What is Economics? 1 Chapter 13 expenditure multipliers: The

... Data for the United States show that the U.S. consumption function has shifted upward over time because economic growth has created greater wealth and higher expected future income. ...

... Data for the United States show that the U.S. consumption function has shifted upward over time because economic growth has created greater wealth and higher expected future income. ...

Explaining trends in UK business investment

... capital in the second half of the 1990s. In particular, the CBI survey of manufacturers’ investment appraisal techniques conducted in June 2001 finds that where financial hurdle rates are used, real rates may have fallen by around 5 percentage points since 1994.(2) Theory suggests that there are sev ...

... capital in the second half of the 1990s. In particular, the CBI survey of manufacturers’ investment appraisal techniques conducted in June 2001 finds that where financial hurdle rates are used, real rates may have fallen by around 5 percentage points since 1994.(2) Theory suggests that there are sev ...

The Effects of Government Spending Shocks on Consumption under

... should rise in response to a rise in government spending. The magnitude of the e¤ect depends on the exact combination of tax and debt …nance used to fund increased public spending. The e¤ect on aggregate output also depends on changes in investment, the response in which crucially depends on monetar ...

... should rise in response to a rise in government spending. The magnitude of the e¤ect depends on the exact combination of tax and debt …nance used to fund increased public spending. The e¤ect on aggregate output also depends on changes in investment, the response in which crucially depends on monetar ...

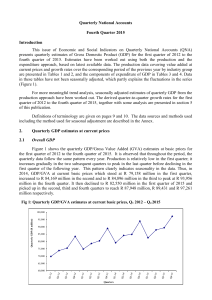

Note: Figures in some tables may not add up to the total published

... During the fourth quarter of 2015 final consumption expenditure comprising consumption expenditure of private households and general government, amounted to R 95,407 million, representing 86.7% of the quarterly GDP at market prices. Final consumption of households estimated at R 80,436 million, repr ...

... During the fourth quarter of 2015 final consumption expenditure comprising consumption expenditure of private households and general government, amounted to R 95,407 million, representing 86.7% of the quarterly GDP at market prices. Final consumption of households estimated at R 80,436 million, repr ...

MacroLab Documentation - BORA

... that the real-world counterparts to the components of the model—and their general relationships—should resemble the U.S. economy described in standard textbooks, whether in words or models. Suitable also means that the behavior generated endogenously by the model’s structure is more or less consiste ...

... that the real-world counterparts to the components of the model—and their general relationships—should resemble the U.S. economy described in standard textbooks, whether in words or models. Suitable also means that the behavior generated endogenously by the model’s structure is more or less consiste ...

CHAPTER 13 | Aggregate Demand and Aggregate Supply Analysis

... because in the long run, real GDP is always at its potential level and is unaffected by the price level. The short-run aggregate supply curve slopes upward because workers and firms fail to accurately predict the future price level. The three main explanations of why this failure results in an upwar ...

... because in the long run, real GDP is always at its potential level and is unaffected by the price level. The short-run aggregate supply curve slopes upward because workers and firms fail to accurately predict the future price level. The three main explanations of why this failure results in an upwar ...

Costly capital reallocation and the effects of government spending

... The two-sector neoclassical model can produce a much richer set of implications for the data than the standard, one-sector neoclassical model. In particular, it can produce some of the implications that were previously believed only obtainable in a model with imperfect competition and increasing ret ...

... The two-sector neoclassical model can produce a much richer set of implications for the data than the standard, one-sector neoclassical model. In particular, it can produce some of the implications that were previously believed only obtainable in a model with imperfect competition and increasing ret ...

as a PDF

... Mises to substantiate the C-F view that Mises makes this suggestion. It is true that Mises says that complex phenomena can only be studied by abstracting from change and then introducing an isolated factor to provoke change (p. 248). But this is not the same as saying that a purpose of ERE is to exp ...

... Mises to substantiate the C-F view that Mises makes this suggestion. It is true that Mises says that complex phenomena can only be studied by abstracting from change and then introducing an isolated factor to provoke change (p. 248). But this is not the same as saying that a purpose of ERE is to exp ...

Using Policy to Stabilize the Economy

... policymakers should try to stabilize the economy. Some argue that the government should use fiscal and monetary policy to combat destabilizing fluctuations in output and employment. Others argue that policy will end up destabilizing the economy, because policies work with long ...

... policymakers should try to stabilize the economy. Some argue that the government should use fiscal and monetary policy to combat destabilizing fluctuations in output and employment. Others argue that policy will end up destabilizing the economy, because policies work with long ...

Unit 3 Review Answers

... D. revenue the government gets from printing money. E. costs associated with negotiating lower prices. ____ 42. Unanticipated inflation: A. helps those on fixed incomes. B. hurts borrowers and helps lenders. C. helps borrowers and hurts lenders. D. causes nominal interest rates to decrease. E. cause ...

