New Venture Creation

... between venture and team member used to guard against the event that some portion of the stock has been earned and some portion will remain unearned, as when a team member quits or dies; the venture places the stock purchased by team members in escrow to be released over a two- or three-year period. ...

... between venture and team member used to guard against the event that some portion of the stock has been earned and some portion will remain unearned, as when a team member quits or dies; the venture places the stock purchased by team members in escrow to be released over a two- or three-year period. ...

Key Trends Shaping the Rapid Growth of the Venture Capital

... Sure we could keep buying small companies and G.E.-ize them. But we've learned that it's better to partner with the #3 company that wants to be #1 than to buy a tiny ...

... Sure we could keep buying small companies and G.E.-ize them. But we've learned that it's better to partner with the #3 company that wants to be #1 than to buy a tiny ...

Aegera Therapeutics announces $20 million Series B financing round

... largest private equity and venture capital firm managing both retail and institutional assets. Since 1982, VenGrowth’s accomplished team of seasoned private equity managers has invested over $1 billion in 169 companies, building a strong track record of successful portfolio transactions. These inves ...

... largest private equity and venture capital firm managing both retail and institutional assets. Since 1982, VenGrowth’s accomplished team of seasoned private equity managers has invested over $1 billion in 169 companies, building a strong track record of successful portfolio transactions. These inves ...

DATE

... arising under the Securities Exchange Act of 1934, and subsequently, mandatory predispute arbitration clauses have become a fixture in contracts between investors and brokerage firms. Three years ago, Congress took the first step to reestablish adequate protection for investors when it enacted Secti ...

... arising under the Securities Exchange Act of 1934, and subsequently, mandatory predispute arbitration clauses have become a fixture in contracts between investors and brokerage firms. Three years ago, Congress took the first step to reestablish adequate protection for investors when it enacted Secti ...

Is this a good time to invest in equity funds

... So should investors be exiting equities given the weakness in stock markets or should they be adding to their investments? In our view, this is just the time for investors to show confidence in equities. Like all assets and not just equities, there is a rule of thumb worth remembering – buy low and ...

... So should investors be exiting equities given the weakness in stock markets or should they be adding to their investments? In our view, this is just the time for investors to show confidence in equities. Like all assets and not just equities, there is a rule of thumb worth remembering – buy low and ...

September 30, 2013 Dear Friends, Large cap companies generated

... those who favor low interest rates to stimulate further economic growth was resolved in favor of the low interest rate advocates. The Federal Reserve announced that it would continue to buy $85 billion a month of government securities and mortgages. The net effect of this policy decision is benefici ...

... those who favor low interest rates to stimulate further economic growth was resolved in favor of the low interest rate advocates. The Federal Reserve announced that it would continue to buy $85 billion a month of government securities and mortgages. The net effect of this policy decision is benefici ...

Eikon Private Equity PDF

... Private Equity content is available in Thomson Reuters Eikon and includes over 30 years of daily-updated history covering private equity and venture capital firms, funds, and portfolio companies around the world. The Private Equity data and capabilities are powered by VentureXpert, the premier sourc ...

... Private Equity content is available in Thomson Reuters Eikon and includes over 30 years of daily-updated history covering private equity and venture capital firms, funds, and portfolio companies around the world. The Private Equity data and capabilities are powered by VentureXpert, the premier sourc ...

What annual returns do investors expect?

... The results presented in this document were gathered through a Web survey conducted by Leger from November 21 to 25, 2014 among a representative sample of 1,505 English- or French-speaking Canadians, 18 years of age or older, who have an investment portfolio for retirement. Using data from Statistic ...

... The results presented in this document were gathered through a Web survey conducted by Leger from November 21 to 25, 2014 among a representative sample of 1,505 English- or French-speaking Canadians, 18 years of age or older, who have an investment portfolio for retirement. Using data from Statistic ...

Press Release Brussels, 8 June 2017 `EU publicly quoted

... EuropeanIssuers, representing the interests of publicly quoted companies across Europe, welcomes the Commission’s renewed commitment to the Capital Markets Union Action Plan contained in its Communication on the Mid-Term Review published today. Florence Bindelle, Secretary General of EuropeanIssuers ...

... EuropeanIssuers, representing the interests of publicly quoted companies across Europe, welcomes the Commission’s renewed commitment to the Capital Markets Union Action Plan contained in its Communication on the Mid-Term Review published today. Florence Bindelle, Secretary General of EuropeanIssuers ...

Seed Equity uses LinkedIn targeting, Spotlight Ads and Sponsored

... Reaching the right investors at the right time As a new player in the equity crowdfunding space, Seed Equity – a registered broker dealer providing investment banking services to startups and growth companies – needed to spread the word about investment opportunities to the right audience: accredi ...

... Reaching the right investors at the right time As a new player in the equity crowdfunding space, Seed Equity – a registered broker dealer providing investment banking services to startups and growth companies – needed to spread the word about investment opportunities to the right audience: accredi ...

