Overcoming the Great Recession: Lessons From China

... For the past decade, Liu He has been an influential economist and policy advisor in Beijing. An alumnus of the Harvard Kennedy School (MPA ’95), Liu was a trusted advisor to President Hu Jintao during the global financial crisis of 2008. Since Xi Jinping became president in 2012, he has emerged as X ...

... For the past decade, Liu He has been an influential economist and policy advisor in Beijing. An alumnus of the Harvard Kennedy School (MPA ’95), Liu was a trusted advisor to President Hu Jintao during the global financial crisis of 2008. Since Xi Jinping became president in 2012, he has emerged as X ...

Ned Phelps’ Contributions as Viewed from Today through My

... Nominal disturbances have real effects because prices do not adjust instantly There is no Walrasian “auctioneer” to coordinate the resetting of prices and wages In 1967 and 1968 he introduced price and wage expectations as the key ingredient in decisions by workers and firms The business cycle then ...

... Nominal disturbances have real effects because prices do not adjust instantly There is no Walrasian “auctioneer” to coordinate the resetting of prices and wages In 1967 and 1968 he introduced price and wage expectations as the key ingredient in decisions by workers and firms The business cycle then ...

Economic Insight:

... making the economy less attractive to investors because sectors are now less profitable. Africa hosts many oil- and commodity-exporting economies. In Nigeria, its biggest economy and home to its second-largest oil reserves, oil accounts for the vast majority of exports. Angola, Africa’s second-large ...

... making the economy less attractive to investors because sectors are now less profitable. Africa hosts many oil- and commodity-exporting economies. In Nigeria, its biggest economy and home to its second-largest oil reserves, oil accounts for the vast majority of exports. Angola, Africa’s second-large ...

The Global Financial Crisis and Its Implications for Heterodox

... before the bubble broke. It is easy to construct models of bubbles. But most of the losses occur after the bubble breaks, in the persistent gap between actual and potential output – Standard theory predicts a relatively quick recovery, as the economy adjusts to new “reality” – New equilibrium associ ...

... before the bubble broke. It is easy to construct models of bubbles. But most of the losses occur after the bubble breaks, in the persistent gap between actual and potential output – Standard theory predicts a relatively quick recovery, as the economy adjusts to new “reality” – New equilibrium associ ...

How Did Economists Get It So Wrong?

... extensive body of economic theory was developed, whose central message was: Trust the market. Yes, economists admitted that there were cases in which markets might fail, of which the most important was the case of “externalities” — costs that people impose on others without paying the price, like tr ...

... extensive body of economic theory was developed, whose central message was: Trust the market. Yes, economists admitted that there were cases in which markets might fail, of which the most important was the case of “externalities” — costs that people impose on others without paying the price, like tr ...

Revision – Inflation and deflation

... Inflation rate: It is usually measured by governments using a retail price index (RPI). The rate of inflation is the percentage increase in that index over the previous 12 months. Inflation measures: Inflation is sometimes measured using other prices, such as commodity prices, food prices, house pri ...

... Inflation rate: It is usually measured by governments using a retail price index (RPI). The rate of inflation is the percentage increase in that index over the previous 12 months. Inflation measures: Inflation is sometimes measured using other prices, such as commodity prices, food prices, house pri ...

part ii concepts and problems

... recession A period during which aggregate output declines. Conventionally, a period in which aggregate output declines for two consecutive quarters. depression A prolonged and deep recession. expansion or boom The period in the business cycle from a trough up to a peak during which output and employ ...

... recession A period during which aggregate output declines. Conventionally, a period in which aggregate output declines for two consecutive quarters. depression A prolonged and deep recession. expansion or boom The period in the business cycle from a trough up to a peak during which output and employ ...

File

... services (real GDP) that firms will produce in an economy at different price levels. The supply for everything by all firms. Aggregate Supply differentiates between short run and long-run and has two different curves. Short-run Aggregate Supply •Wages and Resource Prices will not increase as price l ...

... services (real GDP) that firms will produce in an economy at different price levels. The supply for everything by all firms. Aggregate Supply differentiates between short run and long-run and has two different curves. Short-run Aggregate Supply •Wages and Resource Prices will not increase as price l ...

65 Keynesian LRAS Ed

... to the left as levels of consumption and investment fall. The real output will fall from Y1 to Y2, resulting in unemployment and the price level will fall from P1 to P2. Based on the following extract explain what is happening to the real output and price level using a fully labelled Aggregate Deman ...

... to the left as levels of consumption and investment fall. The real output will fall from Y1 to Y2, resulting in unemployment and the price level will fall from P1 to P2. Based on the following extract explain what is happening to the real output and price level using a fully labelled Aggregate Deman ...

