Inflation Targeting in South Africa: A VAR Analysis

... the IS shock on output and the price of domestic goods, the CPI still increases because of the rise in the local currency price of imported goods. Under a binding CPI inflation target, the central bank would have to enact a contractionary monetary policy to offset the increase in the CPI, as is illu ...

... the IS shock on output and the price of domestic goods, the CPI still increases because of the rise in the local currency price of imported goods. Under a binding CPI inflation target, the central bank would have to enact a contractionary monetary policy to offset the increase in the CPI, as is illu ...

The 3-Equation New Keynesian Model — a Graphical

... and output pairs faced by the central bank. The only points on the curve with inflation below 4% are to the left of B, i.e. with lower output and hence higher unemployment. With Phillips curves like this, disinflation will always be costly. This result comes from the assumption that last period’s in ...

... and output pairs faced by the central bank. The only points on the curve with inflation below 4% are to the left of B, i.e. with lower output and hence higher unemployment. With Phillips curves like this, disinflation will always be costly. This result comes from the assumption that last period’s in ...

Macroeconomics Final Study Guide

... Question: Economists believe that resources should be used as efficiently as possible to: Your achieve society's goals. CORRECT ANSWER Answer: ...

... Question: Economists believe that resources should be used as efficiently as possible to: Your achieve society's goals. CORRECT ANSWER Answer: ...

Optimal Mane~ary Palicy and Sacrifice Ra~ia Jeffrey C. Fuhrer*

... policy goals--usually inflation and real output from their targets so as to minimize this weighted average. The weights on inflation and real output reflect the monetary authority’s relative distaste for inflation and real output deviations. An optimal policy frontier depicts the minimum attainable ...

... policy goals--usually inflation and real output from their targets so as to minimize this weighted average. The weights on inflation and real output reflect the monetary authority’s relative distaste for inflation and real output deviations. An optimal policy frontier depicts the minimum attainable ...

The unemployment problem. A Norwegian perspective

... Within this theoretical framework, deviations of actual unemployment from equilibrium unemployment are usually associated with nominal demand shocks, expectational errors and nominal rigidities. I shall argue that in the Norwegian context an emphasis on expectational errors and nominal rigidities as ...

... Within this theoretical framework, deviations of actual unemployment from equilibrium unemployment are usually associated with nominal demand shocks, expectational errors and nominal rigidities. I shall argue that in the Norwegian context an emphasis on expectational errors and nominal rigidities as ...

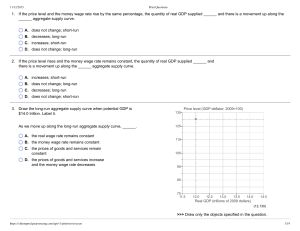

Compiled homework

... D. quantity of physical and human capital 6. Choose the statement that is incorrect. A. Along the LAS curve the money wage rate is constant and the real wage rate rises as the price level rises. B. A movement along the LAS curve is accompanied by a change in the prices of goods and services and th ...

... D. quantity of physical and human capital 6. Choose the statement that is incorrect. A. Along the LAS curve the money wage rate is constant and the real wage rate rises as the price level rises. B. A movement along the LAS curve is accompanied by a change in the prices of goods and services and th ...

PROBLEMS AND SOLUTIONS for B-level course Joakim Persson

... month. Among uninvolved people, 5 percent will enter into a relationship every month. What is the steady-state (“equilibrium”) fraction of residents who are uninvolved? Problem 6.4: Suppose that Congress passes legislation making it more difficult for firms to fire workers. If this legislation reduc ...

... month. Among uninvolved people, 5 percent will enter into a relationship every month. What is the steady-state (“equilibrium”) fraction of residents who are uninvolved? Problem 6.4: Suppose that Congress passes legislation making it more difficult for firms to fire workers. If this legislation reduc ...

NBER WORKING PAPER SERIES WEALTH TRANSFERS, CONTAGION, AND PORTFOLIO CONSTRAINTS Anna Pavlova

... of the transmission of these crises surprised many—academics and practitioners—and sparked a vast literature on international financial contagion. International transmission have been typically attributed to one of the two channels. The first one, put forward by the international trade literature, is ...

... of the transmission of these crises surprised many—academics and practitioners—and sparked a vast literature on international financial contagion. International transmission have been typically attributed to one of the two channels. The first one, put forward by the international trade literature, is ...

What Explains Inflation in China?

... Central to current monetary policy in the major advanced economies is price stability, where an increase in the general price level is termed inflation and a decrease deflation. Inflation and deflation distort price signals, leading to inefficient allocation of resources; they also undermine the cre ...

... Central to current monetary policy in the major advanced economies is price stability, where an increase in the general price level is termed inflation and a decrease deflation. Inflation and deflation distort price signals, leading to inefficient allocation of resources; they also undermine the cre ...

