aia-qb

... (a) If the futures contract with a one year maturity on the stock is now quoted at $106, is the futures correctly priced? Show workings. (b) If the stock price drops by 5%, but the futures remains at $106, write out the arbitrage strategy that can be applied. (c) ) If the stock price drops by 5%, an ...

... (a) If the futures contract with a one year maturity on the stock is now quoted at $106, is the futures correctly priced? Show workings. (b) If the stock price drops by 5%, but the futures remains at $106, write out the arbitrage strategy that can be applied. (c) ) If the stock price drops by 5%, an ...

Lesson 10-2 Principles of Saving and Investing

... Bull Market exists in the stock market when prices are steadily increasing. During a Bull market, price increases are often followed by profit-taking. ...

... Bull Market exists in the stock market when prices are steadily increasing. During a Bull market, price increases are often followed by profit-taking. ...

Order Number: 41512 Running Head: A JOB AT EAST COAST

... mutual funds offer vivid assessment tool for the returns as compared to the companies Stocks. The manager can assess the benchmark and the overall returns. The pricing of the mutual fund is based on the prices of the underlying securities. The mutual fund indicates the number of assets in the portfo ...

... mutual funds offer vivid assessment tool for the returns as compared to the companies Stocks. The manager can assess the benchmark and the overall returns. The pricing of the mutual fund is based on the prices of the underlying securities. The mutual fund indicates the number of assets in the portfo ...

Delivering Active Management in REITs

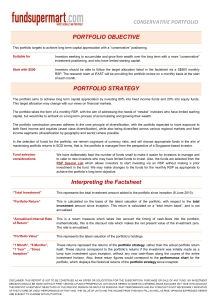

... Alpha is a measure of the difference between a fund’s actual returns and its expected performance, given its level of risk as measured by beta. Run up % is the cumulative return during a period of positive performance. Run down % is the cumulative return during a period of negative performance. Ris ...

... Alpha is a measure of the difference between a fund’s actual returns and its expected performance, given its level of risk as measured by beta. Run up % is the cumulative return during a period of positive performance. Run down % is the cumulative return during a period of negative performance. Ris ...

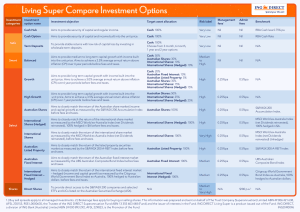

Living Super Compare Investments Options

... 1.) Buy sell spreads apply to all managed investments. 2.) Brokerage fees apply for buying or selling shares. This information was prepared and sent on behalf of The Trust Company (Superannuation) Limited ABN 49 006 421 638, AFSL 235153, RSE L0000635, the Trustee of the ING DIRECT Superannuation Fun ...

... 1.) Buy sell spreads apply to all managed investments. 2.) Brokerage fees apply for buying or selling shares. This information was prepared and sent on behalf of The Trust Company (Superannuation) Limited ABN 49 006 421 638, AFSL 235153, RSE L0000635, the Trustee of the ING DIRECT Superannuation Fun ...

Company Number Form AR ANNUAL RETURN OF A COMPANY

... The date of registration of each transfer should be given as well as the number of shares transferred on each date. The particulars should be placed opposite the name of the transferor, and not opposite that of the transferee, but the name of the transferee may be inserted in the “remarks” column im ...

... The date of registration of each transfer should be given as well as the number of shares transferred on each date. The particulars should be placed opposite the name of the transferor, and not opposite that of the transferee, but the name of the transferee may be inserted in the “remarks” column im ...

OLD MUTUAL FIXED INTEREST TRACKER LIFE FUND

... or implied, is made as to their accuracy, completeness or correctness. The opinions expressed herein are not intended to serve as authoritative investment advice and should not be used in substitution for the exercise of own judgement. The price of shares/units and any income from them may fall as w ...

... or implied, is made as to their accuracy, completeness or correctness. The opinions expressed herein are not intended to serve as authoritative investment advice and should not be used in substitution for the exercise of own judgement. The price of shares/units and any income from them may fall as w ...

Keeping Up with the (Paul Tudor) Joneses: a Hedge

... fund and is free to operate in a variety of markets and to utilize investments and strategies with variable long/short exposures and degrees of leverage. ...

... fund and is free to operate in a variety of markets and to utilize investments and strategies with variable long/short exposures and degrees of leverage. ...

power consistency - Voya Investment Management

... Funds that ranked higher on these factors tended to produce consistent excess returns in both up and down markets— meaning fund performance was less of a roller coaster ride compared to funds that ranked lower on those factors. Keep in mind that not all funds will rank highly across all six factors. ...

... Funds that ranked higher on these factors tended to produce consistent excess returns in both up and down markets— meaning fund performance was less of a roller coaster ride compared to funds that ranked lower on those factors. Keep in mind that not all funds will rank highly across all six factors. ...

Chapter 10 - personal.kent.edu

... 14. The return of any asset is the increase in price, plus any dividends or cash flows, all divided by the initial price. This preferred stock paid a dividend of $5, so the return for the year was: R = ($80.27 – 84.12 + 5.00) / $84.12 R = .0137 or 1.37% 15. The return of any asset is the increase in ...

... 14. The return of any asset is the increase in price, plus any dividends or cash flows, all divided by the initial price. This preferred stock paid a dividend of $5, so the return for the year was: R = ($80.27 – 84.12 + 5.00) / $84.12 R = .0137 or 1.37% 15. The return of any asset is the increase in ...

Choosing an International Fund, Part 2

... When fund managers buy foreign stocks, they're also effectively buying the foreign currency that the stock is denominated in. So a foreign stock's return is really a combination of two things: the performance of the stock itself and the performance of the country's currency versus the U.S. dollar. L ...

... When fund managers buy foreign stocks, they're also effectively buying the foreign currency that the stock is denominated in. So a foreign stock's return is really a combination of two things: the performance of the stock itself and the performance of the country's currency versus the U.S. dollar. L ...

Quantitative Techniques and Financial Mathematics

... =5LAC/1.09=Rs.4,58,715.59 Net Present Value=PV-Required Investment NPV=Rs.4,58,715.59-Rs.4,00,00=Rs.58,715.59 NPV=C0+C1/(1+r).Where C0 is cash flow today which will be negative. Relation of risk to present value-We do not use the same discount factor while comparing alternative investment avenues. T ...

... =5LAC/1.09=Rs.4,58,715.59 Net Present Value=PV-Required Investment NPV=Rs.4,58,715.59-Rs.4,00,00=Rs.58,715.59 NPV=C0+C1/(1+r).Where C0 is cash flow today which will be negative. Relation of risk to present value-We do not use the same discount factor while comparing alternative investment avenues. T ...

Quantitative Techniques and Financial Mathematics

... =5LAC/1.09=Rs.4,58,715.59 Net Present Value=PV-Required Investment NPV=Rs.4,58,715.59-Rs.4,00,00=Rs.58,715.59 NPV=C0+C1/(1+r).Where C0 is cash flow today which will be negative. Relation of risk to present value-We do not use the same discount factor while comparing alternative investment avenues. T ...

... =5LAC/1.09=Rs.4,58,715.59 Net Present Value=PV-Required Investment NPV=Rs.4,58,715.59-Rs.4,00,00=Rs.58,715.59 NPV=C0+C1/(1+r).Where C0 is cash flow today which will be negative. Relation of risk to present value-We do not use the same discount factor while comparing alternative investment avenues. T ...