Lexis Securities Mosaic: SEC Forms Guide

... public or having been public for less than three years. Announces the filer’s intention to offer securities, and includes a detailed preliminary prospectus describing the company and its stock. ...

... public or having been public for less than three years. Announces the filer’s intention to offer securities, and includes a detailed preliminary prospectus describing the company and its stock. ...

Chapter 3: How Securities are Traded

... • Commission: fee paid to broker for making the transaction • Spread: cost of trading with dealer – Bid: price dealer will buy from you – Ask: price dealer will sell to you – Spread: ask - bid • Combination: on some trades both are paid ...

... • Commission: fee paid to broker for making the transaction • Spread: cost of trading with dealer – Bid: price dealer will buy from you – Ask: price dealer will sell to you – Spread: ask - bid • Combination: on some trades both are paid ...

Changes to Result in Better Framework and Incentive Structure for

... scheme for MMs trading in stock index futures or options. Under existing HKFE Rules, Registered Traders (RTs) in a stock index futures or options market enjoy discounted trading fees in that market when trading for their own market making accounts. In addition, they enjoy discounted trading fees whe ...

... scheme for MMs trading in stock index futures or options. Under existing HKFE Rules, Registered Traders (RTs) in a stock index futures or options market enjoy discounted trading fees in that market when trading for their own market making accounts. In addition, they enjoy discounted trading fees whe ...

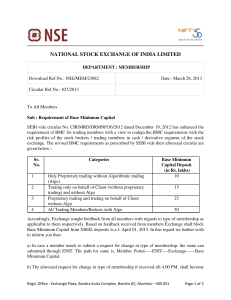

Ref No

... segment shall also be utilised towards the same. d) The amount blocked towards BMC will not be allowed for taking exposure on trades. e) In case of members who have not selected their type of membership on ENIT, by default Exchange will consider type of membership as:Category 4 i.e. " All Trading Me ...

... segment shall also be utilised towards the same. d) The amount blocked towards BMC will not be allowed for taking exposure on trades. e) In case of members who have not selected their type of membership on ENIT, by default Exchange will consider type of membership as:Category 4 i.e. " All Trading Me ...

press release brookfield business partners commences limited

... we do business; the behavior of financial markets, including fluctuations in interest and foreign exchange rates; global equity and capital markets and the availability of equity and debt financing and refinancing within these markets; strategic actions including dispositions; the ability to complet ...

... we do business; the behavior of financial markets, including fluctuations in interest and foreign exchange rates; global equity and capital markets and the availability of equity and debt financing and refinancing within these markets; strategic actions including dispositions; the ability to complet ...

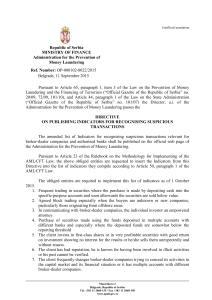

Broker-dealer Companies Indicators

... higher amounts, activation of the pledge on account of unsettled liabilities for loans approved; investment of shares for establishing legal entities; contracts on absorptiontype merger as well as transfer of ownership of securities between persons within a consortium. 13. The client often (several ...

... higher amounts, activation of the pledge on account of unsettled liabilities for loans approved; investment of shares for establishing legal entities; contracts on absorptiontype merger as well as transfer of ownership of securities between persons within a consortium. 13. The client often (several ...

CEE Trader - Wiener Börse

... ■ Connection via Internet or private network ■ RSA securID trading login (one login for all markets) ■ Market data sources: CEESEG FIX, Enhanced Broadcast Solution (EnBS), Alliance Data Highway (ADH) ■ Trading interface: CEESEG FIX ...

... ■ Connection via Internet or private network ■ RSA securID trading login (one login for all markets) ■ Market data sources: CEESEG FIX, Enhanced Broadcast Solution (EnBS), Alliance Data Highway (ADH) ■ Trading interface: CEESEG FIX ...

Code of Conduct on UPSI

... 1. Prompt public disclosure of Unpublished Price Sensitive Information Unpublished Price Sensitive Information shall be promptly disclosed by company in order to make such information generally available. For this purpose Unpublished Price Sensitive Information means any information, which relates d ...

