Zest Interims 2009 PDF

... Zest owns 100% of the recording and publishing rights of all five Nasio Fontaine's albums and is currently negotiating a new worldwide license deal. In addition, VP Records/Greensleeves will be releasing a "Best of" Nasio album with a DVD late in the summer of 2009. To support this release, Nasio is ...

... Zest owns 100% of the recording and publishing rights of all five Nasio Fontaine's albums and is currently negotiating a new worldwide license deal. In addition, VP Records/Greensleeves will be releasing a "Best of" Nasio album with a DVD late in the summer of 2009. To support this release, Nasio is ...

bonds plus 400 fund - Insight Investment

... This document may not be used for the purposes of an offer or solicitation to anyone in any jurisdiction in which such offer or solicitation is not authorised or to any person to whom it is unlawful to make such offer or solicitation. The information in this document is general in nature and does no ...

... This document may not be used for the purposes of an offer or solicitation to anyone in any jurisdiction in which such offer or solicitation is not authorised or to any person to whom it is unlawful to make such offer or solicitation. The information in this document is general in nature and does no ...

30. Earnings Per Share

... is adjusted for the effects of all dilutive potential ordinary shares. The Company has three categories of dilutive potential ordinary shares: share options, performance shares and restricted shares. For share options, the weighted average number of ordinary shares in issue is adjusted to take into ...

... is adjusted for the effects of all dilutive potential ordinary shares. The Company has three categories of dilutive potential ordinary shares: share options, performance shares and restricted shares. For share options, the weighted average number of ordinary shares in issue is adjusted to take into ...

Acct 2220 Zeigler - GQ #3 (Chp 10)

... a) The after-tax NPV would be lower. b) The after-tax NPV would not change. c) The after-tax NPV would be higher. (see P10-22A solution & class notes to confirm) 23. IF the machine was fully depreciated and then sold for $10,000 at the end of year 10: a. The after-tax NPV would be higher. b. The pre ...

... a) The after-tax NPV would be lower. b) The after-tax NPV would not change. c) The after-tax NPV would be higher. (see P10-22A solution & class notes to confirm) 23. IF the machine was fully depreciated and then sold for $10,000 at the end of year 10: a. The after-tax NPV would be higher. b. The pre ...

Test Bank for Quiz-2 FINA252 Financial Management

... a funds flow analysis a ratio analysis calculations for preparing the balance sheet. ...

... a funds flow analysis a ratio analysis calculations for preparing the balance sheet. ...

A Closer Look at Money Market Funds: Bank CD Alternatives

... against credit risk. Conversely, the principal value of the typical bank savings account or CD is insured up to $100,000 by the Federal Deposit Insurance Corporation (FDIC). Nevertheless, money funds represent a highly attractive alternative to bank accounts, small CDs, and even money market deposit ...

... against credit risk. Conversely, the principal value of the typical bank savings account or CD is insured up to $100,000 by the Federal Deposit Insurance Corporation (FDIC). Nevertheless, money funds represent a highly attractive alternative to bank accounts, small CDs, and even money market deposit ...

II. How to Read a Mutual Fund Prospectus

... fund and to encourage brokers to continue to service existing clients The maximum by law is .75% for marketing and distribution, and .25% to compensate brokers These charges are considered by some (many?) critics as an insidious means of assessing additional fees on customers and are particularly ob ...

... fund and to encourage brokers to continue to service existing clients The maximum by law is .75% for marketing and distribution, and .25% to compensate brokers These charges are considered by some (many?) critics as an insidious means of assessing additional fees on customers and are particularly ob ...

PPT

... • Experimental annual current and capital accounts by institutional sectors (2013)- for the period 2010-12. • Experimental annual /quarterly sectoral stocks of financial assets and liabilities (2014) and quarterly sectoral financial accounts (2015) • Development of methodology and data sources for t ...

... • Experimental annual current and capital accounts by institutional sectors (2013)- for the period 2010-12. • Experimental annual /quarterly sectoral stocks of financial assets and liabilities (2014) and quarterly sectoral financial accounts (2015) • Development of methodology and data sources for t ...

Welcome to Introduction to Accounting Preparing for a User`s

... Example: In 20X1 Jones Co. received $100 cash in advance from Bob Co. for sales commissions he expected to earn in 20X2. As you can see, the cash is received, and since he can’t record the revenue, we’ve got to figure out what the credit in this journal entry is going to be to balance out the receip ...

... Example: In 20X1 Jones Co. received $100 cash in advance from Bob Co. for sales commissions he expected to earn in 20X2. As you can see, the cash is received, and since he can’t record the revenue, we’ve got to figure out what the credit in this journal entry is going to be to balance out the receip ...

Slides 1-4 (1m:49s) Welcome to Introduction to Accounting

... Example: In 20X1 Jones Co. received $100 cash in advance from Bob Co. for sales commissions he expected to earn in 20X2. As you can see, the cash is received, and since he can’t record the revenue, we’ve got to figure out what the credit in this journal entry is going to be to balance out the receip ...

... Example: In 20X1 Jones Co. received $100 cash in advance from Bob Co. for sales commissions he expected to earn in 20X2. As you can see, the cash is received, and since he can’t record the revenue, we’ve got to figure out what the credit in this journal entry is going to be to balance out the receip ...

ch03 - U of L Class Index

... Traded throughout the day on exchanges Lower management fees (e.g., 0.08% to 0.25% versus 2.5% average for active equity funds versus 0.75% average for Index funds) Lower portfolio turnover – reduces capital gains income and taxes payable ...

