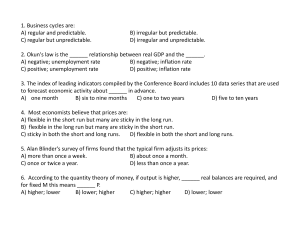

1. Business cycles are: A) regular and predictable. B) irregular but

... 2. Okun's law is the ______ relationship between real GDP and the ______. A) negative; unemployment rate B) negative; inflation rate C) positive; unemployment rate )p p y D) positive; inflation rate )p 3. The index of leading indicators compiled by the Conference Board includes 10 data series that a ...

... 2. Okun's law is the ______ relationship between real GDP and the ______. A) negative; unemployment rate B) negative; inflation rate C) positive; unemployment rate )p p y D) positive; inflation rate )p 3. The index of leading indicators compiled by the Conference Board includes 10 data series that a ...

The Price of Capital - Harvard Business School

... technological advances across borders.1 The relative price of capital goods is thus a crucial determinant of a country’s access to these two channels of economic growth. A large empirical literature has linked differences in the relative price of capital goods in poor countries to lower levels of in ...

... technological advances across borders.1 The relative price of capital goods is thus a crucial determinant of a country’s access to these two channels of economic growth. A large empirical literature has linked differences in the relative price of capital goods in poor countries to lower levels of in ...

April 2017 World Economic Outlook, Chapter 1: Global

... In the second half of 2016, the stronger global momentum in demand—investment in particular— resulted in marked improvements in manufacturing and trade, which were very weak in late 2015 and early 2016 (Figure 1.1, panel 1). Production of both consumer durables and capital goods rebounded in the sec ...

... In the second half of 2016, the stronger global momentum in demand—investment in particular— resulted in marked improvements in manufacturing and trade, which were very weak in late 2015 and early 2016 (Figure 1.1, panel 1). Production of both consumer durables and capital goods rebounded in the sec ...

NBER WORKING PAPER SERIES SUPPLY SHOCKS AND OPTIMAL MONETARY POLICY Stephen J. Turnovsky

... Blinder (1981), Aizenman and Frenkel (1986), Fischer (1985). With the current fall in oil prices, the topic promises to be relevant for some time, although the direction of the shocks has been reversed. ...

... Blinder (1981), Aizenman and Frenkel (1986), Fischer (1985). With the current fall in oil prices, the topic promises to be relevant for some time, although the direction of the shocks has been reversed. ...

IOSR Journal of Economics and Finance (IOSR-JEF)

... development of national identity and social and economic reorganization (MESCT, 2000). In the 1980s two new public higher education institutions were established, namely the Pedagogic Higher Institute (ISP) and Higher Institute for International Relations (ISRI). ISP was upgraded to become a Pedagog ...

... development of national identity and social and economic reorganization (MESCT, 2000). In the 1980s two new public higher education institutions were established, namely the Pedagogic Higher Institute (ISP) and Higher Institute for International Relations (ISRI). ISP was upgraded to become a Pedagog ...

Chapter 10: Classical Business Cycle Analysis: Market

... The Fed would respond to the higher demand for money by increasing money supply; otherwise, the price level would decline. The early theoretical RBC models did not include a monetary sector at all—they assumed that money was unimportant for the business cycle. More recently, RBC theorists have been ...

... The Fed would respond to the higher demand for money by increasing money supply; otherwise, the price level would decline. The early theoretical RBC models did not include a monetary sector at all—they assumed that money was unimportant for the business cycle. More recently, RBC theorists have been ...

likviditás és reálgazdaság kapcsolata - doktori

... intermediation the bilateral relationship observed earlier in case of lending and payment services offered by moneychangers broadens to a trilateral one: savers – agent – debtors. Since financial institutions 'convert' depositors’ money into loans, the institutional guarantee is essentially a funct ...

... intermediation the bilateral relationship observed earlier in case of lending and payment services offered by moneychangers broadens to a trilateral one: savers – agent – debtors. Since financial institutions 'convert' depositors’ money into loans, the institutional guarantee is essentially a funct ...

Petroleum Product Subsidies: Costly, Inequitable, and Rising

... Estimates of the magnitude of consumer subsidies are based on a new database on domestic retail petroleum product prices from 2003 to 2009. Unit (per liter) subsidies are calculated as the difference between an appropriate benchmark price and domestic (tax-inclusive) retail prices. The benchmark pri ...

... Estimates of the magnitude of consumer subsidies are based on a new database on domestic retail petroleum product prices from 2003 to 2009. Unit (per liter) subsidies are calculated as the difference between an appropriate benchmark price and domestic (tax-inclusive) retail prices. The benchmark pri ...

PDF

... p, = price of manufactured (customer) products, p, = price of agricultural (auction) products, m = nominal money supply, p = general price, and y = total outpuL2In addition, x denotes the speed of adjustment of manufactured prices, while a n overdot denotes the rate of change with respect to time. E ...

