International Workshop on 'Macroeconomic Management and Financial Regulation in Core... the Periphery', organised by CAFRAL, Levy Economics Institute & IDEAs,...

... of income, in such situations the level of economic activity depends on the magnitude of net exports or on the current account surplus. Further, the current account surplus itself, via the level of activity, determines the level of capacity utilisation and therefore the level of investment and hence ...

... of income, in such situations the level of economic activity depends on the magnitude of net exports or on the current account surplus. Further, the current account surplus itself, via the level of activity, determines the level of capacity utilisation and therefore the level of investment and hence ...

FISCAL POLICY AFTER THE REFERENDUM Jagjit S. Chadha*

... money supply or a fall in the risk-adjusted return on domestic assets the money market curve shifts out to MM* and the exchange rate jumps from A to B. At B it is now below its long-run equilibrium which might be at C if the equilibrium exchange rate relationship has not shifted but may indeed be at ...

... money supply or a fall in the risk-adjusted return on domestic assets the money market curve shifts out to MM* and the exchange rate jumps from A to B. At B it is now below its long-run equilibrium which might be at C if the equilibrium exchange rate relationship has not shifted but may indeed be at ...

Course Outline

... 3.3.2.1 Y = DAE approach 3.3.2.2 Leakage = Injection approach 3.3.3 Changes in equilibrium national income and adjustment to new equilibrium 3.4 Paradox of Thrift 3.5 Inflationary and deflationary gap 3.6 Keynesian, Classical and Non-Keynes non-classical concept Read: Case & Fair, ch. 6; LCR, ch.21, ...

... 3.3.2.1 Y = DAE approach 3.3.2.2 Leakage = Injection approach 3.3.3 Changes in equilibrium national income and adjustment to new equilibrium 3.4 Paradox of Thrift 3.5 Inflationary and deflationary gap 3.6 Keynesian, Classical and Non-Keynes non-classical concept Read: Case & Fair, ch. 6; LCR, ch.21, ...

Quantity Theory of Money, Inflation and the Demand

... • on nominal income – P x Y • the cost of holding money • and the availability of substitutes • As P and/or Y increase => money demand will increases • As opportunity cost increases => money demand will decrease ...

... • on nominal income – P x Y • the cost of holding money • and the availability of substitutes • As P and/or Y increase => money demand will increases • As opportunity cost increases => money demand will decrease ...

UNIT 5-2

... Refers to the efforts by the central bank to buy or sell government bonds This is the most common form of monetary policy and is generally used to try to control short-term interest rates By selling bonds, the Fed effectively removes money from circulation, slowing the economy By purchasing bonds, t ...

... Refers to the efforts by the central bank to buy or sell government bonds This is the most common form of monetary policy and is generally used to try to control short-term interest rates By selling bonds, the Fed effectively removes money from circulation, slowing the economy By purchasing bonds, t ...

Glossary

... Automatic stabilisers: An institutional feature of an economy that dampens its macroeconomic fluctuations, e.g., an income tax, which acts like a tax increase in a boom and a tax cut in a recession. Balance sheet recession: A situation where a large portion of the private sector is reducing spending ...

... Automatic stabilisers: An institutional feature of an economy that dampens its macroeconomic fluctuations, e.g., an income tax, which acts like a tax increase in a boom and a tax cut in a recession. Balance sheet recession: A situation where a large portion of the private sector is reducing spending ...

Monetary policy

... and inflation rates low, but it can’t affect either of these economic variables directly. The Fed uses variables, called monetary policy targets, that it can affect directly and that, in turn, affect variables that are closely related to the Fed’s policy goals, such as real GDP, employment, and the ...

... and inflation rates low, but it can’t affect either of these economic variables directly. The Fed uses variables, called monetary policy targets, that it can affect directly and that, in turn, affect variables that are closely related to the Fed’s policy goals, such as real GDP, employment, and the ...

lecture notes - Livingston Public Schools

... Fiscal Policy, Deficits, and Debt 2. State and local finance policies may offset federal stabilization policies. They are often procyclical, because balanced-budget requirements cause states and local governments to raise taxes in a recession or cut spending making the recession possibly worse. In ...

... Fiscal Policy, Deficits, and Debt 2. State and local finance policies may offset federal stabilization policies. They are often procyclical, because balanced-budget requirements cause states and local governments to raise taxes in a recession or cut spending making the recession possibly worse. In ...

Click www.ondix.com to visit our student-to

... *This and the next year are the worst years of the Great Depression. For 1932, GNP falls a record 13.4 percent; unemployment rises to 23.6 percent. *Industrial stocks have lost 80 percent of their value since 1930. *10,000 banks have failed since 1929, or 40 percent of the 1929 total. *About $2 bill ...

... *This and the next year are the worst years of the Great Depression. For 1932, GNP falls a record 13.4 percent; unemployment rises to 23.6 percent. *Industrial stocks have lost 80 percent of their value since 1930. *10,000 banks have failed since 1929, or 40 percent of the 1929 total. *About $2 bill ...

Currency, Economics and Financial Markets

... banking system leads to a run on the banks as individuals and companies withdraw their deposits – If banks do not have cash on hand to meet their short term obligations (such as customer savings – that’s why they are considered liabilities to banks) they go out of business ...

... banking system leads to a run on the banks as individuals and companies withdraw their deposits – If banks do not have cash on hand to meet their short term obligations (such as customer savings – that’s why they are considered liabilities to banks) they go out of business ...