... Traded throughout the day on exchanges Lower management fees (e.g., 0.08% to 0.25% versus 2.5% average for active equity funds versus 0.75% average for Index funds) Lower portfolio turnover – reduces capital gains income and taxes payable ...

Operating Activities

... payments of an entity during a period. • Accrual basis revenues and expenses must be converted to equivalent cash receipts and payments. • The amount of cash actually collected or paid is determined. ...

... payments of an entity during a period. • Accrual basis revenues and expenses must be converted to equivalent cash receipts and payments. • The amount of cash actually collected or paid is determined. ...

Tutorial 2

... The issue was underwritten at a commission of $8000. By 15th August, applications had been received for 1200000 ordinary shares of which applications for 200000 shares forwarded the full $6 per shares, the remainder paying only the application money. At a directors meeting on 16th August, it was dec ...

... The issue was underwritten at a commission of $8000. By 15th August, applications had been received for 1200000 ordinary shares of which applications for 200000 shares forwarded the full $6 per shares, the remainder paying only the application money. At a directors meeting on 16th August, it was dec ...

Pacific Global Equity Opportunity UCITS

... has no bias to any underlying asset class, country or region and, subject to the investment restrictions, provides exposure to investments which are listed or traded on Regulated Markets globally and which may include exposures to Emerging Markets and to fixed income securities that are rated below ...

... has no bias to any underlying asset class, country or region and, subject to the investment restrictions, provides exposure to investments which are listed or traded on Regulated Markets globally and which may include exposures to Emerging Markets and to fixed income securities that are rated below ...

capital investment

... principal back (not until almost the end of the 2nd year since more of the cash flow is rate of return rather than return of principal) and you must now earn a 47.16% rate of return on the surplus funds to cover the cost of $7,200 at the end of the project life. (Check out the NPV of this project at ...

... principal back (not until almost the end of the 2nd year since more of the cash flow is rate of return rather than return of principal) and you must now earn a 47.16% rate of return on the surplus funds to cover the cost of $7,200 at the end of the project life. (Check out the NPV of this project at ...

Current Ratio

... If the current ratio in 2005 was 2.5:1. Try to write the meaning of the ratio. This means for every $1 of current liabilities, there were $2.5 of current assets available to pay current liabilities within the next 12 months. This tells users that the business is ABLE to pay its debts which are due w ...

... If the current ratio in 2005 was 2.5:1. Try to write the meaning of the ratio. This means for every $1 of current liabilities, there were $2.5 of current assets available to pay current liabilities within the next 12 months. This tells users that the business is ABLE to pay its debts which are due w ...

euro high yield bond fund - Henderson Global Investors

... The value of an investment in the Fund can go up or down. When you sell your shares they may be worth less than you paid for them. The risk/reward rating above is based on medium-term volatility. In the future, the Fund's actual volatility could be higher or lower and its rated risk/reward level cou ...

... The value of an investment in the Fund can go up or down. When you sell your shares they may be worth less than you paid for them. The risk/reward rating above is based on medium-term volatility. In the future, the Fund's actual volatility could be higher or lower and its rated risk/reward level cou ...

1.00

... During 2015, Omega Company had net sales of $11,400,000. Most of the sales were on credit. At the end of 2015, the balance of Accounts Receivable was $1,400,000, and Allowance for Uncollectible Accounts had a debit balance of $48,000. • Omega Company's management uses two methods of estimating uncol ...

... During 2015, Omega Company had net sales of $11,400,000. Most of the sales were on credit. At the end of 2015, the balance of Accounts Receivable was $1,400,000, and Allowance for Uncollectible Accounts had a debit balance of $48,000. • Omega Company's management uses two methods of estimating uncol ...

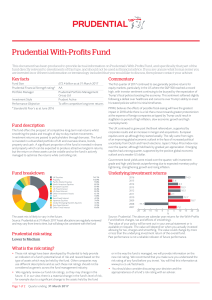

Prudential With

... The performance figures shown are overall annualised returns for contributions made on the dates specified. The returns include both regular and final bonuses added to a benefit paid at normal retirement date, but make no allowance for any applicable initial charges, allocation rates or early cash i ...

... The performance figures shown are overall annualised returns for contributions made on the dates specified. The returns include both regular and final bonuses added to a benefit paid at normal retirement date, but make no allowance for any applicable initial charges, allocation rates or early cash i ...

Existing ISA - New money top up with no changes

... Although not as tax efficient as an Individual Savings Plan (ISA), you can make a certain amount of gain each year before you have to pay capital gains tax. It has no fixed term and the amount you can invest is not limited. ...

... Although not as tax efficient as an Individual Savings Plan (ISA), you can make a certain amount of gain each year before you have to pay capital gains tax. It has no fixed term and the amount you can invest is not limited. ...

Financial Management in the International Business

... 31. Dividends have certain tax advantages over royalties and fees, particularly when the corporate tax rate is higher in the host country than in the parent's home country. ...

... 31. Dividends have certain tax advantages over royalties and fees, particularly when the corporate tax rate is higher in the host country than in the parent's home country. ...

SOCIAL INVESTMENT - A comparison of the principal

... *Note: An "accredited social impact contractor" is a company limited by shares that is accredited under the Income Taxes Act 2007 as a social impact contractor. This note makes no further ...

... *Note: An "accredited social impact contractor" is a company limited by shares that is accredited under the Income Taxes Act 2007 as a social impact contractor. This note makes no further ...