... 1. Prompt public disclosure of Unpublished Price Sensitive Information Unpublished Price Sensitive Information shall be promptly disclosed by company in order to make such information generally available. For this purpose Unpublished Price Sensitive Information means any information, which relates d ...

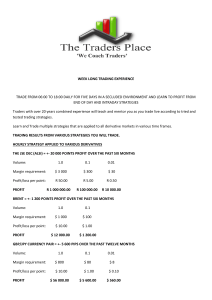

week long trading experience trade from 06:00 to 18:00 daily for five

... I thoroughly enjoyed both the ALSI and Forex courses that I attended with Warren. The material is presented in a clear and concise way and the small class size assures you get individual attention. Warren is extremely knowledgeable and presents the information in a way that is easy to digest regardl ...

... I thoroughly enjoyed both the ALSI and Forex courses that I attended with Warren. The material is presented in a clear and concise way and the small class size assures you get individual attention. Warren is extremely knowledgeable and presents the information in a way that is easy to digest regardl ...

CfP: Workshop on Commodity Trading Companies in the First

... highpoint of Britain’s economic dominance, British commodity trading companies were front runners. However, rapid growth and a growing need for raw materials and natural resources in the US, Germany and Japan opened up new trading opportunities and markets. Simultaneously, opening imperial trade sys ...

... highpoint of Britain’s economic dominance, British commodity trading companies were front runners. However, rapid growth and a growing need for raw materials and natural resources in the US, Germany and Japan opened up new trading opportunities and markets. Simultaneously, opening imperial trade sys ...

Online Quizzes and Answers for Business Law Today

... the trading of securities, whether on organized exchanges, in over-thecounter markets, or in private transactions. b. Incorrect. SEC Rule 10b-5 is applicable in virtually all cases concerning the trading of securities, whether on organized exchanges, in over-thecounter markets, or in private transac ...

... the trading of securities, whether on organized exchanges, in over-thecounter markets, or in private transactions. b. Incorrect. SEC Rule 10b-5 is applicable in virtually all cases concerning the trading of securities, whether on organized exchanges, in over-thecounter markets, or in private transac ...

assessing behaviour within an environment of uncertainty and risk

... decisions within an environment of uncertainty and risk. After candidates receive a contemporary market overview and platform demonstration they will take to their live trading terminal to execute trading strategies across multiple asset classes. Candidates will be taken through three stages of asse ...

... decisions within an environment of uncertainty and risk. After candidates receive a contemporary market overview and platform demonstration they will take to their live trading terminal to execute trading strategies across multiple asset classes. Candidates will be taken through three stages of asse ...

Trading Policy of Securities Issued by CPFL Energia S.A.

... Majority Shareholders: signifies the shareholders who have the power of control over the Company, as defined in article 116, Law No. 6,404, of December 15, 1976, subsequently amended. Shares: signifies the common shares issued by the Company. Material Event: any decision made by a majority sharehold ...

... Majority Shareholders: signifies the shareholders who have the power of control over the Company, as defined in article 116, Law No. 6,404, of December 15, 1976, subsequently amended. Shares: signifies the common shares issued by the Company. Material Event: any decision made by a majority sharehold ...

Buyside Traders Want SEC to Press Exchanges and Dark Pools for

... disclosure process would certainly help. Comparing and contrasting existing disclosures and then challenging any differences among providers is cumbersome and time consuming. There are a few providers who offer their own standardized ‘checklist’ for wider dissemination; but again, this lack of stand ...

... disclosure process would certainly help. Comparing and contrasting existing disclosures and then challenging any differences among providers is cumbersome and time consuming. There are a few providers who offer their own standardized ‘checklist’ for wider dissemination; but again, this lack of stand ...

The course presents an introduction to financial intermediation and

... trading and aims at investigating the following aspects: 1) what are banks and what do they do? 2) what are the motives for trading and how is the trading process organized? 3) how do traders (and protocols) affect market quality? The analysis of these ...

... trading and aims at investigating the following aspects: 1) what are banks and what do they do? 2) what are the motives for trading and how is the trading process organized? 3) how do traders (and protocols) affect market quality? The analysis of these ...

