See Mind the Bytes` press release here.

... realm of overfunding with 234% of the initial investment objective thanks to over one hundred investors The funds are intended to boost the international marketing of its SaaS platform, which reduces the time and cost of developing new drugs by up to 30% Barcelona, 29 October 2015.- In just 43 days, ...

... realm of overfunding with 234% of the initial investment objective thanks to over one hundred investors The funds are intended to boost the international marketing of its SaaS platform, which reduces the time and cost of developing new drugs by up to 30% Barcelona, 29 October 2015.- In just 43 days, ...

What is a Secondary? - Voya Investment Management

... investment, a fund will exhibit low or negative returns and cash flows. This is normal as during this time of a fund’s lifecycle the private equity fund manager is making investments, which will have a dragging effect on the internal rate of return (IRR). Proceeds returned back to investors from rea ...

... investment, a fund will exhibit low or negative returns and cash flows. This is normal as during this time of a fund’s lifecycle the private equity fund manager is making investments, which will have a dragging effect on the internal rate of return (IRR). Proceeds returned back to investors from rea ...

MT Crowdfunding Case Study 1.indd

... financial crisis, ‘credit crunch,’ and subsequent ‘Great Recession’ which limited the availability of capital from traditional sources. The second is being driven by investor demand for alternative investments and regulatory changes that (among other things) are set to allow non-accredited investors ...

... financial crisis, ‘credit crunch,’ and subsequent ‘Great Recession’ which limited the availability of capital from traditional sources. The second is being driven by investor demand for alternative investments and regulatory changes that (among other things) are set to allow non-accredited investors ...

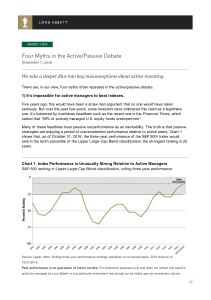

Four Myths in the Active/Passive Debate

... Risks to Consider: The value of investments in equity securities will f luctuate in response to general economic conditions and to changes in the prospects of particular companies and/or sectors in the economy. Historically speaking, growth and value investments tend to react dif f erently during ...

... Risks to Consider: The value of investments in equity securities will f luctuate in response to general economic conditions and to changes in the prospects of particular companies and/or sectors in the economy. Historically speaking, growth and value investments tend to react dif f erently during ...

Where to Raise Capital as a Certified B Corporation

... Angel Investors: Accredited investors who invest their personal capital in companies (typically start-ups) Venture Capital/Private Equity Funds: Funds professionally managed by investment managers. Capital invested in venture capital and private equity funds typically comes from high net worth indiv ...

... Angel Investors: Accredited investors who invest their personal capital in companies (typically start-ups) Venture Capital/Private Equity Funds: Funds professionally managed by investment managers. Capital invested in venture capital and private equity funds typically comes from high net worth indiv ...

Introducing - StockCentral

... stocks that meet your criteria, thereby finding re reasonable candidates for study. Learn how to build your personal search criteria criteria,, and always have a collection lection of potentially hot stocks just a point and click away. • When Bad Things Happen to Good Companies Learn how to handle u ...

... stocks that meet your criteria, thereby finding re reasonable candidates for study. Learn how to build your personal search criteria criteria,, and always have a collection lection of potentially hot stocks just a point and click away. • When Bad Things Happen to Good Companies Learn how to handle u ...

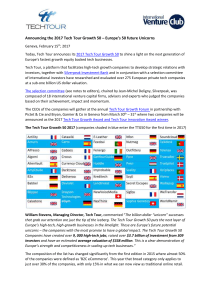

press release content

... European tech dynasties are now emerging where the capital and expertise created by realised unicorn successes such as Skype, Zoopla and Autonomy is supporting many of the future unicorns we see in this year’s Tech Tour Growth 50. This, together with a host of European serial entreprenuers turned su ...

... European tech dynasties are now emerging where the capital and expertise created by realised unicorn successes such as Skype, Zoopla and Autonomy is supporting many of the future unicorns we see in this year’s Tech Tour Growth 50. This, together with a host of European serial entreprenuers turned su ...

Thesis Statements

... Your thesis statement should tell the reader exactly what your paper is about. It comes at the end of your opening paragraph. A thesis statement can be thought of as your paper’s road map; it shows the reader what to expect in the rest of the paper. Your thesis statement may require revision if y ...

