BT Smaller Companies Fund

... Financial Services Limited ABN 20 000 241 127, AFSL 233716 are the Responsible Entities of the BT Investment Funds Product Disclosure Statement (PDS). BT Funds Management No. 2 Limited ABN 22 000 727 659, AFSL 233720 is the issuer of units in, the BT Smaller Companies Fund (the Fund). A PDS and Fina ...

... Financial Services Limited ABN 20 000 241 127, AFSL 233716 are the Responsible Entities of the BT Investment Funds Product Disclosure Statement (PDS). BT Funds Management No. 2 Limited ABN 22 000 727 659, AFSL 233720 is the issuer of units in, the BT Smaller Companies Fund (the Fund). A PDS and Fina ...

14 App 1 Appendix 14(1): Interpretation

... (a) a possible obligation that arises from past events and whose existence will be confirmed only by the occurrence of one or more uncertain future events not wholly within the entity's control or (b) a present obligation that arises from past events but is not recognised because: (i) it is not prob ...

... (a) a possible obligation that arises from past events and whose existence will be confirmed only by the occurrence of one or more uncertain future events not wholly within the entity's control or (b) a present obligation that arises from past events but is not recognised because: (i) it is not prob ...

Reasons to Include ESG Factors in Security Selection

... Some research suggests that companies with strong ESG profiles also tend to make good decisions about allocating capital.4 This makes sense to us as ESG decisions require the same kind of sound, long-term thinking as management of finances and capital expenditures. For more information, please refer ...

... Some research suggests that companies with strong ESG profiles also tend to make good decisions about allocating capital.4 This makes sense to us as ESG decisions require the same kind of sound, long-term thinking as management of finances and capital expenditures. For more information, please refer ...

Michael Dimelow, VP Business Development, ARM

... ARM Ownership: • Undisclosed Strategic Rationale for Investment: • Establish presence in low power server chips Recent Events: • Significant customer traction for ultra low power compute • Closed $55 Million Funding Round Q4’2012 ...

... ARM Ownership: • Undisclosed Strategic Rationale for Investment: • Establish presence in low power server chips Recent Events: • Significant customer traction for ultra low power compute • Closed $55 Million Funding Round Q4’2012 ...

Advisen Industry Report

... Widely regarded as one of the financial sector’s most lucrative industries, the investment bank industry has long enjoyed high returns given its involvement in big-ticket transactions with large business establishments and governments. However, high returns often involve great risks, which could con ...

... Widely regarded as one of the financial sector’s most lucrative industries, the investment bank industry has long enjoyed high returns given its involvement in big-ticket transactions with large business establishments and governments. However, high returns often involve great risks, which could con ...

Swedish investments in the global energy sector and how

... money through investment and insurance companies. Deposits are made by employers and through private savings in e.g. pension/ pension schemes, housing investments and savings for children. The banks and companies that we use then invest our savings into stocks and securities on the global financial ...

... money through investment and insurance companies. Deposits are made by employers and through private savings in e.g. pension/ pension schemes, housing investments and savings for children. The banks and companies that we use then invest our savings into stocks and securities on the global financial ...

Title: INVESTMENTS Policy No. 102

... Obligations of foreign governments, including their respective agencies, which have an “Investment Grade” credit rating as rated by any major bond rating agency; ...

... Obligations of foreign governments, including their respective agencies, which have an “Investment Grade” credit rating as rated by any major bond rating agency; ...

annexure

... a. This category of Investments will henceforth be referred to as ‘Other Investments’. b. All provisions of the Act, Regulations, Circulars and Guidelines pertaining to investments falling under Section 27A (2) and 27B (3) of Insurance Act, 1938 shall continue to be applicable as such. ...

... a. This category of Investments will henceforth be referred to as ‘Other Investments’. b. All provisions of the Act, Regulations, Circulars and Guidelines pertaining to investments falling under Section 27A (2) and 27B (3) of Insurance Act, 1938 shall continue to be applicable as such. ...