Long_Tail_PE.112134455

... bar by adding an average of $2 million in pre-IPO SOX compliance cost followed by an additional $1 million in annual compliance expense after going public. With no marketing machine and a much higher revenue/profit hurdle to ‘get out’, the IPO market began to dry up, a dehydration process that conti ...

... bar by adding an average of $2 million in pre-IPO SOX compliance cost followed by an additional $1 million in annual compliance expense after going public. With no marketing machine and a much higher revenue/profit hurdle to ‘get out’, the IPO market began to dry up, a dehydration process that conti ...

2017 NH Startup Challenge Sponsorship Opportunities

... Greater Manchester, NH community. MYPN was New Hampshire’s first young professionals’ networking organization, established in 2004. MYPN supports nearly 4,000 young professionals as they expand their contact base, develop professional skills, promote themselves and their business and gain access to ...

... Greater Manchester, NH community. MYPN was New Hampshire’s first young professionals’ networking organization, established in 2004. MYPN supports nearly 4,000 young professionals as they expand their contact base, develop professional skills, promote themselves and their business and gain access to ...

Reasons to Include ESG Factors in Security Selection

... 2. Companies with improving ESG profiles can even beat their peers. It’s possible that investors can even utilize companies’ environmental, social and governance factors to produce alpha. Our research indicates that companies with improving ESG profiles in the Russell 1000 index may outperform simil ...

... 2. Companies with improving ESG profiles can even beat their peers. It’s possible that investors can even utilize companies’ environmental, social and governance factors to produce alpha. Our research indicates that companies with improving ESG profiles in the Russell 1000 index may outperform simil ...

Colbar Completes $7.25 Million Series D Financing Round

... Colbar Completes $7.25 million Round Led by Vitalife Vitalife joins existing investors Pitango, Evergreen, Genesis, and Biomedical Investments in current round Tel Aviv, Israel – 7th September, 2004: Colbar, the Israeli manufacturer of reconstructive medicine and tissue engineering products, today a ...

... Colbar Completes $7.25 million Round Led by Vitalife Vitalife joins existing investors Pitango, Evergreen, Genesis, and Biomedical Investments in current round Tel Aviv, Israel – 7th September, 2004: Colbar, the Israeli manufacturer of reconstructive medicine and tissue engineering products, today a ...

Entrepreneurs Foundation of Colorado Provides $430K in Grants to

... community. EFCO received equity in Jive when the EFCO member company, Filtrbox, was acquired by Jive in 2010. Foundry Group, a venture capital firm focused on investing in earlystage information technology companies, has endowed EFCO with a portion of its carried interest. Foundry is the first VC fi ...

... community. EFCO received equity in Jive when the EFCO member company, Filtrbox, was acquired by Jive in 2010. Foundry Group, a venture capital firm focused on investing in earlystage information technology companies, has endowed EFCO with a portion of its carried interest. Foundry is the first VC fi ...

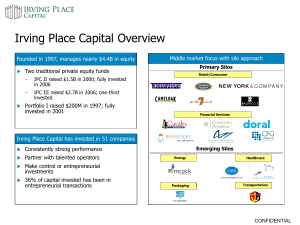

RBC Capital Markets

... Cash, patient investors, great fundraising capability Far easier to find “pile-on” money than lead investors ...

... Cash, patient investors, great fundraising capability Far easier to find “pile-on” money than lead investors ...

MedTech ”Made in Germany”

... addition to this, the country has an exceptional clinical development infrastructure. This permits close collaboration between research institutions, development companies and clinics. In the future, working together along the value chain will become increasingly important as a locational advantage ...

... addition to this, the country has an exceptional clinical development infrastructure. This permits close collaboration between research institutions, development companies and clinics. In the future, working together along the value chain will become increasingly important as a locational advantage ...

News Release

... semiconductor company developing proprietary display technologies for the flat panel display market. INCJ will invest ¥300 million, through a third-party allocation of shares, to provide CerebrEX with the necessary funding for activities such as future product development. In recent years, LSI and L ...

... semiconductor company developing proprietary display technologies for the flat panel display market. INCJ will invest ¥300 million, through a third-party allocation of shares, to provide CerebrEX with the necessary funding for activities such as future product development. In recent years, LSI and L ...

PPT

... very early-stage company (demo, 2-3 employees) • Motivation: – Dramatic return on investment via exit or liquidity event: • Initial Public Offering (IPO) of company • Subsequent financing rounds ...

... very early-stage company (demo, 2-3 employees) • Motivation: – Dramatic return on investment via exit or liquidity event: • Initial Public Offering (IPO) of company • Subsequent financing rounds ...

Startup company

A startup company or startup or start-up (sometimes referred as innovative SME) is an entrepreneurial venture or a new business in the form of a company, a partnership or temporary organization designed to search for a repeatable and scalable business model. These companies, generally newly created, are innovation in a process of development, validation and research for target markets. The term became popular internationally during the dot-com bubble when a great number of dot-com companies were founded. Due to this background, many consider startups to be only tech companies, but this is not always true: the essence of startups has more to do with high ambition, innovativeness, scalability and growth.