Financial statements of limited companies – profit and loss account

... What is profit? We saw from the worked examples in Chapter 2 that profit (or loss) may be considered from two perspectives. We may consider these perspectives to illustrate the links between the profit and loss account and the balance sheet. The first perspective, which is not suggested as a method ...

... What is profit? We saw from the worked examples in Chapter 2 that profit (or loss) may be considered from two perspectives. We may consider these perspectives to illustrate the links between the profit and loss account and the balance sheet. The first perspective, which is not suggested as a method ...

1272. FORM HCFA-2552-83 11-83

... (3)When extended peritoneal dialysis of 20-29 hours duration is needed more frequently than twice a week, additional medical evidence must be submitted to and accepted by the intermediary before additional payment can be made. (4)When extended peritoneal dialysis of 30 hours or more is needed more f ...

... (3)When extended peritoneal dialysis of 20-29 hours duration is needed more frequently than twice a week, additional medical evidence must be submitted to and accepted by the intermediary before additional payment can be made. (4)When extended peritoneal dialysis of 30 hours or more is needed more f ...

Chapter 7

... operating income move in the same direction when unit selling prices and the cost structure are constant. Because variable costing net operating income declined, unit sales must have also declined. This is true even though the absorption costing net operating income increased. How can that be? By ma ...

... operating income move in the same direction when unit selling prices and the cost structure are constant. Because variable costing net operating income declined, unit sales must have also declined. This is true even though the absorption costing net operating income increased. How can that be? By ma ...

Xero offers an attractive combination of growing

... accountants, making accountants key gatekeepers to the SME market. The transition from a one-off upfront fee for a perpetual licence towards monthly subscription fees also presented an opportunity to increase customer retention rates, historically around 80%, as well as customer lifetime value, or L ...

... accountants, making accountants key gatekeepers to the SME market. The transition from a one-off upfront fee for a perpetual licence towards monthly subscription fees also presented an opportunity to increase customer retention rates, historically around 80%, as well as customer lifetime value, or L ...

Introduction - University of Southern California

... consumers place on the brand and is essential to the brand’s value (they must have contributed to the development of their brand equities in the first place.). Since this brand characteristic is salient and forms a basis for initial and continuing brand relationships, an unnamed brand that also has ...

... consumers place on the brand and is essential to the brand’s value (they must have contributed to the development of their brand equities in the first place.). Since this brand characteristic is salient and forms a basis for initial and continuing brand relationships, an unnamed brand that also has ...

Allocating Cost of Service to Customers in Inventory Routing

... In this section, we review related literature, which can be categorized into two streams: literature on inventory routing problem and cooperative game theory. There exists a large body of literature on inventory routing problems. We refer the reader to surveys Campbell et al. (1998), Cordeau et al. ...

... In this section, we review related literature, which can be categorized into two streams: literature on inventory routing problem and cooperative game theory. There exists a large body of literature on inventory routing problems. We refer the reader to surveys Campbell et al. (1998), Cordeau et al. ...

IAS 38 Intangible Assets

... Intangible Assets – key defintions Intangible asset: An identifiable nonmonetary asset without physical substance. An asset is a resource that is controlled by the enterprise as a result of past events (for example, purchase or self-creation) and from which future ecnomic benefits (inflows of cash ...

... Intangible Assets – key defintions Intangible asset: An identifiable nonmonetary asset without physical substance. An asset is a resource that is controlled by the enterprise as a result of past events (for example, purchase or self-creation) and from which future ecnomic benefits (inflows of cash ...

Measuring Cost of Quality (CoQ) on SDLC Projects is

... Accordingly, Open Source Software Development (OSSD) is the process by which open source software is developed within the confines of software engineering life-cycle methods. However when open source used for commercial purpose, then an open source license is required. Although Open source software ...

... Accordingly, Open Source Software Development (OSSD) is the process by which open source software is developed within the confines of software engineering life-cycle methods. However when open source used for commercial purpose, then an open source license is required. Although Open source software ...

