Measuring Health, Unemployment, Inflation

... The Cost-Push Theory According to the cost-push theory, inflation occurs when producers raise prices in order to meet increased costs, or changes in aggregate supply. Cost-push inflation can lead to a wage-price spiral — the process by which rising wages cause higher prices, and higher prices ca ...

... The Cost-Push Theory According to the cost-push theory, inflation occurs when producers raise prices in order to meet increased costs, or changes in aggregate supply. Cost-push inflation can lead to a wage-price spiral — the process by which rising wages cause higher prices, and higher prices ca ...

On The Derivation and Consistent Use of Growth and Discount

... What is too rarely madeclear is that this expression of Fisher’s Equ~/tion and this expression of earnings growth rate are valid only at the limit of continuous compounding. When these expressions are applied to data defined for discrete periods (annual earnings, for example), using a discrete time ...

... What is too rarely madeclear is that this expression of Fisher’s Equ~/tion and this expression of earnings growth rate are valid only at the limit of continuous compounding. When these expressions are applied to data defined for discrete periods (annual earnings, for example), using a discrete time ...

1 - JustAnswer.de

... c.) Debit to Interest Payable $200 d.) Debit to Interest Expense $200 5.) 5.) Chu Co. issued a $50,000 60-day, discounted note to River City Bank. The discount rate is 6%. The cash proceeds to Chu Co. are a.) $ 50,500 b.) $ 50,250 c.) $ 49,500 d.) $ 50,250 6.) 6.) Pilgrim Company sells merchandise w ...

... c.) Debit to Interest Payable $200 d.) Debit to Interest Expense $200 5.) 5.) Chu Co. issued a $50,000 60-day, discounted note to River City Bank. The discount rate is 6%. The cash proceeds to Chu Co. are a.) $ 50,500 b.) $ 50,250 c.) $ 49,500 d.) $ 50,250 6.) 6.) Pilgrim Company sells merchandise w ...

creation of money

... required to hold at the central bank, calculated as a percentage of total deposits (reserve requirement) Excess reserves – voluntary additional reserves held by the banks („money parked at the central bank”). Monetary base is steered by the central bank via monetary policy instruments (open market ...

... required to hold at the central bank, calculated as a percentage of total deposits (reserve requirement) Excess reserves – voluntary additional reserves held by the banks („money parked at the central bank”). Monetary base is steered by the central bank via monetary policy instruments (open market ...

Why Business Cycles?

... a huge stimulant to the economy for most of the early 1940s • Recession returned in 1945, but it did not last • As soon as the war was over, consumers went on a buying binge that stimulated expansion again • Since 1965, there has been a recurring pattern of recessions and expansions ...

... a huge stimulant to the economy for most of the early 1940s • Recession returned in 1945, but it did not last • As soon as the war was over, consumers went on a buying binge that stimulated expansion again • Since 1965, there has been a recurring pattern of recessions and expansions ...

Federal Open Market Committee (FOMC)

... economy. The Federal Reserve can change the amount of money that banks are holding in reserves by buying or selling existing U.S. Treasury bonds. When the Federal Reserve buys a bond, the seller deposits the Federal Reserves' check in her bank account. As a bank’s reserves increase, it has an increa ...

... economy. The Federal Reserve can change the amount of money that banks are holding in reserves by buying or selling existing U.S. Treasury bonds. When the Federal Reserve buys a bond, the seller deposits the Federal Reserves' check in her bank account. As a bank’s reserves increase, it has an increa ...

Chapter 16: Extending the Analysis of Aggregate

... opportunity cost on leisure. b. Lower taxes would increase productive effort in several ways: increase the number of hours worked per unit of time; encourage workers to postpone retirement; induce more people to enter the labor force; motivate people to work harder and to avoid long periods of unemp ...

... opportunity cost on leisure. b. Lower taxes would increase productive effort in several ways: increase the number of hours worked per unit of time; encourage workers to postpone retirement; induce more people to enter the labor force; motivate people to work harder and to avoid long periods of unemp ...

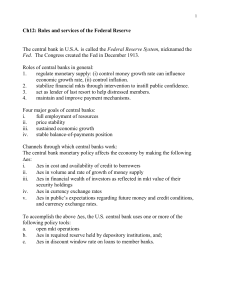

Ch13: Roles and services of the Federal Reserve

... set minimum reserve requirement on deposits iii. set margin requirements for investors to buy securities iv. set discount-window borrowing rate Federal Open Market Committee (FOMC) Chairperson of the Federal Reserve Board and president of the NY Fed bank serve as chairperson and vice-chairperson o ...

... set minimum reserve requirement on deposits iii. set margin requirements for investors to buy securities iv. set discount-window borrowing rate Federal Open Market Committee (FOMC) Chairperson of the Federal Reserve Board and president of the NY Fed bank serve as chairperson and vice-chairperson o ...

Sabse Bada Rupaiya

... employment levels. The more people there are out of work, the less the public as a whole will spend on goods and services. Central banks typically have little difficulty adjusting the available money supply to accommodate changes in the demand for money due to business transactions. A currency will ...

... employment levels. The more people there are out of work, the less the public as a whole will spend on goods and services. Central banks typically have little difficulty adjusting the available money supply to accommodate changes in the demand for money due to business transactions. A currency will ...

San Diego Community Leaders’ Luncheon

... expected pattern for the national output data. Disruption of production in the Gulf will undoubtedly slow growth somewhat in the second half—a common estimate is that it will depress national real GDP growth by around one-half to three-quarters percent. This is likely to be followed by a surge in gr ...