... Your thesis statement should tell the reader exactly what your paper is about. It comes at the end of your opening paragraph. A thesis statement can be thought of as your paper’s road map; it shows the reader what to expect in the rest of the paper. Your thesis statement may require revision if y ...

new proxy advisory code seeks to resolve concerns from listed

... managing conflicts of interest; and proxy firms should report on compliance with the Code on a regular basis. “One of the significant problems for proxy firms is that, just like many other financial intermediaries, they are suffering a financial squeeze,” Mr Matheson said. “A strong push by investor ...

... managing conflicts of interest; and proxy firms should report on compliance with the Code on a regular basis. “One of the significant problems for proxy firms is that, just like many other financial intermediaries, they are suffering a financial squeeze,” Mr Matheson said. “A strong push by investor ...

Folie 1 - INTERREG project recommend

... • It is an independent Italian association with the aim to: – Map the crowdfunding offer in the Italian market; – Support the crowdfunding regulation process by the national law; – Represent crowdfunding on-line platforms interests; – Improve cooperation between organisations and ...

... • It is an independent Italian association with the aim to: – Map the crowdfunding offer in the Italian market; – Support the crowdfunding regulation process by the national law; – Represent crowdfunding on-line platforms interests; – Improve cooperation between organisations and ...

1 The Equity Home Bias: Why do Investors Prefer Domestic

... investors are deliberately forgoing maximizing returns and profits by not diversifying their portfolios internationally. Diversifying decreases risk and maximizes returns, so it is puzzling why investors would avoid diversifying in this situation. Also, diversifying internationally can insulate you ...

... investors are deliberately forgoing maximizing returns and profits by not diversifying their portfolios internationally. Diversifying decreases risk and maximizes returns, so it is puzzling why investors would avoid diversifying in this situation. Also, diversifying internationally can insulate you ...

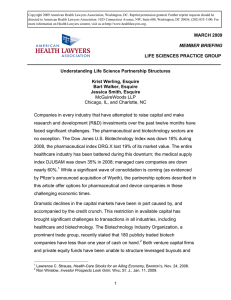

Understanding Life Science Partnership Structures

... generally limits the liability of each individual party to its contribution to the joint venture entity. This separate entity structure of a joint venture affiliation does bring some challenges, however. A joint venture can be difficult to unwind. Further, governance issues may arise: there are only ...

... generally limits the liability of each individual party to its contribution to the joint venture entity. This separate entity structure of a joint venture affiliation does bring some challenges, however. A joint venture can be difficult to unwind. Further, governance issues may arise: there are only ...

types of companies

... A sole proprietorship, also known as the sole trader or simply a proprietorship, is a type of business entity that is owned and run by one natural person and in which there is no legal distinction between the owner and the business. The owner is in direct control of all elements and is legally accou ...

... A sole proprietorship, also known as the sole trader or simply a proprietorship, is a type of business entity that is owned and run by one natural person and in which there is no legal distinction between the owner and the business. The owner is in direct control of all elements and is legally accou ...

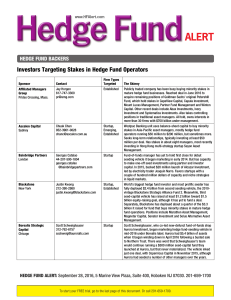

RISK FACTORS As is the case with any type of investment, hedge

... Limited liquidity Investors typically have limited rights to redeem and substantially limited rights to transfer hedge fund interests. In addition, there is generally no secondary market for interests in hedge funds and none is ever expected to develop. In addition, illiquidity of a hedge fund’s inv ...

... Limited liquidity Investors typically have limited rights to redeem and substantially limited rights to transfer hedge fund interests. In addition, there is generally no secondary market for interests in hedge funds and none is ever expected to develop. In addition, illiquidity of a hedge fund’s inv ...

Ten Highly Effective Habits of Successful Angel Investing

... • Disruptive Technology in Intelligent Storage Networks • 12 patents filed, more to come • Market projected to grow 900% by 2003 to $6.7B • Experienced management team has built two successful companies • Elite industry board • Key industry relationships in place ...

... • Disruptive Technology in Intelligent Storage Networks • 12 patents filed, more to come • Market projected to grow 900% by 2003 to $6.7B • Experienced management team has built two successful companies • Elite industry board • Key industry relationships in place ...

Uber is now worth $17 billion

... company has solid financial fundamentals to back up the hype. The new funding comes mostly from mutual funds — Fidelity Investments, Wellington Management, and Blackrock — with four of the venture-capital firms that previously backed the company also joining this round. "The common gut reaction when y ...