... p, = price of manufactured (customer) products, p, = price of agricultural (auction) products, m = nominal money supply, p = general price, and y = total outpuL2In addition, x denotes the speed of adjustment of manufactured prices, while a n overdot denotes the rate of change with respect to time. E ...

THE EVALUATION OF ECONOMIC RECESSION MAGNITUDE

... Fluctuations of main economic indicators are studied from the statistical point of view (Clark, 1987 and Harding and Pagan, 2002), as well as from the economic point of view (Kim and Nelson, 1999). Coe (2002) showed the Great Depression (1929-1933) had a character of a financial crisis, while Romer ( ...

... Fluctuations of main economic indicators are studied from the statistical point of view (Clark, 1987 and Harding and Pagan, 2002), as well as from the economic point of view (Kim and Nelson, 1999). Coe (2002) showed the Great Depression (1929-1933) had a character of a financial crisis, while Romer ( ...

NBER WORKING PAPER SERIES ARE ALL BANKING CRISES ALIKE? THE JAPANESE EXPERIENCE

... Banking crises have become commonplace during the past two decades, but the range of experience in terms of the nature of the crisis, causes and effects, vary widely across countries and time periods. Japan’s banking problem is distinctive in several dimensions, as seen by comparison with similar ep ...

... Banking crises have become commonplace during the past two decades, but the range of experience in terms of the nature of the crisis, causes and effects, vary widely across countries and time periods. Japan’s banking problem is distinctive in several dimensions, as seen by comparison with similar ep ...

AS-AD and the Business Cycle

... A full employment equilibrium occurs when equilibrium real GDP equals potential GDP. An above full-employment equilibrium occurs when real GDP exceeds potential GDP. The amount by which real GDP exceeds potential GDP is called an inflationary gap. An inflationary gap occurs when the AS curve and the ...

... A full employment equilibrium occurs when equilibrium real GDP equals potential GDP. An above full-employment equilibrium occurs when real GDP exceeds potential GDP. The amount by which real GDP exceeds potential GDP is called an inflationary gap. An inflationary gap occurs when the AS curve and the ...

ECONOMICS: PRINCIPLES AND PRACTICES Daily Lecture Notes

... How may economic interdependence be a strength of an economy? A weakness? (Answers ...

... How may economic interdependence be a strength of an economy? A weakness? (Answers ...

NBER WORKING PAPER SERIES Robert J. Gordon Working Paper 11778

... previously invented "general purpose technologies" stimulated an increase in fixed investment that became excessive and proved to be unsustainable, while the productivity acceleration helps to account for low inflation in both decades. The uncanny parallel of the stock market boom, bubble, and colla ...

... previously invented "general purpose technologies" stimulated an increase in fixed investment that became excessive and proved to be unsustainable, while the productivity acceleration helps to account for low inflation in both decades. The uncanny parallel of the stock market boom, bubble, and colla ...

The 1920s and the 1990s in Mutual Reflection

... addressed by growth rates, as in Table 1. Others are better illuminated by raw numbers and ratios. The top section of Table 2 provides the values of nominal and real GDP, the GDP deflator, and the CPI for the beginning and end years of the 1920s and 1990s. Here we are impressed at how much everythin ...

... addressed by growth rates, as in Table 1. Others are better illuminated by raw numbers and ratios. The top section of Table 2 provides the values of nominal and real GDP, the GDP deflator, and the CPI for the beginning and end years of the 1920s and 1990s. Here we are impressed at how much everythin ...

Accounting for economic growth in the Netherlands since

... characterised by major changes i n structure and substantial variations in growth rates. Some of these changes are similar t o those in many other countries i n Northwest Europe, such as the rapid increase in per capita income and productivity during the 1950s and 1960s. However, other aspects of Du ...

... characterised by major changes i n structure and substantial variations in growth rates. Some of these changes are similar t o those in many other countries i n Northwest Europe, such as the rapid increase in per capita income and productivity during the 1950s and 1960s. However, other aspects of Du ...

Business Cycles

... by the total population. The U.S. capita real output growth has been 1.5 to 2.5 percent per year since ...

... by the total population. The U.S. capita real output growth has been 1.5 to 2.5 percent per year since ...

This PDF is a selection from an out-of-print volume from... of Economic Research Volume Title: Currency Crises

... given to GDP-weighted leaver and stayer aggregates. However, these aggregates disguise diversity; just as Nickell’s (1997) analysis of structural unemployment in Europe remarks on the diversity of experience within Europe, so our analysis uncovers a wide range of experience among the leavers, and to ...

... given to GDP-weighted leaver and stayer aggregates. However, these aggregates disguise diversity; just as Nickell’s (1997) analysis of structural unemployment in Europe remarks on the diversity of experience within Europe, so our analysis uncovers a wide range of experience among the leavers, and to ...

