ECON 201: Introduction to Macroeconomics Final Exam December

... D) real estate agent who leaves a job in Texas and searches for a similar, higherpaying job in California. Use the following to answer question 16: ...

... D) real estate agent who leaves a job in Texas and searches for a similar, higherpaying job in California. Use the following to answer question 16: ...

Gaining Trust

... contracting.2 Moreover, though the post-Brexit market turmoil led to tighter financial conditions, they are being offset by other effects—like lower-cost mortgages and loans. When second-quarter figures are tallied, consumption growth is expected to be 4%, a rate that corresponds with GDP growth of ...

... contracting.2 Moreover, though the post-Brexit market turmoil led to tighter financial conditions, they are being offset by other effects—like lower-cost mortgages and loans. When second-quarter figures are tallied, consumption growth is expected to be 4%, a rate that corresponds with GDP growth of ...

Practice Problems on NIPA and Key Prices

... The three approaches to national income accounting are the product approach, the income approach, and the expenditure approach. They all give the same answer because they are designed that way; any entry based on one approach has an entry in the other approaches with the same value. Whenever output ...

... The three approaches to national income accounting are the product approach, the income approach, and the expenditure approach. They all give the same answer because they are designed that way; any entry based on one approach has an entry in the other approaches with the same value. Whenever output ...

Inflation, Deregulation and Recession

... standard capital/assets and capital/deposits ratios in predicting S&L failures. The results show that these ratios are poor indicators of S&L failures. A possible reason for the lack of correlation could be that forebearance actually tended to reduce the number of failures despite the low amount of ...

... standard capital/assets and capital/deposits ratios in predicting S&L failures. The results show that these ratios are poor indicators of S&L failures. A possible reason for the lack of correlation could be that forebearance actually tended to reduce the number of failures despite the low amount of ...

AD Curve 2

... The lines intercept at the equilibrium. To the left of the equilibrium, AE>Y, i.e. the economy produces less goods and services than are purchased. This leads to inflation. To the right of it, AE

... The lines intercept at the equilibrium. To the left of the equilibrium, AE>Y, i.e. the economy produces less goods and services than are purchased. This leads to inflation. To the right of it, AE

Chapter 6 "DO YOU UNDERSTAND" QUESTIONS Assume that the

... Answer: Investors do not shift their holdings from one segment to another because of the assumption, that they are risk averse. Another reason could be that some financial institutions that face regulatory capital requirements may desire to hold only those securities whose durations match their hold ...

... Answer: Investors do not shift their holdings from one segment to another because of the assumption, that they are risk averse. Another reason could be that some financial institutions that face regulatory capital requirements may desire to hold only those securities whose durations match their hold ...

8190498040 - PastPapers.Co

... Permission to reproduce items where third-party owned material protected by copyright is included has been sought and cleared where possible. Every reasonable effort has been made by the publisher (UCLES) to trace copyright holders, but if any items requiring clearance have unwittingly been included ...

... Permission to reproduce items where third-party owned material protected by copyright is included has been sought and cleared where possible. Every reasonable effort has been made by the publisher (UCLES) to trace copyright holders, but if any items requiring clearance have unwittingly been included ...

1969

... banking confidence brought a return to strong economic growth? The likely answer is that banks were only part of the problem.” ...

... banking confidence brought a return to strong economic growth? The likely answer is that banks were only part of the problem.” ...

chapter 12 questions

... b. can significantly impact spending on capital formation. c. pass costs onto future generations with no corresponding benefits. d. will cause the government to go bankrupt Currently, the Social Security trust fund is running a a. deficit, which reduces the apparent size of the budget deficit. b. su ...

... b. can significantly impact spending on capital formation. c. pass costs onto future generations with no corresponding benefits. d. will cause the government to go bankrupt Currently, the Social Security trust fund is running a a. deficit, which reduces the apparent size of the budget deficit. b. su ...

The Fisher Relation in the Great Depression and the Great Recession

... of policy along explicitly quantity-theoretic lines. Many contemporary critics of the Fed, including Hawtrey (e.g. 1932) and his sometime assistant Lauchlin Currie (e.g.1934), not to mention Fisher himself on many occasions, derived policy advice from such data about the need to bring about vigorous ...