Circular 2013/8 Market conduct rules Supervisory rules on

... The term “security-related derivatives” under Article 142 para. 1 FMIA also includes nonstandardised over-the-counter (OTC) products. The question of whether a derivatives transaction is made on or off a trading venue is immaterial for the purpose of determining misuse of information. It is equally ...

... The term “security-related derivatives” under Article 142 para. 1 FMIA also includes nonstandardised over-the-counter (OTC) products. The question of whether a derivatives transaction is made on or off a trading venue is immaterial for the purpose of determining misuse of information. It is equally ...

On Market Makers` Contribution to Trading Efficiency in Options

... decided to encourage market making in shekel-euro options by offering direct remuneration to market makers in exchange for obligations they would assume. These obligations include the obligation to enter quotes for sell and buy orders. Market makers began to operate in March 2004. This event creates ...

... decided to encourage market making in shekel-euro options by offering direct remuneration to market makers in exchange for obligations they would assume. These obligations include the obligation to enter quotes for sell and buy orders. Market makers began to operate in March 2004. This event creates ...

POLICY: MARKET DISCLOSURE GENERAL PRINCIPLES 1.1 The

... confidence in the fairness of the disclosure process, and could lead to liability under insider trading legislation or breach of the NZX and ASX rules. Accordingly, this policy establishes: (a) corporate procedures designed to prevent the selective disclosure of material, nonpublic information; and ...

... confidence in the fairness of the disclosure process, and could lead to liability under insider trading legislation or breach of the NZX and ASX rules. Accordingly, this policy establishes: (a) corporate procedures designed to prevent the selective disclosure of material, nonpublic information; and ...

Stock Market Efficiency and Insider Trading Kris McKinley, Elon

... market were well informed. “All it takes is a few people knowledgeable enough to recognize a bargain, and prices will quickly be bid up or down to levels that reflect complete information. And if prices reflect complete information, even uninformed buyers, purchasing at current prices, will reap the ...

... market were well informed. “All it takes is a few people knowledgeable enough to recognize a bargain, and prices will quickly be bid up or down to levels that reflect complete information. And if prices reflect complete information, even uninformed buyers, purchasing at current prices, will reap the ...

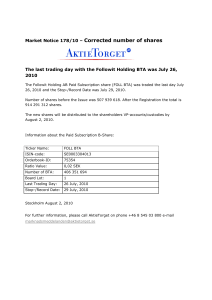

Market Notice 178/10 – Corrected number of shares

... The last trading day with the Followit Holding BTA was July 26, ...

... The last trading day with the Followit Holding BTA was July 26, ...

Trading Nokia: The Roles of the Helsinki vs. the New York Stock

... markets in processing new information concerning Nokia’s price than by just studying the overlapping trading time. In particular, our approach empirically ...

... markets in processing new information concerning Nokia’s price than by just studying the overlapping trading time. In particular, our approach empirically ...

Code for fair disclosure - Indraprastha Gas Limited

... The Company shall provide only public information to the analyst/research persons/large investors like institutional investor. Alternatively, the information given to the analyst should be simultaneously made public at the earliest. (ii) Handling of unanticipated questions – The Company should be ca ...

... The Company shall provide only public information to the analyst/research persons/large investors like institutional investor. Alternatively, the information given to the analyst should be simultaneously made public at the earliest. (ii) Handling of unanticipated questions – The Company should be ca ...

Code Of Corporate Disclosure Practices For Prevention Of Insider

... generally available. While disseminating the information as such, care shall be taken to see that the same is uniform and will avoid selective disclosures. C. ...

... generally available. While disseminating the information as such, care shall be taken to see that the same is uniform and will avoid selective disclosures. C. ...

Math Club Meeting #4 Friday, March 12th, 2010

... His talk was titled Math Finance and Quantitative Trading Strategies. The talk can be summarized in a few sentences said by Arindam Kundu himself: “In the last decade, mathematical and computational engineers have devised innovative strategies to generate consistent returns in the markets using a co ...

... His talk was titled Math Finance and Quantitative Trading Strategies. The talk can be summarized in a few sentences said by Arindam Kundu himself: “In the last decade, mathematical and computational engineers have devised innovative strategies to generate consistent returns in the markets using a co ...