... company has solid financial fundamentals to back up the hype. The new funding comes mostly from mutual funds — Fidelity Investments, Wellington Management, and Blackrock — with four of the venture-capital firms that previously backed the company also joining this round. "The common gut reaction when y ...

structured return for all market conditions

... are denominated in the base currency may be subject to a strongly increased volatility. The volatility of other Share Classes may be different. Past performance is not a reliable indicator of future results. The products or securities described herein may not be available for sale in all jurisdictio ...

... are denominated in the base currency may be subject to a strongly increased volatility. The volatility of other Share Classes may be different. Past performance is not a reliable indicator of future results. The products or securities described herein may not be available for sale in all jurisdictio ...

Crowdfunding - North American Securities Administrators Association

... strategy that began as a way for the public to donate small amounts of money, often through social networking websites, to help artists, musicians, filmmakers and other creative people finance their projects. ...

... strategy that began as a way for the public to donate small amounts of money, often through social networking websites, to help artists, musicians, filmmakers and other creative people finance their projects. ...

Investment treaties: the emerging crisis

... The law suits, which have resulted in judgments totalling many billions of dollars against governments, were taken by companies and investors claiming that their investments including future profits had been affected by a range of government policies, including noncompliance with contracts or new he ...

... The law suits, which have resulted in judgments totalling many billions of dollars against governments, were taken by companies and investors claiming that their investments including future profits had been affected by a range of government policies, including noncompliance with contracts or new he ...

The Venture Capital Industry`s Crisis: A Problem of

... several highly placed VC partners, they are running business services firms targeting two very different customers. They need to better market themselves to entrepreneurs. Simply offering the most attractive financial backing will not be enough to help develop high value, sustainable portfolio firms ...

... several highly placed VC partners, they are running business services firms targeting two very different customers. They need to better market themselves to entrepreneurs. Simply offering the most attractive financial backing will not be enough to help develop high value, sustainable portfolio firms ...

Crowdfunding in the context of securities offerings in the US and

... to how smaller businesses are using new avenues for their funding needs. Whether crowdfunding will impact the business models of private equity or venture capital firms – the traditional places where companies go to ask for private investor funding – remains to be seen. Crowdfunding can benefit comp ...

... to how smaller businesses are using new avenues for their funding needs. Whether crowdfunding will impact the business models of private equity or venture capital firms – the traditional places where companies go to ask for private investor funding – remains to be seen. Crowdfunding can benefit comp ...

The Asset Management Industry and Retail Clients

... such as annual general meetings, dividend payments, investment guidelines changes and fund mergers), the picture becomes even more opaque. Not only are end investors often left to discover that these events have taken place until it’s too late to react to them, but even direct intermediaries sometim ...

... such as annual general meetings, dividend payments, investment guidelines changes and fund mergers), the picture becomes even more opaque. Not only are end investors often left to discover that these events have taken place until it’s too late to react to them, but even direct intermediaries sometim ...

Tengion Inc. Completes $50 Million Series "B

... Financing led by Bain Capital and Quaker BioVentures will support neobladder clinical trials, manufacturing capacity and pipeline development King of Prussia, Pa., June 23, 2006 - Tengion Inc., a leader in the field of regenerative medicine, announced that the company has raised $50 million in a rec ...

... Financing led by Bain Capital and Quaker BioVentures will support neobladder clinical trials, manufacturing capacity and pipeline development King of Prussia, Pa., June 23, 2006 - Tengion Inc., a leader in the field of regenerative medicine, announced that the company has raised $50 million in a rec ...

objective straightforward communications generating potential

... Write Income is solely focused on generating yield through dividends and derivatives strategies with a focus on seeking to generate a high single-digit yield. This strategy is comprised of firms that have sustainable business models, attractive balance sheets and strong cash flow generation with a h ...

... Write Income is solely focused on generating yield through dividends and derivatives strategies with a focus on seeking to generate a high single-digit yield. This strategy is comprised of firms that have sustainable business models, attractive balance sheets and strong cash flow generation with a h ...

Startup company

A startup company or startup or start-up (sometimes referred as innovative SME) is an entrepreneurial venture or a new business in the form of a company, a partnership or temporary organization designed to search for a repeatable and scalable business model. These companies, generally newly created, are innovation in a process of development, validation and research for target markets. The term became popular internationally during the dot-com bubble when a great number of dot-com companies were founded. Due to this background, many consider startups to be only tech companies, but this is not always true: the essence of startups has more to do with high ambition, innovativeness, scalability and growth.