BGF European Value Fund

... Source: BlackRock, data as of 30 April, 2015. Performance is shown in EUR on a NAV to NAV price basis with income reinvested. Fund performance figures are calculated net of fees. The above Fund data is for information only. ^Morningstar All Rights Reserved. Morningstar Rating as of 30/04/2015. Inves ...

... Source: BlackRock, data as of 30 April, 2015. Performance is shown in EUR on a NAV to NAV price basis with income reinvested. Fund performance figures are calculated net of fees. The above Fund data is for information only. ^Morningstar All Rights Reserved. Morningstar Rating as of 30/04/2015. Inves ...

PPT Unit 2

... holding period return affects the others • The greater the volatility in the holding period returns, the greater the difference in the arithmetic and geometric mean returns • The importance of the last statement is that higher variability in holding period returns results in lower growth rates over ...

... holding period return affects the others • The greater the volatility in the holding period returns, the greater the difference in the arithmetic and geometric mean returns • The importance of the last statement is that higher variability in holding period returns results in lower growth rates over ...

Vanguard US Growth Investor Fund as of 03/31/2017

... Past performance is no guarantee of future results. Market indices have been provided for comparison purposes only. They are unmanaged and do not reflect fees or expenses. Individuals cannot invest directly in an index. Alpha - The difference between an investment's actual returns and its expected p ...

... Past performance is no guarantee of future results. Market indices have been provided for comparison purposes only. They are unmanaged and do not reflect fees or expenses. Individuals cannot invest directly in an index. Alpha - The difference between an investment's actual returns and its expected p ...

Stocks vs. Bonds: A Decade of Record Disparity

... resulting from last year’s global financial crisis and stocks’ abysmal performance over the past decade is the gaping disparity between stock and bond returns. The chart on this page illustrates the striking performance differential between the annualized return of the S&P 500 Stock Index and 10-yea ...

... resulting from last year’s global financial crisis and stocks’ abysmal performance over the past decade is the gaping disparity between stock and bond returns. The chart on this page illustrates the striking performance differential between the annualized return of the S&P 500 Stock Index and 10-yea ...

download soal

... 6. Calculate the expected returns for the stock. Its current price is $ 125. Its next expected dividend is $ 21. And you expect to sell it for $ 137 in one year. 7. An analyst projects that a stock will pay a $ 2 dividend next year and that it will sell for $40 at year-end. If the required rate of r ...

... 6. Calculate the expected returns for the stock. Its current price is $ 125. Its next expected dividend is $ 21. And you expect to sell it for $ 137 in one year. 7. An analyst projects that a stock will pay a $ 2 dividend next year and that it will sell for $40 at year-end. If the required rate of r ...

Sample Questions

... payments and a nominal (annual) interest rate of 8 percent. What is the total dollar amount of interest the family will pay during the first three years of their mortgage? (Assume that all payments are made at the end of the month; also note that the future value (FV) for the mortgage will be zero, ...

... payments and a nominal (annual) interest rate of 8 percent. What is the total dollar amount of interest the family will pay during the first three years of their mortgage? (Assume that all payments are made at the end of the month; also note that the future value (FV) for the mortgage will be zero, ...

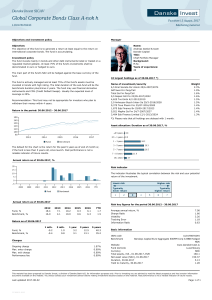

Global Corporate Bonds Class A-nok h

... The main part of the fund's NAV will be hedged against the base currency of the fund. The fund is actively managed and at least 75% of the fund's assets must be invested in bonds with high rating. The total duration of the sub-fund will be the benchmark duration plus/minus 2 years. The fund may use ...

... The main part of the fund's NAV will be hedged against the base currency of the fund. The fund is actively managed and at least 75% of the fund's assets must be invested in bonds with high rating. The total duration of the sub-fund will be the benchmark duration plus/minus 2 years. The fund may use ...

Factsheet Floating Rate Income Trust USD

... Premium-discount graph illustrates the amount by which the market price trades above or below net asset value. ...

... Premium-discount graph illustrates the amount by which the market price trades above or below net asset value. ...

Investments: Analysis and Management, Second Canadian Edition

... period, denoted CFt +(PE - PB), to the start of period price, PB CFt (PE PB ) TR PB ...

... period, denoted CFt +(PE - PB), to the start of period price, PB CFt (PE PB ) TR PB ...

Slide 1

... • Increased life expectancy not matched by later retirement ages or increased contributions • Irrational exuberance, apparent “surpluses” and contribution holidays • Tax and residual ownership disincentives to very large surpluses • “Costless” tax increase of 1997 ...

... • Increased life expectancy not matched by later retirement ages or increased contributions • Irrational exuberance, apparent “surpluses” and contribution holidays • Tax and residual ownership disincentives to very large surpluses • “Costless” tax increase of 1997 ...