0538479736_265849

... Trade receivables, generally most significant category of receivables, result from the normal activities of a business. Trade receivables may be evidenced by a formal written promise to pay and classified as notes receivables. In its broadest sense, the term receivable is applicable to all claims ag ...

... Trade receivables, generally most significant category of receivables, result from the normal activities of a business. Trade receivables may be evidenced by a formal written promise to pay and classified as notes receivables. In its broadest sense, the term receivable is applicable to all claims ag ...

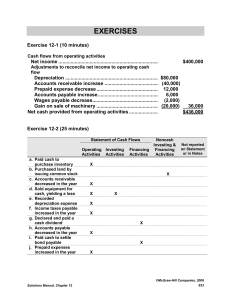

Cash flows from operating activities

... Interpretation: A 49.6% result on the cash flow on total assets ratio is indicative of very good performance. Also, this favorably compares to its return on assets figure of 32.6% (high quality earnings). ...

... Interpretation: A 49.6% result on the cash flow on total assets ratio is indicative of very good performance. Also, this favorably compares to its return on assets figure of 32.6% (high quality earnings). ...

How do you manage a with-profits firm under IFRS 4 Phase II?

... Three conditions could apply: 1. the returns to be passed to the policyholder arise from the underlying items the entity holds (regardless of whether the entity is required to hold those items or whether the entity has discretion over the payments to policyholders) e.g. profits from non-profit busin ...

... Three conditions could apply: 1. the returns to be passed to the policyholder arise from the underlying items the entity holds (regardless of whether the entity is required to hold those items or whether the entity has discretion over the payments to policyholders) e.g. profits from non-profit busin ...

PPF - An Investment and Tax Saving Instrument

... Scheme 2004 (SCSS) any money deposited in these accounts by means of a cheque, the date of encashment of the cheque is treated as the date of deposit. Thus, in order to remove inconsistency between PPF and other small savings schemes and to bring in uniformity in the reckoning of the date of deposit ...

... Scheme 2004 (SCSS) any money deposited in these accounts by means of a cheque, the date of encashment of the cheque is treated as the date of deposit. Thus, in order to remove inconsistency between PPF and other small savings schemes and to bring in uniformity in the reckoning of the date of deposit ...

CASH

... worth of those goods? (Or did we pay for those plus some we purchased the period before?) ...

... worth of those goods? (Or did we pay for those plus some we purchased the period before?) ...

CFA Institute Member Poll: Cash Flow Survey

... Int exp on decommissioning Investing: purchase and sale of AfS Assets could be netted or just marked in a footnote next to "others" Investment activities are shown both above and below the Net Cash from Oper Activities. How do companies make that distinction? Would prefer to see in one section ...

... Int exp on decommissioning Investing: purchase and sale of AfS Assets could be netted or just marked in a footnote next to "others" Investment activities are shown both above and below the Net Cash from Oper Activities. How do companies make that distinction? Would prefer to see in one section ...

Mutual Funds - Cornerstone Retirement

... at age 70. If he earns an average of 5 percent over 15 years, his nest egg will grow to $519,732. If he is charged just 2 percent annually by his mutual funds, the same $250,000 will be worth only $389,492—a difference of $130,240 for his retirement funds. Remember, the impact of fund expenses reduc ...

... at age 70. If he earns an average of 5 percent over 15 years, his nest egg will grow to $519,732. If he is charged just 2 percent annually by his mutual funds, the same $250,000 will be worth only $389,492—a difference of $130,240 for his retirement funds. Remember, the impact of fund expenses reduc ...

Course 4: Managing Cash Flow

... Sweep Accounts, and Investment Accounts. These accounts will automatically invest surplus cash while still serving as your main transaction account. Disbursements are cleared through a special account which has just enough cash to cover all transactions. The Bank makes a "sweep" of the account and t ...

... Sweep Accounts, and Investment Accounts. These accounts will automatically invest surplus cash while still serving as your main transaction account. Disbursements are cleared through a special account which has just enough cash to cover all transactions. The Bank makes a "sweep" of the account and t ...

Overview of Governmental Fund Accounting

... Stuart Trippel, CPA, CGMA, Executive Director, Business and Student Support Services, Shoreline Community College ...

... Stuart Trippel, CPA, CGMA, Executive Director, Business and Student Support Services, Shoreline Community College ...

Vanguard Materials ETF Summary Prospectus

... should expect the Fund’s share price and total return to fluctuate within a wide range. The Fund is subject to the following risks, which could affect the Fund’s performance: • Stock market risk, which is the chance that stock prices overall will decline. Stock markets tend to move in cycles, with p ...

... should expect the Fund’s share price and total return to fluctuate within a wide range. The Fund is subject to the following risks, which could affect the Fund’s performance: • Stock market risk, which is the chance that stock prices overall will decline. Stock markets tend to move in cycles, with p ...

investment planning

... kinds of investments (‘asset classes’) and different kinds of investment product, helps reduce the risk of your overall investments (referred to as your ‘portfolio’) under-performing or losing money. Protection for your money Cash you put into UK banks or building societies (that are authorised by t ...

... kinds of investments (‘asset classes’) and different kinds of investment product, helps reduce the risk of your overall investments (referred to as your ‘portfolio’) under-performing or losing money. Protection for your money Cash you put into UK banks or building societies (that are authorised by t ...

