Dark pools in European equity markets

... equity trading in Europe. New trading venues and new types of traders have emerged, affecting the costs of trading for different participants. The growth of dark pools, trading venues where information about orders is not displayed before execution, has been one aspect of these structural developmen ...

... equity trading in Europe. New trading venues and new types of traders have emerged, affecting the costs of trading for different participants. The growth of dark pools, trading venues where information about orders is not displayed before execution, has been one aspect of these structural developmen ...

Trading Volume Reaction to the Earnings Reconciliation from IFRS

... require the use of IFRS as the primary GAAP for external financial reporting purpose. In addition, the IASB, in an effort to improve the quality of accounting standards, issued a series of new international financial reporting standards, most of which were effective on or after January 1, 2005. Thus ...

... require the use of IFRS as the primary GAAP for external financial reporting purpose. In addition, the IASB, in an effort to improve the quality of accounting standards, issued a series of new international financial reporting standards, most of which were effective on or after January 1, 2005. Thus ...

Gains from Stock Exchange Integration: The

... the same degree of platform integration and common trading rules, which would have had the same effect on competition among exchanges as a full merger, but most likely would not have secured the same cost reductions, due to the difficulty of coordinating the investment decisions of independent excha ...

... the same degree of platform integration and common trading rules, which would have had the same effect on competition among exchanges as a full merger, but most likely would not have secured the same cost reductions, due to the difficulty of coordinating the investment decisions of independent excha ...

Decimalization, trading costs, and information transmission between

... where Ait (Bit) is the quoted ask (bid) price for stock i at time t, and Mit is the midpoint of the quoted ask and bid prices. Relative quoted spreads are likely to be biased estimators of trading costs, because trades do not always occur at the posted quotes. The relative effective spread (ES) meas ...

... where Ait (Bit) is the quoted ask (bid) price for stock i at time t, and Mit is the midpoint of the quoted ask and bid prices. Relative quoted spreads are likely to be biased estimators of trading costs, because trades do not always occur at the posted quotes. The relative effective spread (ES) meas ...

Do retail traders suffer from high frequency traders?

... The advent of fully electronic trading platforms has changed the equity trading landscape dramatically over the last decade and has enabled the rise of trading by computer algorithms without any human interference. One of the most extreme forms of electronic trading is the practice of high frequenc ...

... The advent of fully electronic trading platforms has changed the equity trading landscape dramatically over the last decade and has enabled the rise of trading by computer algorithms without any human interference. One of the most extreme forms of electronic trading is the practice of high frequenc ...

Automated Trading Desk and Price Prediction in High

... studies of finance’, the application to financial markets not of economics but of wider social-science disciplines such as anthropology, politics, geography, sociology and science and technology studies (STS). STS-inflected work has been particularly prominent within social studies of finance, and m ...

... studies of finance’, the application to financial markets not of economics but of wider social-science disciplines such as anthropology, politics, geography, sociology and science and technology studies (STS). STS-inflected work has been particularly prominent within social studies of finance, and m ...

Does Supply Curve Inelasticity Explain Abnormal Long

... The TSX has the following rules that regulate how repurchase programs are executed. ...

... The TSX has the following rules that regulate how repurchase programs are executed. ...

Correlated Trading and Returns

... Why do individual investors move together? Answering this question requires understanding why individuals actively trade stocks and voluntarily take on idiosyncratic risk and high transaction costs. Knowing the investor’s identity, characteristics of his trades, and his stock, bond, fund, and option ...

... Why do individual investors move together? Answering this question requires understanding why individuals actively trade stocks and voluntarily take on idiosyncratic risk and high transaction costs. Knowing the investor’s identity, characteristics of his trades, and his stock, bond, fund, and option ...

High frequency trading: assessing the impact on market

... that hit US equities markets on 6 May 2010, wiping 650 points off the Dow in half an hour, has been in part attributed to practices of high-frequency traders. 3 While regulators make use of formal consultation processes to help them make decisions about whether to authorise a given market design cha ...

