* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download real interest rate

Fiscal multiplier wikipedia , lookup

Modern Monetary Theory wikipedia , lookup

Monetary policy wikipedia , lookup

Exchange rate wikipedia , lookup

Fear of floating wikipedia , lookup

Pensions crisis wikipedia , lookup

Okishio's theorem wikipedia , lookup

Early 1980s recession wikipedia , lookup

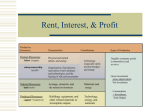

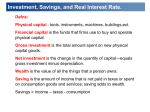

Saving, Investment, and the Financial System: Part II A few definitions from last week Saving: part of a person’s income that is not used for consumption. Investment: purchases of new capital, such as business equipment and machinery. The financial system is the collection of markets and institutions that coordinate the economy’s savings and investment. direct the resources of savers into the hands of borrowers who have good investment projects but no funds to finance them. consist of mainly, banks and the stock market. The financial system Banks, the stock market, the bonds market and a great many other institutions, which we collectively refer to as the financial system, coordinate the economy’s saving and investment. But these are complicated things. So, we replace them by something which we simply call: The market for loanable funds. (Türkçesi: Borç verilebilir fonlar piyasası!) The market for loanable funds We assume that the market for loanable funds is the only market for financial transactions! That means: • All savers deposit their savings in this market. • All borrowers take out loans from this market. • There is one interest rate, which is both the return to saving and the cost of borrowing. This is a supply-demand model of the financial system. The “price” that will balance the demand and supply in this market is The (real) interest rate. The market for loanable funds helps us understand how the financial system coordinates saving and investment how government policies affect saving, investment, the interest rate. Supply and demand for loanable funds The supply of loanable funds comes from … people who have extra income they want to save and lend out. Household savings: Supply of loanable funds Why do people (households) save? For retirement For emergencies / bad times For education (university) of their children To buy a new home or car Investment and the demand for loanable funds The demand for loanable funds comes from … Firms that profitable investment projects, and want to borrow to fund these projects. — also households who purchase a newly built house. What determines the demand for loanable funds? One key determinant of investment is the interest rate. Investment, or the demand for loanable funds, is a downward sloping function of the interest rate. The graph looks something like this Demand for loanable funds, Investment demand, Investment function What determines the demand for loanable funds? One key determinant of investment is the interest rate. Investment, or the demand for loanable funds, is a downward sloping function of the interest rate. Firms invest if they expect the returns on extra investment (i.e. profits) > the costs of borrowing funds. The higher the real interest rate, the higher is the cost of funds and the lower is level of investment demand. Supply and Demand for Loanable Funds Financial markets work much like other markets in the economy. The equilibrium of the supply and demand for loanable funds determines the real interest rate. The real interest rate and the loanable funds market The interest rate is the price of the loan. It is the price that borrowers (buyers) pay for loans and the price that lenders (sellers) receive on their saving. The interest rate in the market for loanable funds is the real interest rate. What do we mean by the “real” interest rate? The real interest rate vs. the nominal interest rate You deposit 1,000TL in the bank for one year. Suppose the nominal interest rate is 9%. This means: At the end of one year you will get 1090TL. Suppose that the yearly inflation rate is 3.5%. The purchasing power of your 1090TL is 1090/(1+0,035) = 1053TL So, in one year, the purchasing power of your initial deposit has increased from 1000TL to 1053TL This is a 5,3% “real” increase. This is why we say that the real interest rate is 5,3%. A quick calculation Real interest rate = Nominal interest rate – rate of Inflation = 9.0% – 3.5% = 5.5% The purchasing power of the 1,000TL deposit has grown 5.5%. If the nominal interest rate and the rate of inflation are both small (in the 5 to 10% range), then we will use the following formula as an approximation: Real interest rate = (nominal interest rate) – (inflation rate) From Mahfi Eğilmez’s blog: 18 Ekim 2012 Perşembe Faiz Düştü Düşmesine de http://www.mahfiegilmez.com/2012/10/faiz-dustu-dusmesine-de.html 1. “Türkiye'de brüt nominal mevduat faizi ortalama yüzde 8,5. 2. Bunun vergisi yüzde 15. 3. Bu durumda net nominal faiz yüzde 7,2 oluyor.” Suppose you expect the rate of inflation to be 6% next year. Calculate the net real interest rate. Back to the market for loanable funds The equilibrium in the loanable funds market The Market for Loanable Funds Interest Rate Supply - SAVERS 5% Demand - BORROWERS 0 €1,200 Loanable Funds (in billions of euros) Now it’s your turn A simple example: Savings and Investment Y = 1,200, Exports – Imports = 0 C = 125 + 0.75(Y – T) I = I(r) = 200 – 10r, (r is the interest rate in percentage points) G = 150, and T = 100 Please compute consumption (C), the equilibrium real interest rate (r), investment (I), and private and public saving, (Sp) and (Sg) What happens to investment and the equilibrium real interest rate if G increases to 200? (assume that T doesn’t change.) ANSWERS Consumption C = 125 + 0.75 (Y – T) = 125 + 0.75 (1200 – 100) = 125 + 0.75 x 1100 = 950. Savings S =Y–C–G = 1200 – 950 – 150 = 100, We use the “supply = demand” condition to compute the equilibrium r: 100 = 200 – 10r We solve for r*: r* = 10%. ANSWERS, continued Private saving = Income after tax – Consumption SP = Y – T – C = 1200 – 100 – 950 = 150, Public saving is tax – government expenditures SG = T – G = 100 – 150 = – 50. ANSWERS, continued As G increases to 200, private saving does not change (becauseY is constant) but public saving decreases (because public saving = T – G), therefore total saving decreases from 100 to 50. The new “supply = demand” condition becomes 50 = 200 – 10r Again, we solve for r*: r* = 15%. The real r increases, investment level decreases. What happens to saving and investment when the government runs a larger budget deficit? The Effect of a Government Budget Deficit Interest Rate S2 Supply, S1 1. A budget deficit decreases the supply of loanable funds . . . 