... D. revenue the government gets from printing money. E. costs associated with negotiating lower prices. ____ 42. Unanticipated inflation: A. helps those on fixed incomes. B. hurts borrowers and helps lenders. C. helps borrowers and hurts lenders. D. causes nominal interest rates to decrease. E. cause ...

Introduntion - Hakan Berument`sHomepage

... proposes to use a VAR (Vector Autoregressive) method to capture the monetary policy stance. To be specific, he suggests using the innovation in money aggregate or interest rate as a measure of monetary policy change. Christiano and Eichenbaum (1992a) argue that changes in broad aggregates reflect bo ...

... proposes to use a VAR (Vector Autoregressive) method to capture the monetary policy stance. To be specific, he suggests using the innovation in money aggregate or interest rate as a measure of monetary policy change. Christiano and Eichenbaum (1992a) argue that changes in broad aggregates reflect bo ...

This PDF is a selection from a published volume from

... The Economic Derivatives market prices options on many different outcomes, allowing us to assess forecasts of a full probability distribution. In section 4 we compare the dispersion of the option- and survey-based distributions, and exploit the unique feature of our data that allows us to address th ...

... The Economic Derivatives market prices options on many different outcomes, allowing us to assess forecasts of a full probability distribution. In section 4 we compare the dispersion of the option- and survey-based distributions, and exploit the unique feature of our data that allows us to address th ...

Preparing for inflation - Charles Schwab Bank Collective Trust Funds

... purchasing power, or value, of money.2 Specifically, inflation is the rate at which the prices of goods and services are rising, and, correspondingly, purchasing power is falling. For example, if inflation were to rise 2% in a given year, then something that cost $100 at the start of a year would in ...

... purchasing power, or value, of money.2 Specifically, inflation is the rate at which the prices of goods and services are rising, and, correspondingly, purchasing power is falling. For example, if inflation were to rise 2% in a given year, then something that cost $100 at the start of a year would in ...

When are the Effects of Fiscal Policy Uncertainty Large?

... reason is that the rise in government spending increases output and reduces the household’s desire to save, which leads to higher inflation. Since the nominal interest rate is at the ZLB, the rise in inflation causes the real interest rate to fall, which encourages consumption and investment and, in ...

... reason is that the rise in government spending increases output and reduces the household’s desire to save, which leads to higher inflation. Since the nominal interest rate is at the ZLB, the rise in inflation causes the real interest rate to fall, which encourages consumption and investment and, in ...

29 INFLATION, JOBS, AND THE BUSINESS CYCLE**

... initial rise in the price level and the money wage rate response to a one-time rise in the price level. Figure 12.3 shows the effect of a one-time increase in the price level that results from a onetime increase in aggregate demand. The aggregate demand curve shifts rightward from AD0 to AD1 and ini ...

... initial rise in the price level and the money wage rate response to a one-time rise in the price level. Figure 12.3 shows the effect of a one-time increase in the price level that results from a onetime increase in aggregate demand. The aggregate demand curve shifts rightward from AD0 to AD1 and ini ...

Comparing the Real Size of African Economies

... them. There is a close parallel here with GDP comparisons over time for a single country, where it is necessary to remove the price changes from one year to the next in order to assess the change in underlying volumes. Why not use exchange rates? Before PPPs became widely available, people who wante ...

... them. There is a close parallel here with GDP comparisons over time for a single country, where it is necessary to remove the price changes from one year to the next in order to assess the change in underlying volumes. Why not use exchange rates? Before PPPs became widely available, people who wante ...

Inflation and Unemployment: The Phillips Curve

... want to have borrowed less and lenders want to have loaned more. ...

... want to have borrowed less and lenders want to have loaned more. ...

Document

... to have borrowed more and lenders want to have loaned less. When the inflation rate is lower than anticipated, the real interest rate is higher than anticipated, and borrowers want to have borrowed less and lenders want to have loaned more. ...

... to have borrowed more and lenders want to have loaned less. When the inflation rate is lower than anticipated, the real interest rate is higher than anticipated, and borrowers want to have borrowed less and lenders want to have loaned more. ...

Chapter 12

... • The Great Depression of the 1930s • Keynes and Keynesian economics – Keynes (1936), General theory of employment, interest and money – The capitalist economy is inherently unstable and likely to achieve equilibrium with considerable unemployment or severe inflation, and the possibility of persiste ...

... • The Great Depression of the 1930s • Keynes and Keynesian economics – Keynes (1936), General theory of employment, interest and money – The capitalist economy is inherently unstable and likely to achieve equilibrium with considerable unemployment or severe inflation, and the possibility of persiste ...