The Transmission of Monetary Policy Operations through

... dynamic, stochastic, general-equilibrium (DSGE) model. In the model, overlapping generations (OLG) of households use money, bonds, and durable goods to smooth consumption over their life cycle as well as the business cycle. In the baseline case, we assume that all prices are flexible and there are n ...

... dynamic, stochastic, general-equilibrium (DSGE) model. In the model, overlapping generations (OLG) of households use money, bonds, and durable goods to smooth consumption over their life cycle as well as the business cycle. In the baseline case, we assume that all prices are flexible and there are n ...

Complementarity Between Public and Private

... In India, a major reason why public investment was assigned such importance as it has is because the policy makers wanted to exercise control over prices and output in the economy to further the nations’ equity goals [Government of India (1956, pp. 9-10) World Bank (1979, p. lo)]. It is important, t ...

... In India, a major reason why public investment was assigned such importance as it has is because the policy makers wanted to exercise control over prices and output in the economy to further the nations’ equity goals [Government of India (1956, pp. 9-10) World Bank (1979, p. lo)]. It is important, t ...

L8_20110415

... in economic activity around its long-run trend. • The aggregate-demand curve shows the quantity of goods and services that households, firms, and the government want to buy at each price level. • The aggregate-supply curve shows the quantity of goods and services that firms choose to produce and ...

... in economic activity around its long-run trend. • The aggregate-demand curve shows the quantity of goods and services that households, firms, and the government want to buy at each price level. • The aggregate-supply curve shows the quantity of goods and services that firms choose to produce and ...

Lecture 8

... in economic activity around its long-run trend. • The aggregate-demand curve shows the quantity of goods and services that households, firms, and the government want to buy at each price level. • The aggregate-supply curve shows the quantity of goods and services that firms choose to produce and ...

... in economic activity around its long-run trend. • The aggregate-demand curve shows the quantity of goods and services that households, firms, and the government want to buy at each price level. • The aggregate-supply curve shows the quantity of goods and services that firms choose to produce and ...

Should the Central Bank Be Concerned About Housing Prices?

... share of that sector (Woodford, 2003; Benigno, 2004; Huang and Liu, 2005). This result is typically obtained in models with some kind of symmetry imposed across sectors. In particular, factor intensities in the production technologies are typically assumed to be identical across sectors (Erceg and L ...

... share of that sector (Woodford, 2003; Benigno, 2004; Huang and Liu, 2005). This result is typically obtained in models with some kind of symmetry imposed across sectors. In particular, factor intensities in the production technologies are typically assumed to be identical across sectors (Erceg and L ...

New method

... Real VAD Estimation Old method: Deflator = Weighted average of CPI and IPI New method: Deflator = (Investment revenue / Insurance output) × Deflator of securities + [(Insurance output - Investment revenue) ÷ Insurance output] × Weighted average of CPI and IPI ...

... Real VAD Estimation Old method: Deflator = Weighted average of CPI and IPI New method: Deflator = (Investment revenue / Insurance output) × Deflator of securities + [(Insurance output - Investment revenue) ÷ Insurance output] × Weighted average of CPI and IPI ...

State-controlled Banks and the Effectiveness of Monetary Policy

... up a broader range of securities. In either case, buying up debt securities with money increases the money supply and selling debt securities for money deceases the money supply. Buying up debt securities decreases the supply of debt instruments, increasing their prices and driving down their yield ...

... up a broader range of securities. In either case, buying up debt securities with money increases the money supply and selling debt securities for money deceases the money supply. Buying up debt securities decreases the supply of debt instruments, increasing their prices and driving down their yield ...

Long Depression

The Long Depression was a worldwide price recession, beginning in 1873 and running through the spring of 1879. It was the most severe in Europe and the United States, which had been experiencing strong economic growth fueled by the Second Industrial Revolution in the decade following the American Civil War. The episode was labeled the ""Great Depression"" at the time, and it held that designation until the Great Depression of the 1930s. Though a period of general deflation and a general contraction, it did not have the severe economic retrogression of the Great Depression.It was most notable in Western Europe and North America, at least in part because reliable data from the period are most readily available in those parts of the world. The United Kingdom is often considered to have been the hardest hit; during this period it lost some of its large industrial lead over the economies of Continental Europe. While it was occurring, the view was prominent that the economy of the United Kingdom had been in continuous depression from 1873 to as late as 1896 and some texts refer to the period as the Great Depression of 1873–96.In the United States, economists typically refer to the Long Depression as the Depression of 1873–79, kicked off by the Panic of 1873, and followed by the Panic of 1893, book-ending the entire period of the wider Long Depression. The National Bureau of Economic Research dates the contraction following the panic as lasting from October 1873 to March 1879. At 65 months, it is the longest-lasting contraction identified by the NBER, eclipsing the Great Depression's 43 months of contraction.In the US, from 1873–1879, 18,000 businesses went bankrupt, including 89 railroads. Ten states and hundreds of banks went bankrupt. Unemployment peaked in 1878, long after the panic ended. Different sources peg the peak unemployment rate anywhere from 8.25% to 14%.