... expected pattern for the national output data. Disruption of production in the Gulf will undoubtedly slow growth somewhat in the second half—a common estimate is that it will depress national real GDP growth by around one-half to three-quarters percent. This is likely to be followed by a surge in gr ...

PRIVATE BANKING INSIGHTS – Market Commentary

... long-term uptrend (which would be sustained until 2001), the US economy was outperforming on a global basis and the Federal Reserve was about to embark on a tightening cycle. Sounds familiar? You can see it in the air, see it on the streets, hear it on the shop floor: This growth is for real, with f ...

... long-term uptrend (which would be sustained until 2001), the US economy was outperforming on a global basis and the Federal Reserve was about to embark on a tightening cycle. Sounds familiar? You can see it in the air, see it on the streets, hear it on the shop floor: This growth is for real, with f ...

Current Cacophony of Monetary Policy

... interest rates did not materialize and hence the longer-term interest rates did not rise that time around. Chairman Greenspan was caught by surprise and declared it a CONUNDRUM. The FED, at that time, did not have sufficient longer-term securities to sell as they do now thanks to the QEs. This would ...

... interest rates did not materialize and hence the longer-term interest rates did not rise that time around. Chairman Greenspan was caught by surprise and declared it a CONUNDRUM. The FED, at that time, did not have sufficient longer-term securities to sell as they do now thanks to the QEs. This would ...

Chapter 10: Inflation and Unemployment

... adjustments are called ______________________7. Three types of indexation: _____________ indexed incomes8, _____________ indexed incomes9, and _____________incomes10. Those whose incomes are _____________ indexed to inflation rates maintain their purchasing power, while those with ______________ in ...

... adjustments are called ______________________7. Three types of indexation: _____________ indexed incomes8, _____________ indexed incomes9, and _____________incomes10. Those whose incomes are _____________ indexed to inflation rates maintain their purchasing power, while those with ______________ in ...

Challenges for the UK economy

... Bank of England data on household and non-financial corporation deposit holdings and lending, including lending to individuals shows the widening gap that has until recently been reliant upon wholesale funding. This has grown from GBP150bn in 1996 to a peak of £769 billion in October 2008. ...

... Bank of England data on household and non-financial corporation deposit holdings and lending, including lending to individuals shows the widening gap that has until recently been reliant upon wholesale funding. This has grown from GBP150bn in 1996 to a peak of £769 billion in October 2008. ...

File

... Money Supply - Decreases / Interest Rates - Decrease D) Money Supply - Increases / Interest Rates - Decrease Explanation: When the Federal Reserve sells government securities on the open market, it collects payment from banks, which decreases the money banks have in their reserve accounts, so the mo ...

... Money Supply - Decreases / Interest Rates - Decrease D) Money Supply - Increases / Interest Rates - Decrease Explanation: When the Federal Reserve sells government securities on the open market, it collects payment from banks, which decreases the money banks have in their reserve accounts, so the mo ...

통화완화정책

... not last for long. If the price of a share, say, was too low, wellinformed investors would buy it and make a killing. If it looked too dear, they could sell or short it and make money that way. It also followed that bubbles could not form—or, at any rate, could not last: some wise investor would spo ...

... not last for long. If the price of a share, say, was too low, wellinformed investors would buy it and make a killing. If it looked too dear, they could sell or short it and make money that way. It also followed that bubbles could not form—or, at any rate, could not last: some wise investor would spo ...

Show all necessary work in a neat and orderly manner.

... current continuous interest rate is 4% then how much will be in your savings account in seven years? How much of this is earned interest? Show ALL appropriate formulas clearly identified. Use fnInt to evaluate all integrals. Answer for amount in your Calculate all the values we usually do in these p ...

... current continuous interest rate is 4% then how much will be in your savings account in seven years? How much of this is earned interest? Show ALL appropriate formulas clearly identified. Use fnInt to evaluate all integrals. Answer for amount in your Calculate all the values we usually do in these p ...

14.02 Principles of Macroeconomics Problem Set 1 Spring 2003

... currently employed Navy officer. (d) When measuring GDP, you must include the pension the government pays to a retired Navy officer. (e) If the central bank buys government bonds from the general public in an open market operation, interest rates should fall. (f) Imports can be larger than GDP. (g) ...

... currently employed Navy officer. (d) When measuring GDP, you must include the pension the government pays to a retired Navy officer. (e) If the central bank buys government bonds from the general public in an open market operation, interest rates should fall. (f) Imports can be larger than GDP. (g) ...

Interest rate

An interest rate is the rate at which interest is paid by borrowers (debtors) for the use of money that they borrow from lenders (creditors). Specifically, the interest rate is a percentage of principal paid a certain number of times per period for all periods during the total term of the loan or credit. Interest rates are normally expressed as a percentage of the principal for a period of one year, sometimes they are expressed for different periods such as a month or a day. Different interest rates exist parallelly for the same or comparable time periods, depending on the default probability of the borrower, the residual term, the payback currency, and many more determinants of a loan or credit. For example, a company borrows capital from a bank to buy new assets for its business, and in return the lender receives rights on the new assets as collateral and interest at a predetermined interest rate for deferring the use of funds and instead lending it to the borrower.Interest-rate targets are a vital tool of monetary policy and are taken into account when dealing with variables like investment, inflation, and unemployment. The central banks of countries generally tend to reduce interest rates when they wish to increase investment and consumption in the country's economy. However, a low interest rate as a macro-economic policy can be risky and may lead to the creation of an economic bubble, in which large amounts of investments are poured into the real-estate market and stock market. In developed economies, interest-rate adjustments are thus made to keep inflation within a target range for the health of economic activities or cap the interest rate concurrently with economic growth to safeguard economic momentum.