CNMV Corporate Actions

... * Please contact us at [email protected] for additional information regarding market data distribution agreements for this product. * These prices do not include VAT. *Disclaimer of content from the CNMV: the CNMV shall not be held responsible for the accuracy of public information included in ...

... * Please contact us at [email protected] for additional information regarding market data distribution agreements for this product. * These prices do not include VAT. *Disclaimer of content from the CNMV: the CNMV shall not be held responsible for the accuracy of public information included in ...

(PDF 656ko)

... SG is the first bank to implement this product in Spain, which is more developed in some other markets like USA and France, and is the market leader for this type of transactions, having successfully completed a range of this kind of issues (*) What is an ‘Equity Line’? This structure is based on SG ...

... SG is the first bank to implement this product in Spain, which is more developed in some other markets like USA and France, and is the market leader for this type of transactions, having successfully completed a range of this kind of issues (*) What is an ‘Equity Line’? This structure is based on SG ...

Introduction

... • An FDI inflow is an acquisition of domestic financial assets that results in foreign residents owning 10 percent or more of a domestic entity. • An FDI outflow is an acquisition of foreign financial assets that results in domestic residents owning 10 percent or more of a foreign entity. ...

... • An FDI inflow is an acquisition of domestic financial assets that results in foreign residents owning 10 percent or more of a domestic entity. • An FDI outflow is an acquisition of foreign financial assets that results in domestic residents owning 10 percent or more of a foreign entity. ...

march 23rd-27th, 2015 - Imber Wealth Advisors

... Recent volatility has led to some raised eyebrows and concern over the near-term direction of U.S. equity markets. It is our opinion that yesterday’s sell off was primarily an act of taking profit and rebalancing portfolios at quarter-end. Two of the hardest hit areas were technology at large and mo ...

... Recent volatility has led to some raised eyebrows and concern over the near-term direction of U.S. equity markets. It is our opinion that yesterday’s sell off was primarily an act of taking profit and rebalancing portfolios at quarter-end. Two of the hardest hit areas were technology at large and mo ...

Investments and Their Characteristics

... There are many different types of investments which have different risks. It is important that you recognize that different individuals have different goals, wants, and needs from their investments. In other words, different people have different ____________________________________________. Many ev ...

... There are many different types of investments which have different risks. It is important that you recognize that different individuals have different goals, wants, and needs from their investments. In other words, different people have different ____________________________________________. Many ev ...

Comparing The Two Types Of Investments

... are actually designed to show a substantial yield in a short time period. While long-term investments, on the other hand, are designed to last for quite a few years and present a slow yet progressive increase in its yield. Let us discover more about the differences when it comes to the disadvantages ...

... are actually designed to show a substantial yield in a short time period. While long-term investments, on the other hand, are designed to last for quite a few years and present a slow yet progressive increase in its yield. Let us discover more about the differences when it comes to the disadvantages ...

If You`re So Smart Why Aren`t You Rich

... Securities: stocks, bonds, mutual funds Savings accounts, certificates of deposit ...

... Securities: stocks, bonds, mutual funds Savings accounts, certificates of deposit ...

Payment of Dividends out of Capital

... her investment and (2) there is a danger that returns which include distributions out of capital are potentially misleading. There has been a recent increase in investor demand globally (and in particular in Asian markets) for investment products that can provide a consistent income with a certain t ...

... her investment and (2) there is a danger that returns which include distributions out of capital are potentially misleading. There has been a recent increase in investor demand globally (and in particular in Asian markets) for investment products that can provide a consistent income with a certain t ...

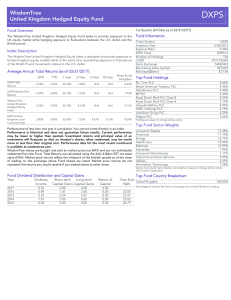

WisdomTree United Kingdom Hedged Equity Fund

... MSCI United Kingdom Local Currency Index: The MSCI United Kingdom Local Currency Index is a capitalization-weighted index that measures the performance of the UK equity market and is calculated in local currency. IOPV, or Indicative Optimized Portfolio Value, is a calculation disseminated by the sto ...

