Lecture 13

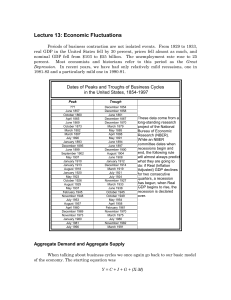

... Lecture 13: Economic Fluctuations Periods of business contraction are not isolated events. From 1929 to 1933, real GDP in the United States fell by 30 percent, prices fell almost as much, and nominal GDP fell from $103 to $55 billion. The unemployment rate rose to 25 percent. Most economists and his ...

... Lecture 13: Economic Fluctuations Periods of business contraction are not isolated events. From 1929 to 1933, real GDP in the United States fell by 30 percent, prices fell almost as much, and nominal GDP fell from $103 to $55 billion. The unemployment rate rose to 25 percent. Most economists and his ...

1AC – NIB Aff

... concepts of their “classical” predecessors) was that we should have faith in the market system. This faith was, however, shattered by the Great Depression. Actually, even in the face of total collapse some economists insisted that whatever happens in a market economy must be right: “Depressions are ...

... concepts of their “classical” predecessors) was that we should have faith in the market system. This faith was, however, shattered by the Great Depression. Actually, even in the face of total collapse some economists insisted that whatever happens in a market economy must be right: “Depressions are ...

Is Monetary Policy Overburdened? No. 13-8 Athanasios Orphanides

... problems. To some observers, monetary policy is the “only game in town.” Exceptionally low interest rates and unprecedented liquidity provision by major central banks for several years has eased the burden of adjustment following the crisis. But these policies do not come without potential costs. In ...

... problems. To some observers, monetary policy is the “only game in town.” Exceptionally low interest rates and unprecedented liquidity provision by major central banks for several years has eased the burden of adjustment following the crisis. But these policies do not come without potential costs. In ...

Which of the following is the most fundamental issue that economics

... to changes in interest rates 28. Increases in the real per capita income of a country are most closely associated with increases in which of the following? a. The labor force b. The price level c. The money supply d. Productivity e. Tax rates 29. The consumer price index (CPI) is criticized for a. o ...

... to changes in interest rates 28. Increases in the real per capita income of a country are most closely associated with increases in which of the following? a. The labor force b. The price level c. The money supply d. Productivity e. Tax rates 29. The consumer price index (CPI) is criticized for a. o ...

THE THEORY OF THE GLOBAL “SAVINGS GLUT”

... interest rate, could be drawn for every level of income, whence it followed that there was an infinity of such curves (which explains Keynes’ remark apropos Wicksell’s “natural rate of interest” that there is a “natural rate of interest” corresponding to every level of income), there was no reason w ...

... interest rate, could be drawn for every level of income, whence it followed that there was an infinity of such curves (which explains Keynes’ remark apropos Wicksell’s “natural rate of interest” that there is a “natural rate of interest” corresponding to every level of income), there was no reason w ...

Money Growth and Inflation THE CLASSICAL THEORY OF

... – Hyperinflation refers to high rates of inflation such as Germany experienced in the 1920s. – In the 1970s prices rose by 7 percent per year. – During the 1990s, prices rose at an average rate of 2 percent per year. © 2007 Thomson South-Western ...

... – Hyperinflation refers to high rates of inflation such as Germany experienced in the 1920s. – In the 1970s prices rose by 7 percent per year. – During the 1990s, prices rose at an average rate of 2 percent per year. © 2007 Thomson South-Western ...

Slide 1

... – 1980’s transition to deregulation of Financial and Transportation Industries – 1990’s transition back to more regulation ...

... – 1980’s transition to deregulation of Financial and Transportation Industries – 1990’s transition back to more regulation ...

From Slowdown to Recovery

... case firms tend to shift these effects on consumers, so prices go up. Another type of inflation has its roots in external trade balance. It appears when a domestic currency becomes cheaper with respect to foreign currencies (so called depreciation), which makes import goods, both production and cons ...