Lesson 4-1

... Nine numbers are unused between each account on TechKnow Consulting’s chart of accounts. New numbers can be assigned between existing account numbers without renumbering all existing accounts. ...

... Nine numbers are unused between each account on TechKnow Consulting’s chart of accounts. New numbers can be assigned between existing account numbers without renumbering all existing accounts. ...

Lesson 2-1 - Lawton Community Schools

... A business owned by one person is called a proprietorship. • The IRS does not require the proprietorship, itself, to pay taxes. • However, the owner must include the net income of the proprietorship in his or her own taxable income. ...

... A business owned by one person is called a proprietorship. • The IRS does not require the proprietorship, itself, to pay taxes. • However, the owner must include the net income of the proprietorship in his or her own taxable income. ...

Farm Financials Starting with Schedule F

... Forces us to keep good records Forces us to track cash farm income Forces us to track cash farm expenses Forces us to think about depreciation Usually done on a calendar-year basis, which makes it easy to do year-to-year comparison I love doing taxes!! ...

... Forces us to keep good records Forces us to track cash farm income Forces us to track cash farm expenses Forces us to think about depreciation Usually done on a calendar-year basis, which makes it easy to do year-to-year comparison I love doing taxes!! ...

Can Risk Aversion Explain The Demand for Dividends?

... chosen dividend level does not finance the consumption requirement, shares must be sold in the open market to generate cash. These investors understand that stock prices fluctuate to some extent away from their “fundamental values” and understand the statistical properties of these fluctuations. How ...

... chosen dividend level does not finance the consumption requirement, shares must be sold in the open market to generate cash. These investors understand that stock prices fluctuate to some extent away from their “fundamental values” and understand the statistical properties of these fluctuations. How ...

Fund Analysis, Cash-Flow Analysis, and Financial Planning

... Why should we bother to understand a Flow of Funds Statement that is no longer required to appear in U.S. audited annual reports? ...

... Why should we bother to understand a Flow of Funds Statement that is no longer required to appear in U.S. audited annual reports? ...

A4.8 - Treasurers Handbook

... date paid. This should overcome paying the invoice twice. Cash Payment Vouchers should show the following Name of the Club. ...

... date paid. This should overcome paying the invoice twice. Cash Payment Vouchers should show the following Name of the Club. ...

Statement of Cash Flows Revisited

... Land Buildings and equipment Less: Accumulated depreciation ...

... Land Buildings and equipment Less: Accumulated depreciation ...

Good First--and Maybe Only--Funds

... simply doing what the index does--management fees tend to be low. Index funds are also advantageous because they are fairly predictable. First, they tend to return what the index does, minus their expenses. Second, they always own what the index owns, which means they tend to be style specific. For ...

... simply doing what the index does--management fees tend to be low. Index funds are also advantageous because they are fairly predictable. First, they tend to return what the index does, minus their expenses. Second, they always own what the index owns, which means they tend to be style specific. For ...

Statement of Cash Flows

... Does free cash flow exist? Is this a longterm trend? What plan does management have to deploy free cash flow? Were dividends paid from free cash flow? Or was external financing used? If external financing is used for dividends, is the dividend policy sustainable? FIN 591: Financial Fundament ...

... Does free cash flow exist? Is this a longterm trend? What plan does management have to deploy free cash flow? Were dividends paid from free cash flow? Or was external financing used? If external financing is used for dividends, is the dividend policy sustainable? FIN 591: Financial Fundament ...

EBITDA

... Some shortcomings of EBITDA • Does not truly represent operating cash flow as it is based on accrual accounting. (Revenue and expense are recognised when they occur, not when cash is actually spent or received) • EBITDA does not take into account Capital costs, as depreciation is excluded. • Does n ...

... Some shortcomings of EBITDA • Does not truly represent operating cash flow as it is based on accrual accounting. (Revenue and expense are recognised when they occur, not when cash is actually spent or received) • EBITDA does not take into account Capital costs, as depreciation is excluded. • Does n ...

Financial Accounting: Assets Question 1 (30 marks) Multiple choice

... business. The purchase was made at a translated price of €24 per share. Consolidated has five seats on the eight-person Board of Directors. The foreign country has suffered through a number of years of severe economic turmoil and the government has imposed exchange restrictions that prevent money fr ...

... business. The purchase was made at a translated price of €24 per share. Consolidated has five seats on the eight-person Board of Directors. The foreign country has suffered through a number of years of severe economic turmoil and the government has imposed exchange restrictions that prevent money fr ...

Fidelity Global Income Class Portfolio P1

... If you do not hold this series of shares in a fee-forservice account where your representative’s firm may charge you a fee directly, you may opt to enter into an advisor service fee agreement between you, your representative’s firm and Fidelity. If you enter into an advisor service fee agreement, Fi ...

... If you do not hold this series of shares in a fee-forservice account where your representative’s firm may charge you a fee directly, you may opt to enter into an advisor service fee agreement between you, your representative’s firm and Fidelity. If you enter into an advisor service fee agreement, Fi ...

cash flow statement

... • Or the liabilities of the business may have decreased ,i.e more cash has been spent this year in paying off suppliers than was the case last year. • A cash flow statement is needed because of the differences between profits and cash. It achieves the following: ---Provides additional information o ...

... • Or the liabilities of the business may have decreased ,i.e more cash has been spent this year in paying off suppliers than was the case last year. • A cash flow statement is needed because of the differences between profits and cash. It achieves the following: ---Provides additional information o ...