6% 5% 2. . . . which raises the equilibrium interest rate . . . Demand 0 €800 €1,200 Loanable Funds (in billions of euros) 3. . . . and reduces the equilibrium quantity of loanable funds. Copyright©2010 South-Western Government Budget Deficits The budget deficit decreases the supply of loanable funds. The supply curve shifts to the left. The equilibrium interest rate increases. The equilibrium level of investment decreases. Government Budget Deficits Government borrowing to finance the budget deficit reduces the supply of loanable funds available to finance investment by households and firms. This fall in investment is referred to as crowding out. The deficit borrowing crowds out private borrowers who are trying to finance investments. Government Budget Deficits When the government spends more than it receives in tax revenues, the short fall is called the budget deficit. The accumulation of past budget deficits is called the government debt. What are the government debt levels in Turkey? Turkey - Public Debt Stock to GDP How does public debt level in Turkey compare with the rest of the world? Public Debt to GDP 2011 ??? Other determinants of investment demand Expectations The expectations of business owners and management for future growth and sales of their products. What happens if improved economic conditions are expected in future? Another exercise using the loanable funds market model An Increase in the Demand for Loanable Funds Interest Rate Supply 1. An improvement In confidence of entrepreneurs and business community . . . 6% 5% 2. raises the equilibrium interest rate . . . 0 D2 Demand, D1 €1,200 €1,400 Loanable Funds (in billions of euros) 3. . . . and raises the equilibrium quantity of loanable funds. Copyright©2010 South-Western Debt, austerity, and Reinhart and Rogoff! Austerity Austerity (measures) [Kemer sıkma politikaları] Government policies during a period of bad economic conditions that reduce budget deficit using a combination of spending cuts or tax rises. How to revive a depressed economy? In the debate, debt (mostly public debt) has become the key issue. The conservatives (Ken Rogoff and Carmen Reinhart) say: The economy’s capacity for recovery is limited by too much government borrowing. The liberals (Paul Krugman and Joseph Stiglitz) say: Only faster growth rates and higher GDP will reduce the relative weight of past debts. Austerity will shrink demand and slow growth, making the debt burden heavier. Again, Reinhart and Rogoff Carmen Reinhart and Ken Rogoff have written a research paper on the relationship between national debt levels and economic growth: "Growth in a Time of Debt" (It was published in 2010 in a most prestigious academic journal!) The main result was: Countries with ratios of public debt to GDP above 90% have their GDP decrease by about 0.1% annually. Reinhart and Rogoff heavily used this finding to defend/promote austerity policies used by governments to reduce debt levels. How do countries reduce debt levels? They reduce government spending, and increase tax revenue. Governments reduce spending also by cutting welfare benefits to the low income households. child benefit programs, 2. income support programs, 3. health benefits, 4. public education, etc., 1. They also reduce salaries of government employees, and payments to the pensioners Example: Greece Proposed actions: 1. cut public sector wages by up to 25%; 2. limit lower-wage workers’ bonuses, eliminate higher- paid workers’ bonuses 3. don’t renew temporary workers’ contracts. 4. increase VAT by 4%, tax on fuel, alcohol and tobacco, new property, and gambling by 10% 5. raise the average retirement age from 61.4 to 63.5 6. Cut/reduce pensions. http://www.europeaninstitute.org/Special-G-20-Issue-on-Financial-Reform/austerity-measures-in-the-eu.html UK Toughest public spending cuts in more than 60 years. 1. A 24% cut to the Department of Culture (includes the BBC) 2. Raise the retirement age from 65 to 66 by 2020 3. Eliminate 490,000 public sector jobs over the next four years 4. University funding cuts 5. Lower long-term unemployment benefits 6. Eliminate benefits to those who do not seek jobs 7. Reduce child benefits 8. Other funding cuts to the welfare system (Public health services) 9. The VAT tax will rise from 17.5 to 20% Then… In April 2013, something funny happened. In an econometrics course taught by Professors Michael Ash and Robert Pollin at the University of Massachusetts Amherst, Thomas Herndon , a graduate student in economics, was required to replicate the calculations in a significant work in economic literature, to demonstrate his knowledge of and proficiency in empirical economics. Thomas chose the Reinhart-Rogoff paper. But … He couldn’t replicate the results. No matter how many times he repeated his calculations, he kept getting different results! From the BBC website… This week, economists have been astonished to find that a famous academic paper often used to make the case for austerity cuts contains major errors. Another surprise is that the mistakes, by two eminent Harvard professors, were spotted by a student doing his homework. The mistake in the paper by Reinhart and Rogoff is “a glitch in spreadsheet coding!” The corrected results show that instead that countries with debt- to-GDP ratios above 90% saw GDP growth of 2.2%, a percentage point lower than the growth rate seen in countries with lower debtto-GDP ratios. This is the corrected graph! The big question is… Causality! Does high debt levels cause low economic growth or … Does low economic growth cause high debt levels? On this question, Paul Krugman says… OK, Reinhart and Rogoff have said their piece. They deny asserting that the debt-growth relationship is causal. But … They keep making statements that suggest that it is. They deny having been strong austerity advocates . But … They were happy to enjoy the celebrity that came with their adoption as austerian mascots, and never said anything against the “90 percent!” rhetoric that was used to justify sharp austerity. http://krugman.blogs.nytimes.com/2013/04/26/grasping-at-straw-men/