MV=PQ I

... Enact pricing policies that hold the prices in these areas down and thereby counter the inflationary ...

... Enact pricing policies that hold the prices in these areas down and thereby counter the inflationary ...

Further Reforms after the “BIG BANG”: The JGB Market

... With well-functioning government bond markets, second alternative becomes the norm among industrialized countries ...

... With well-functioning government bond markets, second alternative becomes the norm among industrialized countries ...

Views of American leaders on the national debt

... - Higher deficit and debt leads to lower saving and capital stock - Leads to lower potential output (we will review the savings experiment) ...

... - Higher deficit and debt leads to lower saving and capital stock - Leads to lower potential output (we will review the savings experiment) ...

Is the "Fiscal Cliff" a Hoax? Many of you have asked me to make

... parties are to blame. So this year is like any other, right? WRONG. Since 2006, spending has increased unbridled; compare a national debt in 2006 of about $8.5 trillion, around half of what is it today. That was around 63-64% of GDP, high by historical standards. At present, the $16.4 trillion natio ...

... parties are to blame. So this year is like any other, right? WRONG. Since 2006, spending has increased unbridled; compare a national debt in 2006 of about $8.5 trillion, around half of what is it today. That was around 63-64% of GDP, high by historical standards. At present, the $16.4 trillion natio ...

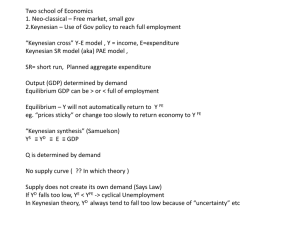

Two school of Economics 1. Neo-classical * Free

... For eg, ↑Go causes additional in C and I. Final ∆∆YYmust greater than initial ∆ Go. ∆ Y = ∆Go + ∆C + ∆I Small fiscal or monetary stimulus can return economy to Yfe, full employment NB. High saving from extra income reduces multiplier effect. High “marginal propensity to save”. Similarly, higher rate ...

... For eg, ↑Go causes additional in C and I. Final ∆∆YYmust greater than initial ∆ Go. ∆ Y = ∆Go + ∆C + ∆I Small fiscal or monetary stimulus can return economy to Yfe, full employment NB. High saving from extra income reduces multiplier effect. High “marginal propensity to save”. Similarly, higher rate ...

The Quantity Theory of Money in a Developing Economy: Empirical

... monetary stability through the management of debt and foreign exchange rate. In essence, appropriate demand and supply management policies by the CBN necessary for economic development requires money to be stable and functional. As such, since early 1990s, the CBN has employed a market-oriented mone ...

... monetary stability through the management of debt and foreign exchange rate. In essence, appropriate demand and supply management policies by the CBN necessary for economic development requires money to be stable and functional. As such, since early 1990s, the CBN has employed a market-oriented mone ...

Quick Links

... government’s expenditures and private investment are autonomous. Suppose the government increases its expenditure. a) The smaller the tax rate t and the larger the marginal propensity to consume c, the larger the multiplier effect. b) The larger the tax rate t and the smaller the marginal propensity ...

... government’s expenditures and private investment are autonomous. Suppose the government increases its expenditure. a) The smaller the tax rate t and the larger the marginal propensity to consume c, the larger the multiplier effect. b) The larger the tax rate t and the smaller the marginal propensity ...

where does come from?

... 6.3. The effect of government borrowing on the money supply: ‘crowding out’ ....... 124 6.3.1. Linking fiscal policy to increased credit creation .................................................................................. 126 6.4. Foreign exchange, international capital flows and the eff ...

... 6.3. The effect of government borrowing on the money supply: ‘crowding out’ ....... 124 6.3.1. Linking fiscal policy to increased credit creation .................................................................................. 126 6.4. Foreign exchange, international capital flows and the eff ...

Monetary Policy Instruments for Developing

... and lower buffer to prevent undue interest rate gyrations in case the day-today instruments for influencing interest rates are unable to cope with a big surge in the demand for liquidity or in the availability of liquid funds. Third, the fluctuations of interest rates provide much information to the ...

... and lower buffer to prevent undue interest rate gyrations in case the day-today instruments for influencing interest rates are unable to cope with a big surge in the demand for liquidity or in the availability of liquid funds. Third, the fluctuations of interest rates provide much information to the ...

exchange rate forecasts

... percent (not annualized) in the second quarter, as consumption and especially tourism spending slumped after the Sewol ferry disaster in April. In response to slowing growth (and perhaps also to its falling approval ratings), the Korean government announced a stimulus program of one percent of GDP i ...

... percent (not annualized) in the second quarter, as consumption and especially tourism spending slumped after the Sewol ferry disaster in April. In response to slowing growth (and perhaps also to its falling approval ratings), the Korean government announced a stimulus program of one percent of GDP i ...

Money, Time Preference, and External Balance

... often invoked to account for the pattern of international capital movements. Countries, Buiter (1981) has argued, whose residents are, ceteris paribus, more impatient to consume than their international trading partners will experience a long run current account deficit - thus confirming, in a nonmo ...

... often invoked to account for the pattern of international capital movements. Countries, Buiter (1981) has argued, whose residents are, ceteris paribus, more impatient to consume than their international trading partners will experience a long run current account deficit - thus confirming, in a nonmo ...