Garvin Smith`s Unit 3

... FED raises interest rates 3) 1930 – 33: Bank Failures from 3.5% to 6%. 4) 1932: Revenue Act 5) 1932 – 33: Roosevelt’s socialist/fascist policies 6) 1937: Revenue Act ...

... FED raises interest rates 3) 1930 – 33: Bank Failures from 3.5% to 6%. 4) 1932: Revenue Act 5) 1932 – 33: Roosevelt’s socialist/fascist policies 6) 1937: Revenue Act ...

MEASURING PRODUCTION AND INCOME, Chapter 2

... A. The closed economy: The interest rate is flexible. Main lesson: Increased government spending or lower net taxes (which implies a higher government budget deficit) increases the real interest rate and thereby lowers private investment to the same extent so that aggregate demand and output are unc ...

... A. The closed economy: The interest rate is flexible. Main lesson: Increased government spending or lower net taxes (which implies a higher government budget deficit) increases the real interest rate and thereby lowers private investment to the same extent so that aggregate demand and output are unc ...

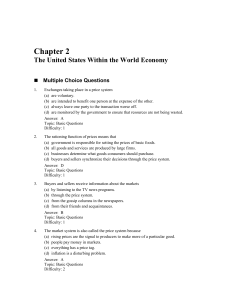

Sample

... d. a drop in the inflation rate at the beginning of December Incorrect: Microeconomics focuses on the allocation of resources specific to the business product or service. Answer: b Diff: 2 Type: MC Page Reference: 29 Objective: 2.1 Define economics and describe the different types of economic system ...

... d. a drop in the inflation rate at the beginning of December Incorrect: Microeconomics focuses on the allocation of resources specific to the business product or service. Answer: b Diff: 2 Type: MC Page Reference: 29 Objective: 2.1 Define economics and describe the different types of economic system ...

Chapter 12: Aggregate Demand and Aggregate Supply Analysis

... also have their wages adjusted only once a year. If …rms adjust wages only slowly, a rise in the PL will increase the pro…tability of hiring more workers and producing more output. 3. Menu costs (The costs to …rms of changing prices) make some prices sticky. Firms base their prices today partly on w ...

... also have their wages adjusted only once a year. If …rms adjust wages only slowly, a rise in the PL will increase the pro…tability of hiring more workers and producing more output. 3. Menu costs (The costs to …rms of changing prices) make some prices sticky. Firms base their prices today partly on w ...

a general equilibrium analysis

... These deterrent effects, which discourage future anticompetitive behaviour, are difficult to assess because they are not felt immediately and cannot be measured directly. Nevertheless, there appears to be a consensus in the literature that these effects are considerable. This paper makes the assumpt ...

... These deterrent effects, which discourage future anticompetitive behaviour, are difficult to assess because they are not felt immediately and cannot be measured directly. Nevertheless, there appears to be a consensus in the literature that these effects are considerable. This paper makes the assumpt ...

A Antonio Martino

... an answer to today’s problems. Cottfried Haberler (1974, p. 162), for example, states: “The gold standard broke down with the outbreak of war in 1914. It was superficially restored in the early 1920s but was definitively swept away and abandoned in the Creat Depression. There is now no chance that i ...

... an answer to today’s problems. Cottfried Haberler (1974, p. 162), for example, states: “The gold standard broke down with the outbreak of war in 1914. It was superficially restored in the early 1920s but was definitively swept away and abandoned in the Creat Depression. There is now no chance that i ...

Sample

... guidelines because they don’t want to anger their consumers. (b) Industry associations establish an acceptable price range for each commodity sold within the industry, and member firms are obligated to abide by association guidelines. (c) The forces underlying supply and demand interact to determine ...

... guidelines because they don’t want to anger their consumers. (b) Industry associations establish an acceptable price range for each commodity sold within the industry, and member firms are obligated to abide by association guidelines. (c) The forces underlying supply and demand interact to determine ...

explanation of the prize

... observed data. Sims argued that existing methods relied on “incredible” identi…cation assumptions, whereby interpretations of “what causes what” in macroeconomic time series were almost necessarily ‡awed. Misestimated models could not serve as useful tools for monetary policy analysis and, often, no ...

... observed data. Sims argued that existing methods relied on “incredible” identi…cation assumptions, whereby interpretations of “what causes what” in macroeconomic time series were almost necessarily ‡awed. Misestimated models could not serve as useful tools for monetary policy analysis and, often, no ...

mankiw6e-chap04_2007_

... Suppose V is constant, M is growing 5% per year, Y is growing 2% per year, and r = 4. a. Solve for i. b. If the Fed increases the money growth rate by 2 percentage points per year, find i. c. Suppose the growth rate of Y falls to 1% per year. What will happen to ? What must the Fed do if it w ...

... Suppose V is constant, M is growing 5% per year, Y is growing 2% per year, and r = 4. a. Solve for i. b. If the Fed increases the money growth rate by 2 percentage points per year, find i. c. Suppose the growth rate of Y falls to 1% per year. What will happen to ? What must the Fed do if it w ...