... case firms tend to shift these effects on consumers, so prices go up. Another type of inflation has its roots in external trade balance. It appears when a domestic currency becomes cheaper with respect to foreign currencies (so called depreciation), which makes import goods, both production and cons ...

Trial Estimation of Financial Intermediation Services Indirectly

... TRIAL ESTIMATION OF FINANCIAL INTERMEDIATION SERVICES INDIRECTLY MEASURED (FISIM) IN JAPAN* By Yuji Onuki** and Hideki Yamaguchi Economic and Social Research Institute ...

... TRIAL ESTIMATION OF FINANCIAL INTERMEDIATION SERVICES INDIRECTLY MEASURED (FISIM) IN JAPAN* By Yuji Onuki** and Hideki Yamaguchi Economic and Social Research Institute ...

Power Point ( 5.3M ) - St. Louis Fed

... NOTE: Inventory investment expressed as contribution to real GDP growth. November 6, 2008 ...

... NOTE: Inventory investment expressed as contribution to real GDP growth. November 6, 2008 ...

The Deep Causes of Secular Stagnation and the Rise of

... Federal Reserve research team was focusing on the NAIRU while ignoring what was actually leading to inflation. All the evidence suggests that the complete opposite of what the Federal Reserve economists expected to happen actually happened: As unemployment began to fall below the NAIRU in 1997 and 1 ...

... Federal Reserve research team was focusing on the NAIRU while ignoring what was actually leading to inflation. All the evidence suggests that the complete opposite of what the Federal Reserve economists expected to happen actually happened: As unemployment began to fall below the NAIRU in 1997 and 1 ...

This PDF is a selection from a published volume from... Research Volume Title: International Dimensions of Monetary Policy

... do the same thing, and that there is an equilibrium where the rule that every central bank takes as given for other central banks is actually optimal for those other central banks. In contrast, the coordinated or cooperative solution is where all central banks jointly maximize a global objective fun ...

... do the same thing, and that there is an equilibrium where the rule that every central bank takes as given for other central banks is actually optimal for those other central banks. In contrast, the coordinated or cooperative solution is where all central banks jointly maximize a global objective fun ...

Chapter 4: Inflation in the Twentieth Century

... Our discussion has focused on the Consumer Price Index because it is so important to so many people. But, as noted earlier, in this course, we will not use the Consumer Price Index. We will not use it because it is limited to the prices of certain consumer goods and services. The prices of a diamond ...

... Our discussion has focused on the Consumer Price Index because it is so important to so many people. But, as noted earlier, in this course, we will not use the Consumer Price Index. We will not use it because it is limited to the prices of certain consumer goods and services. The prices of a diamond ...

Reserve Bank of New Zealand Analytical Notes

... The current recovery is much more gradual than those of the previous two recessions. New Zealand’s GDP and employment growth have been subdued, especially when compared with the recoveries from the 1991-92 and 1997-98 recessions (figure 1). The unemployment rate is virtually unchanged since late 200 ...

... The current recovery is much more gradual than those of the previous two recessions. New Zealand’s GDP and employment growth have been subdued, especially when compared with the recoveries from the 1991-92 and 1997-98 recessions (figure 1). The unemployment rate is virtually unchanged since late 200 ...

Fiat Value in the Theory of Value

... The size of the stock of money may seem large. The 1.5 times annual GNP stock is much larger than M2, which is about 0.6. As pointed out by Williamson [2012], two types of money are used for transaction purposes. Much of the liquid government debt is held as cash reserves, and in 2015 the nomin ...

... The size of the stock of money may seem large. The 1.5 times annual GNP stock is much larger than M2, which is about 0.6. As pointed out by Williamson [2012], two types of money are used for transaction purposes. Much of the liquid government debt is held as cash reserves, and in 2015 the nomin ...

Early 1980s recession

The early 1980s recession describes the severe global economic recession affecting much of the developed world in the late 1970s and early 1980s. The United States and Japan exited the recession relatively early, but high unemployment would continue to affect other OECD nations through to at least 1985. Long-term effects of the recession contributed to the Latin American debt crisis, the savings and loans crisis in the United States, and a general adoption of neoliberal economic policies throughout the 1980s and 1990s.