Overcoming the Great Recession - The Belfer Center for Science

... For the past decade, Liu He has been an influential economist and policy advisor in Beijing. An alumnus of the Harvard Kennedy School (MPA ’95), Liu was a trusted advisor to President Hu Jintao during the global financial crisis of 2008. Since Xi Jinping became president in 2012, he has emerged as X ...

... For the past decade, Liu He has been an influential economist and policy advisor in Beijing. An alumnus of the Harvard Kennedy School (MPA ’95), Liu was a trusted advisor to President Hu Jintao during the global financial crisis of 2008. Since Xi Jinping became president in 2012, he has emerged as X ...

Recession or Depression? - Federal Reserve Bank of St. Louis

... possible that the current recession might be as severe as any experienced since then. ...

... possible that the current recession might be as severe as any experienced since then. ...

Op-Ed

... theory was developed, whose central message was: Trust the market. Yes, economists admitted that there were cases in which markets might fail, of which the most important was the case of “externalities” — costs that people impose on others without paying the price, like traffic congestion or polluti ...

... theory was developed, whose central message was: Trust the market. Yes, economists admitted that there were cases in which markets might fail, of which the most important was the case of “externalities” — costs that people impose on others without paying the price, like traffic congestion or polluti ...

How Did Economists Get It So Wrong?

... Wealth of Nations” in 1776. Over the next 160 years an extensive body of economic theory was developed, whose central message was: Trust the market. Yes, economists admitted that there were cases in which markets might fail, of which the most important was the case of “externalities” — costs that pe ...

... Wealth of Nations” in 1776. Over the next 160 years an extensive body of economic theory was developed, whose central message was: Trust the market. Yes, economists admitted that there were cases in which markets might fail, of which the most important was the case of “externalities” — costs that pe ...

Fina 353-Lecture Slide Week 6

... Capital is the most responsible resource for increasing labor productivity. New Technology is another factor that increase labor productivity. Two broad categories of capital Human Capital Accumulated knowledge, skill, (come from education and training) and experience of the labor force. As individu ...

... Capital is the most responsible resource for increasing labor productivity. New Technology is another factor that increase labor productivity. Two broad categories of capital Human Capital Accumulated knowledge, skill, (come from education and training) and experience of the labor force. As individu ...

Tutorial

... b. not a concern during war. c. a result of high unemployment. d. an increase in the relative price level. A. Inflation is always a concern and it is not caused by a high unemployment rate. ...

... b. not a concern during war. c. a result of high unemployment. d. an increase in the relative price level. A. Inflation is always a concern and it is not caused by a high unemployment rate. ...

Overcoming the Great Recession

... For the past decade, Liu He has been an influential economist and policy advisor in Beijing. An alumnus of the Harvard Kennedy School (MPA ’95), Liu was a trusted advisor to President Hu Jintao during the global financial crisis of 2008. Since Xi Jinping became president in 2012, he has emerged as X ...

... For the past decade, Liu He has been an influential economist and policy advisor in Beijing. An alumnus of the Harvard Kennedy School (MPA ’95), Liu was a trusted advisor to President Hu Jintao during the global financial crisis of 2008. Since Xi Jinping became president in 2012, he has emerged as X ...

Lucas Imperfect-Information Model

... model. Perfectly competitive firms observe the prices of their individual products, but they do not observe the economy-wide price level. Therefore, when the producer observes a change in the price of her product, she does not know if this is a reflection of increased demand for her individual good, ...

... model. Perfectly competitive firms observe the prices of their individual products, but they do not observe the economy-wide price level. Therefore, when the producer observes a change in the price of her product, she does not know if this is a reflection of increased demand for her individual good, ...

State Board of Equalization A Review of the Economy: Fiscal Year 2013-14

... National Association for Business Economists ...

... National Association for Business Economists ...

Short-Run Model Essentials

... Net export, or foreign purchases, effect we buy foreign goods because they are cheaper than domestic goods same holds true for foreigners if our PL falls compared to the PL in other countries, “our” goods become more attractive residents of other countries, so our exports rise simultane ...

... Net export, or foreign purchases, effect we buy foreign goods because they are cheaper than domestic goods same holds true for foreigners if our PL falls compared to the PL in other countries, “our” goods become more attractive residents of other countries, so our exports rise simultane ...

BOOK REVIEWS and York: Robert Higgs

... offree trade. Higgs uses this as evidence for the “severely binding ideological constraints” affecting political decisionmakers. Now, maybe the secretary of ...

