rates of interest for commercial banks. • The Monetary Policy aims to maintain price ...

real interest rate

... Financial markets work much like other markets in the economy. The equilibrium of the supply and demand for loanable funds determines the real interest rate. ...

... Financial markets work much like other markets in the economy. The equilibrium of the supply and demand for loanable funds determines the real interest rate. ...

Advanced Placement Microeconomics Review Sheet

... 4) Use PPC’s to illustrate the gains from trade. 5) What is a tariff, and what are some of the effects of tariffs? 6) Use supply and demand graphs to illustrate the economic effects of tariffs and quotas on price levels and output. 7) Describe and evaluate the 6 arguments in favor of protectionism. ...

... 4) Use PPC’s to illustrate the gains from trade. 5) What is a tariff, and what are some of the effects of tariffs? 6) Use supply and demand graphs to illustrate the economic effects of tariffs and quotas on price levels and output. 7) Describe and evaluate the 6 arguments in favor of protectionism. ...

14.02 Principles of Macroeconomics

... Decide whether each of the following statement is true or false, and justify your answer with a short argument. 1. The ratio of imports to GDP cannot be larger than 1. 2. If GM decides to use only French made Michelin tires for its cars instead of Firestone US made tires, the total demand for US goo ...

... Decide whether each of the following statement is true or false, and justify your answer with a short argument. 1. The ratio of imports to GDP cannot be larger than 1. 2. If GM decides to use only French made Michelin tires for its cars instead of Firestone US made tires, the total demand for US goo ...

Midterm 1 - uc-davis economics

... Suppose the supply side of an economy is characterized as follows: Y = 2K + 4L, K = 200, L = 100 Suppose the demand side of the economy is characterized as follows (all in units of goods): G = 100, T = 100, C = 150 + 0.5(Y-T), and I = 350 - 1000r a) Compute total supply and the equilibrium levels co ...

... Suppose the supply side of an economy is characterized as follows: Y = 2K + 4L, K = 200, L = 100 Suppose the demand side of the economy is characterized as follows (all in units of goods): G = 100, T = 100, C = 150 + 0.5(Y-T), and I = 350 - 1000r a) Compute total supply and the equilibrium levels co ...

1 - BrainMass

... a) Graph the Phillips curve of this economy for an expected inflation rate of 0.10. If the Fed chooses to keep the actual inflation rate at 0.10, what will be the unemployment rate? b) An aggregate demand shock (resulting from increased military spending) raises expected inflation to 0.12 (the natu ...

... a) Graph the Phillips curve of this economy for an expected inflation rate of 0.10. If the Fed chooses to keep the actual inflation rate at 0.10, what will be the unemployment rate? b) An aggregate demand shock (resulting from increased military spending) raises expected inflation to 0.12 (the natu ...

Bonds

... unemployment, limited credit availability and higher gas prices than one year ago. Consumer Sentiment Index (sensitive to household finances, gas and stock prices) rose to 69.9 (5-year inflation expectations = 2.7%, 1-year inflation expectations = 3.1%) Uncertainty has fed and fed on a weak economic ...

... unemployment, limited credit availability and higher gas prices than one year ago. Consumer Sentiment Index (sensitive to household finances, gas and stock prices) rose to 69.9 (5-year inflation expectations = 2.7%, 1-year inflation expectations = 3.1%) Uncertainty has fed and fed on a weak economic ...

Brazil_en.pdf

... The Brazilian labour market reflected developments in production sectors, especially the urban industrial sector. The unemployment rate of the main metropolitan regions in the early months of 2009 reflected layoffs in industry, rising to 9% from the average of 7.3% recorded in the last quarter of 20 ...

... The Brazilian labour market reflected developments in production sectors, especially the urban industrial sector. The unemployment rate of the main metropolitan regions in the early months of 2009 reflected layoffs in industry, rising to 9% from the average of 7.3% recorded in the last quarter of 20 ...

Chapter 5 Power Point Presentation

... excessive withdrawals, the bank must somehow increase the diminished reserves B. Federal Funds Market 1. Market in which banks borrow and lend excess reserves 2. Short term borrowing 3. If a bank lacks sufficient reserves against deposits, it can borrow from a commercial bank 4. If a bank has excess ...

... excessive withdrawals, the bank must somehow increase the diminished reserves B. Federal Funds Market 1. Market in which banks borrow and lend excess reserves 2. Short term borrowing 3. If a bank lacks sufficient reserves against deposits, it can borrow from a commercial bank 4. If a bank has excess ...

Interest rate

An interest rate is the rate at which interest is paid by borrowers (debtors) for the use of money that they borrow from lenders (creditors). Specifically, the interest rate is a percentage of principal paid a certain number of times per period for all periods during the total term of the loan or credit. Interest rates are normally expressed as a percentage of the principal for a period of one year, sometimes they are expressed for different periods such as a month or a day. Different interest rates exist parallelly for the same or comparable time periods, depending on the default probability of the borrower, the residual term, the payback currency, and many more determinants of a loan or credit. For example, a company borrows capital from a bank to buy new assets for its business, and in return the lender receives rights on the new assets as collateral and interest at a predetermined interest rate for deferring the use of funds and instead lending it to the borrower.Interest-rate targets are a vital tool of monetary policy and are taken into account when dealing with variables like investment, inflation, and unemployment. The central banks of countries generally tend to reduce interest rates when they wish to increase investment and consumption in the country's economy. However, a low interest rate as a macro-economic policy can be risky and may lead to the creation of an economic bubble, in which large amounts of investments are poured into the real-estate market and stock market. In developed economies, interest-rate adjustments are thus made to keep inflation within a target range for the health of economic activities or cap the interest rate concurrently with economic growth to safeguard economic momentum.