... MSCI United Kingdom Local Currency Index: The MSCI United Kingdom Local Currency Index is a capitalization-weighted index that measures the performance of the UK equity market and is calculated in local currency. IOPV, or Indicative Optimized Portfolio Value, is a calculation disseminated by the sto ...

DE Seminar Invitation evite

... Socially responsible investing describes an investment strategy which seeks to maximize both financial return and social good. In general, socially responsible investors favor corporate practices that promote environmental stewardship, consumer protection, human rights, and diversity. Investors can ...

... Socially responsible investing describes an investment strategy which seeks to maximize both financial return and social good. In general, socially responsible investors favor corporate practices that promote environmental stewardship, consumer protection, human rights, and diversity. Investors can ...

March 2015 AULIEN S.C.A., Sicav

... Europe benefitting from low oil, low EUR and its QE1 to reach 2-3% growth. We have our doubts with this optimistic scenario but will not fight stock markets for the time being. We still think that printing money and kicking the debt can further down the road will not permit any sustainable and sound ...

... Europe benefitting from low oil, low EUR and its QE1 to reach 2-3% growth. We have our doubts with this optimistic scenario but will not fight stock markets for the time being. We still think that printing money and kicking the debt can further down the road will not permit any sustainable and sound ...

Document

... option. Our entry valuation is very competitive. But from the entrepreneur’s perspective, he owned 45% and postprivatization his stake has risen to 70% without putting in any additional capital. We have invested and also helped the company make some small acquisitions to enter new areas. We have bee ...

... option. Our entry valuation is very competitive. But from the entrepreneur’s perspective, he owned 45% and postprivatization his stake has risen to 70% without putting in any additional capital. We have invested and also helped the company make some small acquisitions to enter new areas. We have bee ...

Busting the myth that value has underperformed since the financial

... and differences when evaluating the comparative benchmark data performance. Information regarding indices is included merely to show general trends in the periods indicated and is not intended to imply that the Fund was similar to the indices in composition or risk. Regulatory Status: Polar Capital ...

... and differences when evaluating the comparative benchmark data performance. Information regarding indices is included merely to show general trends in the periods indicated and is not intended to imply that the Fund was similar to the indices in composition or risk. Regulatory Status: Polar Capital ...

NVIT Large Cap Growth Fund — Class I

... Investment Strategy from investment’s prospectus The investment seeks long-term capital growth. The fund invests at least 80% of its net assets in common stocks issued by large-cap companies, utilizing a growth style of investing. It seeks companies whose earnings the subadviser expects to grow cons ...

... Investment Strategy from investment’s prospectus The investment seeks long-term capital growth. The fund invests at least 80% of its net assets in common stocks issued by large-cap companies, utilizing a growth style of investing. It seeks companies whose earnings the subadviser expects to grow cons ...

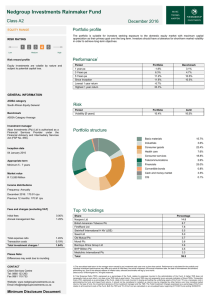

Fact sheets - Nedgroup Investments

... Nedgroup Investments has the right to close unit trust funds to new investors in order to manage it more efficiently. For further additional information on the fund, including but not limited to, brochures, application forms and the annual report please contact Nedgroup Investments. ...

... Nedgroup Investments has the right to close unit trust funds to new investors in order to manage it more efficiently. For further additional information on the fund, including but not limited to, brochures, application forms and the annual report please contact Nedgroup Investments. ...

Product Profile

... The Fund may use derivative instruments, such as options and futures, for hedging purposes or as part of its investment strategy. There is a risk that a derivative intended as a hedge may not perform as expected. The main risk with derivatives is that some types can amplify a gain or loss, potential ...

... The Fund may use derivative instruments, such as options and futures, for hedging purposes or as part of its investment strategy. There is a risk that a derivative intended as a hedge may not perform as expected. The main risk with derivatives is that some types can amplify a gain or loss, potential ...