Download File

... cost estimate for BRM pieces, above and beyond the costs already to First-Class ...

... cost estimate for BRM pieces, above and beyond the costs already to First-Class ...

Chapter12

... Explicit Costs and Implicit Costs An explicit cost is a cost paid in money. An implicit cost is an opportunity cost incurred by a firm when it uses a factor of production for which it does not make a direct money payment. The two main implicit costs are economic depreciation and the cost of using th ...

... Explicit Costs and Implicit Costs An explicit cost is a cost paid in money. An implicit cost is an opportunity cost incurred by a firm when it uses a factor of production for which it does not make a direct money payment. The two main implicit costs are economic depreciation and the cost of using th ...

Basic Cost Management Concepts

... Each of the examples in the preceding paragraph focuses on costs of one type or another. An important first step in studying managerial accounting is to gain an understanding of the various types of costs incurred by organizations and how those costs are actively managed. At the most basic level, a ...

... Each of the examples in the preceding paragraph focuses on costs of one type or another. An important first step in studying managerial accounting is to gain an understanding of the various types of costs incurred by organizations and how those costs are actively managed. At the most basic level, a ...

EASTMAN CHEMICAL CO (Form: 8-K/A, Received

... Taminco. The accompanying Statements do not reflect the costs of any integration activities or benefits that may result from realization of future cost savings from operating efficiencies or any revenue or other synergies expected to result from the Acquisition. In addition, certain non-recurring it ...

... Taminco. The accompanying Statements do not reflect the costs of any integration activities or benefits that may result from realization of future cost savings from operating efficiencies or any revenue or other synergies expected to result from the Acquisition. In addition, certain non-recurring it ...

Management Type Environmental Policy Instruments

... schemes as a means of risk management. The author concludes that risk management by both principals and agents has the potential to diminish the moral hazard problem. By introducing uncertainty about farmer characteristics into the moral hazard problem Hart and Latacz-Lohmann (2005) find, that if fa ...

... schemes as a means of risk management. The author concludes that risk management by both principals and agents has the potential to diminish the moral hazard problem. By introducing uncertainty about farmer characteristics into the moral hazard problem Hart and Latacz-Lohmann (2005) find, that if fa ...

ACCO_120_09

... Non-LIFO disclosures may be provided, as long as they are not on the face of the income statement. ...

... Non-LIFO disclosures may be provided, as long as they are not on the face of the income statement. ...

The economic cost of upland and gully erosion on subsistence

... The first step was to measure sediment data from the stream flow. These data were collected during the months of June to September 2013 and 2014. Discharge, sediment and nutrient losses were monitored at three gauging stations (weirs) because of the variability of the landscape conditions. During st ...

... The first step was to measure sediment data from the stream flow. These data were collected during the months of June to September 2013 and 2014. Discharge, sediment and nutrient losses were monitored at three gauging stations (weirs) because of the variability of the landscape conditions. During st ...

Document

... Cost-plus pricing is often used on government contracts (cost-plus contracts) and has been criticized as promoting wasteful expenditures in the form of direct costs, indirect costs, and fixed costs whether related to the production and sale of the product or service or not. These costs are converted ...

... Cost-plus pricing is often used on government contracts (cost-plus contracts) and has been criticized as promoting wasteful expenditures in the form of direct costs, indirect costs, and fixed costs whether related to the production and sale of the product or service or not. These costs are converted ...

Chapter 23 Alternate Problems - McGraw Hill Higher Education

... b. Determine the standard quantity of materials allowed for the productive output achieved during May. c. Determine the actual average direct labor rate in May. d. Determine the standard direct labor hours allowed the production output achieved during May. e. Determine the total overhead costs allow ...

... b. Determine the standard quantity of materials allowed for the productive output achieved during May. c. Determine the actual average direct labor rate in May. d. Determine the standard direct labor hours allowed the production output achieved during May. e. Determine the total overhead costs allow ...

A cost model for small scale automated digital

... the long term. The total lifecycle costs for preserving a digital data collection consists of several cost factors. Some of them are difficult to identify and to break down. It includes for example user’s work of starting a backup process, recurring cost for replacing storage media after their lifespa ...