... of policy along explicitly quantity-theoretic lines. Many contemporary critics of the Fed, including Hawtrey (e.g. 1932) and his sometime assistant Lauchlin Currie (e.g.1934), not to mention Fisher himself on many occasions, derived policy advice from such data about the need to bring about vigorous ...

homework 3 (chapter 34) eco 11 fall 2006 udayan roy

... a. interest rates rise as the Fed reduces the quantity of money demanded. b. interest rates fall as the Fed reduces the supply of money. c. people will want to hold less money as the cost of doing so falls. d. people will want to hold more money as the cost of doing so falls. 3. According to the the ...

... a. interest rates rise as the Fed reduces the quantity of money demanded. b. interest rates fall as the Fed reduces the supply of money. c. people will want to hold less money as the cost of doing so falls. d. people will want to hold more money as the cost of doing so falls. 3. According to the the ...

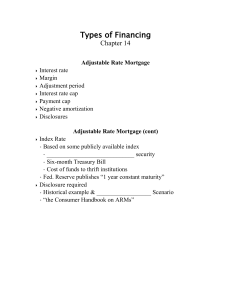

Adjustable Rate Mortgage

... Adjustment period Interest rate cap Payment cap Negative amortization Disclosures Adjustable Rate Mortgage (cont) ...

... Adjustment period Interest rate cap Payment cap Negative amortization Disclosures Adjustable Rate Mortgage (cont) ...

Monetary expansion raises AD in the SR

... Monetary expansion raises AD in the SR An increase in the current level of M shifts LM curve out as we have seen (because M/P in the SR => i) => Y↑ for given P => AD shifts right. An increase in the expected future rate of growth of M shifts IS out, ...

... Monetary expansion raises AD in the SR An increase in the current level of M shifts LM curve out as we have seen (because M/P in the SR => i) => Y↑ for given P => AD shifts right. An increase in the expected future rate of growth of M shifts IS out, ...

Document

... • Faced by the combination of deflationary/ disinflationary pressures and weak growth, central banks in both AEs and EMEs have pursued accommodative monetary policies. In the US, monetary policy remains highly accommodative with interest rates close to zero. • Facing persistent deflation, the Bank o ...

... • Faced by the combination of deflationary/ disinflationary pressures and weak growth, central banks in both AEs and EMEs have pursued accommodative monetary policies. In the US, monetary policy remains highly accommodative with interest rates close to zero. • Facing persistent deflation, the Bank o ...

Fund Facts

... Regulatory information and risk warning We do not represent that this information, including any third party information, is accurate or complete and it should not be relied upon as such. Opinions expressed herein are subject to change without notice. The services described are provided by CCLA Fun ...

... Regulatory information and risk warning We do not represent that this information, including any third party information, is accurate or complete and it should not be relied upon as such. Opinions expressed herein are subject to change without notice. The services described are provided by CCLA Fun ...

Treasury Management Strategy

... overdrawn we would incur costs of 29% of the overdrawn balance for the period that the account is overdrawn. Given the fact that we rarely use the overdraft coupled with projected cash balances, it is considered more cost effective not to have an approved overdraft facility than to incur fees to kee ...

... overdrawn we would incur costs of 29% of the overdrawn balance for the period that the account is overdrawn. Given the fact that we rarely use the overdraft coupled with projected cash balances, it is considered more cost effective not to have an approved overdraft facility than to incur fees to kee ...

Interest rate

An interest rate is the rate at which interest is paid by borrowers (debtors) for the use of money that they borrow from lenders (creditors). Specifically, the interest rate is a percentage of principal paid a certain number of times per period for all periods during the total term of the loan or credit. Interest rates are normally expressed as a percentage of the principal for a period of one year, sometimes they are expressed for different periods such as a month or a day. Different interest rates exist parallelly for the same or comparable time periods, depending on the default probability of the borrower, the residual term, the payback currency, and many more determinants of a loan or credit. For example, a company borrows capital from a bank to buy new assets for its business, and in return the lender receives rights on the new assets as collateral and interest at a predetermined interest rate for deferring the use of funds and instead lending it to the borrower.Interest-rate targets are a vital tool of monetary policy and are taken into account when dealing with variables like investment, inflation, and unemployment. The central banks of countries generally tend to reduce interest rates when they wish to increase investment and consumption in the country's economy. However, a low interest rate as a macro-economic policy can be risky and may lead to the creation of an economic bubble, in which large amounts of investments are poured into the real-estate market and stock market. In developed economies, interest-rate adjustments are thus made to keep inflation within a target range for the health of economic activities or cap the interest rate concurrently with economic growth to safeguard economic momentum.