MIS12 Ch14 LT1 Capital Budgeting Methods for

... Thus, to compare the investment (made in today’s dollars) with future savings or earnings, you need to discount the earnings to their present value and then calculate the net present value of the investment. The net present value is the amount of money an investment is worth, taking into account its ...

... Thus, to compare the investment (made in today’s dollars) with future savings or earnings, you need to discount the earnings to their present value and then calculate the net present value of the investment. The net present value is the amount of money an investment is worth, taking into account its ...

Presented by

... Reproduction or use of these materials for any other purpose or by or for any individuals is strictly prohibited. The information contained in this presentation has been obtained from sources that AAM believes to be reliable, but AAM does not represent or warrant that it is accurate or complete. The ...

... Reproduction or use of these materials for any other purpose or by or for any individuals is strictly prohibited. The information contained in this presentation has been obtained from sources that AAM believes to be reliable, but AAM does not represent or warrant that it is accurate or complete. The ...

One Minute Guide - Why betting on long-term `average

... if returns early in your retirement are negative, then proportionately more of your capital is needed to fund ongoing living expenses. This reduces the base for future growth and your money will run out earlier, even if later returns are good. The largest impact from market risk is when the investme ...

... if returns early in your retirement are negative, then proportionately more of your capital is needed to fund ongoing living expenses. This reduces the base for future growth and your money will run out earlier, even if later returns are good. The largest impact from market risk is when the investme ...

Goldman Sachs Financial Square Government Fund

... The Quarter-End Total Returns are average annual total returns or cumulative total returns (only if the performance period is one year or less) as of the most recent calendar quarter-end. They assume reinvestment of all distributions at net asset value. Performance reflects cumulative total returns ...

... The Quarter-End Total Returns are average annual total returns or cumulative total returns (only if the performance period is one year or less) as of the most recent calendar quarter-end. They assume reinvestment of all distributions at net asset value. Performance reflects cumulative total returns ...

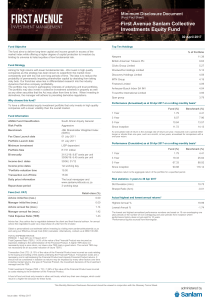

First Avenue Sanlam Collective Investments Equity Fund

... annual or quarterly reports, can be obtained from the Manager, free of charge. Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in the port ...

... annual or quarterly reports, can be obtained from the Manager, free of charge. Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in the port ...

International Emerging Markets Separate Account

... MSCI Emerging Markets NR Index measures equity market performance in the global emerging markets. It consists of 26 emerging market countries in Europe, Latin America and the Pacific Basin. Past performance is no guarantee of future results. Market indices have been provided for comparison purposes ...

... MSCI Emerging Markets NR Index measures equity market performance in the global emerging markets. It consists of 26 emerging market countries in Europe, Latin America and the Pacific Basin. Past performance is no guarantee of future results. Market indices have been provided for comparison purposes ...

Vanguard High Dividend Yield Index Fund ETF Shares

... ETF and its underlying index or benchmark, so that returns over periods longer than one day can differ in amount and direction from the target return of the same period. Consequently, these ETFs may experience losses even in situations where the underlying index or benchmark has performed as hoped. ...

... ETF and its underlying index or benchmark, so that returns over periods longer than one day can differ in amount and direction from the target return of the same period. Consequently, these ETFs may experience losses even in situations where the underlying index or benchmark has performed as hoped. ...

Examples of CIPM Principles Exam Questions

... Equity Valuation Principles? When there have been no recent market transactions, the best method for valuing private equity investments is to use: A. market-based multiples. B. cash flows discounted at the risk-free rate. C. cash flows discounted at an appropriate risk-adjusted rate. 15. For the pur ...

... Equity Valuation Principles? When there have been no recent market transactions, the best method for valuing private equity investments is to use: A. market-based multiples. B. cash flows discounted at the risk-free rate. C. cash flows discounted at an appropriate risk-adjusted rate. 15. For the pur ...

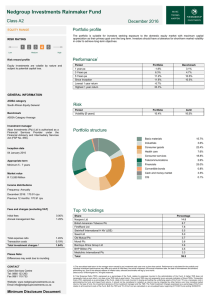

Fact sheets - Nedgroup Investments

... The JSE All Share Index recorded a gain of 1.0% in December and 2.6% for the 2016 calendar year. For the month of December, Financials gained 3.5% and Industrials +1.8%. Resources lagged in December (-3.6%) but still ended the year well ahead of the other major sectors in performance terms. Our hold ...

... The JSE All Share Index recorded a gain of 1.0% in December and 2.6% for the 2016 calendar year. For the month of December, Financials gained 3.5% and Industrials +1.8%. Resources lagged in December (-3.6%) but still ended the year well ahead of the other major sectors in performance terms. Our hold ...

Present Values, Investment Returns and Discount Rates

... The concept of present value lies at the heart of finance in general and actuarial science in particular. The importance of the concept is universally recognized. Present values of various cash flows are extensively utilized in the pricing of financial instruments, funding of financial commitments, ...

... The concept of present value lies at the heart of finance in general and actuarial science in particular. The importance of the concept is universally recognized. Present values of various cash flows are extensively utilized in the pricing of financial instruments, funding of financial commitments, ...

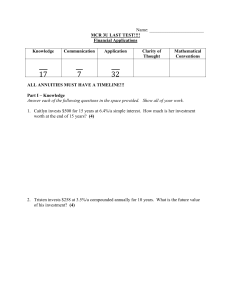

Test Chapter 8 Spring `14

... years, the interest rate changes to 9%/a compounded semi-annually. Calculate the value of the investment two years after this change. (7) ...

... years, the interest rate changes to 9%/a compounded semi-annually. Calculate the value of the investment two years after this change. (7) ...

Helpful Comments: Excel Financial functions perform common

... NPER(rate, pmt, pv, fv, type) - computes number of payment periods for a stated PV to equal a stated FV PMT(rate,nper,pv,fv,type) - computes periodic payment for an annuity IPMT(rate,per,nper,pv,fv,type) - computes interest portion of a specific payment for some period of time PPMT(rate,per,nper,pv, ...

... NPER(rate, pmt, pv, fv, type) - computes number of payment periods for a stated PV to equal a stated FV PMT(rate,nper,pv,fv,type) - computes periodic payment for an annuity IPMT(rate,per,nper,pv,fv,type) - computes interest portion of a specific payment for some period of time PPMT(rate,per,nper,pv, ...

Leveraged ETF credit risks

... Although an investor may be taking on the underlying risks of those portfolio holdings, they are not exposed to any risk from the issuer's financial state. For example, if State Street (NYSE:STT - News) were to go bankrupt (unlikely, even in these tumultuous times), investors in the SPDRs ETF (AMEX: ...

... Although an investor may be taking on the underlying risks of those portfolio holdings, they are not exposed to any risk from the issuer's financial state. For example, if State Street (NYSE:STT - News) were to go bankrupt (unlikely, even in these tumultuous times), investors in the SPDRs ETF (AMEX: ...

Nuveen High Yield Municipal Bond Fund

... The fund concentrates in non-investment-grade and unrated bonds with long maturities and durations which carry heightened credit risk, liquidity risk, and potential for default. In addition, the fund oftentimes engages in a significant amount of portfolio leverage and in doing so, assumes a high lev ...

... The fund concentrates in non-investment-grade and unrated bonds with long maturities and durations which carry heightened credit risk, liquidity risk, and potential for default. In addition, the fund oftentimes engages in a significant amount of portfolio leverage and in doing so, assumes a high lev ...