... the long term. The total lifecycle costs for preserving a digital data collection consists of several cost factors. Some of them are difficult to identify and to break down. It includes for example user’s work of starting a backup process, recurring cost for replacing storage media after their lifespa ...

Which of the following refers to the relationship between cost and

... A committed cost results from an organization's ownership or use of facilities and its basic organizational structure. Salaries of tenured faculty would be considered a committed fixed cost. These costs can be changed but it is a major decision and is not easy to do. Faculty working under a one year ...

... A committed cost results from an organization's ownership or use of facilities and its basic organizational structure. Salaries of tenured faculty would be considered a committed fixed cost. These costs can be changed but it is a major decision and is not easy to do. Faculty working under a one year ...

ch11lecture.ppt [Read

... The technology that a firm uses determines its costs. At low levels of employment and output, as the firm hires more labor, marginal product and average product rise, and marginal cost and average variable cost fall. Then, at the point of maximum marginal product, marginal cost is a minimum. As the ...

... The technology that a firm uses determines its costs. At low levels of employment and output, as the firm hires more labor, marginal product and average product rise, and marginal cost and average variable cost fall. Then, at the point of maximum marginal product, marginal cost is a minimum. As the ...

Discrete Damages-Cost Variance Analysis

... Actual costs are recorded and reported as construction progresses. Labor costs are based on periodic payrolls. Equipment use hours are developed from operators' time cards and validated from recorded readings on hour meters. Construction equipment charges are based on hours of operation. Material co ...

... Actual costs are recorded and reported as construction progresses. Labor costs are based on periodic payrolls. Equipment use hours are developed from operators' time cards and validated from recorded readings on hour meters. Construction equipment charges are based on hours of operation. Material co ...

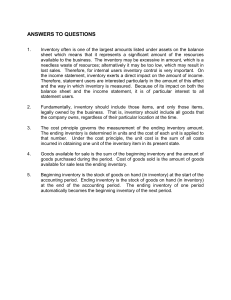

ANSWERS TO QUESTIONS

... will be $100; if the second unit is selected, the gross profit will be $85; or alternatively, if the third unit is selected, the gross profit will be $75. Thus, the amount of gross profit (and income) will vary significantly depending upon which one of the three is selected arbitrarily from the shel ...

... will be $100; if the second unit is selected, the gross profit will be $85; or alternatively, if the third unit is selected, the gross profit will be $75. Thus, the amount of gross profit (and income) will vary significantly depending upon which one of the three is selected arbitrarily from the shel ...

The Impact of Target Cost Method to Strengthen

... The study explored the relationship between target costing and competitiveness at Jordanian Private Universities. The research question regarding target costing focused on leadership of target selling price, customer needs, degree of developing a team work, cost of the product life cycle, stage of p ...

... The study explored the relationship between target costing and competitiveness at Jordanian Private Universities. The research question regarding target costing focused on leadership of target selling price, customer needs, degree of developing a team work, cost of the product life cycle, stage of p ...

CHAPTER 10 PLANT ASSETS, NATURAL RESOURCES, AND

... depreciation does not result in an accumulation of cash for the replacement of the asset. Land is the only plant asset that is not depreciated. ...

... depreciation does not result in an accumulation of cash for the replacement of the asset. Land is the only plant asset that is not depreciated. ...

Warren/Reeve/Duchac Accounting 23e - Chapter 7 Pr 7-1A, Pr 7

... The problem provides the quantity and unit cost for both the beginning inventory and purchases. The quantity of ending inventory is also provided. Determine the cost of ending inventory by applying each of the three inventory cost flow assumptions. The ending inventory under the FIFO and LIFO method ...

... The problem provides the quantity and unit cost for both the beginning inventory and purchases. The quantity of ending inventory is also provided. Determine the cost of ending inventory by applying each of the three inventory cost flow assumptions. The ending inventory under the FIFO and LIFO method ...