... that hit US equities markets on 6 May 2010, wiping 650 points off the Dow in half an hour, has been in part attributed to practices of high-frequency traders. 3 While regulators make use of formal consultation processes to help them make decisions about whether to authorise a given market design cha ...

Trading and Returns under Periodic Market Closures

... The actual time variation in the stock price is determined by the interaction of these two effects: the effect of time-varying hedging trade and the effect of time-varying information asymmetry. The interaction between these two effects can generate a rich set of patterns in stock returns. For examp ...

... The actual time variation in the stock price is determined by the interaction of these two effects: the effect of time-varying hedging trade and the effect of time-varying information asymmetry. The interaction between these two effects can generate a rich set of patterns in stock returns. For examp ...

Urgent Notice for non-EU issuers of Securities

... country in which its securities are listed; provided, however, that if such an issuer lists Equity or Low Denomination Securities on an EU stock exchange after the Directive enters into force and it has not notified the competent authority of its choice under Article 30.1, the Member State where the ...

... country in which its securities are listed; provided, however, that if such an issuer lists Equity or Low Denomination Securities on an EU stock exchange after the Directive enters into force and it has not notified the competent authority of its choice under Article 30.1, the Member State where the ...

Weather, Stock Returns, and the Impact of Localized Trading Behavior

... stocks for each of the 25 cities with the largest number of Nasdaq firms. The University of Chicago’s Center for Research in Security Prices (CRSP) provides the returns, trading volume, and price information for the sample. To minimize the impact of lowpriced stocks, we require the firm to have a st ...

... stocks for each of the 25 cities with the largest number of Nasdaq firms. The University of Chicago’s Center for Research in Security Prices (CRSP) provides the returns, trading volume, and price information for the sample. To minimize the impact of lowpriced stocks, we require the firm to have a st ...

Volume and Liquidity After Cross

... foreign investors, being typically more sensitive to inside information. A possible rationalization of this puzzle is that informational asymmetries between domestic and foreign investors are actually lower for small, high-growth and high-tech firms. This may be the case if these firms cross-list pr ...

... foreign investors, being typically more sensitive to inside information. A possible rationalization of this puzzle is that informational asymmetries between domestic and foreign investors are actually lower for small, high-growth and high-tech firms. This may be the case if these firms cross-list pr ...

Day Trading Skill 110523

... longer sample period of 1992 to 2006. We focus on day trading for two reasons. First, we are interested in analyzing the cross-section of speculator skill, and day traders, given their short holding period, are almost certainly speculators. Second, the signal-to-noise ratio regarding investor skill ...

... longer sample period of 1992 to 2006. We focus on day trading for two reasons. First, we are interested in analyzing the cross-section of speculator skill, and day traders, given their short holding period, are almost certainly speculators. Second, the signal-to-noise ratio regarding investor skill ...

Estimating a Structural Model of Herd Behavior in Financial Markets

... the possibility that informed traders may receive noisy signals, and that they may …nd it optimal to ignore them and engage in herd behavior. In this circumstance, the sequence by which trades arrive in the market does matter: in contrast to Easley et al. (1997), we cannot estimate our model using o ...

... the possibility that informed traders may receive noisy signals, and that they may …nd it optimal to ignore them and engage in herd behavior. In this circumstance, the sequence by which trades arrive in the market does matter: in contrast to Easley et al. (1997), we cannot estimate our model using o ...

Heat Waves, Meteor Showers, and Trading Volume: An Analysis of

... Tokyo (3 a.m. New York ST), when trading passes to London, where it is 8 a.m. At about 12:30 p.m. local time in London, trading passes to New York, where it is 7:30 a.m.7 Trading continues in New York until roughly 5:30 p.m. Regardless of location, the trading process for U.S. Treasuries is the sam ...

... Tokyo (3 a.m. New York ST), when trading passes to London, where it is 8 a.m. At about 12:30 p.m. local time in London, trading passes to New York, where it is 7:30 a.m.7 Trading continues in New York until roughly 5:30 p.m. Regardless of location, the trading process for U.S. Treasuries is the sam ...