... offree trade. Higgs uses this as evidence for the “severely binding ideological constraints” affecting political decisionmakers. Now, maybe the secretary of ...

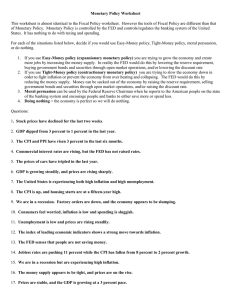

Monetary Policy Worksheet

... 4. Doing nothing = the economy is perfect so we will do nothing. Here are the questions and answers: 1. Stock prices have declined for the last two weeks. (A= Do nothing - the stock market is not one of the major economic indicators. It will rise or fall if the wrong person sneezes! Hah Choooo!!!!) ...

... 4. Doing nothing = the economy is perfect so we will do nothing. Here are the questions and answers: 1. Stock prices have declined for the last two weeks. (A= Do nothing - the stock market is not one of the major economic indicators. It will rise or fall if the wrong person sneezes! Hah Choooo!!!!) ...

Economics R. Glenn Hubbard, Anthony Patrick O`Brien, 2e.

... Durable goods output is more volatile than non-durables and services because spending on the latter usually cannot be postponed. Capital goods and consumer durables are affected the most. In recessions, firms delay the purchase of new machines and equipments and consumers repair their old appliances ...

... Durable goods output is more volatile than non-durables and services because spending on the latter usually cannot be postponed. Capital goods and consumer durables are affected the most. In recessions, firms delay the purchase of new machines and equipments and consumers repair their old appliances ...

Who gains and who loses from an import tariff

... labor unions, etc.), failure of production functions to exhibit constant returns to scale, government policy distortions (production taxes, price supports, etc.), lack of homogeneity in worker skill, and the impossibility of the basic assumption that technologies are the same everywhere. The Heckshe ...

... labor unions, etc.), failure of production functions to exhibit constant returns to scale, government policy distortions (production taxes, price supports, etc.), lack of homogeneity in worker skill, and the impossibility of the basic assumption that technologies are the same everywhere. The Heckshe ...

Economics - Issaquah Connect

... Explain and demonstrate how the equilibrium price is determined. Explain and demonstrate how shortages and surpluses affect price. Describe and graph how shifts in equilibrium price occur. Contrast loose money and tight money policies. Fiscal Policy. Describe fractional reserve banking Explain money ...

... Explain and demonstrate how the equilibrium price is determined. Explain and demonstrate how shortages and surpluses affect price. Describe and graph how shifts in equilibrium price occur. Contrast loose money and tight money policies. Fiscal Policy. Describe fractional reserve banking Explain money ...

Monetary Policy

... growth rate in the money supply will be equal to the average annual growth rate in Real GDP minus the growth rate in velocity. • Some Monetary rule proponents claim that even if a monetary rule does not adjust for changes in velocity, there is little cause for concern. ...

... growth rate in the money supply will be equal to the average annual growth rate in Real GDP minus the growth rate in velocity. • Some Monetary rule proponents claim that even if a monetary rule does not adjust for changes in velocity, there is little cause for concern. ...

Long Depression

The Long Depression was a worldwide price recession, beginning in 1873 and running through the spring of 1879. It was the most severe in Europe and the United States, which had been experiencing strong economic growth fueled by the Second Industrial Revolution in the decade following the American Civil War. The episode was labeled the ""Great Depression"" at the time, and it held that designation until the Great Depression of the 1930s. Though a period of general deflation and a general contraction, it did not have the severe economic retrogression of the Great Depression.It was most notable in Western Europe and North America, at least in part because reliable data from the period are most readily available in those parts of the world. The United Kingdom is often considered to have been the hardest hit; during this period it lost some of its large industrial lead over the economies of Continental Europe. While it was occurring, the view was prominent that the economy of the United Kingdom had been in continuous depression from 1873 to as late as 1896 and some texts refer to the period as the Great Depression of 1873–96.In the United States, economists typically refer to the Long Depression as the Depression of 1873–79, kicked off by the Panic of 1873, and followed by the Panic of 1893, book-ending the entire period of the wider Long Depression. The National Bureau of Economic Research dates the contraction following the panic as lasting from October 1873 to March 1879. At 65 months, it is the longest-lasting contraction identified by the NBER, eclipsing the Great Depression's 43 months of contraction.In the US, from 1873–1879, 18,000 businesses went bankrupt, including 89 railroads. Ten states and hundreds of banks went bankrupt. Unemployment peaked in 1878, long after the panic ended. Different sources peg the peak unemployment rate anywhere from 8.25% to 14%.