Disputation, August 4th, 2009, Ryan Riordan

... Is every use of technology good? How do we think about (evaluate) HFT? What are costs/benefits of those closest to the market? ...

... Is every use of technology good? How do we think about (evaluate) HFT? What are costs/benefits of those closest to the market? ...

Option Trading: Information or Differences of

... questionable if this type of demand would explain the large volume of trading. Besides, Lakonsihok, Lee, Pearson and Poteshman (2006) found that the most popular option-trading strategy is covered call writing, followed by purchasing calls and writing puts, none of which appears to be a logical hedg ...

... questionable if this type of demand would explain the large volume of trading. Besides, Lakonsihok, Lee, Pearson and Poteshman (2006) found that the most popular option-trading strategy is covered call writing, followed by purchasing calls and writing puts, none of which appears to be a logical hedg ...

High-Frequency Trading in the US Treasury Market

... Menkveld, 2011; and Menkveld, 2013), but they are in line with others recording that HF market orders negatively impact liquidity when information uncertainty is high (Brogaard, Hendershott and Riordan, 2014). We also find, consistent with the predictions of the theoretical literature, that HF tradi ...

... Menkveld, 2011; and Menkveld, 2013), but they are in line with others recording that HF market orders negatively impact liquidity when information uncertainty is high (Brogaard, Hendershott and Riordan, 2014). We also find, consistent with the predictions of the theoretical literature, that HF tradi ...

Price Discovery and Trading After Hours

... informed to uninformed trading in the preopen than at any other time of day. Although the trading day has by far the most price discovery, the preopen has the greatest amount of price discovery per trade. Second, during the postclose, when there is less informed trading and less price discovery than ...

... informed to uninformed trading in the preopen than at any other time of day. Although the trading day has by far the most price discovery, the preopen has the greatest amount of price discovery per trade. Second, during the postclose, when there is less informed trading and less price discovery than ...

The Round-the-Clock Market for US Treasury Securities

... Among their responsibilities, primary dealers are expected to participate meaningfully at auction, make reasonably good markets in their trading relationships with the Federal Reserve Bank of New York’s trading desk, and supply market information to the Fed. Formerly, primary dealers were also requi ...

... Among their responsibilities, primary dealers are expected to participate meaningfully at auction, make reasonably good markets in their trading relationships with the Federal Reserve Bank of New York’s trading desk, and supply market information to the Fed. Formerly, primary dealers were also requi ...

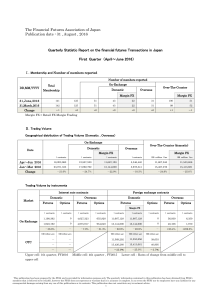

The Financial Futures Association of Japan Publication date : 31

... yen converted value of quarterly trading volume (in units) multiplied by the number of contracts. ・FFAJ converts the amounts of trading volume and open positions denominated in a foreign currency into JPY based on the value of each currency against the yen spot rate published by the Bank of Japan on ...

... yen converted value of quarterly trading volume (in units) multiplied by the number of contracts. ・FFAJ converts the amounts of trading volume and open positions denominated in a foreign currency into JPY based on the value of each currency against the yen spot rate published by the Bank of Japan on ...

Screen Information, Trader Activity, and Bid-Ask

... differentiation is between these stocks and flows. Engle and Russell (1998) find that information in the form of durations between market events also helps to explain the evolution of transactions behavior. Our models are therefore differentiated by four information sets conditioning the price proc ...

... differentiation is between these stocks and flows. Engle and Russell (1998) find that information in the form of durations between market events also helps to explain the evolution of transactions behavior. Our models are therefore differentiated by four information sets conditioning the price proc ...

Computershare Limited Securities Trading Policy

... Computershare Person. For example, if an entity controlled by, or an immediate family member of, a Computershare Person acquires Securities for the Computershare Person while the Computershare Person holds Inside Information in relation to those Securities, then the Computershare Person may have con ...

... Computershare Person. For example, if an entity controlled by, or an immediate family member of, a Computershare Person acquires Securities for the Computershare Person while the Computershare Person holds Inside Information in relation to those Securities, then the Computershare Person may have con ...